👋 If you enjoy the free weekly newsletter, consider joining the Health Tech Nerds Community, a members-only Slack community designed for networking and knowledge sharing!

ACA

Initial sign-ups come in hot, ~12% above prior year, with a lot of caveats

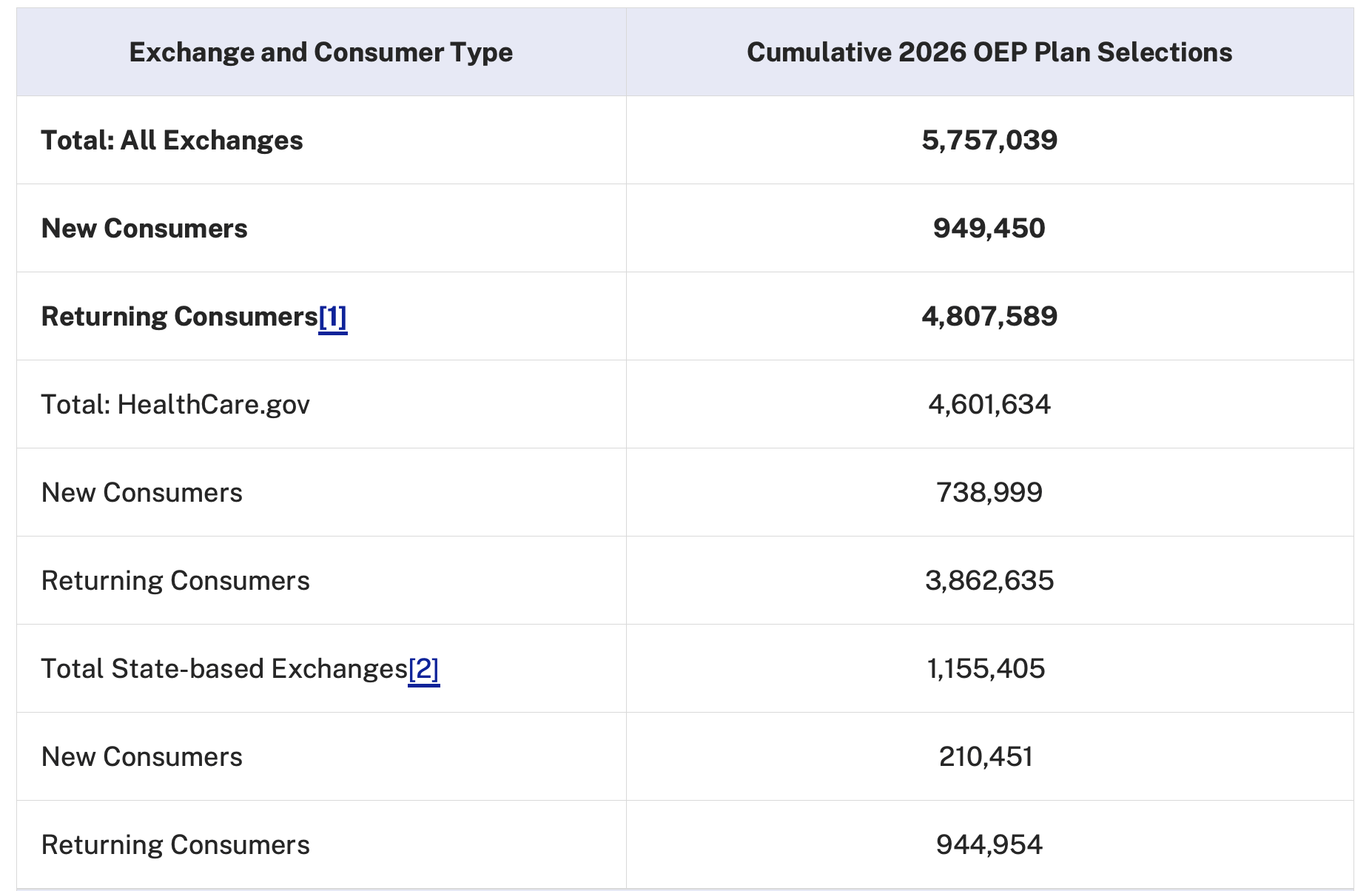

Although state exchanges have been releasing ACA sign-up information in drips and drabs, ACA watchers have been eagerly awaiting the first national snapshot from CMS which dropped last Friday.

The national snapshot is important because Texas and Florida are the largest ACA markets, and they both use healthcare.gov rather than a state-based exchange.

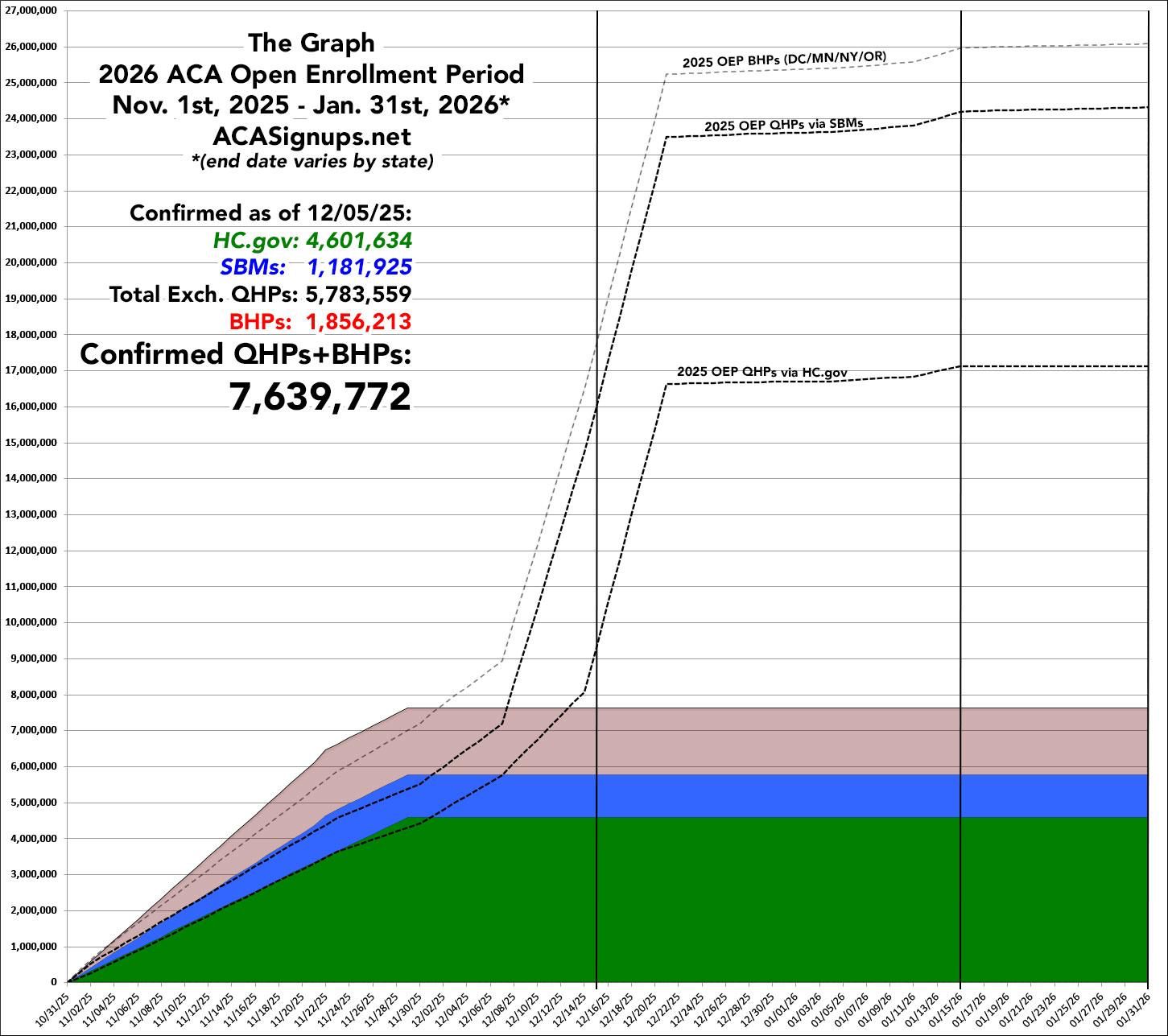

To put these numbers in context, it’s helpful, as we did last week, to look at The Graph from Charles Gaba’s excellent acasignups.net:

After making some adjustments to account for Illinois switching from healthcare.gov to a state-based exchange (SBEs) and an extra day compared to last year, Gaba estimates enrollment is running 11.7% ahead of where it was last year at this time. That steep increase is the deadline for January 1st coverage, which this year is Monday, December 15th.

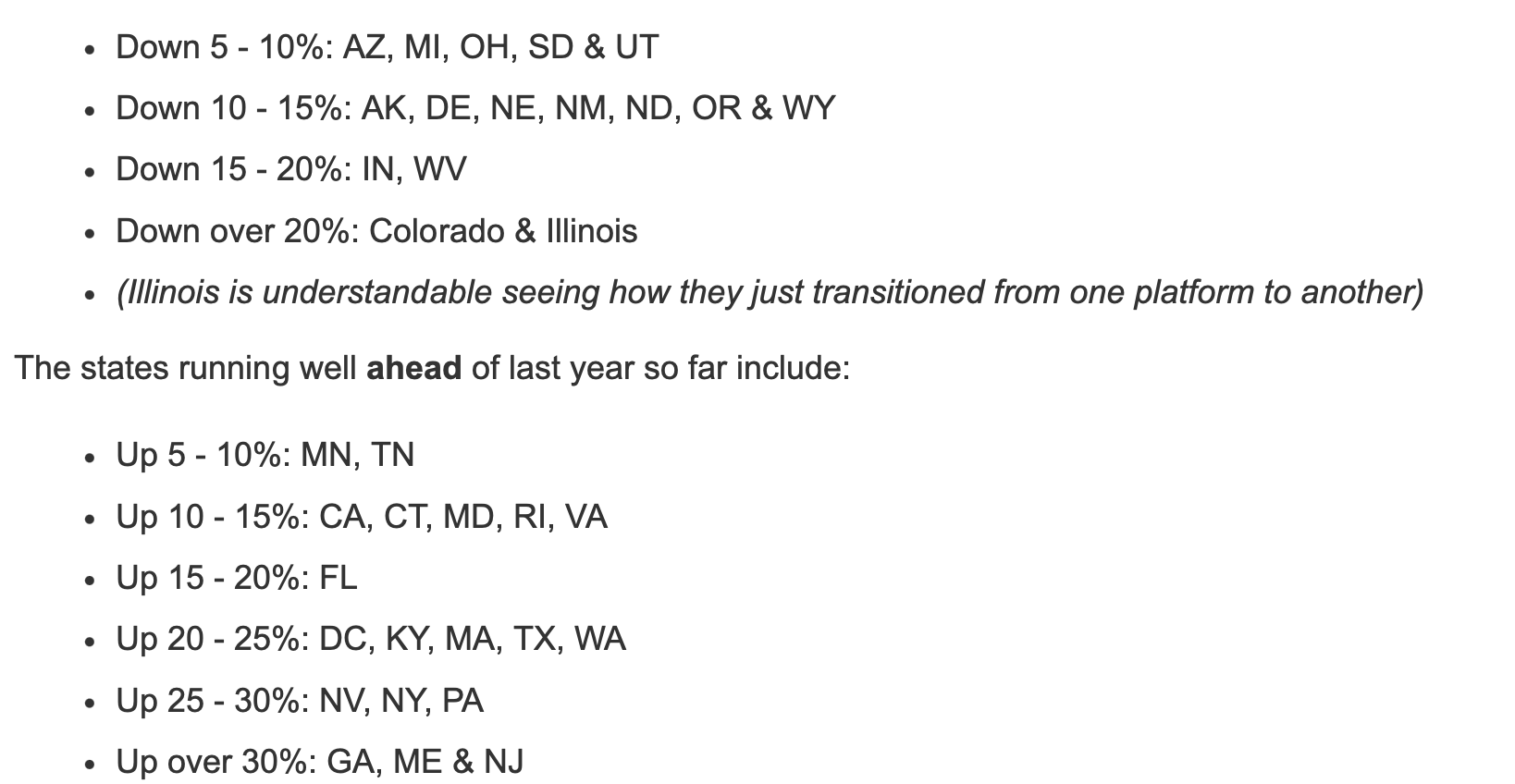

Compositionally, there’s a divergence between healthcare.gov and SBEs. On healthcare.gov, new consumers are up an adjusted 7.3% YoY and returning customers are up 11.3% YoY whereas on the SBEs, new consumers are down -21.8% but returners are up 30.4%. There’s also some interesting geographic dispersion:

From Charles Gaba, acasignups.net

All of this is happening with the backdrop of the Senate is set to vote on competing plans from the Democrats and Republicans for what to do about the expiring subsidies, but no one is particularly optimistic about anything reaching the 60 vote threshold. A bi-partisan group of House members is trying to force a vote on a two year extension but the timing and prospects in the Senate remain open questions.

Analysis

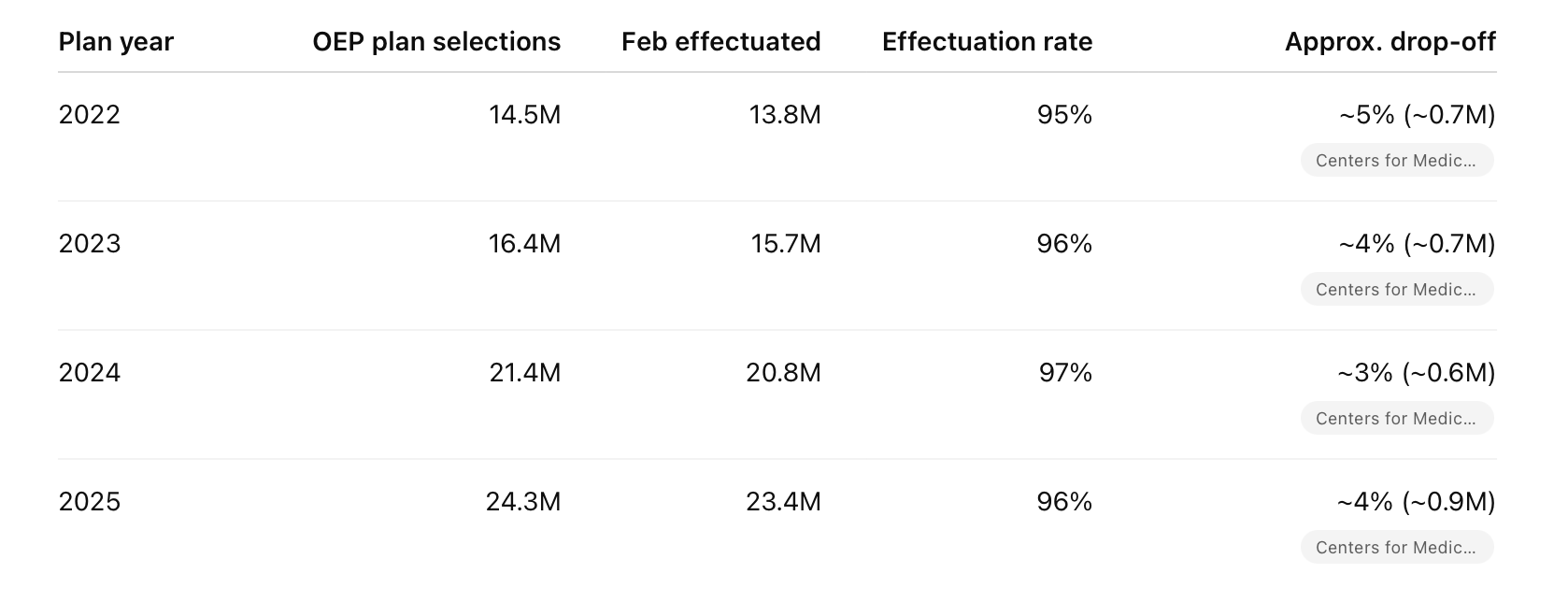

Every year, there’s some attrition from Open Enrollment Period (OEP) plan selection to what CMS calls “effectuation” as people get the bill for the first premium and decide not to pay it. In the enhanced subsidy era, the drop off between selection and effectuation has been in the 3-5% range.

So a year over year comparison at a point in time should be useful, at least directionally, for getting a sense of what enrollment might look like for the broader market.

11.7% YoY growth on 24.3 million OEP selections for 2025 is ~27.1 million and a 5% drop-off would bring February effectuated numbers to ~25.8 million. This would be a great outcome for the ACA marketplace and ACA carriers like $OSCR ( ▼ 3.89% ).

But at least for now, I haven’t heard anyone who really believes we’re going to see a ~10% expansion in the ACA population. For starters, these are early numbers and it’s way too soon to draw any conclusions. There is also the matter of the expiring enhanced subsidies. Analysts and ACA market executives gave ranges for market contraction due to the expiring subsidies which is what you would expect. Prices going up should bring demand down, especially in absence of an insurance mandate.

I think it’s worth doing a bit of speculating on what might be at play if these numbers end up being indicative with the caveat that I don’t think they will be. One hypothesis going around is that all the conversations and debate around the ACA served as free media, and awareness of the ACA is higher. This seems at least plausible, although I’d expect the higher prices to be a countervailing force. Another theory is that people are treating OEP plan selection as an option, i.e. the right but not the obligation to purchase insurance in January if the subsidies get extended. There’s also a scenario where despite the price increases, there is also some driver of increased demand either that Americans are sicker and less willing to be uninsured or employer coverage has decreased due to benefit reductions or lay-offs. Given medical trend this year, I think you could give some credence to the former while there isn’t much data to support the latter. If you have a theory about what’s going on here, I’d love to hear it.

H.R. 1

Work requirements

On Monday, Medicaid and CHIPS Director Dan Brillman released guidance for states on the implementation of the Community Engagement requirements, colloquially referred to as work requirements. This is the instruction manual for states and their various contractors as they get to work preparing for the technical changes to the program.

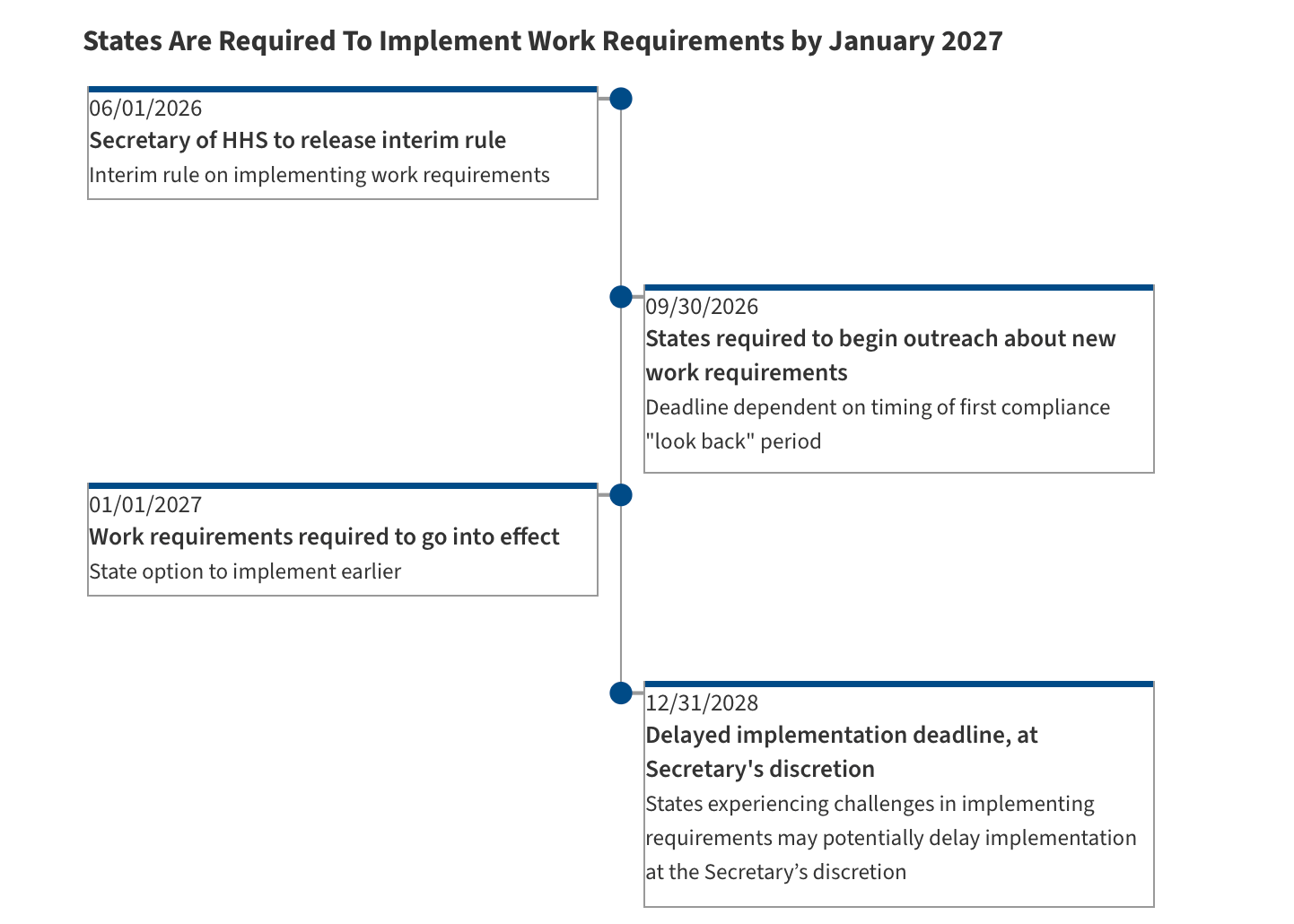

KFF has this helpful resource, which includes a timeline

Meanwhile, states who have tried work requirements in the past are trying to course correct to prevent a repeat of past mistakes citing technological, communication, and staffing challenges that make the task more challenging than it may appear.

Analysis

I continue to be very bullish on Medicaid eligibility infrastructure plays like Fortuna Health and Equifax’s data solutions. I’m also certain these changes are generating lots of billable hours for Deloitte’s Medicaid practice. Setting aside the policy question of whether community engagement requirements are a good or bad idea on the merits, they are an additional layer of complexity and complexity is good for business.

Program integrity efforts for public benefits like work requirements exist along a spectrum. A universal benefit is easy to administer because there is very little in the way of program integrity complexity. I’m sure that there are examples of beneficiary fraud in Medicare1, but it has to be vanishingly small since it’s pretty hard to fake being over 65 and having sufficient Medicare credits.

In a pre-H.R. 1 world, Medicaid eligibility was more complicated than Medicare eligibility. Mostly it involved income verification— are you above or below the line 138% line? Adding hours worked (or other community engagement like volunteering or school) is an order of magnitude increase in complexity because it’s all a lot fuzzier. What counts as proof? A note from your boss? A record of Uber Rides given or DoorDashes delivered? Who is going to verify those records? The edge cases and judgment calls bloom, and that all sounds like a business opportunity for people willing to help manage extreme complexity.

Youssef Kaled wrote an excellent Substack on the topic more broadly called It’s time to build (in Medicaid), and one of the areas he calls out is infrastructure like Fortuna Health. It’s worth a read on where VCs are seeing opportunity, and I appreciate his finding a bit of silver lining in the constraints being the mother of invention.

The Hickpuff Review

MA Annual Open Enrollment is officially over, and while we all wait to see where overall enrollment lands and how strategies to grow or shrink membership played out, it was interesting to see CMS weigh in on a tactic MA plans use to try and trim membership where they cut commissions for a particular MA product. States insurance commissioners have tried to force plans to pay commissions, but CMS issued a reminder that federal law supersedes state laws. I think it’s interesting in the context of what we heard on earnings calls this quarter where commission cutting is one of the levers plans have to manage towards “the right growth”.

The state of Louisiana “abruptly cut” two Medicaid Managed Care contracts, one from Aetna and one from UnitedHealthcare, before reinstating the Aetna contract 12 hours later. Reporting suggests the initial contract terminations were related to on-going PBM litigation between the state and the Caremark and OptumRx.

A couple of regulatory headwinds for hospital operators $HCA ( ▲ 1.19% ) and $THC ( ▼ 0.11% ) as the FTC sent them letters on their use of non-competes while Senate Republicans look to trim hospital payments to fund their healthcare policies.

Niskanen Center’s Katherine Hall wrote about “The missing half of healthcare choice” on eliminating supply-side restrictions and starting the work of un-consolidating the US Healthcare system. It’s a good piece of analysis on an underdiscussed aspect of healthcare reform. I think we set ourselves too easy, too useless a task if consumer-driven healthcare reform doesn’t focus on what would need to be true to make the healthcare market more functional.

Saved for the slide library

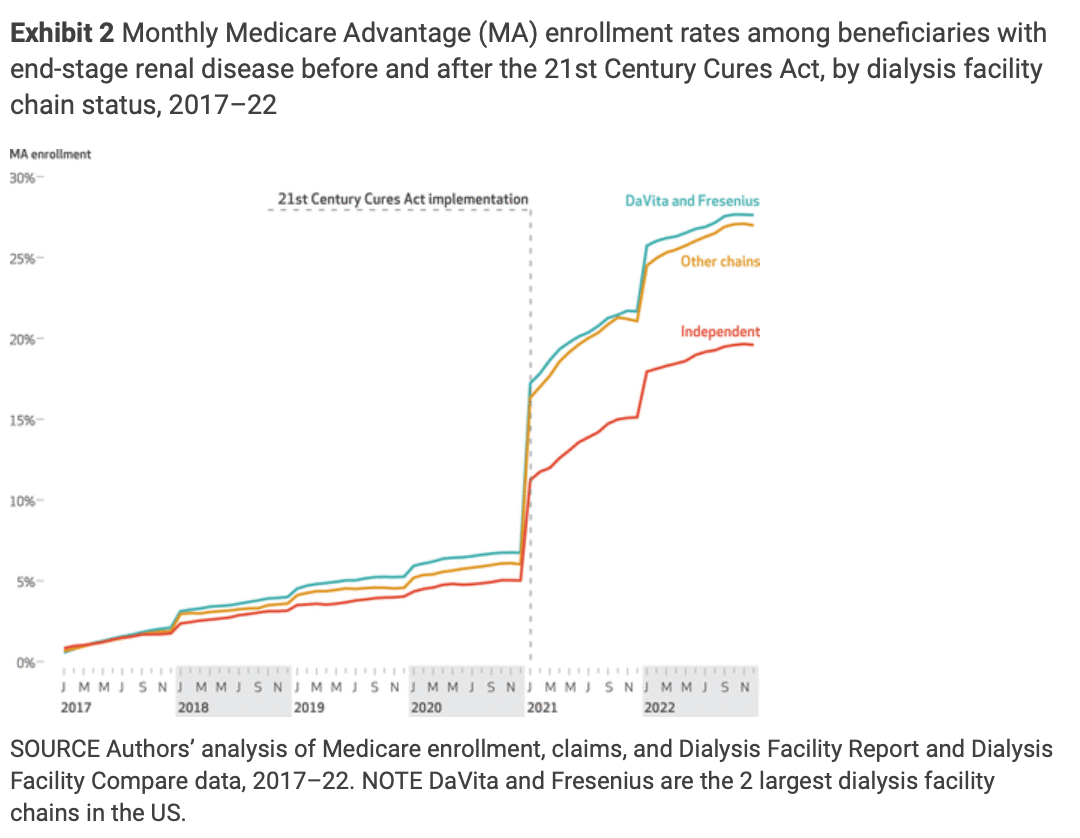

The 21st Century Cures Act allowed Medicare beneficiaries with ESRD to enroll in Medicare Advantage, and very quickly Davita and Fresenius grew their MA businesses to nearly 30% of their patients.

Daeho Kim, David J. Meyers, Kevin H. Nguyen, Maricruz Rivera-Hernandez, Yoojin Lee, Beth A. Dana, Ankur D. Shah, Rajnish Mehrotra, and Amal N. Trivedi in Health Affairs

More from Health Tech Nerds

Since the last newsletter, we’ve hosted a few discussions you might be interested in:

And we’re hosting a few more next week which you can register for below:

Exclusive to premium subscribers

Kevin’s reflections on the CVS/Oak Street Deal: CVS’ investor day was this week, and it was interesting to look back to 2023 when the deal happened and see that it played out almost exactly as he expected.

Mission and margin in rural healthcare: As CMS sifts through the Rural Health Transformation Program applications, I think one of the more interesting companies to watch in the space is Hopscotch Primary Care. After our interview, I asked them some follow up questions on the model and how they’re thinking about the opportunity.

Want to comment or share feedback?

Not sure why you’re receiving this newsletter? Update your preferences here

1 Of course, there are other varieties of Medicare fraud! But people saying they’re eligible for Medicare when they really aren’t isn’t really a thing.