Background and market sizing

If Medicaid were a single payer, it would be the largest payer in the US, covering ~78 million people across the 50 states and the District of Columbia. But rather than a single payer, Medicaid and its sibling program, the Children’s Health Insurance Program (CHIP), operate independently with state funds matched by federal dollars. Those federal dollars from the Centers for Medicare and Medicaid Services (CMS), which make up the majority of the program’s financing, have strings attached to them, and those strings are being wound tighter with the passage of H.R.1, also known as the One Big Beautiful Bill Act.

One important way in which the rules are changing for state Medicaid agencies is the stricter requirements for eligibility and enrollment for Medicaid beneficiaries. To qualify for Medicaid, a prospective member must prove eligibility and enroll in coverage, a notoriously complicated process that involves navigating unfriendly and outdated government interfaces and preparing documentation from multiple sources. Once a member is enrolled, they need to prove their eligibility again regularly, a process called redetermination. H.R. 1 is changing both the eligibility requirements and the cadence that states must conduct redeterminations, increasing complexity for beneficiaries and state Medicaid operations.

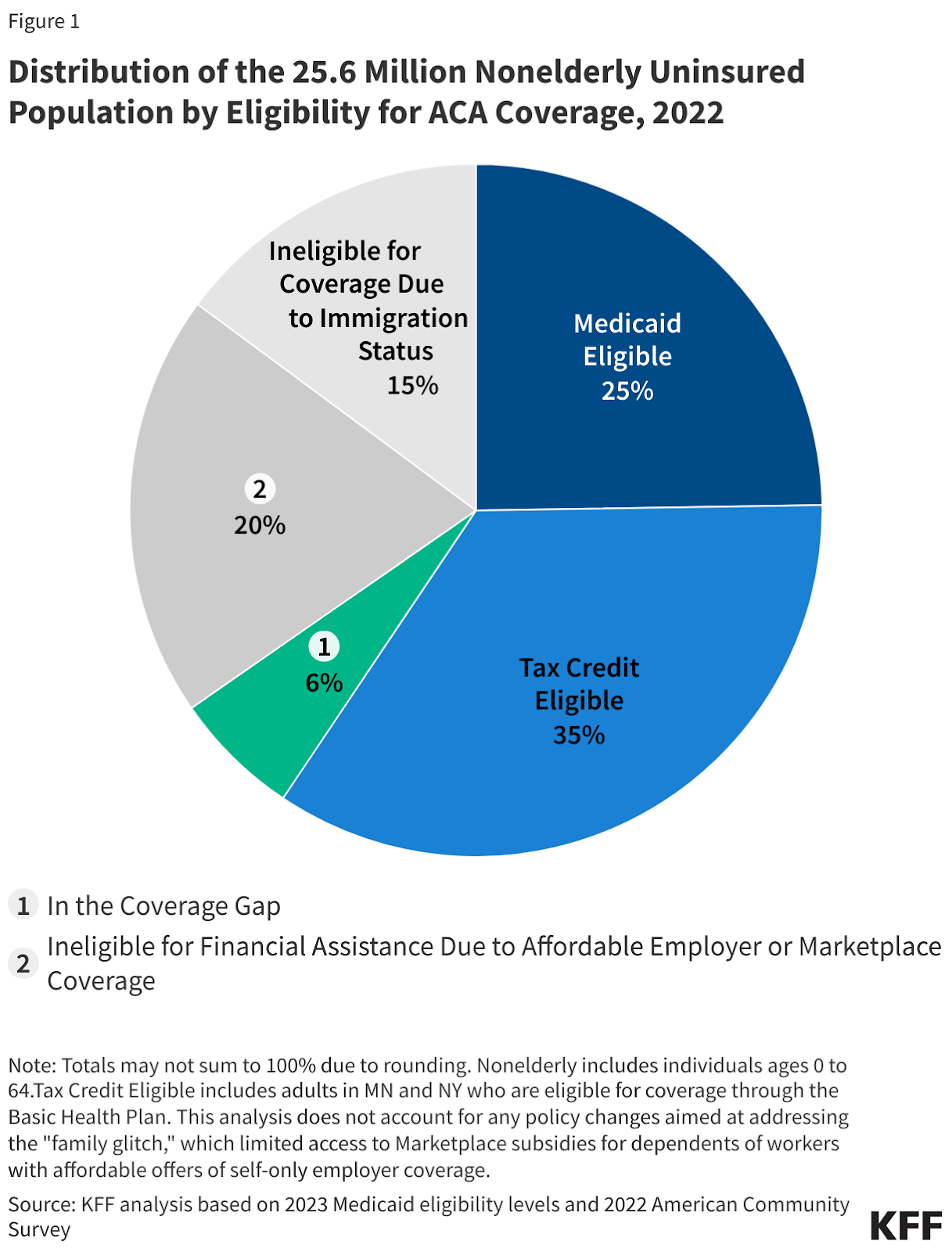

Before H.R.1, this complexity was already a significant factor in increasing access to insurance coverage. A 2024 report from the Kaiser Family Foundation estimated that ~6.4 million people in the United States were eligible for Medicaid but not enrolled, approximately 25% of the uninsured population in the United States.

The 6.4 million eligible but unenrolled population faced significant administrative barriers in the form of outdated state systems, confusing and overlapping program eligibility, under-resourced state Medicaid departments, and a patchwork of data verification systems.

The eligibility provisions of H.R. 1, specifically, the community engagement requirements, are expected to increase this eligible but uninsured population. The Congressional Budget Office estimated that of the ~18.5 million beneficiaries subject to these requirements, ~5.2 million will lose their coverage. Pairing this with other Kaiser Family Foundation research on community engagement among the Medicaid populations suggests that of these ~5.2 million, ~4.8 million are likely eligible for Medicaid benefits but won’t be enrolled. Our estimate for the eligible but not enrolled population post H.R.1 is ~11.1m or ~15% of the current Medicaid market.

When thinking about the total addressable market Fortuna Health is operating in, two other helpful data points are Deloitte and Equifax, both of which have significant Medicaid business lines. Deloitte has ~$6b worth of Medicaid contracts with 25 states covering 53 million Medicaid enrollees, or about $113 per beneficiary. On a recent earnings call, Equifax acknowledged H.R.1 as a tailwind, estimated the TAM for their services at the state and federal level for all social delivery use cases as $5b, and shared that they were currently doing $800 million in revenue. According to an RFP for Maine’s welfare department doing eligibility checks similar to the H.R.1 requirements, Equifax is getting between $143 and $162 a transaction.

As very high-level guideposts for the Total Addressable Market, 11.5 million eligible but unenrolled potential Medicaid members valued between the per beneficiary value to Deloitte at $113 and the high end of the Equifax per transaction fee with two redeterminations per year at $162 is between $1.3 billion and $3.7 billion in addressable market.

Product

Fortuna is an eligibility and enrollment navigator that helps potential and current Medicaid beneficiaries across the administrative lifecycle, including:

Understanding and meeting eligibility criteria

Completing enrollment

Managing coverage renewals and redeterminations

Transitioning off Medicaid when no longer eligible

Business Model

Fortuna Health monetizes this service through a business-to-business-to-consumer (B2B2C) model that is free to beneficiaries and paid for by (1) payers or (2) provider organizations like provider groups and health systems.

The value proposition for these two groups is slightly different.

Payers who run Medicaid Managed Care plans typically get paid on a per-member-per-month (PMPM) basis, so the marginal member is accretive at the top and bottom line. Conversely, churn, which is notoriously high for Medicaid patients of an eligible patient, has a negative impact on revenue and margin.

For a sense of the economics for a payer, we’ve done some back-of-the-envelope math on Centene and Molina1, which both report this information at the Medicaid segment level.

Medicaid Members | Medicaid Revenue | Medical Benefits Ratio2 | Revenue per member per month | Gross margin per member per month | |

14,472,000 | $84b | 88.3% | $484 | $57 | |

4,890,000 | $31b | 89.1% | $521 | $57 |

For hospitals and medical groups, the economics are different and harder to calculate. Typically, providers report negative margins on Medicaid patients, which are often calculated as the difference between commercial reimbursement and Medicaid reimbursement. But the alternative to a patient being on Medicaid is usually a patient being unable to pay, and the provider needing to write off the expenses as bad debt or charity care. Colorado Medicaid found hospital losses due to bad debt or charity care decreased by ~$385m annually post Medicaid expansion.

Calculating the revenue and margin for an incremental Medicaid patient for these groups is more challenging, but we will also note that CMS allows qualified entities, like hospitals and provider groups, to screen patients for Medicaid eligibility under a program called Presumptive Eligibility. In addition to avoiding bad debt or charity care, we assume that hospitals and provider groups also save on the administrative costs associated with presumptive eligibility when using Fortuna.

Competition

Fortuna is in an interesting spot strategically because the organizations best positioned to compete with them are dispositionally unlikely to. Deloitte, as a large, private consultancy with state contracts, favors the status quo. A U.S. Digital Service-style initiative at the state level to make their systems more user-friendly and work better could slow Fortuna’s growth, but in the current budget environment, states are unlikely to have extra funds to invest and have the incentive not to, as marginal Medicaid members cost them more money.

The open-source, non-profit MyFriendBen offers a light benefits navigation tool for a variety of social benefits, including Medicaid in Colorado and North Carolina. Healthy Together seems to be offering a fresher, more modern experience to state governments, but not working with the groups that have an economic incentive to enroll the members.

More direct competition comes from companies like Benelynk and Centauri Health Solutions, which are diversified, call-center businesses. These businesses have existing health plan and provider contracts, but Fortuna’s focus on Medicaid and operational leverage from relying on technology rather than call centers is a compelling point in Fortuna’s favor.

Expansion Opportunities

Although the estimated ~11.5 million eligible but unenrolled Medicaid beneficiaries and the forthcoming bi-annual redeterminations are a sufficiently large opportunity to keep Fortuna Health busy for now, the position of front door and navigator for government benefits affords opportunities to move along the value chain or expand into adjacent areas.

In the near term, populations that are dually eligible for Medicaid and Medicare are an increasingly compelling segment for insurers and value-based care companies like Cityblock because of the increased reimbursement. Additionally, the administratively complicated process for Affordable Care Act tax credits and the similarities between the Medicaid and Marketplace populations position Fortuna well to assist brokers, plans, and care provider organizations during open enrollment periods, where people may be on the edge of Medicaid and ACA tax credit eligibility. Another benefit of working with this population is the increased margin profile and reimbursement associated with ACA plan members, creating a higher willingness to pay among Fortuna’s customers.

In the longer run, it seems plausible that Fortuna could use a combination of user loyalty, aggregated data, and permissions from its users, and relationships with payers and providers to chip away at some of Deloitte’s share of state contracts or Equifax’s transaction fees. Equifax’s ability to command $143 and $162 a transaction for what amounts to data exhaust from their main business seems like a lot of Equifax margin that Fortuna could turn into an opportunity.

Risks

Outside of the normal competitive risks, Fortuna has two unique risks to its business by dint of its position in the market and relationship with states and the federal government. The first risk is disintermediation. Although Fortuna is currently helping payers and providers “find money”, margins are thin in the Medicaid world, and these partners may eventually put downward pressure on Fortuna's fees or try to internalize the process to cut them out completely. This seems low risk in the near-term but a moderate risk in the much longer run.

The second risk is harder to quantify, but deserves a comment. A driver of H.R.1 was a desire to save money by making fewer people eligible for Medicaid, which is jointly financed by the state and federal government. Part of the strategy to save money on this benefit is by adding friction to the process of getting the benefits, so Fortuna is, in some ways, at odds with the state and federal governments in terms of incentives. Although it’s hard to imagine a scenario where a government forbids a state-contracted payer or provider from using Fortuna, this tension could be a headwind on Fortuna’s growth.

Details

Website

Financing

Seed: November 15th, 2023, $4m, led by Andreessen Horowitz (a16z) Bio + Health, Box Group, Y Combinator. Angels included Cyrus Massoumi (ZocDoc), Jeff Gerard (ex-Sutter Health Bay Area), Elliot Cohen (PillPak founder), Iyah and Sylvia Romm (Cityblock), Ellen DaSilva (Summer Health), and John Legend.

Series A: July 21st, 2025: $18m led by Andreessen Horowitz with participation from Y Combinator and founders and executives from Abridge, DoorDash, Hex, One Medical, Oscar Health, Scale, and Vanta

Additional HTN Research

1 The other major players in Medicaid managed care are Aetna, with 2.5 million Medicaid members, Elevance, with 8.9 million Medicaid members, and UnitedHealth Group, with 7.4 million Medicaid members, although they don’t report revenue and MBR separately from the rest of their business.

2 Medical Benefits Ratio is only reported out at the company level for Centene and Molina, but Medicaid is their primary business.