Sponsored by: xCures

xCures is an AI-based platform that transforms medical records from any source into comprehensive patient datasets and surfaces insights via checklists, summaries, and semantic search. Validated models, contextual performance metrics, and traceable data help foster trust and ensure clinical validation.

TEFCA-ready and working with leading tech companies such as Epic, CLEAR, and Kno2, xCures is a powerful solution for achieving clinical data clarity.

If you're interested in sponsoring the newsletter, let us know!

Kevin’s Reflection: Last Week’s Poll on Healthcare Costs

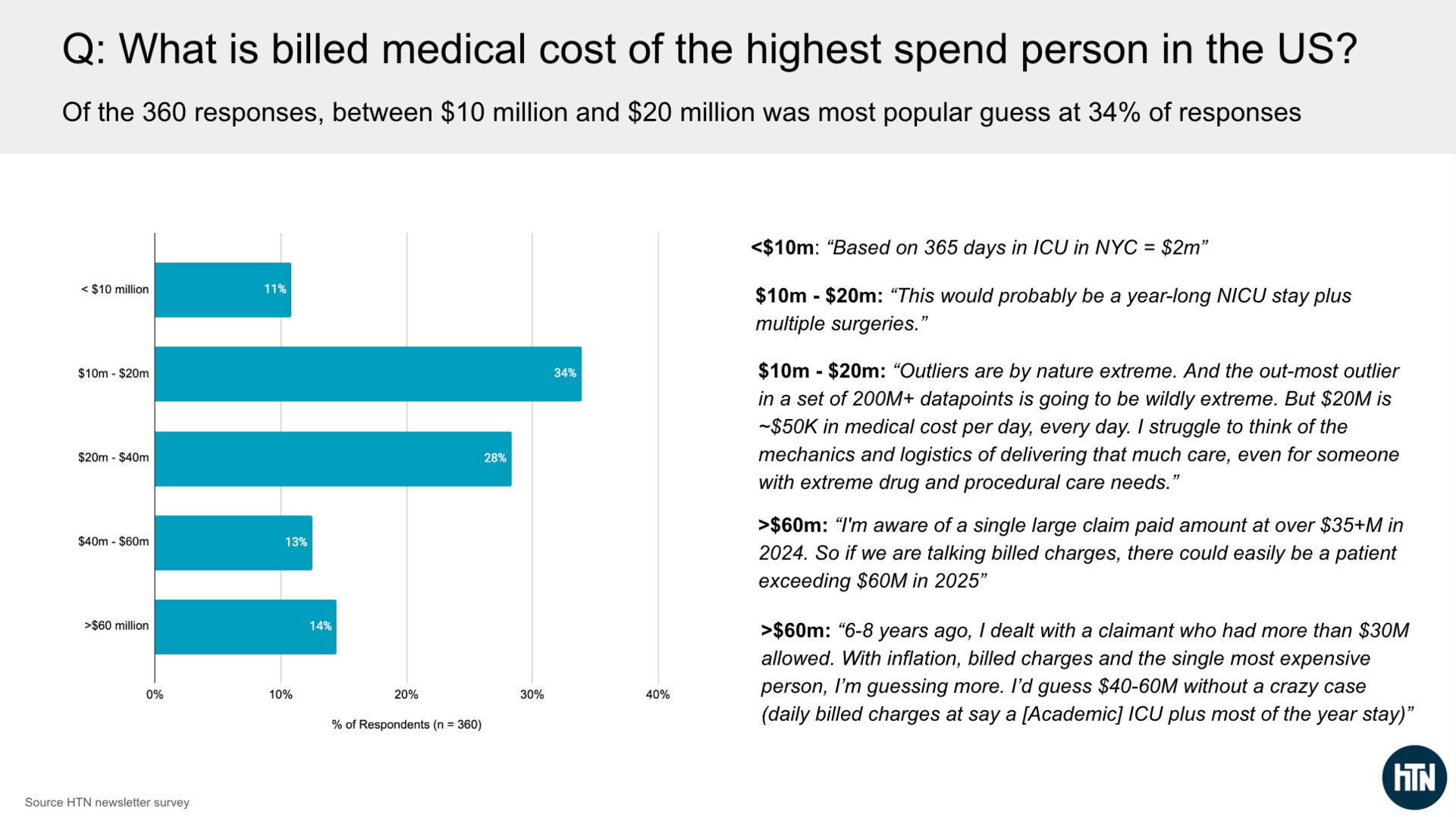

The nerdiness of this newsletter readership never ceases to amaze me, as 360 of you responded to the poll question last week, guessing the highest billed medical spend for a single person in the US in 2025. The responses were across the board, with the highest being the $10 million to $20 million category at 34%. Here’s how it broke down, with some of the more interesting comments people added as well:

Taking a picture of a slide I made saves words here 🙂

I find two things particularly interesting about the results:

As the comments above indicate, it seems that people who attempted to work through math logically end up on the low end of the range here. If I Google ICU costs in New York, I see a high-end cost estimate of $5,100 per day. Multiply that by 365 days, and I get $1.8 million in costs. I very much agree with the comments that it is hard to think about how it would be possible to spend so much, and yet…

I am also not surprised to see some comments from insurance folks who have seen $30+ million cases. As I mentioned in last week’s newsletter, there was a child in California who cost MediCal $21 million in 2014. There is also the well-known story of a $12 million member on the Iowa exchanges. And those are just some publicly available examples. It is not surprising to me to see the comment that there was a $35+ million paid claim in 2024 (which would likely mean insurance negotiated those charges down).

Given the comments about the $30+ million paid / allowed claims, it seems likely that someone is racking up $60+ million in billed charges this year (noting that billed charges are often multiples of what ends up being paid).

As the conversation about the unaffordability of insurance, cash pay healthcare, and related concepts heats up in this country — with the President seemingly weighing in on Truth Social yesterday — I think it is worth thinking deeply about the distribution of medical costs in this country, what drives those costs, and what tradeoffs we’re collectively making as we head down this path.

AI FUNDING

Hippocratic AI’s massive funding round and the future of robocalls

On Monday, Hippocratic AI made waves by announcing a $126 million Series C funding round at a $3.5 billion valuation. The company, which is no stranger to controversy, has a big vision for bringing “healthcare abundance to every person in the world” by training AI agents to safely perform patient-facing clinical tasks (aside from prescribing / diagnosing). As Hippocratic’s CEO put it succinctly in the Med City News article quoted above:

“Everybody’s fussing around about, oh, we’re missing 10% more nurses or 30% more nurses and we have 3 million nurses. We need another 900,000. I’m like, ‘Great. I’ll give you the 900,000.’ ”

This funding round, led by new-ish healthcare investor Avenir Growth, brings Hippocratic AI’s total funding raised to $404 million. Hippocratic announced its $141 million Series B back in January 2025 at a $1.64 billion valuation.

✍ Going Deeper

Given the amount of hype around AI right now, I find it interesting to dig into what these companies are actually doing today to understand what is real.

The Hippocratic press release included customer quotes from six customers: Sanford Health, Cincinnati Children’s, OhioHealth, WellSpan Health, University Hospitals, and Advocate Health. If you read through the quotes, you’ll notice that only one of them refers specifically to a deployment of a product — WellSpan’s AI care assistant, known as Anna. Interesting. Let’s learn about Anna!

WellSpan and Hippocratic seem to have a deep relationship, as WellSpan appears to have invested in every round since either the Seed or Series A. WellSpan’s CEO is also featured in this Hippocratic customer video. In the video, there is a discussion of two key efforts between the two organizations:

WellSpan and Hippocratic published a paper about how they used Anna for colorectal cancer screening. Anna reached out to 1,878 patients, 517 of whom were Spanish-speaking, with the remainder English-speaking. 18.2% of Spanish-speaking patients opted in to receive a FIT test, while only 7.1% of English-speaking patients did so. Hippocratic touts the 2.6x Spanish-speaking engagement on its website. But, if I do the math, that means that only 10% of patients called by the AI algorithm opted in to receive a FIT test. That seems like more of the headline to me: a health system reaches out to its patients, telling them they should get a free colon cancer screening, and 90% of the time those patients choose not to. For comparison, WellSpan’s CHNA data below suggests that 24% of community members who are recommended for screening get it.

11/21 edit: Hippocratic AI’s PR team reached out to clarify their perspective that this work was on an “unreachable” population and that the CHNA results are not comparable, see screenshot below for the full response from Hippocratic AI’s PR team:

Source: Hippocratic AI PR team email to HTN team, 11/21/25

Another key effort that WellSpan and Hippocratic partnered on was automating WellSpan’s 2025 Community Health Needs Assessment (CHNA). If you look at the data from that assessment, you can see how Anna was used — it made 650,000 calls to WellSpan patients over a two-week period to encourage their participation. The survey saw 5,771 responses. WellSpan reported seeing a 275% increase in completion rates from the previous survey.

11/21 edit: Hippocratic AI’s PR team reached out to share that the 650,000 phone calls were made to unique individuals. I have removed a sentence above regarding my misreading of the original study, in which suggested that Hippocratic AI called 75,000 people ~10 times. See screenshot below for full response from Hippocratic AI’s PR team:

Source: Hippocratic AI PR team email to HTN team, 11/21/25

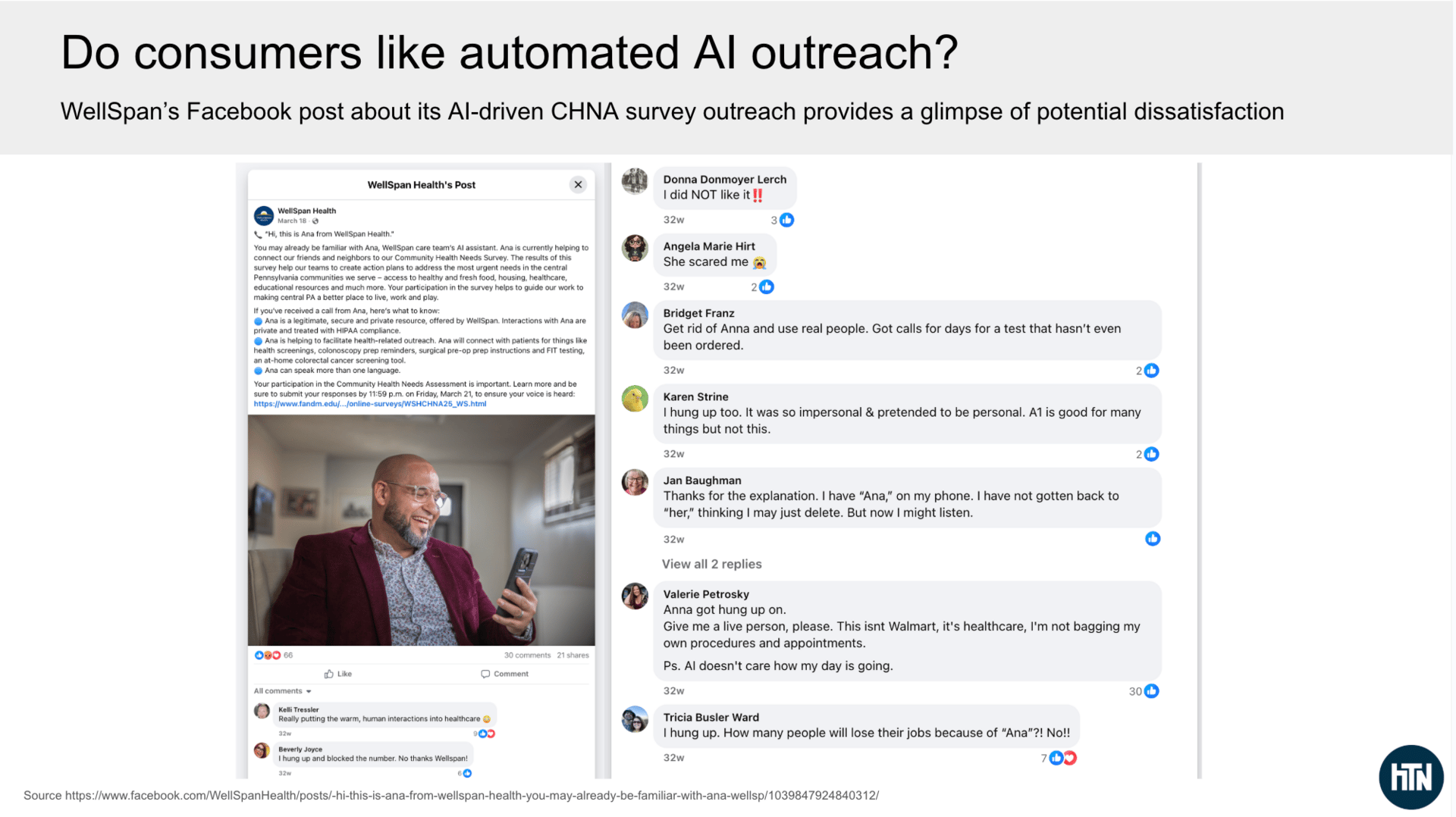

It is interesting to juxtapose the glowing language that WellSpan and Hippocratic use to describe those results with the harsh reality of customer feedback on a Facebook post. Back in March, WellSpan explained in a Facebook post that Anna was conducting the CHNA, and the community's response was… not great. I counted nearly thirty replies, every single one either indicating the person hung up or didn’t like it:

Source: WellSpan’s Facebook post; HTN analysis

I think all of that paints a pretty clear picture of how Anna is being used today (and probably says something about why it is no longer called “Ana”). For all the lofty visions of how Hippocratic is building the nursing workforce of the future, its biggest customer appears to be using it for spammy robocalls.

It’s interesting to juxtapose this with how WellSpan’s CEO talks about the vision for AI, and Anna specifically, as WellSpan’s front door:

Our vision right now is we want care anytime, anywhere, and we think that that's how people are going to consume health care in the future. So Anna could be a huge part of that, and we've already considered her a part of our care team.

So she gets introduced as our AI care assistant. Patients interact with her, but a vision for the future could be around every person who reaches out to WellSpan is initially greeted by Anna. That she really is our front door for any call or any contact — Web, phone, anything. And she's doing a terrific job so far. We've made over 1.6 million calls with Anna. She's a very hard worker. And this last week she scheduled more than 50% of our primary care visits for the week. Clearly, by completing that scheduling, patients enjoy interacting with Anna or they wouldn’t complete the call.

It’s definitely an ambitious “front door” vision to greet every patient with an AI bot. You can see why VCs would get excited here. At the same time, I’ve heard of health systems dreaming of “front door” reinvention for the better part of a decade now. It’s not hard to envision the financial case for a health system, thinking about the potential cost savings and additional revenue capture opportunities automated outreach like this can theoretically deliver. Yet at the same time, consumer pushback seems inevitable here — it seems like only a matter of time before people completely ignore these types of robocalls.

So while I can appreciate the vision of AI like Anna as the future of healthcare in an abundant society, I don’t think this is it.

Q3 EARNINGS

A busy (and challenging) week of earnings

Here’s a quick rundown of the three earnings calls that stood out as the most strategically interesting to me this week:

Humana seems poised for outsized Medicare Advantage growth in 2026 — but is that a good thing?

Check out our full write-up here

As discussed in the write-up above, Humana’s earnings call focused heavily on 2026, as it shared that early AEP results suggest it will come in at the high end of MA enrollment targets. Analysts spent most of the earnings call asking whether Humana is prepared for that. Humana appears confident it can manage new membership profitably in the short term, while also focusing on customer lifetime value. Humana’s stock fell 8% on the earnings report, suggesting some market skepticism. Either way, Humana’s 2026 is going to make for an interesting case study in MA — as I note in my takeaway, Humana is either brilliantly setting itself up for 2028 and beyond, or it is going to have a huge profitability issue in 2026 given the combo of growth + Stars revenue headwind. It doesn’t seem like there’s much middle ground with this strategy.

Clover’s earnings miss hints at cracks in the AI-centric PPO narrative

Check out our full write-up here

Clover’s PPO-centric narrative showed signs of cracking as Clover missed its profit targets, driven by — stop me if you’ve heard this before — an influx of new membership that is more unprofitable than expected. Clover cited a contribution margin of -$110 PMPM on new members versus $217 PMPM on returning members. As we get into the analysis linked above, I remain skeptical that Clover is the only MA plan to solve the puzzle that is PPOs; it seems much more likely to me that the Clover Assistant has been an effective vehicle for capturing risk adjustment codes.

Privia continues chugging along, demonstrating strong VBC results

Check out our full write-up here

Privia continued its habit of posting quarters with solid growth on all fronts. This quarter had a VBC-centric feel, a change of pace for a company known for the phrase “it’s called risk for a reason”. Privia cited its strong results in MSSP and also spent time on the Evolent ACO acquisition and its thinking about growth ahead.

A Rundown of Other Notable Q3 Earnings Reports this week:

Astrana Health. Stock fell 23% on earnings despite solid performance in the quarter, as it missed and revised down guidance due to delays in the timing of full-risk contracts.

agilon health. Stock was down 18% on the week as it continues to work through challenges with global cap contracts.

Evolent Health. Stock dropped 26% this week as earnings miss outweighs solid growth prospects in a rising medical cost environment.

GoodRx. Stock fell 7% this week as it navigates a complicated pharmacy landscape.

Hims. Stock dropped 10% in back half of week after solid earnings on Monday, including a restart of negotiations with Novo Nordisk.

Hinge Health. Stock dropped 8% despite increasing revenue and operating income guidance for 2025.

Oscar Health. Stock ended the week up 2% as it indicated its confidence in growing share and margins in 2026 despite a tumultuous year for the ACA.

Omada Health. Stock dropped 17% despite a solid quarter of growth and the announcement of new GLP-1 prescribing capabilities.

Other Top Headlines

Baylor Scott & White announced the launch of a new for-profit subsidiary, Levanto, a new digital health platform for employers that leverages Baylor Scott & White’s clinical expertise. It’s designed to address point-solution fatigue by stitching together a platform that supports MSK, mental health, weight management, women’s health, and more. Baylor Scott & White’s 50,000-employee plan is the platform's first customer. It’s a bit curious to me that this appears to have launched separately from Longitude Health, the initiative from Baylor Scott & White and other health systems to launch businesses that revolutionize health systems. Seems like the perfect idea for that.

Cambia announced an affiliation with Arkansas Blue Cross. This is the second such affiliation announced this year, following BCBS ND. The news notes that recent financial difficulties were not the primary driver here, but that the bigger platform will enable increased investments in technology and other capabilities.

Brittany Trang did some excellent reporting in Stat on how Med First, a primary care / urgent care chain in the Carolinas, is reportedly seeing a 6% revenue bump by using Arintra’s AI coding tool. The extra revenue is a key driver as Med First expands from 27 locations to 40 locations in the region. I think it serves as a fascinating case study of the various impacts AI is having on healthcare and the trade-offs between increased access and increased costs.

The White House announced on Thursday that it has negotiated agreements with Eli Lilly and Novo Nordisk that will reduce the price of GLP-1s via TrumpRx.

UnitedHealthcare caused a kerfluffle in the remote monitoring market by issuing a new policy that will not cover many remote patient monitoring use cases.

Mayo Clinic Platform_Insights launched a new data platform designed to give other healthcare providers access to its AI best practices.

Featured Jobs

WellTheory, an autoimmune care platform, is hiring for the following roles. Mention HTN in your application to get an expedited review!

Data Analyst (Remote). Learn more.

RVP, Health Plan Sales (Remote). Learn more.

RVP, Employer Sales (Remote). Learn more.

Director, Strategic Initiatives & Program Innovation at Medical Home Network, a nonprofit helping FQHCs implement VBC models for Medicare and Medicaid. Learn more

Remote

Product Marketing Manager, Lyft Business at Lyft, a rideshare company with a growing non-emergency medical transport offering. Learn more.

$118k - $147k | Hybrid (SF or NYC)

Director at Optum AI, UHG’s enterprise AI team. Learn more.

$132,200 to $226,600 | Remote. In-person for Minneapolis and DC-based candidates. Also hiring a Sr Director—learn more here.

Contact us to feature roles in our newsletter.

What I’m Reading

Complexity for the 2026 Marketplace Open Enrollment: Risks of Consumer Confusion & Coverage Loss by Michael Cohen, Lina Rashid, and Zachary Sherman

This paper from Health Management Associates does a nice job articulating what seems bound to be a confusing year for consumers shopping for coverage in open enrollment. Read more

The case for an ambulatory-focused strategy by Lauren Clementi

A quick Kaufmann Hall piece about how health systems need to be looking at ambulatory strategy as a focal point moving forward. Read more

Health care moves into the workplace by Erika Fry

This Washington Post article explores renewed interest in employer on-site/near-site clinic models like Marathon and Premise Health. It is a fairly surface-level overview of the market; what I find more interesting is how it’s described as a new approach. Read more

Funding Announcements

Hippocratic AI, an agentic AI platform, raised $126 million. See above.

Tala Health, an AI care platform, raised $100 million.

Affect Therapeutics, a mental health platform, raised $26 million.

Sovato, a robotic surgery platform, raised $26 million.

Amae Health, a care model for serious mental illness, raised $25 million.

Popai Health, an AI care coordination platform, raised $11 million.

Want to share feedback with us?

Show your support by sharing our newsletter and earn rewards for your referrals!