Overview

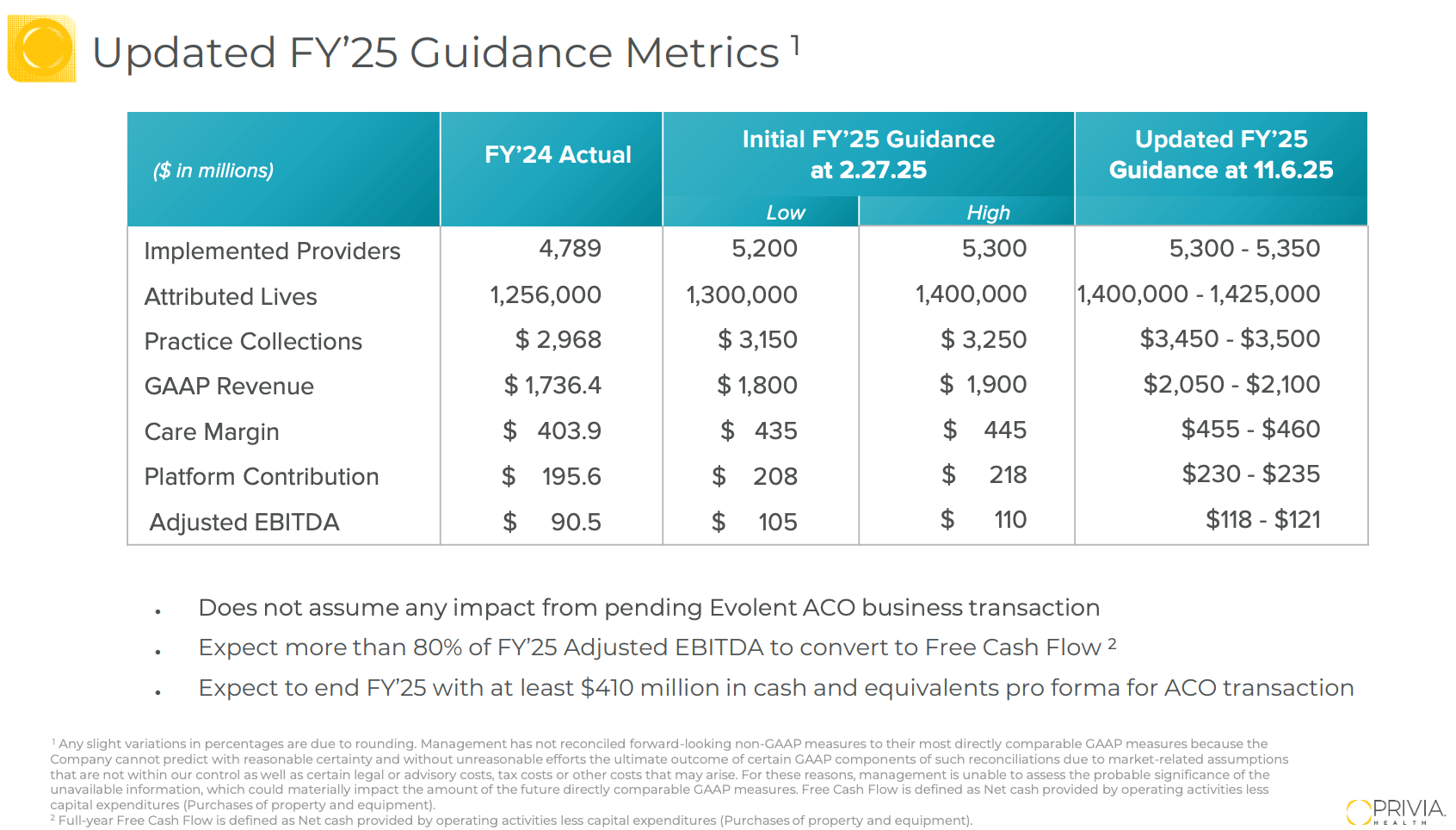

Privia stock was trading up 7% this morning after reporting another solid quarter, before giving those stock gains away in the afternoon as the broader market experienced a sell-off. Despite the vagaries of the stock market, it is quite impressive how consistently Privia is executing its business at the moment. Privia raised its outlook for FY 2025, and as the slide below indicates, it is coming in above the high end of all of its initial guidance estimates for 2025.

In what has been a challenging few years for so many players in the primary care enablement market, Privia continues to execute remarkably well. It’s interesting to go back to Privia’s IPO presentation from 2021 and note how many of its competitors from four years ago do not exist today.

Alignment and Privia continue to stand out in the public markets as companies executing in markets where others are faltering. Both have taken relatively conservative strategies compared to the market that have paid off dividends – Privia by taking a cautious approach to value-based contracts, and Alignment by taking a cautious approach to risk adjustment. In many ways, it seems like flip sides of the same coin, and a good lesson learned for health tech entrepreneurs about the risks of getting too overweight on a single funding source (in this case, risk adjustment revenue).

Privia’s Q3 earnings results this morning again featured increases in revenue and profitability metrics. It was interesting to me that this earnings call placed greater emphasis on VBC, with Privia highlighting its strong MSSP performance in 2024 and its acquisition of Evolent Health’s ACO business. There was a lot of conversation on both topics in the earnings call, which we’ll dive into more below.

Privia seems to be in a really good strategic position at the moment – it has built a strong foundation in the markets it operates in, and as it continues to build density in those markets, it should be able to build on that strength. Given that, the biggest questions ahead of the business seem to be around how and where it chooses to grow from here.

Links:

Key Metrics

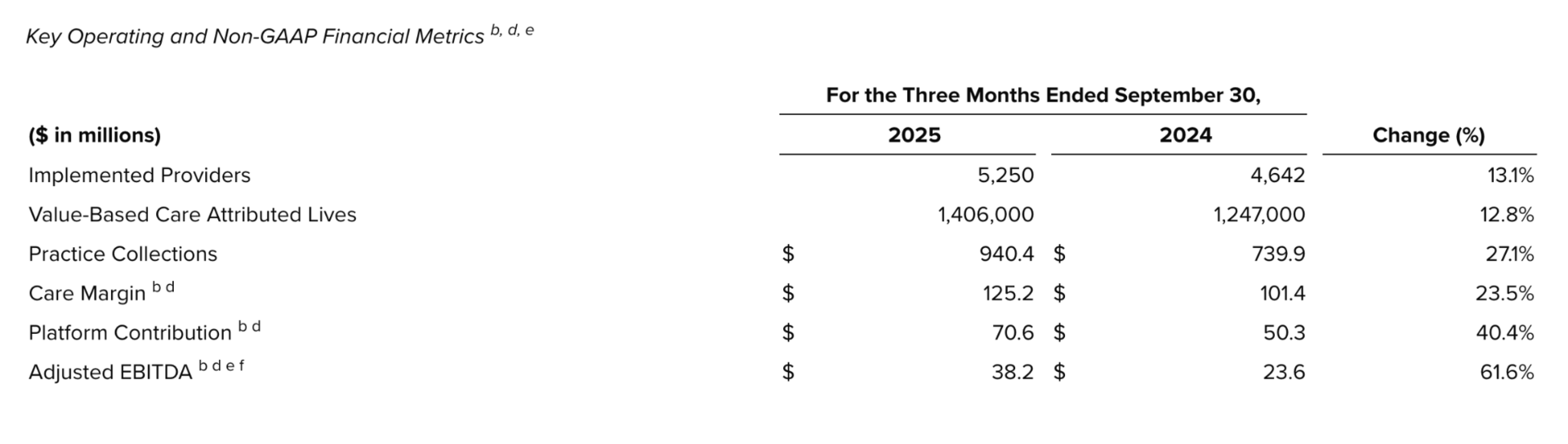

Here is Privia’s chart from the press release summarizing key strategic metric performance:

Earnings Call Discussion:

Here are a few key takeaways from the earnings discussion:

Join the Health Tech Nerds Community to access.

Join thousands of other innovators in healthcare accelerating their learning in healthcare.

Join the Health Tech Nerds CommunityA community membership gets you:

- Private Slack Community: Exchange ideas, lessons learned and insights with your peers in real time.

- Exclusive insights & expert content: Access deep dives, case studies, and curated wisdom, plus live sessions with industry leaders.

- Networking made easy: Get curated matches, connect through the member directory, and join or host local meetups.

- Proven tools & resources: Save time with research, templates, and community-sourced solutions.