Programming note: Next Thursday is Thanksgiving, so barring some sort of health policy emergency, HPB will be off next week and back on December 4th.

Weekly briefing

ACA

An extension, HSAs, or nothing at all

Yesterday, the United States Senate Committee on Finance held a hearing on The Rising Cost of Health Care: Considering Meaningful Solutions for All Americans. The Republican majority invited Douglas Holtz-Eakin, president of the American Action Forum, and Brian Blase, President of the Paragon Health Institute. Witnesses for the minority included Jason Levitis, Senior Fellow at the Urban Institute and Bartley Armitage, a maximally sympathetic constituent of Ron Wyden who buys his insurance on the exchanges.

You can watch a recording of the hearing here, but I’ll summarize the positions people staked out here.

Douglas Holtz-Eakin and a contingent of Republicans including Ron Johnson, the junior senator from Wisconsin, see the Affordable Care Act’s individual market as unworkable in the long run. Temporary fixes could include funding the Cost Sharing Reductions (CSRs), but Holtz-Eakin succinctly summarized the longer run policy preferences of this group by saying, “a better approach would be to get these individuals into the employer-sponsored insurance market, which has the added benefit of rewarding work.”

Another contingent of Republicans led by Bill Cassidy of Louisiana favor the Paragon Health Institute’s HSA option which would restore Cost Sharing Reduction funding for insurance companies, but require payers to offer an HSA contribution as an option instead of lower deductibles and c-pays.

The Democratic caucus was united around an as-is extension which Jason Levitis agreed was the only feasible solution given that open enrollment is already underway with insurance products priced for the binary choice of extensions or no extensions, not CSR funding or the HSA option.

Analysis

An informal and unscientific poll of health care lobbyists and industry acquaintances put the extension of the tax credits in some form at about even odds. The argument that something will happen with the extensions is basically twofold: first, Republican allied pollsters keep releasing polls that warn of dire consequences if the subsidies aren’t extended. This quote from McLaughlin & Associates was particularly striking: If Republicans block extending the tax credits, 51% would vote Democrat versus 41% Republican on the informed generic ballot. The UVA Center for Politics estimate, which you should take with several grains of salt, is that a 10-point generic ballot advantage for the Democrats would translate to losses of 39 House seats and 9 Senate seats in 2026. Second, there’s the politician’s syllogism which tends to have some predictive power when it comes to the actions of the US Congress:

We must do something.

This is something.

Therefore, we must do this.

If you’re looking for evidence that nothing will happen, I think this hearing was a pretty good data point in your favor. The majority party is divided on what to do between the Holtz-Eakin and Blase contingencies and the minority party is united on a separate, third idea. In the meantime, all the marketplace shoppers, payers, hospitals, and policy wonks will keep watching with bated breath.

OB3

“Enacted and imposed by July 4th”

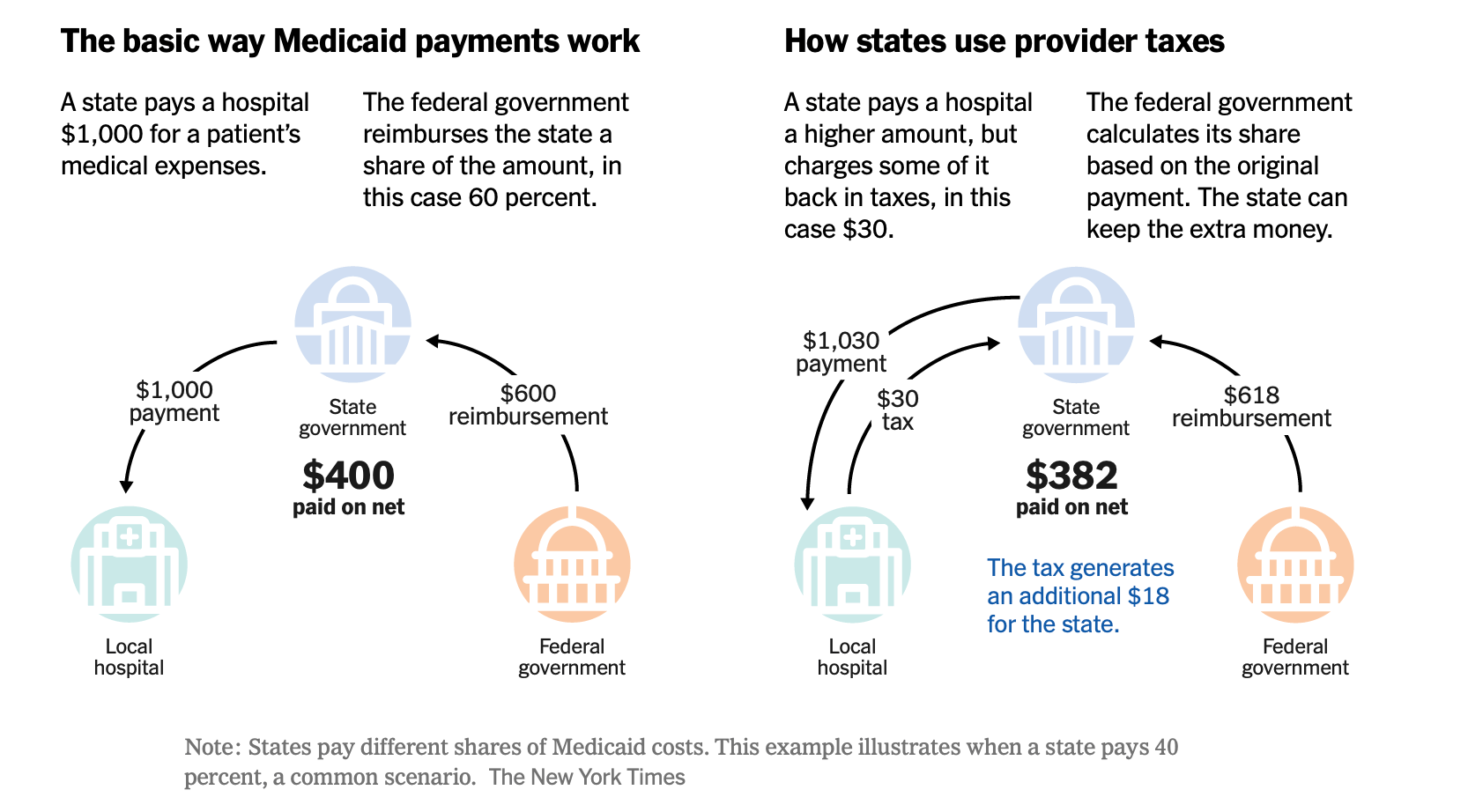

Last Friday night, CMS released preliminary guidance for states on how the provider tax provisions of the One Big Beautiful Bill are going to be enacted. As a quick refresher, provider taxes are an extremely clever workaround that states use to get more federal Medicaid funding:

The One Big Beautiful Bill Act limits new provider taxes and will ratchet them down to no more than 3.5% by 2032. A lot of states have provider taxes above this threshold, but some weren’t using the provider tax loophole to its full potential and when they saw that things were going to change, tried to move quickly to maximize how much they were taking in before the rules changed.

Friday’s guidance from CMS spelled out whether these last minute changes would be allowed. The way they’re drawing the lines asks three questions:

Was the provider tax in effect by July 4th when the bill was signed?

Was CMS approval required and granted by July 4th?

Was the tax imposed by July 4th?

I haven’t found a definitive list of states that might be affected, and I imagine states who feel like they might be aren’t eager to raise their hands and ask. But a quick review of Legiscan and other sources found that Wisconsin, Kansas, Connecticut, Ohio, and North Carolina all moved bills earlier in the year to raise their provider taxes, presumably in anticipation of these changes, and CMS will be looking closely to make sure they meet the criteria.

Analysis

In a remarkable tick-tock of the Wisconsin budget deal, MPR describes Governor Tony Evers and Republican state lawmakers unveiling a budget deal on Tuesday, July 1st, the state Senate passing it on Wednesday, July 2nd, and Evers signing it at 1 a.m. on Thursday July 3rd with a retroactive date of July 1st for the taxes. This raised their provider tax from 1.8%, one of the lower rates in the country, to 6% which is the new limit before the down ramp starts.

My read of the dear colleague letter from CMS, with the caveat that I am not a lawyer, is that Wisconsin’s provider tax change meets the requirements in what is the legislative equivalent of the famous scene from Indiana Jones and the Temple of Doom where he slides through the closing door at the last minute, grabbing his hat on the way out.

Whether it was a staffer in Madison or a lobbyist from the Wisconsin Hospital Association who saw which way the wind was blowing, the move is helping Wisconsin draw down an additional ~$1.5 billion in federal funds, and I think whoever got it over the line deserves a raise.

CMS

CMS innovation center announces new strategy

In a Health Affairs Forefront article, Abe Sutton and Gita Deo outlined the new strategic priorities for the innovation center at CMS which has failed to generate savings in a majority of its programs over its 15-year lifespan.

The Health Affairs piece does a nice job of articulating the philosophy behind what we’ve been seeing from the innovation center so far with WISeR as an example of prioritizing high-value care, TEAM and the Ambulatory Specialty Model (ASM) as they shift away from upside only and voluntary participation demonstrations, simplifying financial benchmarking as in the case of Bundled Payments for Care Improvement Advanced Model where benchmarking changes offset three years of losses in the model and generated net savings of $179.5 million.

Analysis

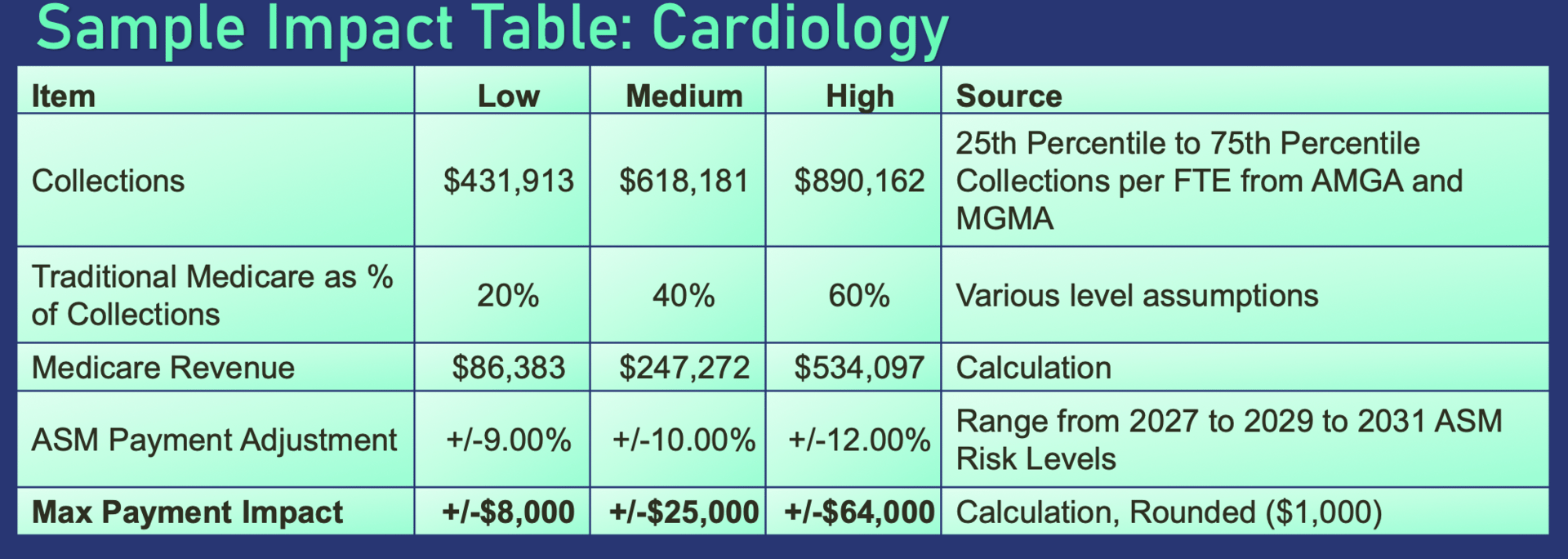

I’m a fan of this new approach for the innovation center, and a believer in mandatory participation with upside and downside risk. My only complaint is that, to me, it still seems the juice isn’t really worth the squeeze for TEAM and ASM participants. I had a chat with Luis Argueso, partner at InHealth Advisors, and this was his analysis of what the swing factor could look like in the Ambulatory Speciality Model:

I don’t think anyone would say no to an extra $25k or $64k, and certainly some loss aversion will kick in, but I think 4% to 7% still feels a little incremental to me, although I’m curious how a cardiologist or back pain specialist that’s part of the mandatory demonstration feels about it.

Regulatory Exposure

HTN company coverage of businesses that are regulated or otherwise impacted by the Centers for Medicare and Medicaid Services and its programs.

Medicaid eligibility and enrollment startup Fortuna Health 1announced a partnership with Unite Us which seems like a logical distribution channel for Fortuna and a nice capability addition for Unite Us’ clients.

At the Wolfe Research Healthcare Conference, $DVA ( ▼ 0.25% ) CFO Joel Ackerman talked about how the enhanced APTCs increased the share of DaVita’s patients on marketplace insurance from 2% to 3%, and if the eAPTCs expire, they’re estimating that about 2/3 of that 1% will go from marketplace to Medicare coverage at lower reimbursement rates, sizing the headwind at about $40 million for next year.

$HCA ( ▼ 1.76% ) CFO Mike Marks also gave some color at the conference on what they’re seeing in terms of impact on volume growth for next year, giving guidance for 2026 in the 2-3% range with the swing factor being the eAPTCs. If extended, they think they’ll come in closer to 3% and if not, they’ll be on the lower end towards 2%.

Steve Filton, CFO at $UHS ( ▼ 1.13% ) shared his view on both the expiration of the enhanced premium tax credits and the provider tax and state directed payment changes from H.R. 1. ACA members are about 6% of their admissions and they’re estimating 1/3 of them will lose coverage which pencils to a $100 million headwind if the eAPTCs expire noting that these people will continue to utilize healthcare services, UHS just won’t get reimbursed for it. On the provider tax front, they reiterated their net benefit from supplemental payments will be around $1.3 billion in 2025 and they expect that changes associated with H.R.1 will result in a reduction of $420-470 million in 2032.

The Hickpuff Review2

Network adequacy problems in Medicaid described in a long-form WSJ article which I have to imagine are going to be exacerbated as state budgets get squeezed and Medicaid agencies have to choose between rate cuts for providers, utilization management, or restricting coverage.

The Committee for a Responsible Federal Budget outlines a menu of options to save Medicare billions through changes to the Physician Fee Schedule, although doctors aren’t going to like it very much.

On the Health Affairs This Week podcast, Jeff Byers hosted Nathan Hostert from Brown’s Center for Advancing Health Policy through Research to talk about ways states are managing hospital cost growth through payment caps.

CMS released the 2026 Medicare Parts A & B premiums and deductibles, which, like everyone’s health insurance premiums are going up a lot. I thought it was cool that they quantified the impact of the PFS skin substitute changes made Part B premiums ~$11 cheaper than they would have been without the changes.

Longer form:

Ardent Health is a hospital operator in what the company describe as midsized urban markets in Kansas, Oklahoma, Texas, New Mexico, Idaho, and New Jersey. Unlike HCA, Tenet, and UHS, they’re smaller and more reliant on government insurance programs and state directed payments.

For idiosyncratic reasons related to their management and market footprint, their performance has been worse than the other major hospital operators this year. But those idiosyncratic reasons also make them a sort of useful comp for a generic hospital or health system.

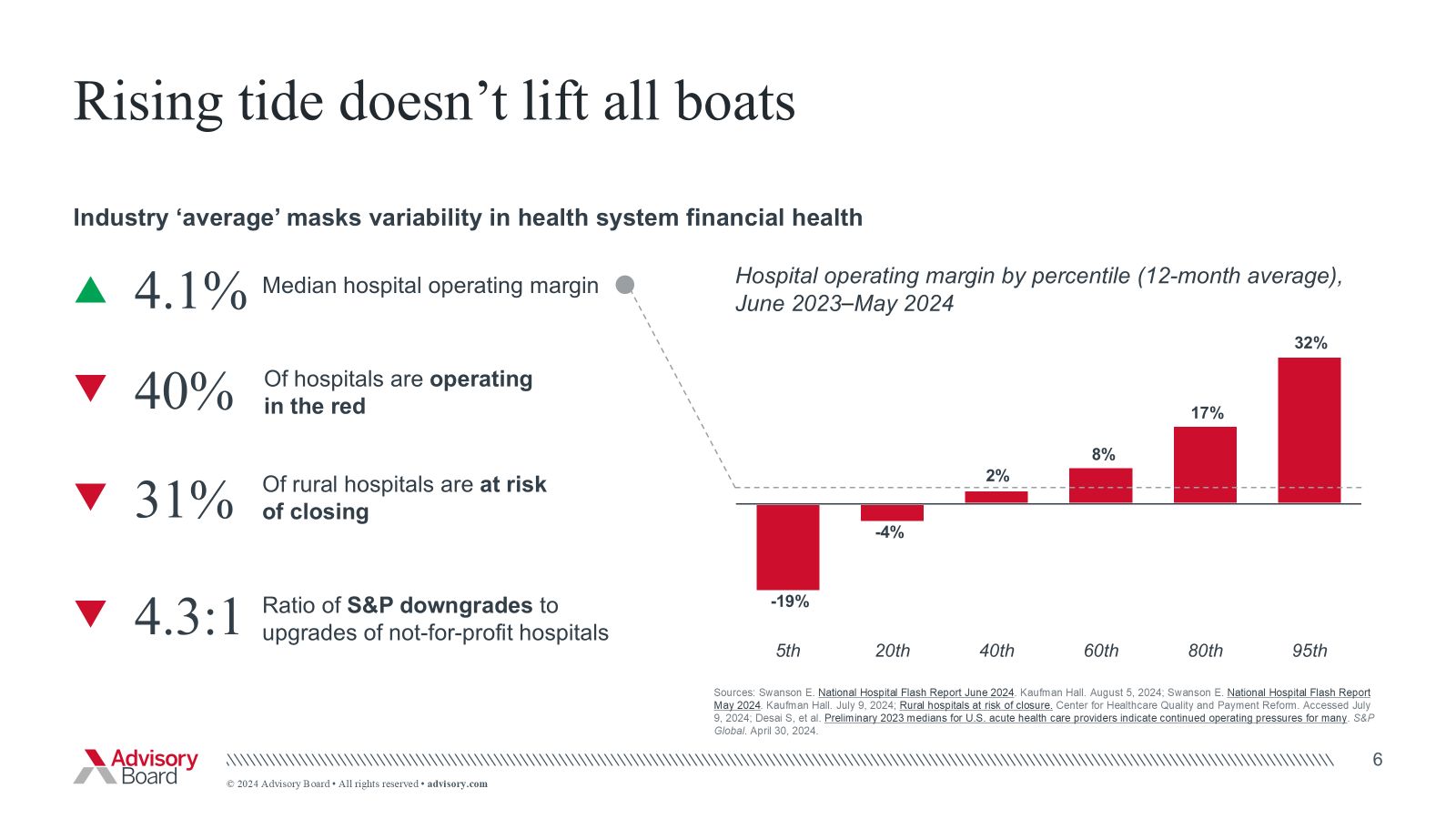

In general, hospitals and health systems fall into three buckets:

Large, publicly traded hospital operators who are laser focused on being in the right markets with the right service lines and able to exercise market power in negotiations with payers

Regional non-profit systems who look and act like their publicly traded peers. UCHealth is my go-to example of this segment with Fitch describing their AA rating as based on a “long track-record of delivering very robust operating margins” in the range of 8%-10%.

All the other hospitals and health systems, the have nots, who operate in the red and are at risk of closing

It seems to me that Ardent’s challenges with payer denials and professional fee cost growth are representative of challenges we’ll see for the hospitals and health systems outside major metro areas with nice payer mixes, donors, and a reliable talent market. The headwinds from H.R.1 and the no good, very bad year that payers have had are real and it’s going to make for a tough 2026 for hospitals outside buckets 1 and 2 in my view.

If you were forwarded this email and want to subscribe to the Weekly Health Policy Briefing, you can click this link.

Like nerding out about health care stuff? Join the Health Tech Nerds community for access to our private Slack channel, community member events, and expert research and analysis to help you stay a step ahead.

1 You can read our initiation of coverage report for Fortuna here.

2 Health care policy and financing, named after my favorite Medicaid agency