👋 If you enjoy the free weekly newsletter, consider joining the Health Tech Nerds Community, a members-only Slack community designed for networking and knowledge sharing!

Medicare Advantage

A lower than expected 0.09% YoY increase for MA in the Advance Notice from CMS

On Monday, CMS released the Calendar Year (CY) 2027 Advance Notice of Methodological Changes for Medicare Advantage (MA) Capitation Rates and Part C and Part D Payment Policies, or the CY 2027 Advance Notice for short.

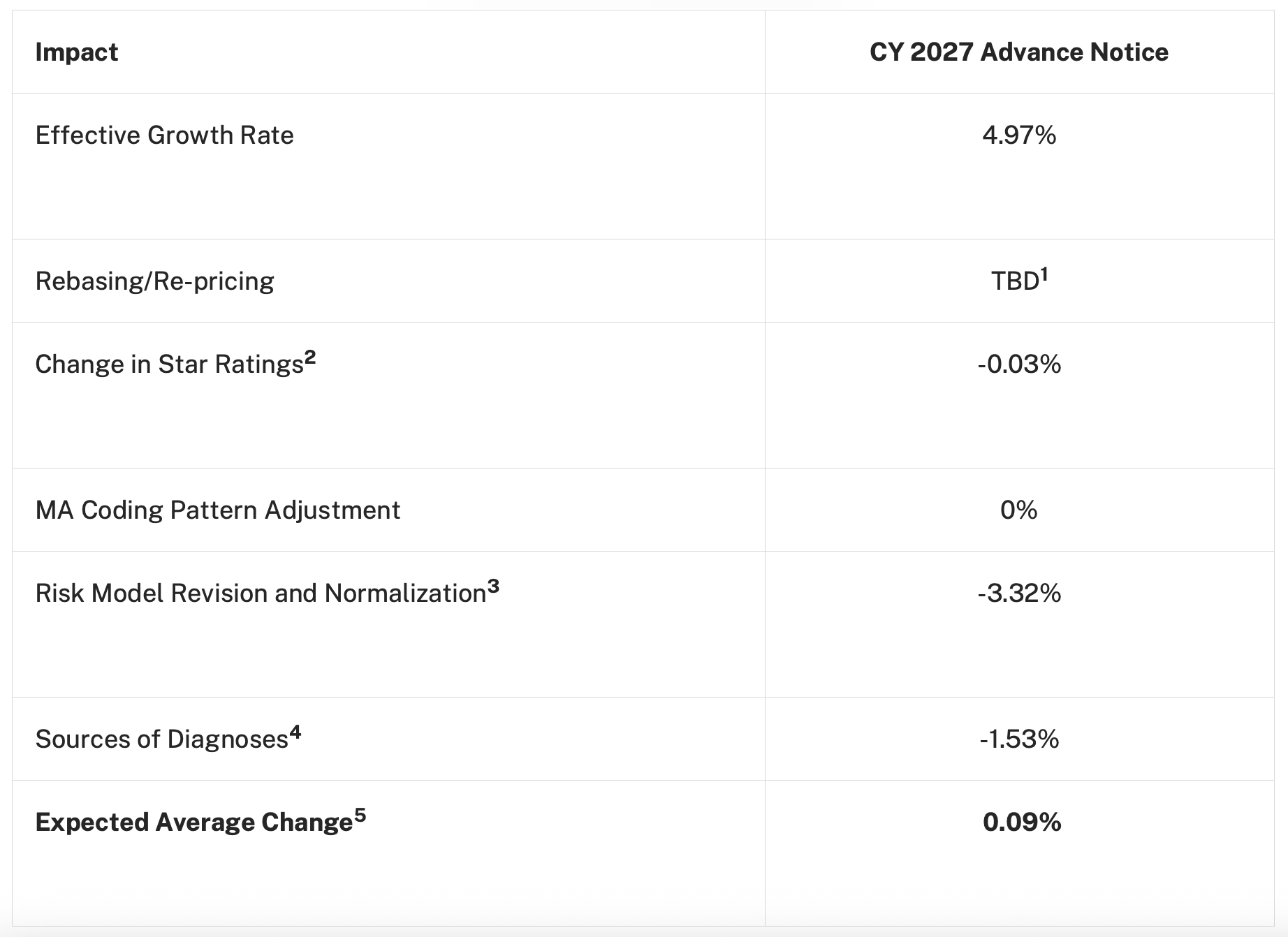

The big, market-moving news was the expected average change year over year at only 0.09%:

The Office of the Actuary at CMS is starting with an effective growth rate in the Original Medicare benchmark rate at 4.97% and then the subtraction starts:

-0.03% for some very modest changes in the MA Quality Bonus Payment program Stars

-3.32%, which is two pieces with a lot of interaction:

The risk adjustment calculations are getting updated with more recent diagnoses and costs data (-1.82%)

The usual normalization factor to bring the average member’s risk score close to 1, (-1.5%)

-1.53% as CMS proposing the exclusion of diagnoses from “unlinked Chart Review Records,” i.e., diagnoses mined from a patient record but not actually from an encounter with a patient

As usual, CMS expects MA plans to roll up their sleeves and figure out a way to get their risk scores up by hook or by crook, on the order of 2.45%, so the net effect the OA is predicting for MA plan revenue is a 2.54%. (cf. The 2026 Advance Notice with a 2.10% increase in the MA risk trend.)

The proposed rule will be finalized this spring, and there has historically been an increase between the proposed and final rule. It also includes guidance on risk adjustment in PACE and Part D, as well as requests for feedback to improve Star Ratings.

You can read the entire proposed rule here, or a very good summary from Jeffrey Davis and Lynn Nonnemaker at McDermott+ here.

Analysis

An HTN community member described this Advance Notice as “the most important thing that will happen all year for the healthcare ecosystem,” and I couldn’t have said it better myself.

One way to describe this administration’s theory of the case for healthcare reform is that the only cure for healthcare’s cost disease is to pull a lot of money out of the system and bet on entrepreneurs and innovation to solve the problems that arise. H.R.1’s cuts to Medicaid and the Rural Health Transformation Program are one example, with Dr. Oz arguing that we don’t want to be a healthcare system with a country attached to it.

This Advance Notice feels to me like CMS is saying, “Here’s what we can offer, figure it out amongst yourselves how to divide the smaller pie.” This isn’t a particularly partisan approach; Maryland achieved something similar for hospitals through its global budgeting model. Setting aside the merits and demerits of this approach, I think it’s interesting to think about how this plays out for MA plans.

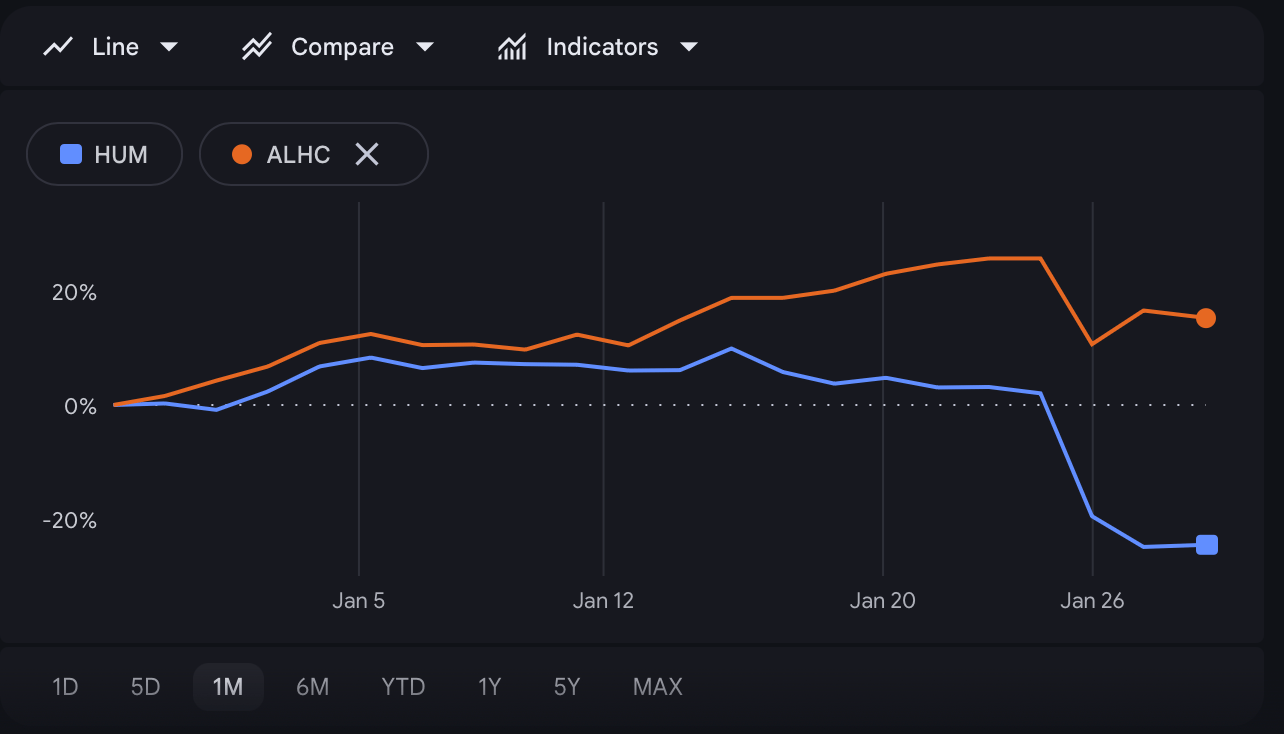

Humana vs Alignment Health YTD

Humana and Alignment Health are my preferred examples for the MA business. Both of them saw big dips in their stock price after the announcement, but investors seem more sanguine about Alignment Health, which fell less and has rebounded slightly. Of course, there are idiosyncrasies, but to a first approximation, Humana represents a business-as-usual model of Medicare Advantage, and Alignment Healthcare represents something more suited to the Dr. Oz theory of the case: lower SGA ratios, less reliance on risk adjustment, and strong Star performance achieved through disciplined care management.

If CMS continues down this path, it’s easier for me to imagine more plans in the Alignment Health style succeeding than for the Humanas in the market to adapt successfully. It seems like the safer bet in this policy environment.

ACA

The latest snapshot and the best and final offer for eAPTCs

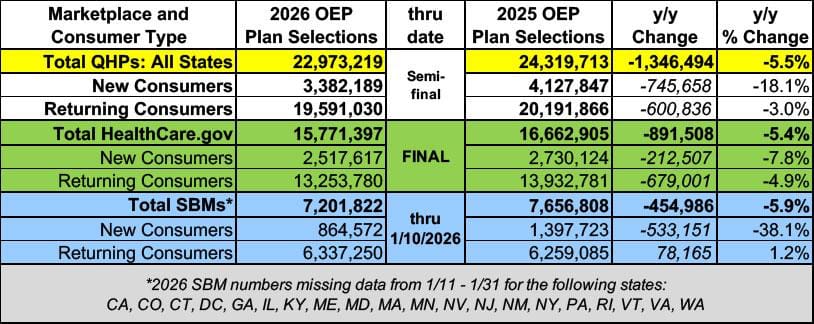

CMS released the latest open enrollment snapshot from CMS for the ACA marketplaces. The headline numbers:

Total, all exchanges: 22.97 million

New: 3.38 million

Returning: 19.59 million

For comps from last year, as always, we’ll turn to Charles Gaba from acasignups.net, who notes that this is still not the final open enrollment number with the state exchanges reporting as of January 10th:

NB: these are “uneffectuated” numbers, meaning most of these enrollees haven’t paid their first premium bill. We’ll get those numbers later in the year.

Elsewhere in ACA news, Bernie Moreno, Senator from Ohio, has shared his “best and final offer” on the enhanced premium tax credits, which includes a 1 year extension as-is, HSA accounts in the second year, and third year phase-outs along with an income limit of 700% of the FPL, a minimum $5 premium, an open enrollment extension to March 31st, and funding the cost-sharing reductions.1

Analysis

A few, disparate thoughts:

Texas, New Mexico, Massachusetts, New Jersey, and California were all up, and Georgia, North Carolina, Florida, Ohio, Tennessee, and Arizona were all down year over year, and it’s interesting to ponder which way the electoral implications of these gains and losses cut for the 2026 midterms.

The consensus estimate for where attrition will land between normal churn and non-effectuation was in the range of 15-30%, but yesterday morning, Elevance seemed to suggest it could be as high as 37%:

They ended 2025 with 1.31M members in the individual market segment

They say they saw 10% growth during open enrollment, which brings them up to something like ~1.44M members

They're guiding to at least 900k members at year's end 2026

NB: I want to emphasize that this is what Elevance is implying would be the high end for their specific ACA membership. Still, 37% is meaningfully higher than the high end of the consensus, which is notable.

The Hickpuff Review

An HTN community member shared two recent publications that form a nice couplet: First, today’s announcement from CMS that they had secured $600 million in pledges from existing and interested technology vendors, including Deloitte, Equifax, Fortuna Health, and others, to support H.R.1’s community engagement requirements and other Medicaid system improvements. Second, an article from the Law and Political Economy Project by Luke Farrell called “The Means Testing Industrial Complex” about how vendors make money administering complex program requirements like the ones being added to Medicaid in H.R. 1

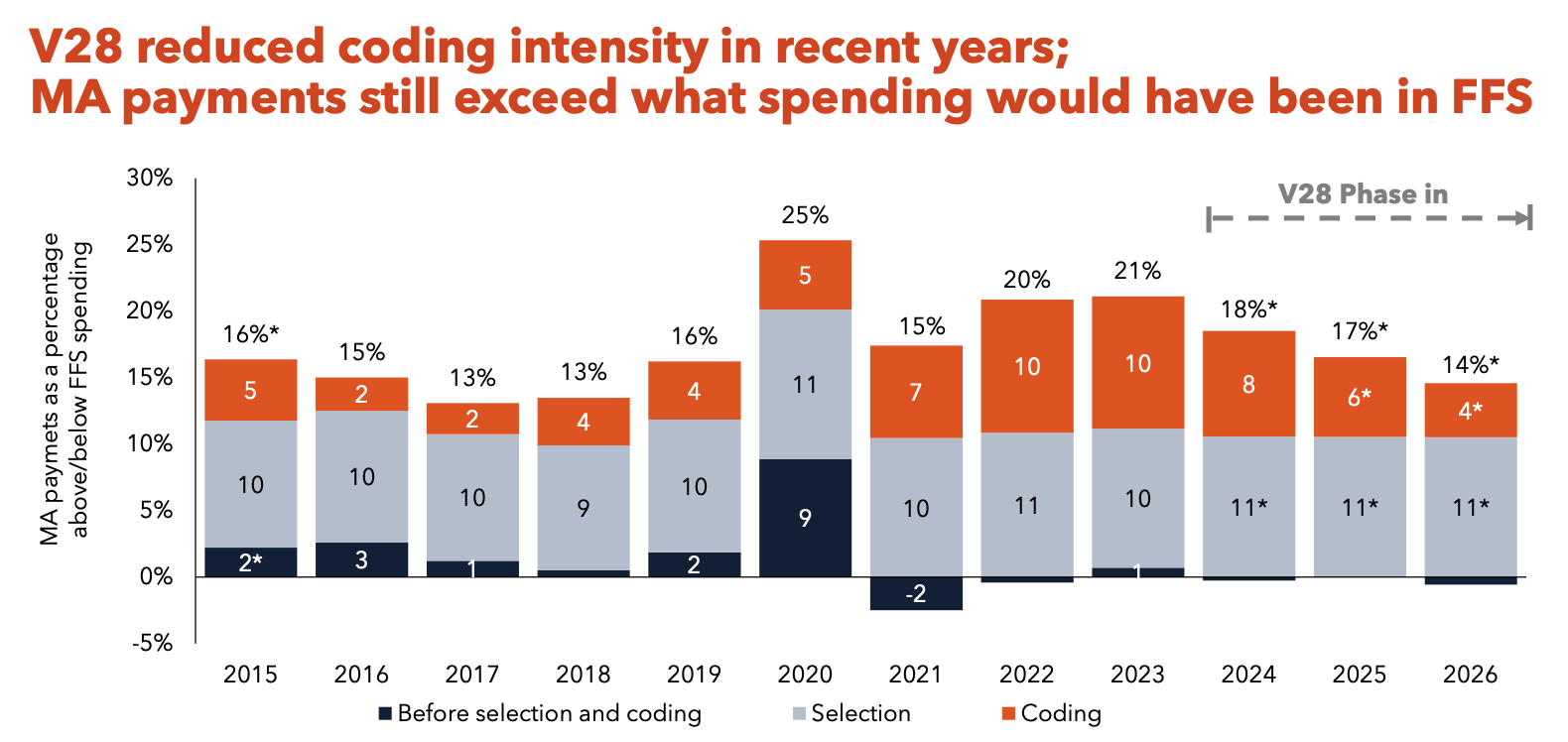

A largely unresolved issue is whether Medicare Advantage is more or less expensive than Original Medicare. Every year, MedPAC makes the case that it is more expensive in its annual status report on the program. About 14% more expensive due to coding and selection effects, if you’re curious, though, V28 did help. CMS leadership also published an interesting piece of research that found v28 eliminated most of the coding effects, bringing it down closer to the 1.5-2% range.

Former CMMI leaders Liz Fowler and Purva Rawal have been on a tear over at Health Affairs Forefront with their ideas to reengineer ACOs and improve the Stars program, both of which are worth a read.

Downstream from general budget pressure at the state level, with a lot more on the horizon from the Medicaid cuts from H.R.1, are a bunch of heart-wrenching stories like this one from the Colorado Sun about caregiver pay cuts in the LTSS program. The author, Jennifer Brown, sums up the challenge well: Medicaid spending is eating up money for education, transportation and the rest of the services the government provides, with spending on the insurance program for people with low incomes and disabilities making up one-third of the entire state budget. It would take $631 million to keep offering the same Medicaid programs next year, but the proposed budget includes less than half of that, or about $300 million. I’m incredibly sympathetic to the impacted family member caregivers here, and also to Medicaid and state budget officials trying to navigate a huge shortfall, limited opportunities to raise revenue, and a lot of hungry mouths to feed, in some cases, very literally.

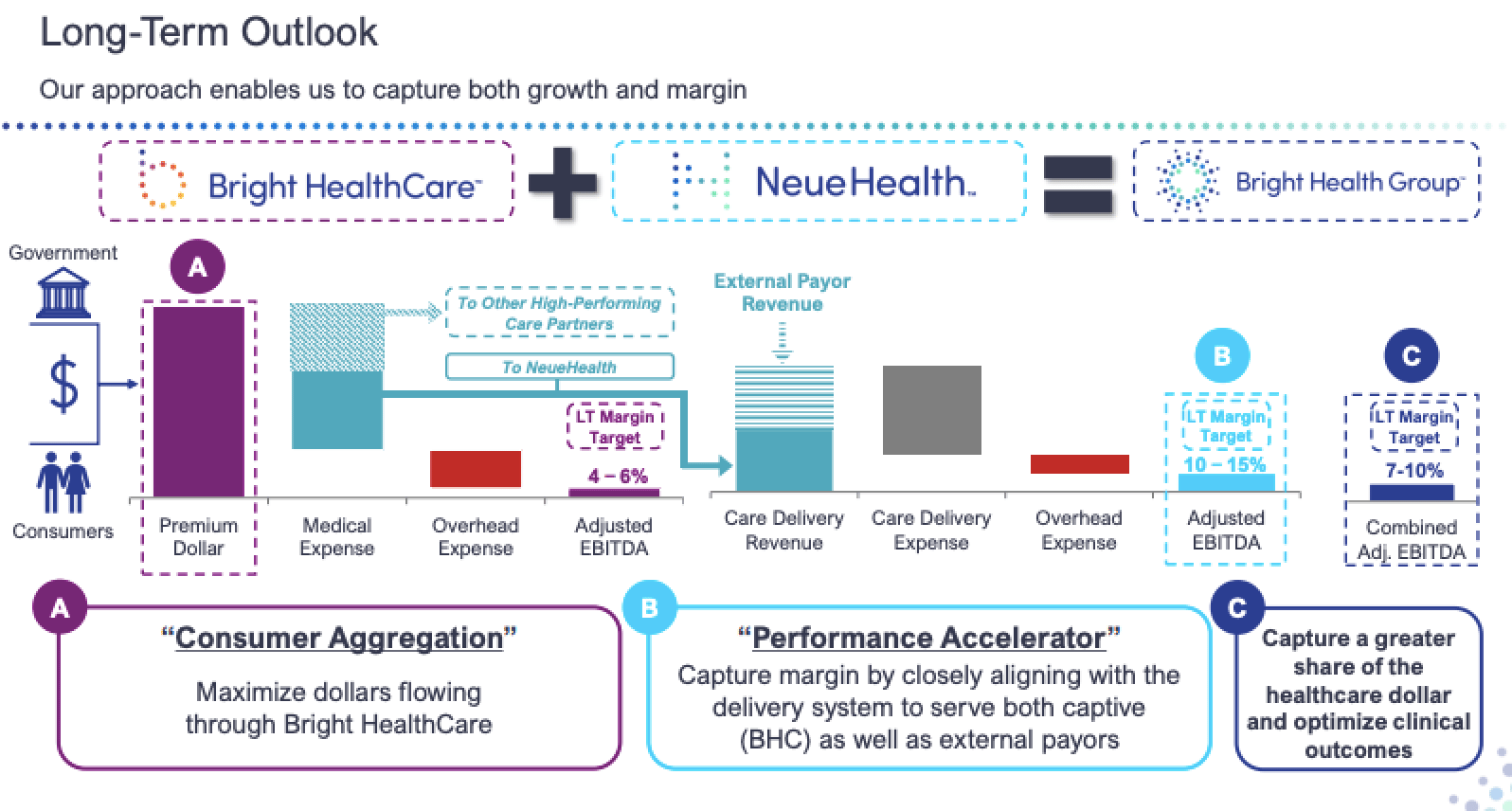

KFF published an article about hospitals setting up their own Medicare Advantage plans, framing it as an alternative for health systems to “fighting with insurers.” It’s a natural question that comes up if you’re a system of sufficient scale, sort of the inverse of the famous Bright Health slide on capturing growth and margin through integrating payer and provider functions. Insurance is a risky business, however, and I’m curious how these hospitals will feel about the move during the next MA winter.

More from Health Tech Nerds

Neil and Nate from Pair Team, which is scaling a care model and technology infrastructure for the highest risk, highest need safety net patients, sat down for an audio interview with Health Tech Nerds

In what ended up being perfect timing with CMS’s Advance Notice drop, Kevin and I spoke with Andy Slavitt and Andie Steinberg from Town Hall Ventures to get their view on the healthcare policy landscape going into 2026.

We’re experimenting with a new format called The Grand Round-Up, where Kevin and I chat about the news of the week on video. You can check it out here.

Want to comment or share feedback?

If this newsletter was forwarded to you, subscribe here or see more from Health Tech Nerds.

1 An earlier version of this newsletter characterized the Moreno plan as a 1 year extension which has been corrected to more accurately describe the three year phase out structure.