Hi! Claire here. The world of health insurance is messy, complicated, and changing fast. It’s full of cost pressures, policy shifts, and tech hype, but also real opportunities to build something better. I’m launching The Payer Digest, a weekly newsletter where I will break down what’s happening and zoom in on one topic that I think deserves more attention. Take a look and let me know what you think!

In Focus: Medical Cost Trend and Payer Response

Zooming in on medical cost trend, the fall out, and how payers should respond.

PWC published their annual Behind the Numbers 2026 report on medical cost trends with the ominous tagline: “No let up in sight. Medical cost trend set to grow at 8.5%. Is your playbook ready?” They also shared their full report, a 33-page in-depth document that covers what’s driving cost increases, what might curb them, and how payers should respond. I spent a good chunk of my week reading this report, so you don’t have to.

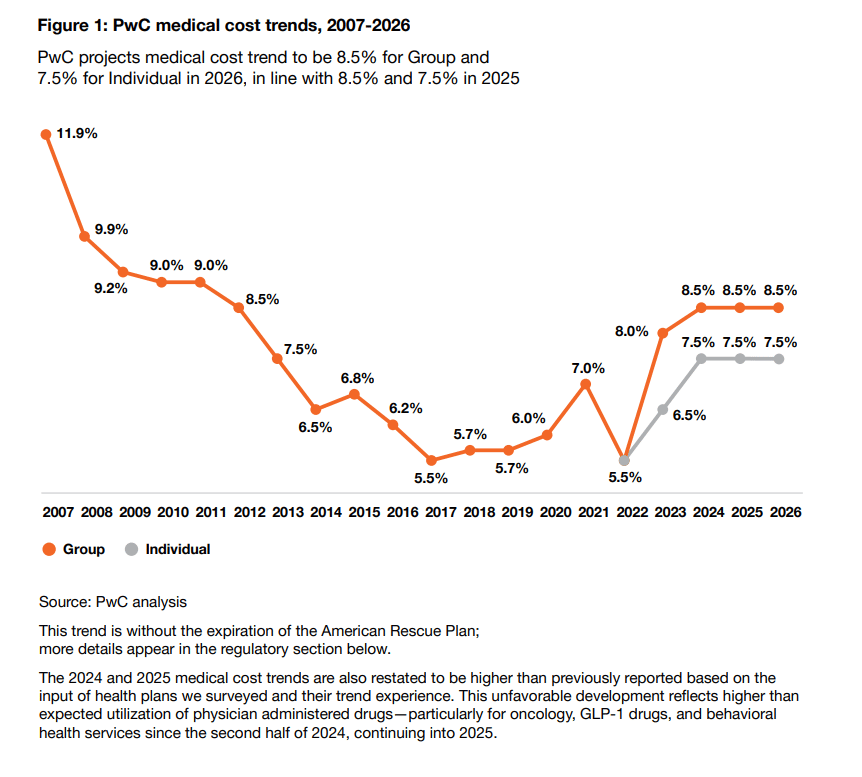

The topline takeaway: medical cost trend is holding at 8.5% for group plans and 7.5% for individual plans, unchanged from 2025 and the highest sustained trend rate in over a decade. These projections are based on a combination of actuarial modeling and interviews with health plan actuaries at 24 major insurers, which cover 125 million employer-sponsored members and 12 million Affordable Care Act (ACA) marketplace members. See their trend chart below, and if you want a throwback, check out the pre-ACA group market trend: 11.9% (!!!).

Quick Context

First, let’s quickly break down medical cost trend. It is the projected year-over-year increase in the cost to treat patients, assuming no change in plan design. In other words, if your plan cost $10,000 per member this year, an 8.5% trend means it’ll cost $10,850 next year. It is also what insurance companies use to calculate health plan premiums for the coming year. So, when medical costs are higher, payers inevitably react by raising prices, which is exactly what we are experiencing in the ACA marketplace. Last week, WSJ published an article noting that consumers should expect to see a 10-20% price hike in the exchanges. Kevin also referenced this in last week’s HTN newsletter, accompanied by a KFF chart that breaks down proposed rate increases by the largest ACA plans.

Second, we have to acknowledge the federal policy changes, specifically the OBBB impacts, that are poised to add extra pressure and an estimated $1 trillion dip in federal healthcare funding… I will not go into great detail here, but I want to address three notable impacts, and if you want to dig more into this, I like this interactive view from KFF.

ACA subsidies could expire at the end of 2025. If that happens, premiums will spike and millions may lose coverage. Between 2021 and 2025, the individual market more than doubled from 12 million to 24.3 million, largely due to the subsidy expansions

Work requirements for Medicaid are coming, and states must implement work/community service requirements by the end of 2026 for certain enrollees, which will likely drive disenrollments and coverage gaps

Proposed pharma import tariffs could make drugs even more expensive and worsen shortages

What’s Driving Trend… and guidance on how payers can prepare / respond

Okay, now back to the PwC report and what plans can do in response to the top cost drivers…

First, hospital costs are rising with inflation, labor shortages, and supply chain strain. PwC estimates that hospitals need 14% commercial rate increases to cover 6-7% expense trendlines. Aka…. plans will either absorb higher unit costs or be met with narrow networks, either way it’s not great. The math here felt a little fuzzy is the 7% cost shifting or is it a profit to the hospitals? A bit of both?

Q1 of 2025 shows a continued downward margin trend (down to 2.1% in 2024 from 7.0% in 2019) despite favorable payer mix shifts and revenue growth. This creates the perfect storm for upcoming contract renewals. Providers are also going to demand more, specifically, commercial rate increases to offset stagnant Medicare/Medicaid reimbursements and the end of temporary Medicare boosts.

Payers should…

Model for inflation early in contract planning, especially in labor-sensitive regions

Tier networks based on efficiency and quality use data from site-of-care audits and quality metrics to reward low-cost, high-performing providers… yes, relationships matter, but the metrics are real

Lock in multi-year value-based contracts to create cost trend ceilings and minimize annual renegotiation risk

Build partnerships with systems earlier in the negotiation cycle to explore joint investments or risk-sharing

Hospital Revenue Cycle Management and AI adoption - hospitals are getting aggressive. They are leaning into coding and RCM practices to boost revenue, especially on inpatient and behavioral health encounters. Payers (Elevance mentioned this in their recent earnings call) are seeing this in the form of more AI-assisted documentation and upcoding, higher frequency of appeals and disputes, and faster turnaround on commercial rate escalations mid-contract. On the flip side, payers are using AI to process claims faster, which is now fueling lawsuits like AdventHealth vs. BCBS Kansas City, where BCBS allegedly denied 350 diagnoses using AI tools. Hospitals aren’t just fighting for higher rates; they are lawyering up against AI-driven denials.

Payers should…

Invest in AI-counter tools to detect coding inflation and predict high-risk claims for audits

Strengthen internal clinical validation people and processes, or partner with vendors that specialize in complex review (neuro, post-acute)

Enforce tight SLAs for appeals and escalations to prevent mid-contract rate creep

Incentivize documentation transparency in network contracts

Pharmacy Spend (largely driven by GLP-1s) - Pharmacy spend increased by $50B in 2024, compared to $20B in 2023, with GLP-1s (e.g., Ozempic, Wegovy) at the top of that list. They are top of the list not just because of utilization, but because of long-term maintenance and off-label prescribing. Everyone is trying to cover these costly, chronic weight loss drugs, but no one has figured out how to pay for them.

Payers should…

Tighten PA criteria, especially off-label

Use step therapy and condition-specific bundles before initiating coverage

Renegotiate PBM contracts, prioritize transparency, and rebate alignment

Behavioral Healthcare - the demand for behavioral health has continued to grow, with claims up 45% since early 2023. Networks are stretched thin, and cost-of-care is rising, even for the once more affordable virtual options. Employers want more mental health coverage but it is getting more expensive to provide. Plans are stuck between meeting demand and managing cost creep.

Payers should…

Expand access through alternative providers (schools, peer coaches, community programs)

Embed BH into chronic care and primary care models to help catch issues earlier and reduce inpatient utilization.

Use claims data to target network expansion and close the gap, and then, when you do this, incentivize your network to fill them.

Pilot outcome-based BH payments tied to engagement and patient-reported outcomes.

What’s Slowing Trend… and what payers can do to drive cost deflators

Biosimilars - biologics account for nearly half of all national prescription drug spend, but biosimilars, which are lower-cost alternatives, are gaining traction and helping to reduce pharmacy spend. Payers should streamline PA and formulary changes to support adoption, reimburse biosimilars to fairly encourage provider use, and work closely with their PBMs to ensure rebate transparency.

Cost containment tools and total cost of care - more than 75% of surveyed plans ranked total cost of care management as a top deflator, which is up 60% from last year - that is a HUGE jump. Payers should match cost containment goals with operational execution, automate audits and integrate data platforms, and work with employers to set targets and push innovation especially in high-cost areas like mental health and benefit design.

A Flat Trend Does Not Equal Stability

This report isn’t necessarily shocking, but it is validating and sobering…. what is very clear is that a flat trend does not equal stability. The other forces at play, namely OBBB impacts, have created an environment where costs are up, funding is down, and payers are expected to do more with less. PwC’s take is clear, and I largely agree… do not expect costs to come down, expect instead to get better at absorbing them.

Lean into alternative payment models with real shared risk

Build more flexible pharmacy strategies, not just rebating, but clinical guardrails and member engagement

Use transparency + cost analytics for smarter contract strategy

Prepare for more tightrope walking with employers, especially around benefit design, cost shifting, and mental health access

Trends to Watch

ICHRAs - plan adoption is up 30% year-over-year. With rising premiums and subsidy volatility, ICHRA may give employers a safer way to guarantee health benefits without overexposing themselves to ACA or group benefit inflation. ICHRAs offer flexibility, consumer choice, and potentially cost savings as employers get off the hook of fixed group-plan pricing.

CMS price transparency enforcement

AI use in clinical workflows and payer ops

Medicaid redeterminations and churn

New News

This week’s top headlines, with a side of context.

Molina’s stock dropped again after reporting higher-than-expected utilization across Medicaid, Medicare, and ACA, pushing its medical cost ratio to 90.4%. This is yet another signal that payers are underpricing medical trend, especially in government lines, and the pressure is compounding across the board.

Humana announces move to cut prior authorizations by one third for outpatient services by Jan 1, 2026, including colonoscopies and transthoracic echos. Prior authorizations have continued to be a hot topic in provider-payer relations. Humana’s move signals positive momentum for the industry-wide reform while also setting a new bar for speed with the commitment to have 95% of electronic PAs decided within one business day.

Humana also filed a new lawsuit over the DOH decision last year to cut its Medicare Advantage star rating after CMS denied its initial appeal. This lawsuit adds some fuel to the fire around how CMS measures plan quality.

Oscar Health cuts guidance; facing rising costs in the ACA marketplace (see above 😉 ), Oscar lowered its 2025 earnings expectations and warned of a loss of $200 million. It follows Elevance Health, Centene, Molina, and UnitedHealth Group in dialing back guidance, highlighting how tough the individual market has become.

Fortuna Health raised $18 million in Series A funding. Check out this HTN article with Nikita Singareddy, Co-Founder and CEO of Fortuna Health, on building for Medicaid. Fortuna is building real infrastructure to address the complexity of Medicaid navigation.