Sponsored by: Frontegg

Lessons from the Field: Implementing Consumer Identity and Access Management

For health tech companies, proper identity management infrastructure is critical for your product roadmap and overall user experience. Frontegg is hosting a live session on August 11th with Insight Health’s CTO Saran Siva to discuss how Insight Health approached choosing a Consumer Identity and Access Management (CIAM) solution and built a CIAM architecture quickly without compromising on compliance.

You’ll learn:

How Insight Health rolled out multi-tenancy and custom logins

Why fine-grained authorization matters in healthcare

What to avoid when building CIAM fast

🎁 Attend live and get a free 3-in-1 charging station.

If you're interested in sponsoring the newsletter, let us know!

👋 Hey all! Kevin here. Welcome to this edition of my free weekly newsletter, where I share my perspective on healthcare innovation news from the past week (in this case, two weeks) that I found interesting.

As I’ve been doing the past few weeks now, here’s a reflection from me on the news before getting into the top stories of the week.

My Reflection

This week, like most weeks these days I suppose, almost everything seems to have an AI flavor to it. I am pretty convinced that AI adoption will in healthcare will have a positive impact on clinical outcomes, I think that is pretty self-evident at this point. But I am also equally certain it will drive upwards pressure on healthcare costs, even if I would love to be convinced that the opposite will be true.

The news this week provided some good examples of why I expect this outcome. Elevance noted on its earnings call that it is seeing pockets of providers using AI to upcode and increase revenue, which caused (a small) part of its cost issue on the ACA. On the other end of the spectrum, AdventHealth is suing BCBS KC because BCBS KC is using AI tools (Apixio) to review Advent’s claim submissions for inappropriate codes and remove them in order to reduce payments to Advent.

The Advent lawsuit included the interesting quote below in the introduction to the petition:

BCBSKC’s unlawful and unethical actions undermine the fundamental principle that healthcare decisions in America should be made by doctors, with the medical expertise, legal responsibility and accountability for making treatment decisions for their patients and should not be made by auditors, accountants or artificial intelligence devices

I think most here would agree that doctors should be making medical decisions, not auditors and accountants. Yet it’s fascinating to me to see Advent’s lawyers lump “artificial intelligence devices” in the same category as auditors and accountants. I think that inclusion will invite a lot more debate given the advances we’re seeing from AI models (this week brought another interesting study exploring how AI can be used to improve clinical practice, this time in cardiology). At the very least, it seems quite far from any sort of “fundamental principle” to me that AI can’t make healthcare decisions.

Regardless of where you net out on that debate, I think Advent’s argument provides yet another good indicator of how AI adoption will unfold in the industry, and how incumbents will attempt to harness it to protect their profit pools. Stepping back, I think it also provides a pretty good indicator that the more closely integrated payor / provider models should have a relative advantage versus peers moving forward.

Kevin

Q2 EARNINGS

Elevance’s stock plummets 18% on the week after revising down earnings estimate by ~13%

Elevance was the first insurer to report Q2 earnings this week, and not surprisingly the headline was that it reduced its diluted EPS expectations by 13% for 2025, a result of the challenges in the ACA and Medicaid markets.

The market reacted negatively to the earnings report, with Elevance’s stock dropping by 18% on the week. I actually thought Elevance handled the call quite well, but it seems the stock decline is being driven by the broader concerns facing the insurance landscape, articulated well by John Tozzi in this Bloomberg piece exploring how far this “insurer meltdown” will go. While Elevance did its best to position these challenges as short term market volatility that will correct soon, it seems that many are understandably questioning that.

The earnings call provided a microcosm of the myriad challenges facing insurers. One analyst, Justin Lake, did the math on Elevance’s margins, noting that he thinks Elevance is at a 1% margin in Medicaid and negative margins on the exchanges this year. Medicare Advantage actually seemed like a bright spot on the earnings call compared to those two businesses, which is saying something given the state of MA.

Here are a few relevant links before I share a couple of the more interesting tidbits I took away from the earnings call, which I’ve broken down by line of business.

ACA:

Elevance noted that its operating margin on the individual business will decline by “high single-digit percent range” year over year, after one analyst noted he expected the business to be at a slightly negative margin in 2025.

Elevance suggested that roughly 70% of the ACA medical trend challenge is related to increasing market morbidity, driven by healthier members exiting the exchanges and sicker Medicaid members moving into ACA following redeterminations. The other 30% is from utilization in several cost categories — ER, behavioral health, specialty pharmacy — and providers getting more aggressive in coding.

Unlike Centene, Elevance did not see a risk adjustment impact from the Wakely report, noting that the overall market morbidity rose consistent with Elevance’s book, meaning that it nets out in the same overall place from a risk adjustment perspective (which is a zero-sum game on the exchanges, so it’s all based on relative performance).

Elevance called out on a number of occasions that the Independent Dispute Resolution process as part of the No Surprises Act as being inappropriately leveraged to increase costs, referencing a lawsuit filed earlier this year about providers gaming the process.

Elevance is seeing increased coding activities from “isolated pockets” of hospitals using AI-enabled coding tools to increase documented acuity and increase unit costs. Elevance noted it is trying to support what it views as responsible innovation here while cracking down on tools that are being used to inflate revenue.

Medicaid:

Elevance noted that margins will be positive for the year, but below long term expectations. An analyst, Justin Lake, estimated margin will be ~1% for the year.

State rate adjustments have been in-line with Elevance’s expectations, but the market morbidity has been higher than expected as redeterminations has caused healthier Medicaid members to move to the ACA. This increased market morbidity means that rates are again inadequate and states will need to adjust them again. This discussion prompted an interesting analyst question about whether this is going to be an ongoing dynamic with states continually playing catch up. Elevance shared that it expects this to normalize after a few rate cycles.

Elevance is seeing elevated utilization in LTSS, behavioral health, and inpatient surgery.

Medicare

MA trend was elevated but in line with expectations this quarter.

Elevance’s 2026 bids are focused on improving margin and driving strong retention in specific geographies and plan design types — specifically HMO plan designs and dual eligible populations.

Carelon

Carelon Services grew 50% driven by CareBridge scaling quickly in dual eligible and high-acuity Medicaid populations, but is also seeing lower margins as a result of CareBridge.

Elevance noted that 1/3 of its benefit expense is in downside risk arrangements, and it is scaling capabilities to support care coordination and cost predictabilities through Carelon.

CarelonRx is also gained traction quickly, with operating revenue growing 20%+ as it gains traction with clients and in the specialty pharmacy market.

AI FUNDING

AI medical search tool OpenEvidence raised $210 million and highlights impressive growth

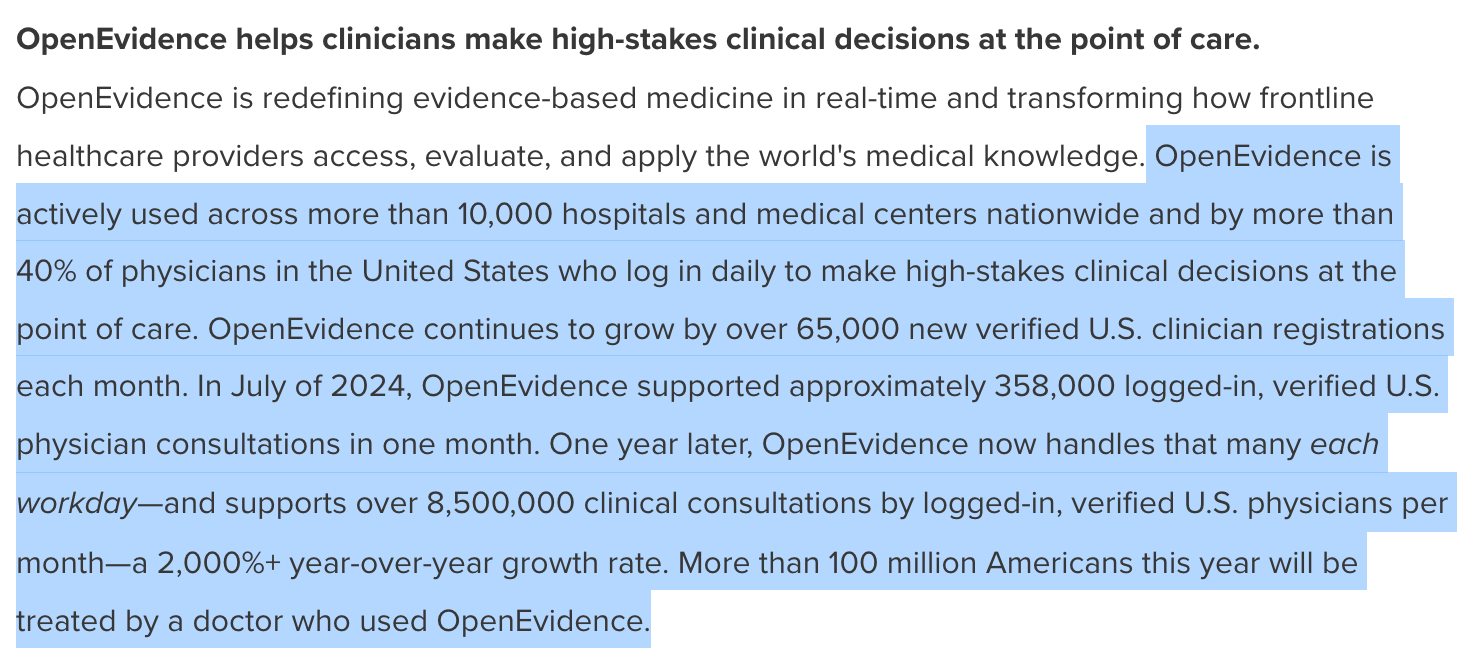

OpenEvidence announced a $210 million funding round at a $3.5 billion valuation this week, calling itself the “fastest-growing application for physicians in history.”

The model is straight-forward — its essentially Google for medical evidence, allowing providers to search medical literature via content partnerships with JAMA, NEJM, and others). The adoption stats for OpenEvidence are wild — check out the paragraph from the press release below. Note that OpenEvidence launched its first product roughly two years ago in 2023.

Source: OpenEvidence Press Release

The adoption of this product is pretty astonishing. The HTN Slack conversation this week provided a good sense of its use these days: every clinician seems to be on it, even if there are some questions about how useful the output is at the moment. The hype around this company is massive, as evidenced by John Doerr’s statement in the Forbes article covering the funding announcement:

I think OpenEvidence looks like it’s going to be for healthcare what Google was for the Internet

While I’m generally skeptical of investor quotes like this, at its current rate of adding 65,000 new clinicians a month, that would imply OpenEvidence reaches the entire US provider community within a year. It isn’t hard to see why investors are so excited.

OpenEvidence generating revenue at an annualized rate of $50 million, monetizing the platform in a Google-esqe way by giving it away to providers for free and selling advertisements to pharma to promote their products. Given the revenue model here, it is interesting juxtaposing the coverage of OpenEvidence’s growth while also seeing the Senate investigation of D2C telehealth companies and their relationship with big pharma this week (more below on that). I have a lot of questions I am asking myself as I think about the role pharma should play in all of this. The one thing that is clear to me from all this… pharma has deep pockets to drive more sales of their medications.

In the case of OpenEvidence, it seems fairly logical to conclude that more people will have access to better medical care as a result of the platform. That seems like a good thing to me, even if it comes at the increased cost of driving advertising business to pharmaceutical companies.

SKIN SUBSTITUTES

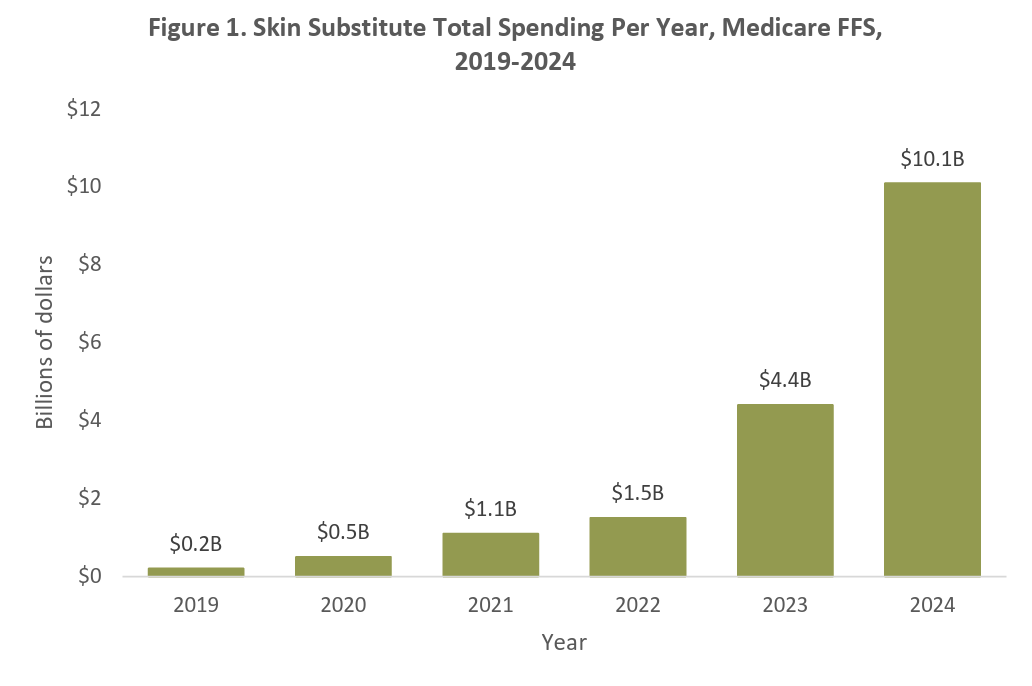

CMS takes aim at the skin substitute market

The New York Times highlighted how CMS is attempting to curtail wasteful spending in the skin substitute market, between CMMI’s WiSeR model and a proposed change in CMS’s 2026 proposed rule. The proposed rule change would mean that skin substitutes as incident-to supplies instead of biologicals, which would cut down their reimbursement potentially by 90%.

While the moves are pushing some pushback from the skin substitute industry (the MASS Coalition published a press release condemning the proposed rule) and others seemingly conceptually opposed to the use of prior authorizations via WiSeR, these steps seem entirely logical, and needed, to me.

L&M Research Institute also published a helpful research brief on the market with a number of charts that highlight the 50x rise in costs between 2019 and 2024 in the chart below. It’s eye opening to see the growth below:

Other Top Headlines

CMS issued its Calendar Year (CY) 2026 Hospital Outpatient Prospective Payment System (OPPS) and Ambulatory Surgical Center (ASC) Payment System proposed rule this week. The proposed rule features a number of proposed changes that the public can comment on over the next 60 days. Some of the bigger suggested changes include site neutrality, phasing out the inpatient-only list, improving hospital price transparency, and adjusting the Hospital Star Rating system. A number of places had good coverage of the various impacts of the proposed rule, which I’m sure we’ll hear a lot more about as it is finalized later this year — I thought these HFMA and Healthcare Dive articles were good summaries, in addition to this Substack post from Trey Rawles highlighting key changes.

The FDA sent Whoop a warning letter notifying Whoop that it’s blood pressure monitoring feature (BPI) is a medical device and needs FDA approval. The letter prompted a LinkedIn post from Whoop’s CEO in response, arguing that while Whoop supports the FDA’s ability to regulate medical devices, this is regulatory overreach and BPI isn’t a medical device. Whoop’s response falls a bit flat for me, given it markets two features specifically as “Medical Grade Insights” — BPI and AFib. AFib has FDA clearance. This all prompted a good conversation in HTN Slack about the tension between regulation and innovation here. Either way, I’m left scratching my head at how Whoop’s CEO went from being one of a handful of health tech leaders meeting with RFK to getting into a public spat with the FDA in a matter of months, particularly given the “wearables-for-all” opportunity in front of Whoop. It seems like a tactical misstep to not have resolved this issue with the FDA privately in the multiple meetings that were had prior to this.

A group of Senators released a report on how Eli Lilly and Pfizer are paying telehealth startups to prescribe medications on their behalf via D2C channels. Stat provided a good summary of the report. The report gives a good sense of the financial relationship between the parties — i.e. Eli Lilly pays its telehealth partners $942,500 in three payments over a three year contract, and it receives data in return on the patients that it sent to those partners. The optics of these payments certainly seem challenging for pharma.

While some of the stats are a little alarming — the document notes repeatedly that 100% of people referred to Cove by Eli Lilly received migration medications. It seems worth that noting the N here is pretty small. The article uses data from 2H 2024 — and using Cove as the example, its only 15 patients who conducted a visit from Eli Lilly to Cove during that period. Eli Lilly referred 3,759 consumers to Form Health, and 620 consumers to 9amHealth. The article further notes that that 74% of people who received a telehealth visit from Eli Lilly ended up receiving a prescription, before noting that a larger number of patients used LillyDirect but didn’t end up doing a telehealth visit. Pfizer’s numbers were even lower — from Aug 27, 2024 to Jan 10, 2025, only 325 people connected to a telehealth visit through UpScript Health.

UnitedHealth included $3.3 billion of asset sales in order to hit earnings targets last year, per Bloomberg reporting. The article notes that UnitedHealth pushed through a number of deals in Q4 in order to hit earnings targets it otherwise would have missed based on the performance of the business. The deals included PE-firm Warburg Pincus purchasing a controlling-stake in UHG’s hearing-benefits business Epic Hearing Healthcare, while KKR invested in another UHG business.

AdventHealth and BCBS KC are in a legal spat, as AdventHealth Shawnee Mission Hospital is suing BCBS KC for withholding $2+ million in payments after using AI tools to identify and deny payment for clinically invalid diagnoses that Advent has submitted to BCBS KC. Advent argues that this clinical validation process BCBS KC has implemented via Apixio (and Cotiviti before that) violate a number of contractual and statutory provisions. The case highlights marketing materials from Apixio, noting that it markets itself as an AI-based solution that “markets its hasty reviews as a selling point”.

Behavioral health providers Brightli and Centerstone announced their intent to merge. The combined entity would be the largest nonprofit behavioral health provider in the US.

Lyra, a mental health provider for employers, acquired pediatric mental health startup Bend Health.

Humana and Epic partnered, making Humana the first insurer to directly integrate into Epic.

Johns Hopkins launched a new population health analytics startup, Illustra Health.

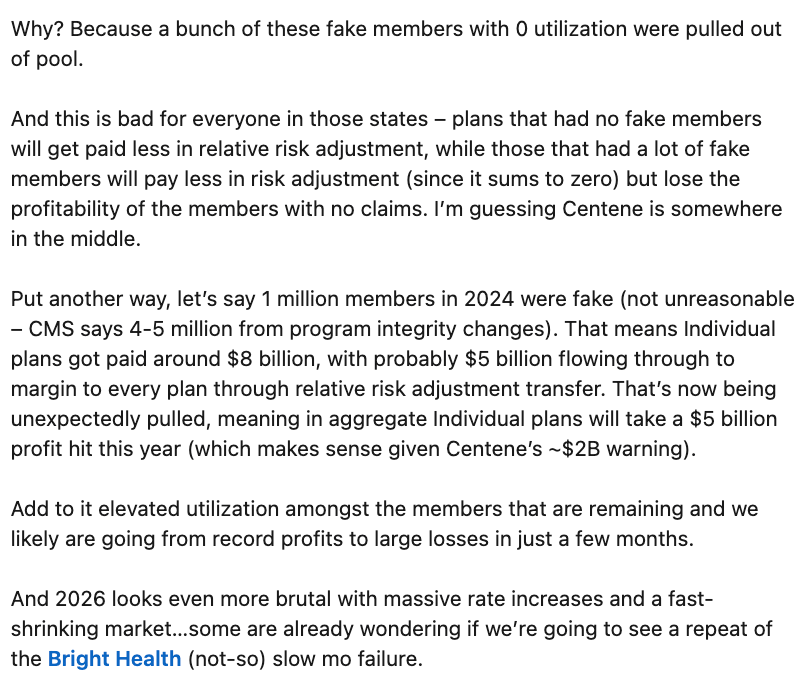

Ari Gottleib’s LinkedIn post on the extent of the ‘fake member’ fraud problem that the ACA exchanges have is another eye-opening example of the issues the exchanges have in front of them. An excerpt of his post discussing the magnitude of the fake member problem is below:

2026 is looking increasingly dire for the exchanges, and this post does a nice job articulating just how big of a challenge this fake member issue might be — essentially wiping out the profit margin for a lot of plans on the exchanges. Elevance’s earnings call, suggesting it would be at a negative margin for the exchanges in 2025, provides a good indicator here as well.

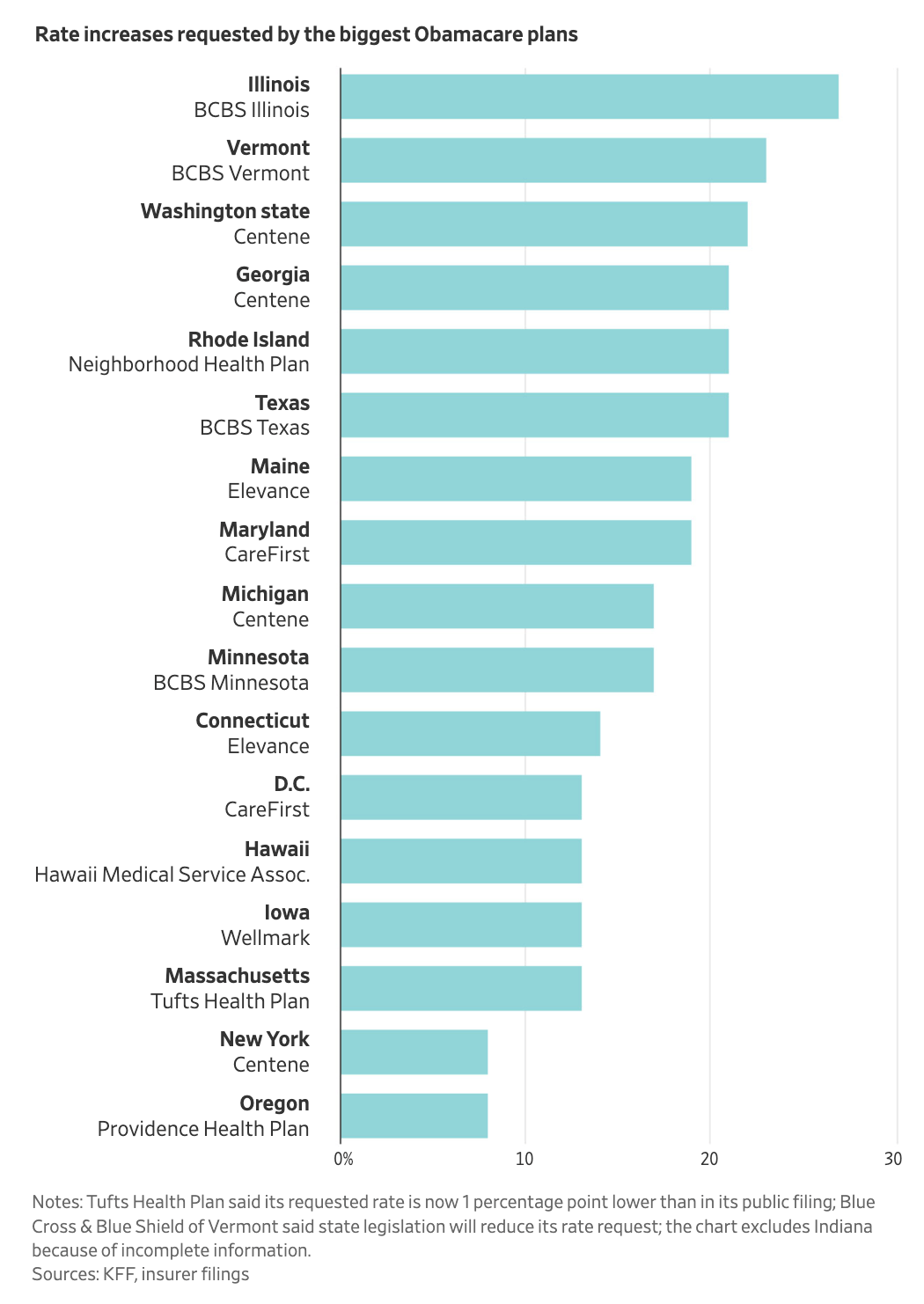

Chart of the Week

On the topic of the exchanges… the WSJ and KFF analyzed 2026 ACA rate filings from seventeen states where the data are public, suggesting we should expect to see 10% - 20% price hikes in the exchanges. BCBS Illinois is currently seeking a 27% rate increase. Also worth noting the article says that Centene is in the process of refiling rates to account for the acuity increase in the ACA population, which seems to indicate.

Funding Announcements

OpenEvidence, a AI-based medical search tool for physicians, raised $250 million at a $3.5 billion valuation. Check the section above for more details here.

Numan, a D2C telehealth provider, raised $60 million. Numan reported it hit $90 million of revenue in 2024, more than double its 2023 revenue, while hitting profitability.

What I’m Reading

CMS 2026 Physician Fee Schedule: A Paradigm Shift Creating Unprecedented Opportunities for Health Technology Innovation by Trey Rawles

This post provides a helpful overview of the proposed 2026 Physician Fee Schedule, calling it the “most significant transformation of Medicare payment methodology since the establishment of value-based care initiatives.” Read more

Maternity Market Under Pressure by Sandbox Advisors

A good read from the team at Sandbox on how the maternity market needs to evolve in the US, highlighting a number of startups that are doing interesting work in the market. Read more

OBBBA's impact on the healthcare industry: Sweeping changes on the horizon by Yulan Egan & Jordan Peterson (Union Healthcare Insight)

This post does a nice job summarizing the impacts of the One Big Beautiful Bill and key takeaways for the industry. Read more

Seth Hain: 5 Thoughts on AI Heading into UGM by Seth Hain

Epic’s Seth Hain shared some perspectives on AI as Epic gears up for its August User Group Meeting. Read more

Survey on health & benefit strategies for 2026 by Mercer

Mercer surveyed employers earlier this year to understand how they are attempting to address continued cost growths. 51% of respondents think it is likely they will shift more costs to employees, while there is a meaningful uptick in employers willing to consider alternative plan designs (variable co-pays, high performance networks, etc). Read more

Featured Jobs

Lead Director, DSNP Program Management at CVS Health, a healthcare conglomerate. Learn more.

$100k - $232k | Remote

VP, Business Development at LifeStance Health, a mental health provider. Learn more.

$210k - $260k | Remote

VP Medicare Advantage at Johns Hopkins Health Plans, the managed care and health services business of Johns Hopkins Medicine. Learn more.

$NA | Hanover, MD

Senior Manager, Growth Marketing – Patient Acquisition at Oshi Health, a virtual GI provider. Learn more.

Contact us to feature roles in our newsletter.

Want to share feedback with us?

Show your support by sharing our newsletter and earn rewards for your referrals!

Social Post of the Week