Hey there! This week, I’m following up on a previous post where I discussed the projected medical cost trends and the hospital rate increases needed to cover rising expense trendlines. This raised some important questions about how payers can manage the increasing costs that hospitals are pushing for, without compromising the sustainability of care. I’m also sharing an interview I did on ICHRA with a fellow HTN-er.

Thanks for being here.

-Claire

In Focus: Payers vs. Providers in Rising Costs and Shifting Healthcare Landscape

In my first publication of The Payer Digest, I dove into PwC’s Behind the Numbers 2026 report, which projected that medical cost trends will hold at 8.5% for group plans and 7.5% for individual plans. These are the highest sustained trend rates we’ve seen in over a decade, and there’s more to this than just inflation and rising wages.

One particular data point that stood out to me was PwC’s estimate that hospitals will need a 14% commercial rate increase to cover their 6-7% expense trendlines. This creates a significant challenge for payers, who are left with a tough choice: absorb these higher costs, which erode margins, or negotiate narrower networks to limit exposure. Neither option is particularly attractive and I wanted to continue to dig into this.

Understanding the Hospital Cost Increase

The 6-7% trend PwC highlights isn’t all about rising operational costs, though that’s definitely a part of it. It’s also about cost shifting. Hospitals need these commercial rate hikes to offset stagnant Medicare and Medicaid reimbursements. The expiration of temporary Medicare boosts is only adding to the pressure. The 7% increase hospitals are pushing for isn’t just to cover rising expenses. It’s a combination of shifting costs from government programs and hospitals seeking additional profits to stay afloat. I’d still like to get a bit more granular on the breakdown across operational costs, cost shifting and profit.

Q2 2025 Earnings and Outlook

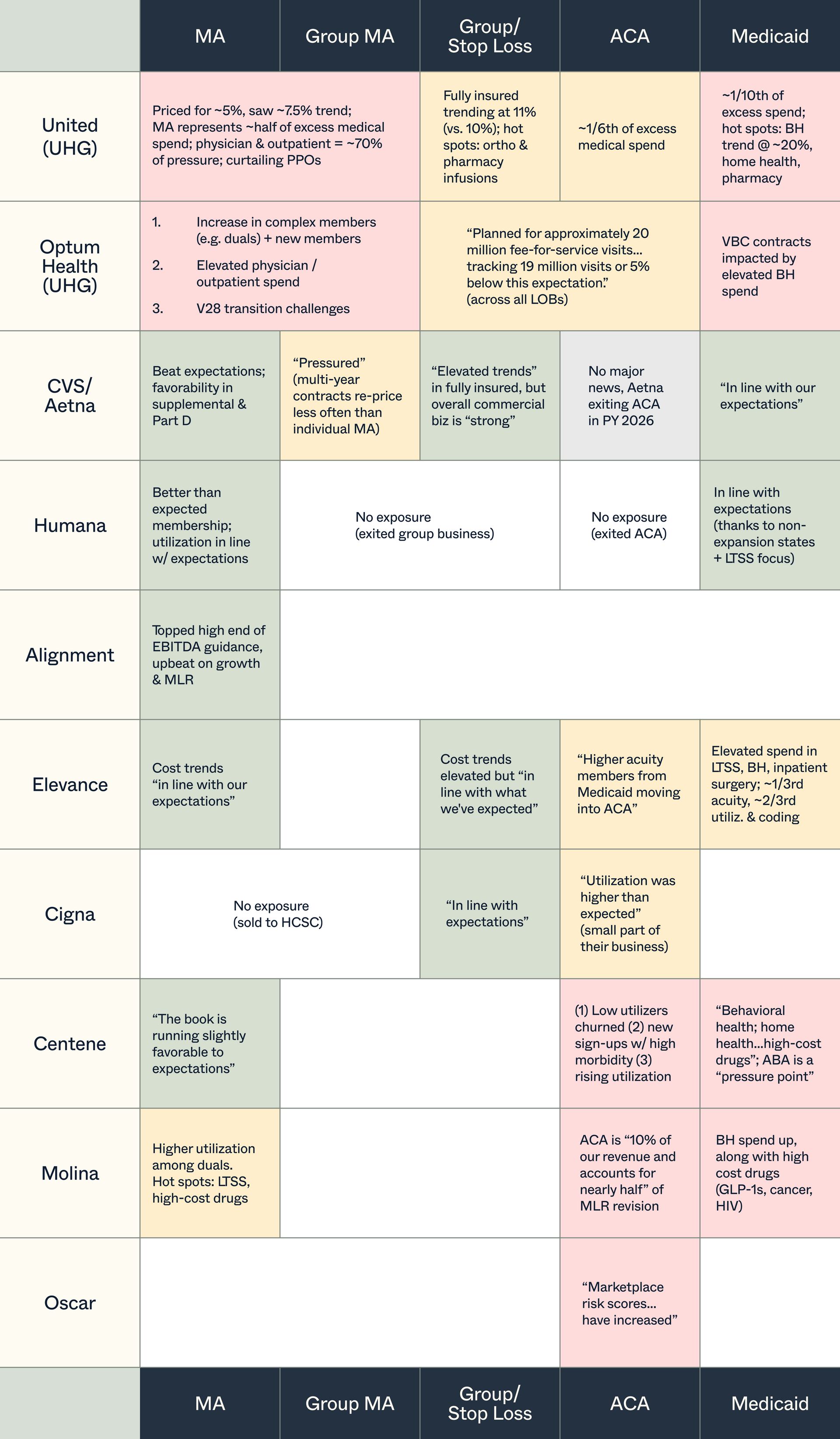

Fast-forward to the Q2 2025 earnings reports and this data point popped back into my head. From the payer side, the reports are as we expected… mixed results. Some insurers have downgraded their guidance, citing ongoing cost pressures. Others are doing better than expected, but they all agree on one thing: medical costs are still high, and the uncertainty around federal policy changes is leaving them with more questions than answers.

One of the biggest takeaways is that more enrollees are seeking medical care. And while some might attribute this to the “post-COVID uptick,” to me it seems more of a shift in how patients are seeking care, which is more frequently. Insurers in the Medicaid and ACA markets are especially feeling the pain here, with more members demanding services, while subsidies and reimbursements are coming under increased scrutiny. It’s a tough spot for payers, and this uptick in medical utilization is a big part of why insurers are facing such a challenging environment. Shout out to fellow HTN-er, Duncan Greenberg, for creating a great utilization heat map that summarizes the increased demand across almost all carriers and lines of business. It’s a useful visual for understanding just how widespread this trend is.

On the provider side, hospital systems, Tenet and HCA, have reported strong Q2 earnings, surpassing expectations and raising their guidance for the year. Both systems have benefited from a surge in patient volume, particularly in outpatient services, as patients return to healthcare facilities. HCA’s ability to leverage its size and negotiate favorable reimbursement rates has contributed to its strong performance, while Tenet has seen higher-than-expected admissions. Here is where the 14% data point popped back into my head and I felt myself going round-and-round. The contrast between hospital and insurer earnings underscores the complex dynamics at play. Hospitals are capitalizing on increased patient demand and better reimbursement rates, while insurers are juggling cost pressures and the uncertainty tied to policy changes.

So, What Gives?

How do we have better collaboration between payers and providers to balance cost containment and quality care. Is it shared incentives, more transparency, partnering together to create joint solutions that manage costs while improving patient outcomes? What do you think?

And as I’m writing this, I realize there are so many other dynamics at play here (hello, AI…sigh) that I’ll save for another edition of The Payer Digest. But I’d love to hear your thoughts on this dynamic and how we can make it work better.

Unpacking ICHRA with Amanda Harlan from Sandbox Advisors: Exploring the potential and challenges of ICHRA, from employer adoption to employee experience.

I recently published an interview with Amanda Harlan, digging into all things ICHRA. We covered what’s working, what’s not, and what might be next.

Check out the full interview here, and see key takeaways / insights from Amanda below:

ICHRA is both a cost management tool and a way to shift costs. For some employers, it’s a more affordable and predictable way to offer coverage. For others, it might just shift more costs onto employees. The real challenge is figuring out if it’s actually saving money or just passing on the burden, which really depends on how it’s implemented and how the individual market evolves.

Smaller employers often focus mostly on affordability, while larger ones are comparing cost, actuarial value, and network quality side by side. The challenge here is that many individual market plans aren’t built with group-to-individual transitions in mind, so making these comparisons isn’t really fair / straightforward. Some platforms are stepping up with tools to help streamline that process.

Those who want flexibility, cost control, and a simpler administration process might be good candidates for ICHRA. It’s not just small employers or those leaving group plans anymore… multi-state employers, smaller groups, and even public-sector employers are jumping in.

Employers and platform partners must be aligned. If not, issues with billing, compliance, employee support, etc. is expected and can derail adoption.

A good ICHRA experience is when employees understand how it works. This includes what their contribution is, how to choose a plan, and what their options are. But since many are new to the individual market, they need guidance.

Provider directories and accuracy are a big pain point.

Families, people with chronic conditions, and older employees often face more challenges under ICHRA, mainly because of higher costs and potential disruptions. A well-thought-out contribution model is key to making it work for these groups.

As the ICHRA market grows, admin fees will likely come down. Platforms will need to step it up by offering more than just basic administration. This includes things like employee guidance, compliance support, and data-driven insights will be essential.

Over the next 3-5 years, ICHRA is expected to grow steadily. As platforms improve and the individual market strengthens, ICHRA could become a central part of the benefits mix for many employers, especially those with distributed or more complex workforces.

New News

DOJ approved UnitedHealth’s $3.3B acquisition of Amedisys: The DOJ and state officials have reached a proposed settlement allowing UnitedHealth’s acquisition of Amedisys to move forward. To address antitrust concerns, the companies will divest 164 home health and hospice locations across 19 states, which will be acquired by BrightSpring Health Services and The Pennant Group. This resolves regulatory issues and enables UnitedHealth to expand its footprint in home health and hospice services

KFF Analysis Projects 18% Median ACA Premium Increase for 2026: A new analysis from the Kaiser Family Foundation (KFF) reveals a median premium hike of 18% for ACA plans in 2026, the largest increase since 2018. This jump is driven by rising healthcare costs, the expiration of enhanced subsidies, and ongoing policy uncertainty. If these trends continue, the increase could lead to greater affordability challenges for consumers, especially without the subsidy extensions, impacting enrollment and the broader healthcare market