Sponsored by: Ubiquity

Outsourcing is often viewed purely as a cost-cutting measure, but with the right partner, it can deliver both savings and value.

Ubiquity streamlines claims, patient support, and back-office operations with teams built for healthcare. Through smarter staffing, strategic optimization, and advanced tech, they go beyond lowering costs.

See how their model reduces overhead, protects patient experience, and delivers measurable results, all without compromising compliance.

Limited spots remaining for 2025. If you're interested in sponsoring the newsletter, let us know!

👋 Hey all! Kevin here. Welcome to this edition of my free weekly newsletter, where I share my perspective on healthcare innovation news from the past week that I found interesting.

Coming out of the Labor Day holiday, a lot of interesting news to recap over the past few weeks, including among other things some fascinating large M&A in EVERSANA / Waltz and Healthedge / USTHealthproof. Yet another reminder that change is afoot in the healthcare industry, and there is a lot of opportunity for business value creation in that.

My Reflection on AI’s Winners and Losers

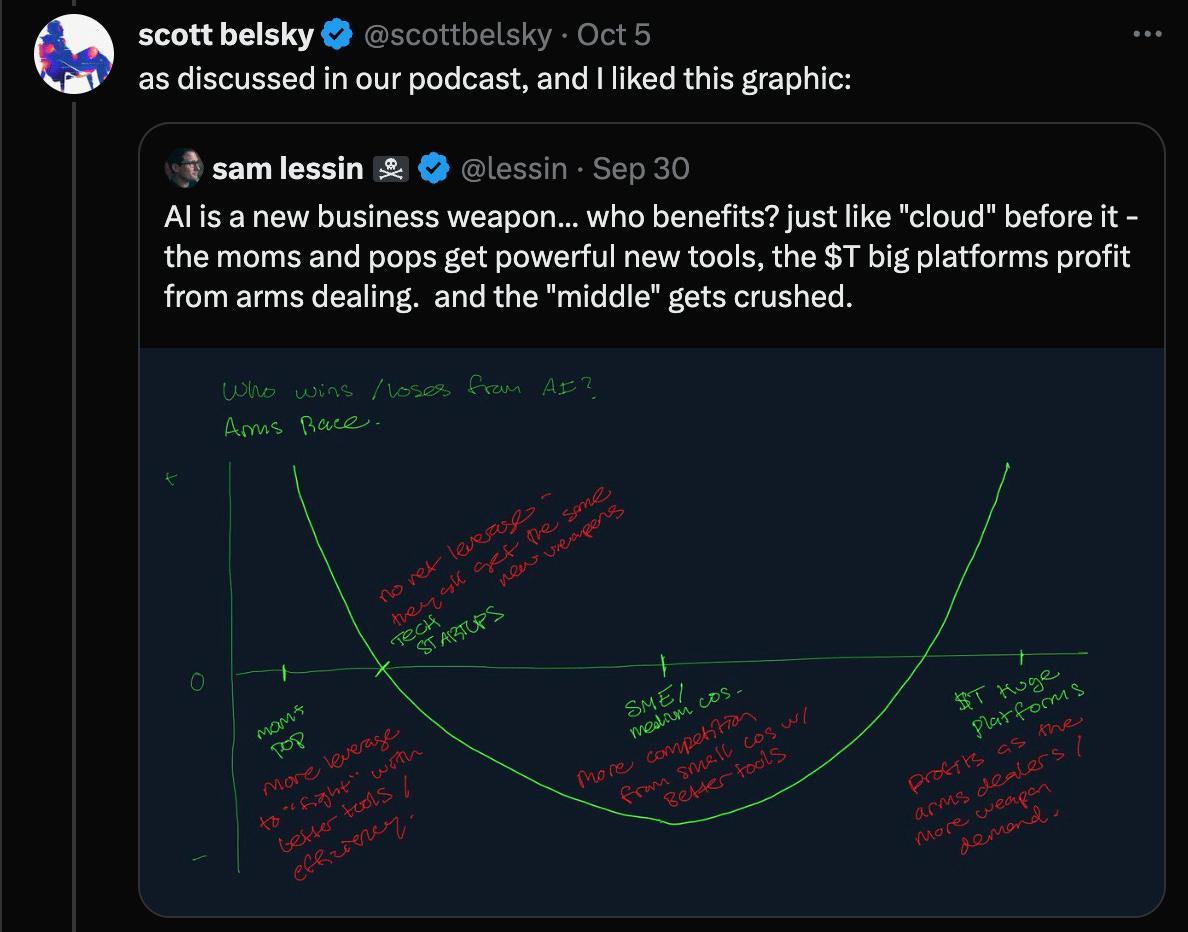

One of the visuals that sticks in my mind often on the topic of AI is this chart below from Sam Lessin. As I interpret it, it makes the case that there is going to be a barbell effect with the smallest and largest organizations benefitting the most from AI, while mid-sized companies are squeezed. The smallest organizations are going to benefit from tools that allow them to scale-up and compete with mid-sized businesses, while the largest organizations are going to benefit from what Lessin refers to as “arms dealing”, leveraging their data and scale to win as platforms:

I see that chart playing out in real time across a number of examples this week (all discussed further down):

Meroka’s $6 million funding round supporting independent practices through Employee Stock Ownership Plans (ESOPs)

Abridge needing to host a town hall with health system customers to address rumors that Abridge will lose functionality now that Epic has gotten into scribes

General Catalyst’s HATCo platform signing an expanded “transformation-as-a-service” partnership with WellSpan Health

In all of these moves, I am pretty confident we in the early innings of a massive reshuffling of the deck in healthcare, and over the coming years we will move even more toward an industry that has a handful of very large scaled platforms and a long tail of smaller organizations.

On the one end of the spectrum, it seems wise to be placing bets on businesses like Meroka to support small independent orgs, as I’ll get into below. On the other end of the spectrum, it seems like a handful of scaled platforms will emerge strengthened coming out of this period. Abridge appears to be in a race to become that platform before Epic steps in and eats its lunch. And if Abridge is getting these sorts of questions from health systems, it seems like a good indicator of what is around the corner for smaller AI scribe businesses. Meanwhile, health systems are turning to partners like GC. Consolidation of mid-sized organizations into larger platform plays feels inevitable.

As this reshuffling occurs, I think there is going to be a lot of energy in this industry in the coming months and years creating these new platforms. The EVERSANA / Waltz and Healthedge / UST Healthproof mergers seem like good examples of new multi-billion dollar platforms being created in industry niches. I have a feeling the competitive set of large platforms five years from now will have some familiar faces — Epic, UHG, CVS, HCA, etc — but also some new ones that are yet to be formed brands built on legacy platforms that don’t make it through this period of dislocation.

M&A

Walgreens deal is finalized, entities are split into five businesses

Walgreens has officially been acquired by PE firm Sycamore Partners, and it has been split into five standalone businesses: Walgreens, The Boots Group, Shields Health Solutions, CareCentrix, and VillageMD. Two parts of this news were particularly interesting to me:

As part of this news, Cigna’s Evernorth division will invest $3.5 billion to acquire a stake in Shields, with the option to invest more in the business. While Jim Cramer is apparently taking a “big, big monster pass” on Cigna, I think this specialty pharma play is really interesting strategically on their part.

While the other entities issued press releases noting they will be operating as standalone entities moving forward — i.e. see CareCentrix here — the VillageMD entity was notably quiet. Will be curious to see what that means for a potential transaction here moving forward.

INDEPENDENT PRACTICES

Meroka raises $6 million to support independent physician practices

Picking up on the theme of supporting independent practitioners from above, Meroka announced a $6 million funding round this week to support independent practices and “restore humanity in healthcare”. That tagline sounds quite familiar to efforts a decade ago, so I’m not sure what it says about all the efforts in the innovation sphere over the past decade, but I digress.

Meroka has a ton of great content out on its approach, both on its website and in the press — something I think more startups should be doing. This Forbes article in particular does a great job walking through the model. Meroka is rolling out this model with five OB/GYN practices across five states. Meroka is targeting solo practices or those owned by families that have been in business for 20 - 30 years with an owner who wants to retire and exit within 2 - 5 years. A practice that partners with Meroka sets up an ESOP and a MSO that is owned by the ESOP, with Meroka taking no ownership stake in the entity or profits out of the practice. At the closing of the transaction, a provider sells 100% of the practice to the ESOP, and typically gets 20% - 90% of the practice value in cash with the remainder paid over time based on performance and transition. Meroka is funding those transactions via its own balance sheet at the moment, but will potentially finance them via other sources in the future.

Meroka is raising this capital and starting to scale after its initial work demonstrated it could help these practices maximize revenue and better manage expenses in a meaningful way. The Forbes article notes how Meroka is managing vendor expenses on behalf of practices, and in one instance saved a practice $70k annually on malpractice premiums. Adding up small tweaks like that leads to a meaningful improvement in practice profitability, with Meroka seeing a 5%+ earnings lift for practices within six months.

I thought this sentence from the end of the Forbes article was a good one explaining the overall thesis:

Meroka is making a venture-style bet inside a traditional private equity lane by underwriting clinics for what they can be, not what last year’s P&L says they are. It is not a guaranteed path, and the capital stack will need to mature as the company grows. But if the early pattern holds—modest, repeatable improvements in revenue cycle and cost leakage, paired with steady distributions that staff can see and feel—the ESOP model offers a credible way to keep more private practices independent while building wealth for the people who keep them running. In a part of the system where the alternative is often consolidation or closure, that is an outcome worth testing at scale.

I find it to be a really interesting investment to think through. In some ways, there isn’t much that is innovative about the model. ESOPs as a concept have been around. But it is cool to see that ESOP coupled with an MSO to help improve the financial sustainability of a small practice. Integrating those things together seems both complicated but also potentially interesting. It also doesn’t seem without risk.

At the end of the day, it seems that Meroka is attempting to present a “better” exit scenario for independent providers than selling to private equity or a large system. It is doing so by seemingly underwriting loans to small businesses that other more traditional sources of capital won’t underwrite, on the premise that margins can be improved via more efficient back office operations.

There’s a million ways it seems like this could go wrong if you’re inclined to take a pessimistic lens on this model. I think there’s reasonable philosophical questions to ask about venture dollars being used to underwrite risky small business loans. Yet if you want to take an optimistic lens on the other hand, it seems like if it works it could open up this option as a potential avenue for more practices to remain independent over time, which seems like a huge win.

MSSP RESULTS

CMS released MSSP performance year data for 2024, saving Medicare $2.4 billion

CMS quietly released MSSP performance data for 2024 ahead of Labor Day, announcing the highest amount of savings for ACOs and Medicare since MSSP launched. The release noted some interesting financial results:

Net per capita savings (the money that Medicare saves per member) increased to $241 in 2024, up from $207 in 2023

Low revenue ACOs generated $316 of net per capita savings, compared to $175 generated by high revenue ACOs. Generally speaking the difference between low revenue and high revenue is the former are physician-led (or are FQHCs) while high revenue are led by hospitals

ACOs mostly of primary care docs generated $401 of net per capita savings, while those with fewer PCPs generated $219

Out of 476 ACOs that participated in MSSP, 75% of ACOs that collectively represent 80% of the 10.3 million assigned Medicare beneficiaries in the program generated performance payments of $4.1 billion. Only 16 out of the 476 participating ACOs generated shared losses and owe CMS $20.3 million. It is interesting to look at the 16 ACOs that generated the shared losses in the program:

It’s not exactly surprising to see a hospital led ACO at the top of the list, but it is a bit more interesting to see the enablers on the list - Aledade, CVS, and agilon all have ACOs on the list. Given only 3% of ACOs generated shared losses, it’s interesting to think about the characteristics of why those models generated losses. Yet also worth keeping in mind that while there were a few negative outliers, on the whole the program is demonstrating solid results.

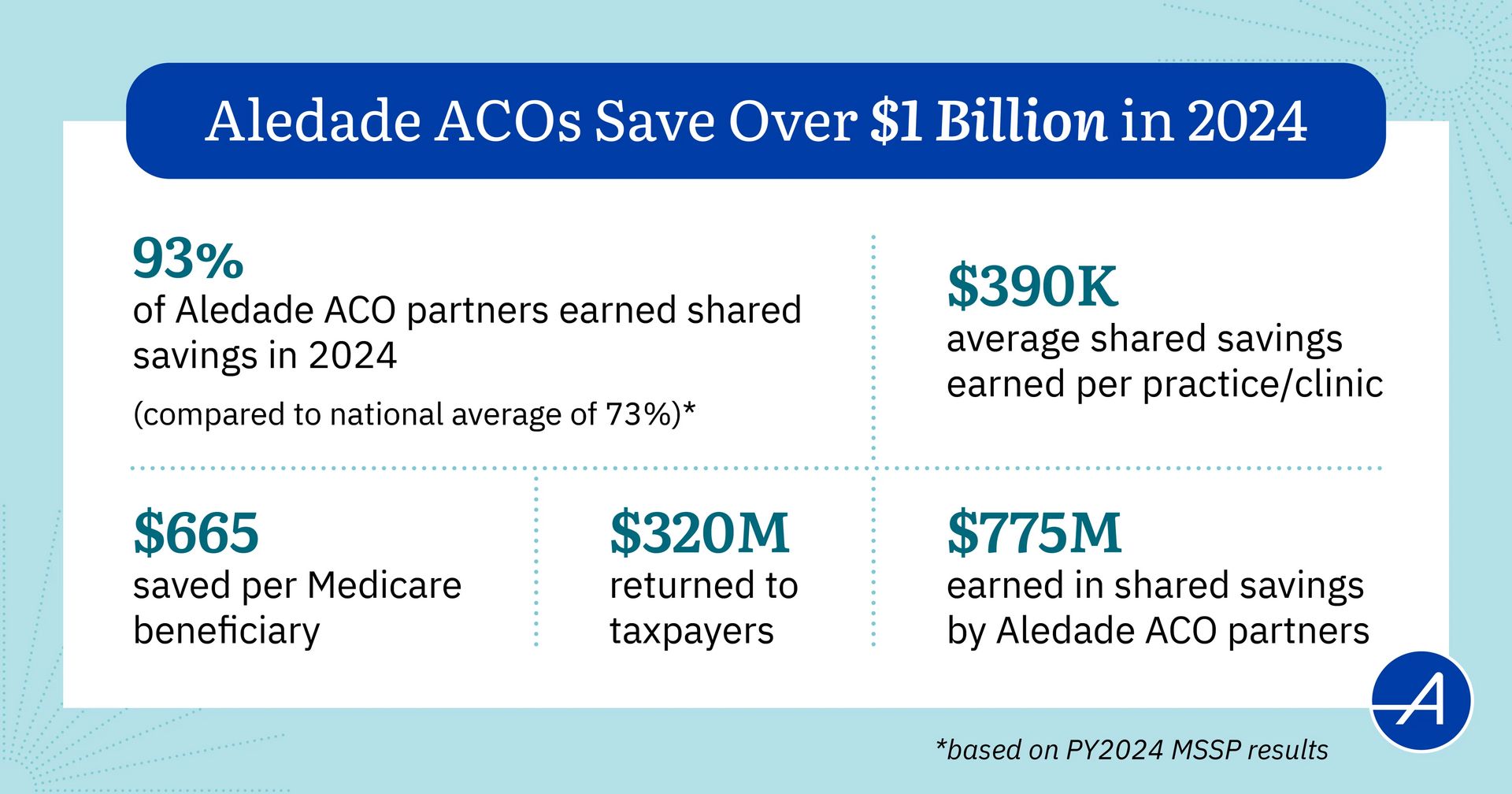

Aledade issued a press release on its positive overall performance in the program, noting it saved over $1 billion in aggregate and that 93% of its ACOs earned shared savings. Aledade summed up its performance nicely in the chart below:

The number on the upper right is the most interesting to me in all of it — generating $390k in share savings payments per practice / clinic feels like a really meaningful payment to these practices.

Other Top Headlines

Pennsylvania-based WellSpan Health announced it is signing a “Transformation-as-a-Service” agreement with General Catalyst’s HATCo. The new collaboration intends to save 400,000 clinical hours annually as a result of AI, while driving “double-digit business performance improvements”. I’m not exactly sure what that last sentence means, but it sure sounds like a 10%+ margin improvement for WellSpan, which seems like a pretty meaningful expectation for this partnership. WellSpan was GC’s fourth health system partner, after HCA, Jefferson, and Intermountain Health, with the two organizations first announcing a strategic partnership with GC back in 2022. Per the press release, WellSpan is now working with Aidoc and Hippocratic AI in GC’s portfolio. Hemant Taneja’s LinkedIn post says that WellSpan is also working with Commure.

EVERSANA acquired Waltz Health to create a new “pharm to table” model that is valued at $6 billion. The combined entity brings together EVERSANA’s commercialization services for pharma with Waltz Health’s specialty pharma marketplace. EVERSANA was originally formed in 2018 by two private equity firms that rolled up the life sciences commercialization services market, combining six consulting services firms. Waltz launched in 2022 to create a marketplace helping pharmacies to provide more visibility into prescription costs, etc. Combining the two entities seems like an astute strategic move given all the dynamics at play in the specialty pharmacy market.

Bain Capital is purchasing UST’s healthcare division, UST Healthproof, for $1.3 billion and combining it with HealthEdge. The combined entity will operate under the HealthEdge brand moving forward. Bain had previously announced the acquisition of HealthEdge from Blackstone in June 2025. UST Healthproof provides BPaaS services for health plans like Clover Health, which announced a partnership with UST Healthproof back in 2023. Clover outsourced all core plan functions to UST Healthproof for an estimated annual savings of ~$30 million.

The House Committee on Energy and Commerce Health Subcommittee held a hearing on the use of AI in healthcare this week. It included witnesses from General Medicine, Clover, Viz.ai, Stanford, and the American Psychological Association talking about how AI is being used in healthcare. It’s pretty interesting to hear the themes from the testimony and questions around the need to develop more trust and governance of AI along with the talking points around how AI isn’t going to replace the clinical workforce.

Stat reported that Abridge hosted a town hall with health system customers seeking to address rumors that Epic’s recently announced entry into the AI scribe market would lose functionality. Per the Stat reporting on the call, customers were asking if they should wait for Epic to enter the market or continue with Abridge. It sounds like we should expect Abridge to announce a new clinical decision support offering similar to OpenEvidence around HLTH.

Politico reported that it appears increasingly likely that enhanced subsidies will be extended for the ACA market as ten House Republicans are pushing for a one-year extension, which would move them past mid-term elections. It seems the sticker shock of premium increases for individuals is causing concern in the Republican party ahead of the midterms.

Two D2C telehealth companies are joining forces as Remedy Meds acquired Thirty Madison for ~$500 million in stock. The Axios reporting does a nice job providing details of the transaction. Remedy Meds is a fascinating story — it’s gone from launching in early 2024 to generating $450 million in annual revenue today by selling compounded GLP-1s to consumers. By my math, that means they currently have ~100,000 customers ($450 million annual revenue / ~$4k annual revenue per customers = 100,000 customers). It would appear the combined entity here is worth at least $1.5 billion if you apply the 2x revenue multiple Thirty Madison is being acquired for to Remedy Meds revenue. Given the growth and profitability I wouldn’t be surprised to hear if that number were higher. It’s an interesting example of how quickly models can grow in healthcare at times as Remedy Meds appears to be taking a D2C consumer subscription mindset and applying it to compounded GLP-1s — it appears they’re purchasing #1 ranking advertising spots on various websites (Forbes, USAToday, etc) to drive customer volumes. As I mentioned on Slack, it feels reminiscent to the COVID testing revenue boom some businesses saw in 2020. I’m curious to see if this is more durable.

Minnesota-based UCare is exiting the Medicare Advantage market in 2026. UCare had 186,700 MA members as of August 1st, up 31% over last year. It is the second largest Medicare Advantage plan in Minnesota. UCare had previously announced plans to scale back Medicaid plans in Minnesota after suffering operating losses of $504 million on $6.3 billion in revenue in 2024, due to Medicare Advantage and Medicaid losses. According to Star Tribune reporting, UCare reported losses of $315 million on its Medicaid business and $263 million in Medicare Advantage, while its ACA business lost $21 million.

CVS is exploring partnerships with health systems via MinuteClinics as it expands primary care offerings in MinuteClinics. CVS has added primary care at 400 MinuteClinic sites in the last year, and plans to add it to all sites moving forward. It’s recent partnership with Emory is an example of this strategy playing out, with MinuteClinic offering in-network primary care at its locations via the Emory Health Network. CVS is expanding these partnerships, including one with Mass General Brigham that is currently under regulatory review. It’s interesting to note that per the filing, CVS appear to be set up to manage total cost of care via MinuteClinic under MGB’s payer contracts.

Medicare Advantage insurer startup Troy Healthcare entered into a non-prosecution agreement with the DOJ after a criminal investigation, admitting to fraudulently enrolling consumers into MA plans without their consent. Troy apparently used its software platform for pharmacies to access beneficiary data and then used that data to enroll members. As I mentioned in HTN Slack, it’s interesting to go back to Troy’s $10 million Series B pitch deck and see how it was trumpeting customer acquisition costs at 1/20th that of large MA plans as a key advantage. It’s an unfortunate outcome as I think there is so much opportunity in expanding the role of pharmacists in managing care.

Humana is expanding VBC partnerships with MSK partners, announcing relationships with Vori Health and HOPCo, in addition to TailorCare.

Chart of the Week

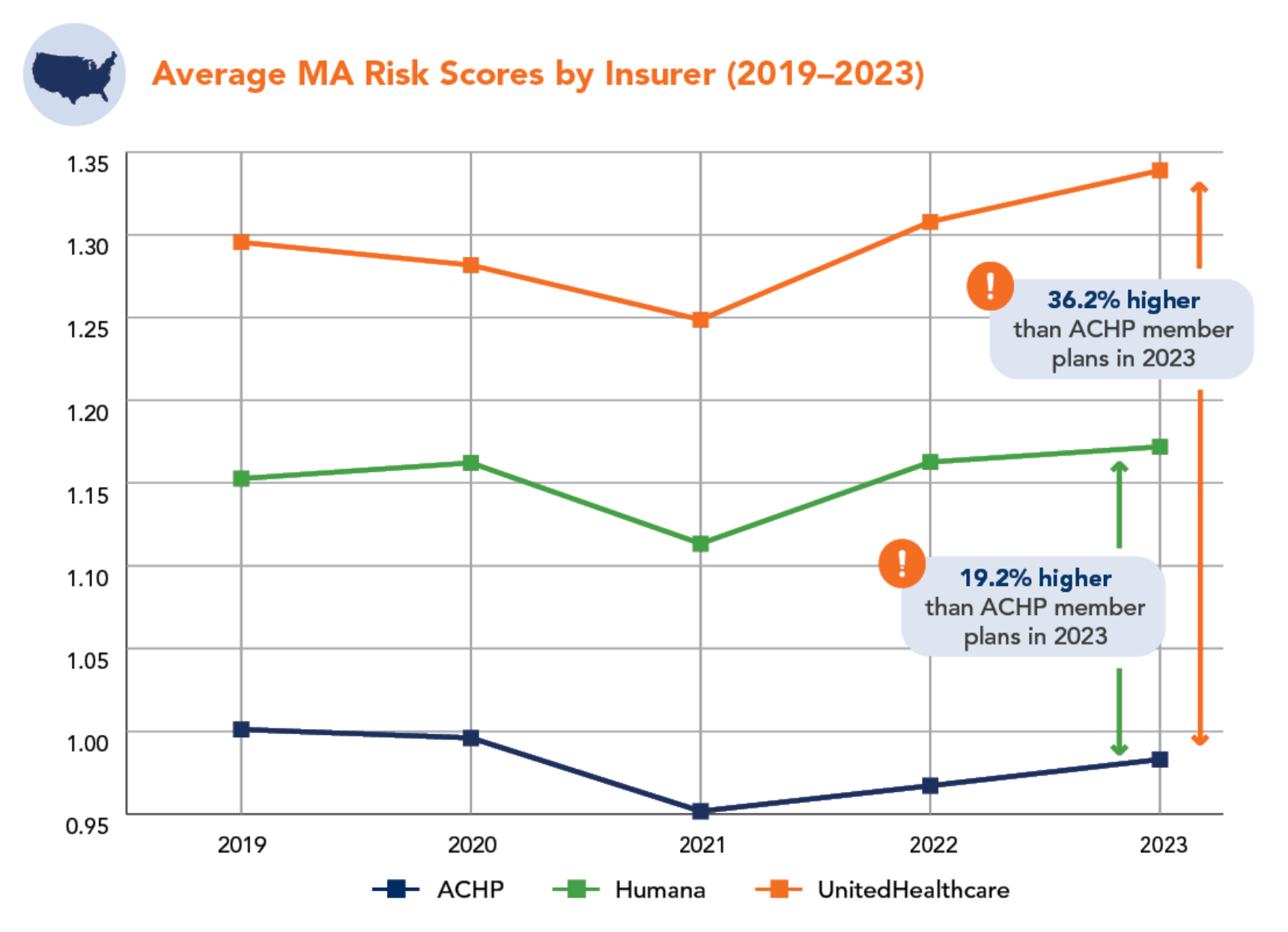

The Alliance of Community Health Plans, which represents a group of provider-sponsored health plans released a report finding that UHC and Humana plans have significantly higher risk scores than ACHP plans based on CMS data in a handful of markets. ACHP is lobbying for changes to the risk adjustment process centered around simplifying the process.

It is interesting to look at this data and think about the profitability of the Medicare Advantage market more broadly. For instance, take ACHP’s data in the Minnesota market: UHC’s risk adjustment scores were 38% higher and Humana’s 19% higher than ACHP plans in Minnesota in 2023. ACHP counts UCare and HealthPartners as members, which both operate in Minnesota. Yet as noted above, UCare is now exiting the MA market entirely in 2026 as a result of massive profitability challenges.

Certainly, all of this seems like a sign the Medicare Advantage market is in need of overhaul, but I actually wonder if it’s maybe for the a different underlying reason than argued. So much energy is being spent discussing years-old data from before the v28 funding cuts that have fundamentally altered the profitability of the industry. That pre-v28 conversation seems to be missing the fact that a number of insurers, like UCare, are either barely hanging on or are not surviving in the current structure of the Medicare Advantage program. Change is going to be needed, but perhaps not to take more profits out of the industry, but rather to make sure plans can stay afloat in this new environment.

Funding Announcements

Ketryx, an AI platform for life sciences companies, raised $39 million.

Eyebot, a vision testing startup, raised $20 million.

PreDoc, a startup using AI to automate medical records management, raised $30 million. The article notes that within six months of founding in 2022 PreDoc hit $500k in revenue and today has 35 customers, many of whom use it as a full outsourced partner replacing internal admin teams.

Nest Health, a in-home provider for Medicaid patients, raised $12.5 million.

Meroka, a platform for supporting independent practices, raised $6 million.

Neon Health, an AI platform for specialty pharma, raised $6 million.

What I’m Reading

Creating a Data Framework by Combining Health Care Cost Transparency and Quality Data for Purchasers by Purchaser Business Group on Health

An white paper discussing how PBGH members are creating a data framework to assess cost and quality. Read more

Billions in Play: Healthcare AI’s Race for Market Dominance by Parth Desai

This report on the AI landscape does a nice job highlighting trends in AI adoption, valuation, the opportunities ahead, and some of the challenges that companies might face. Read more

The Substantial Costs Of The No Surprises Act Arbitration Process by Jack Hoadley and Kennah Watts

An interesting Health Affairs article finds that the No Surprises Act arbitration process has incurred $5 billion in administrative and payment costs since its inception, roughly ~$2 - $2.5 billion per year. It presents an interesting glimpse into the complicated tradeoffs of healthcare — while the paper notes the NSA has protected patients from surprise bills, it also is likely adding to overall healthcare spending. Read more

How churn threatens Americans’ health by Ezekiel Emanuel and John Graves

This Stat article makes the case that health insurance churn is a key problem in American healthcare, adding administrative costs and reducing incentives to invest in long term preventive care. Read more

Clinical AI in Healthcare: Opportunities, Gaps, and Barriers to Adoption by Léa Jabbour and Emma Silverman

This is a interesting piece focused on the adoption of AI in the clinical use case realm and some examples of companies building in the space. It concludes predicting that adoption will be limited in the 1-2 year time horizon, in 3-5 years we’ll see specialty specific copilots emerge, and over the longer term we’ll see AI-native workflows supporting all clinical interactions. Read more

Featured Jobs

Head of Data & Analytics at Sunfish, offering IVF financing, guidance, and emotional support. Learn more.

$210k | Hybrid (NYC, LA)

Head of Care Coordination at Chronius Health, virtual primary care for patients with complex, chronic conditions. Learn more.

$85k - $95k | Remote

Executive Director, Population Health Strategy & Care Model Innovation at Aetna, a CVS Health’s payer arm. Learn more.

$131k - $303k | Remote

Chief of Staff at Luma Health, an AI-native patient engagement platform. Learn more.

$120k - $150k | Remote

Strategic Operations Lead at Solace, connecting Medicare members with patient advocates. Learn more.

Remote

Contact us to feature roles in our newsletter.

Want to share feedback with us?

Show your support by sharing our newsletter and earn rewards for your referrals!