Sponsored by: Venturous Work

Hiring the right leader takes time and is worth getting right. But when you need expertise right away—Venturous matches you with seasoned problem-solvers who can step in quickly without the costs or commitments of full-time hires.

It’s a flexible model that helps fast-moving companies maintain momentum while they build solutions, and teams, for the long term.

If you're interested in sponsoring the newsletter, let us know! Limited spots remaining for Q4.

PRIMARY CARE M&A

Harbor Health acquires 32 VillageMD practices in Texas

Harbor Health, the Austin-based multi-specialty clinic startup, announced this week that it is acquiring 32 VillageMD practices across Texas. Harbor is acquiring ten clinics in Austin, ten in San Antonio, six in El Paso, and six in Dallas. This news comes on the heels of Harbor announcing $130 million in funding earlier in the month. While it doesn’t appear that terms were disclosed, I’d imagine that a decent chunk of that funding round was used for this acquisition. As a comp, Privia acquired a practice in Arizona with 21 locations for ~$95 million back in April.

It seems like a massive bet for an organization like Harbor aiming to build a new integrated “pay-vidor” model to triple it’s size in terms of clinics via an acquisition of a financially distressed asset. But you can see the logic in Harbor co-founder Clay Johnston’s LinkedIn post this week, saying this:

Chapter 2: We're expanding to Dallas, San Antonio, and El Paso.

Backstory: Starting an insurance company is required for us to have full freedom to build the best health system possible, but it is expensive. To justify that investment, you need to have a broad population to sell to. This works best when you can work across multiple metros, as long as you have adequate density in each.

Exciting 4x expansion for Harbor as we bring in 32 VillageMD clinics.

The caveat that Johnston makes towards the end of that quote is the most interesting part of this transaction to me — I can understand the desire to scale for the insurance business to take hold, but to his point, you also need sufficient density in a market. Prior to this transaction, Harbor had eleven locations in Austin. It now has 21 locations there, along with the other markets it acquired clinics in above. This is where I get a little confused — if the core learning in Austin has been that you need sufficient scale and density to offer an insurance product, how does entering the Dallas market by acquiring six clinics help with that problem? Operating in more markets while lacking sufficient density doesn’t seem to solve that problem.

As was noted in the funding announcement, Harbor is launching its ACA product in Texas in 2026 while it looks to continue growing its employer focused product. I’ll be curious to keep an eye on what markets they launch the ACA product in for 2026. Austin seems like the only market where they’d have the density to do it at this point. Having launched an integrated pay-vidor model a few years back with six clinics in Atlanta and four in Chicago, we pretty quickly realized is that it’s hard to attract meaningful employer interest with that few clinics, and the ACA enrollment process makes it challenging for people to understand what the model is. People end up purchasing your product like any other insurance product on healthcare.gov, without knowing that the whole point is that they’re going to your clinics.

Despite the potential growth issues ahead, with ~$260 million of capital having gone into the business over the past few years, it seems that Harbor has purchased a one-way ticket on the “blitzscale or die” ride over the next few years. With Johnston noting that they’ve ear-marked spring 2026 for another potential funding round, it’ll be worth watching how quickly this takes off in Texas and expands nationally.

MEDICARE ADVANTAGE

Semler Scientific settles DOJ probe regarding MA payments

STAT News highlighted this week that Semler settled a fraud claim with the DOJ over its QuantaFlo device, which is used to detect peripheral arterial disease (PAD). As part of the settlement, Semler will make a $29.75 million payment to the United States, while $5.2 million of that payment will go to the whistleblower that originally brought the case forward in 2016.

Semler’s QuantaFlo device was also the subject of a previous investigation by STAT and the Lown Institute, which explored how UnitedHealth was using the device to diagnose PAD at high rates and collect risk adjustment dollars from the government. That reporting found UnitedHealth was paid $4 billion by the government for PAD diagnoses between 2018 and 2021. United wasn’t the only insurer using QuantaFlo in this way, as Signify was also apparently screening extensively at the time. All of this activity caused Semler’s market cap to briefly shoot up to almost $2 billion in October 2021, up from <$100 million in 2017.

Reading this STAT News article this week on Semler Scientific sent me down a rabbit hole I didn’t know existed, as Semler has pivoted its core business to become one of the largest Bitcoin treasuries in the country. This is a fascinating podcast on the approach — essentially Semler used the cash it was generating from operations (i.e. from the QuantaFlo device) to buy and hold Bitcoin, with the belief that Bitcoin is essentially digital gold and Semler can generate returns for investors by holding and trading in Bitcoin. The healthcare business is crashing as insurers move away from using the QuantaFlo device, but its really just a side business for Semler at this point.

Add that all up, Semler makes for one of the more bizarre stories of American healthcare I’ve read in some time.

As I look at the growing interest in D2C healthcare offerings and the variety of screening tests they offer, I think this story provides a variety of lessons to be learned about the incentives and adoption of tools like this. I’m not so sure that giving everyone in America a wearable over the next four years would end up being the best use of taxpayer dollars.

MEDICAID RATES

Oregon bumps Medicaid rate increase to 10% in attempt to keep insurers in program

The state of Oregon has been working with health plans in the state in an attempt to keep health insurers in the Oregon Health Plan, Oregon’s Medicaid program. Per this Salem Reporter article, Oregon had originally budgeted a 3.4% average rate increase, but has now increased that to 10.2% after insurers threatened to pull out of the program. It appears that most insurers are staying in the program as a result, although PacificSource may be pulling out of one county that serves 90,000 people. PacificSource appears to be facing financial challenges per the quote below:

“Like other payers in Oregon, PacificSource is facing serious financial challenges related to Medicaid. Enrollment has surged and costs have risen sharply, far outpacing the state rates meant to cover them. We project operating losses of up to $100 million in 2025, after $40 million in losses in 2024. Losses in 2026 could be significantly higher.”

PacificSource isn’t the only Oregon insurer facing financial challenges. CareOregon, which manages benefits for 560,000 Medicaid enrollees in Oregon — almost 40% of the market — laid off 80 employees earlier this year after it lost $230 million from operations in 2024. CareOregon has now turned to McKinsey to come in and help turn around operations. It seems somewhat ironic that is the case given Oregon’s staunch opposition to the failed SCAN / CareOregon merger attempt in 2024 on the grounds that taxpayer dollars should stay in the state. Turns out there might be some logic to being a scaled insurance business that operates in multiple markets.

It provides for a good example of the challenging dynamics facing the insurance market at the moment, and this is before any of the Medicaid impacts of the OBBB start taking effect. It is going to be interesting to see how states like Oregon address these budget challenges over the coming years.

HCCI on primary care spending trends

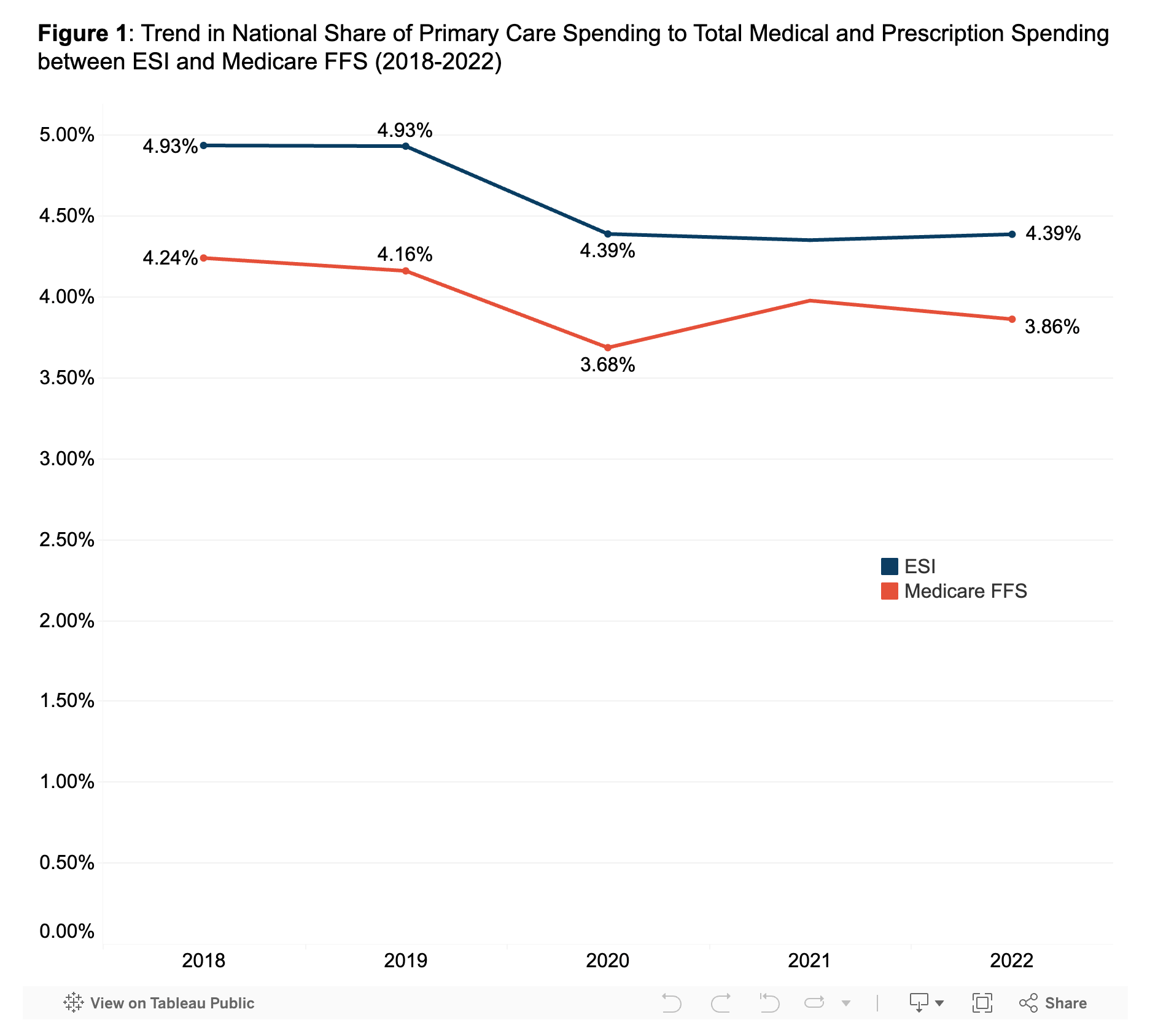

The Health Care Cost Institute (HCCI) published data on Wednesday looking at primary care spending between 2018 and 2022 in the employer and Medicare FFS markets. Over that period, both markets saw a ~10% decline in the share of overall spending:

The report notes that this is a narrow definition of primary care, but that even with broader definitions, the same trend still applies.

The suggestion at the end of the paper is that we need to strategically invest in primary care. I find it hard to argue with that suggestion. At the same time, I can’t help but think about how much money was invested in primary care startups over this period of time and the impact of all that activity. I also think back to Humana’s various VBC reports in this era talking about how it was paying primary care providers something like 2.2x the amount it was paying them in FFS. I’d be quite curious to see the same chart above for Medicare Advantage data and if that looks any different.

Other Top Headlines

Bloomberg reported that Aledade is in negotiations with Ares Capital to raise $500 million in an asset-backed loan, with Bloomberg noting that the loan will be used to fund ongoing operating expenses. This news comes on the heels of recently released 2024 MSSP results, where Aledade generated $775 million in shared savings. Given the MSSP payable to practices of ~$387.5 million (half of the overall shared savings payment), it would appear that this loan is being used to advance payments to PCPs, with some interesting discussion of why that might make sense strategically here in the HTN Slack thread.

CMS announced the new Rural Health Transformation (RHT) Program this week, which will dole out $10 billion in funding annually over the next five years. The funding will be distributed to participating states and used to support rural healthcare providers. Lisa Bari shared a helpful summary of the program over on LinkedIn this week.

Data analytics platform Innovaccer acquired Story Health, a virtual care platform for cardiology. It appears that Innovaccer will use the Story platform to help health systems to manage care pathways in cardiology and beyond, with the press release noting that Story will be expanding into diabetes and COPD. The press release notes that Story counts Intermountain, ChristianaCare, and St. Luke’s as customers, along with “many leading at-risk providers”. A few weeks ago, Innovaccer’s CEO mentioned that it expects to do 2 - 3 acquisitions in the coming months, with hospital admin / revenue cycle task automation as a key focus area. Will be interesting to see what business they end up acquiring in that space.

Blue Shield of California’s sister technology company, Stellarus, announced that two other Blues plans, Hawaii Medical Service Association and Blue Cross and Blue Shield of Kansas, have joined as “co-founders”. Per HealthCareDive reporting, both HMSA and BCBS Kansas made financial investments in Stellarus as part of the deal.

Aegis Ventures added three health systems to its innovation consortium consortium — Yale New Haven Health, Keck Medicine of USC, and Hartford HealthCare. This expands the group to fourteen health systems that will actively support building, investing, and deploying new tech with Aegis.

Lemonaid Health, the D2C telehealth platform that 23andMe acquired in 2021 for $400 million, was acquired for $10 million by two investment firms that will operate Lemonaid moving forward.

Funding Announcements

Imagine Pediatrics, a pediatric care model for children with special needs, raised $67 million. The press release notes that Imagine is now caring for 40,000 children nationwide, and saved health plans $65 million in 2024 via avoidable ER visits and hospital admissions.

Sevaro Health, a neurological care platform, raised $39 million.

Doctronic, an AI primary care chatbot, raised $20 million. Doctronic cites that its chatbot has been used 15 million times.

Birches Health, a care model for gambling addiction, raised $20 million.

Inbox Health, AI for patient billing, raised $20 million.

Seven Starling, virtual women’s maternal mental health provider, raised $8 million.

Assured, a provider credentialing platform, raised $6 million.

Post Acute Analytics, a care transitions platform, raised growth capital.

Trially AI, an AI clinical trial platform, raised $4.7 million.

What I’m Reading

Up-and-Coming MA Carriers by Jared Strock and Emily Reese

A good look at Medicare Advantage enrollment growth for Alignment, Devoted, and Zing. It’s interesting to see the divergent strategies Alignment and Devoted are taking — Alignment continues to grow methodically in a few geographies, while Devoted appears to be going very broad, with some wild swings in membership across various states. I didn’t realize that Devoted dropped ~39% of its membership across in its five largest states between Sept 2024 and Sept 2025. Read more

Community Briefing: the Transforming Episode Accountability Model (TEAM) by Martin Cech

Martin penned a good quick overview of CMMI’s new TEAM model and opportunities that exist. It’s been interesting to me to see that hospitals seem relatively late to the game in preparing for this model, but when you dig into the size of the financial opportunity for hospitals it makes more sense — the potential downside isn’t all that big. Despite that, it seems like this model is a good one to keep an eye on for future direction from CMMI. Read more

Virtual Opioid Use Disorder Solutions by Peterson Health Technology Institute

PHTI released a report looking at the opioid use disorder market and a number of startups offering medication-focuses solutions (Boulder Care, Eleanor Health, Ophelia, etc) or digital wraparound solutions (CHESS Health, DynamiCare Health, etc). Read more

The Gravity of Boston’s Healthcare by Andrew Tsang

This was an interesting look at the financials of large health systems around Boston, highlighting the flywheel driving ever increasing medical innovation in Boston, while also causing a sucking of resources from surrounding communities into Boston. It’s a good read highlighting the economic tensions inherent in American healthcare, and another reminder that these are complicated issues with many tradeoffs. Read more

Resolving the Massachusetts Paradox by Peter Kolchinsky

Staying on the theme of Boston healthcare, this piece highlights the complicated relationship the biopharma industry has with local politics, arguing for a new marketing campaign for biopharma. It’s a fascinating read in the world of PR spin as it discusses the language the industry should use, how it needs to create villains for storytelling purposes, and more. Read more

Featured Jobs

Director of Business Development at Oula, a modern maternity clinic. Learn more.

$180k - $190k | Remote

Principal Product Manager at b.well Connected Health, a FHIR-based interoperability platform. Learn more.

$175k - $210k | Remote

Head of Patient Advocacy Group Partnerships at Citizen Health, an AI advocate for patients with rare diseases. Learn more.

$140k - $170k | Hybrid (Bay Area)

Strategic Growth Director at Aidoc, an AI model that assists physicians with clinical decision making. Learn more.

Remote

Virtual & Whole Health Practice Manager at Diana Health, a network of women's health practices. Learn more.

Remote

Contact us to feature roles in our newsletter.

Want to share feedback with us?

Show your support by sharing our newsletter and earn rewards for your referrals!