Sponsored by: Anatomy

Automate your mail with AI

Anatomy’s HIPAA-compliant AI lockbox eliminates manual posting, speeds cash flow, and reduces costs. Forward your mail to Anatomy from your office or current PO Boxes, and turn your mail into an email-like experience including EOBs converted into ERAs for easy posting into any PM system.

Trusted by leading digital health services, billing companies, and MSOs/DSOs like Alma and Foodsmart.

If you're interested in sponsoring the newsletter, let us know!

My reflection on the political process and cutting costs out of the system

This week we’re again seeing discussion of the unsustainable nature of rising healthcare costs in this country, this time with a focus on the employer market.

The Wall Street Journal noted that employers are expecting health insurance costs to rise at the highest rate in 15 years based on estimates the benefits consultants. Meanwhile, NPR suggested that we should blame insurers, pharma, and employers for this. Because naturally, it wouldn’t be 2025 if we didn’t focus on figuring out who to hold in contempt for the societal challenges we face.

One of the more interesting questions to me these days is how/if we actually take a meaningful chunk of costs out of the healthcare system, and what markets will take the biggest hits. We’ve all seen the national debate raging the past few months about Medicaid cuts and the myriad issues posed by the $1 trillion of potential cuts to that program in the OBBB between 2025 and 2034. By my math equates to approximately $100 billion of cuts per year.

Keeping that number in mind for a minute, it was interesting to see the below commentary from Alignment Health CEO John Kao at Morgan Stanley’s Healthcare Conference, describing the state of v28 and the impact that change has had on the broader Medicare Advantage market:

So for those of you who don't know, V28 is the new risk adjustment model that was implemented in 2024. It was phased in '24, '25, so you're 2/3 of the way through. '26 will be the last year. The impact is generally on a national basis, about 6% to 7% reduction per year. So when you kind of head into 2026, you're looking at like a high teens to 20-plus percent reduction in premium revenue. That's what's creating a lot of the compression in premium right now. And what it's doing is when you take away that premium, the trickle-down effect is huge because the plans are not in the same ability to globally cap downstream providers. There's not enough money in that supply chain is what I say.

It’s the best summary I’ve seen about the magnitude of the impact v28 has had on the industry — and not just for plans, but also for capitated providers (also note it’s similar to statements like this one from America’s Physician Groups in 2024 noting that v28 could result in a 20% revenue decline). If I do the math on what Kao said above, combined with the fact Medicare Advantage plans are paid around $500 billion by CMS annually, v28 will represent roughly a $100 billion funding cut to the Medicare Advantage program annually when fully implemented in 2026 (i.e. 20% of $500 billion).

It goes without saying that there are a lot of reasons why a $100 billion annual funding cut to Medicaid generates significantly more national debate than what appears to be a $100 billion annual funding cut to Medicare Advantage. One seems like it would tangibly cause millions of people to lose access to healthcare, while the other seems like a cut to insurers gaming the system (even if as Kao indicates, the reality is that capitated providers are bearing the brunt of this). But it’s also not lost on me that one change was front and center in a controversial piece of legislation, while one change happened quietly as part of normal course for CMS.

If anything is apparent to me as I read about the cost challenges we face across the employer, ACA, Medicare Advantage, and Medicaid markets, it’s that collectively we’re going to need to have some hard conversations about how to meaningfully cut healthcare expenses in the coming years. Kao’s quote about the MA funding cut I thought provided an interesting case study in one such cut.

COMMERCIAL INSURANCE

Commercial VBC startup XO Health files that it has raised $52 million

Given the WSJ and NPR articles referenced above from this week about the rising insurance costs facing employers heading into 2026, I’d imagine that we’re going to be hearing a lot more about interest in alternate plan designs from employers that are looking to manage costs.

On that front, it was interesting to see Endpoints News share that XO Health filed a SEC document reporting that it has raised $52.2 million in funding to grow its value-based care provider network in the commercial market. This funding spans its Seed round and Series A so far, and it appears that XO is still in the Series A fundraising process. XO appears to have some early momentum after launching in four markets earlier in 2025 (Atlanta, Dallas, Houston, and Minneapolis).

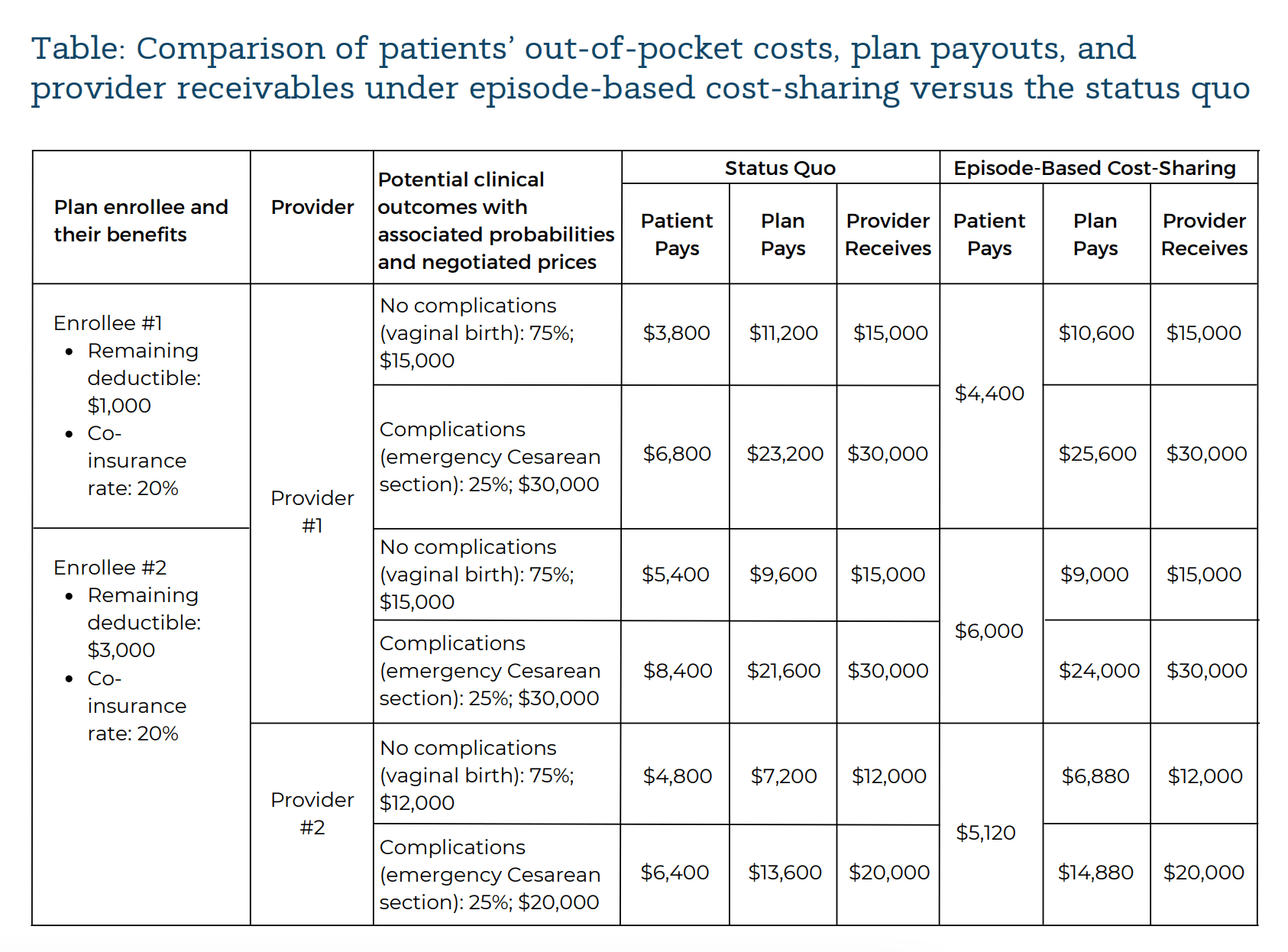

XO has an interesting model, with the core product appearing to be a open-access provider network built around transparent prices for episodes of care. It’s a rather complicated-sounding concept, but XO funded a really helpful white paper earlier this year discussing how episode-based cost sharing works. It includes the visual below discussing what costs look like for two hypothetical pregnant enrollees:

The chart highlights some of the many interesting nuances of conversations like this when you look at the various dollars spent / earned between the patient, employer, and provider. For example, if you’re one of the 75% of patients who have a vaginal birth with no complications, you’ll end up paying more under this episode-based model. That is the concept of pooling risk at play, because it mitigates the 25% chance that you’ll end up paying more if you have complications and end up with a C-Section.

It’s also interesting to think about how these models drive cost savings (i.e. XO mentions on its website that employers can save up to 20% with its model). If you do the math on the chart above, an employer would expect to pay more at Provider 1 under the episode-based cost sharing versus the status quo for both employees. Mathematically that has to be true if providers are getting paid the same and enrollees are saving money — it’s either the employer or the enrollee paying. For the employer to start to see savings, Enrollee #2 needs to choose to go to Provider 2 instead of Provider 1, because it is a cheaper option for the patient. This is where transparency and upfront pricing comes into play, along with the assumption that you can change behavior by presenting this information.

That behavior change by the enrollee seems like the crux of a model like this working — creating a win / win / win for Enrollee 2 (lower costs), Provider 2 (more volume = more revenue), and the employer (lower costs). In that scenario, Provider 1 is the lower (less volume = less revenue), which also underscores the inevitable pushback for models like this.

COMMERCIAL INSURANCE

Mark Cuban Hints at Launching Mark Cuban Cost Plus Wellness

Healthcare’s favorite rabblerouser Mark Cuban went on stage at All In Summit this week for a broad ranging discussion on the topic of “How to Save America”. The conversation started on the topic of healthcare, which you can watch here. He says some curious things, i.e. his answer to the question “is employer sponsored insurance the original sin of healthcare”.

At one point in the conversation, the topic of self-directed healthcare came up (at 11:28). After taking a second to note his perspective that Ro and Hims are rip offs because people can get medicine for cheaper on his website, Cuban mentioned that he is planning to launch a new business, Cost Plus Wellness, at the end of the month. He described the business as follows:

"We’re creating a company called Cost Plus Wellness that hasn’t launched yet. It’ll hopefully launch at the end of this month. What we’re doing is we’re going out there for my companies and eating our own dog food and we're setting up direct contracts with 8,000 providers at this point. And it's based off of cash pay, because those insurance companies not only rip off patients, and deny care, etc. They also underpay doctors too. And so we're going out there and negotiating cash prices with terms that will pay on a cash basis, but what's different is when we launch is we're going to publish all those contracts"

While I can appreciate Cuban’s energy and desire to “f*ck up healthcare” as he puts it, I think it’s interesting to see that his encore to Cost Plus Drugs is launching a cash pay provider network leveraging his companies to negotiate transparent rates. It appears that he has been working on this initiative for some time in his own businesses, as it was also called out in his profile in Modern Healthcare’s 100 Most Influential people in healthcare in 2024. For proponents of cash pay pricing models, I think this effort will be fascinating to keep an eye on. While Cuban has directed his ire towards vertically integrated insurers and PBMs up to now, I’d be curious to hear what it’s like negotiating these provider contracts, and how those providers react when he attempts to publish those rates. As I think the discussion on XO Health above hints at, these negotiations get really complicated, really quickly.

Chart of the Week

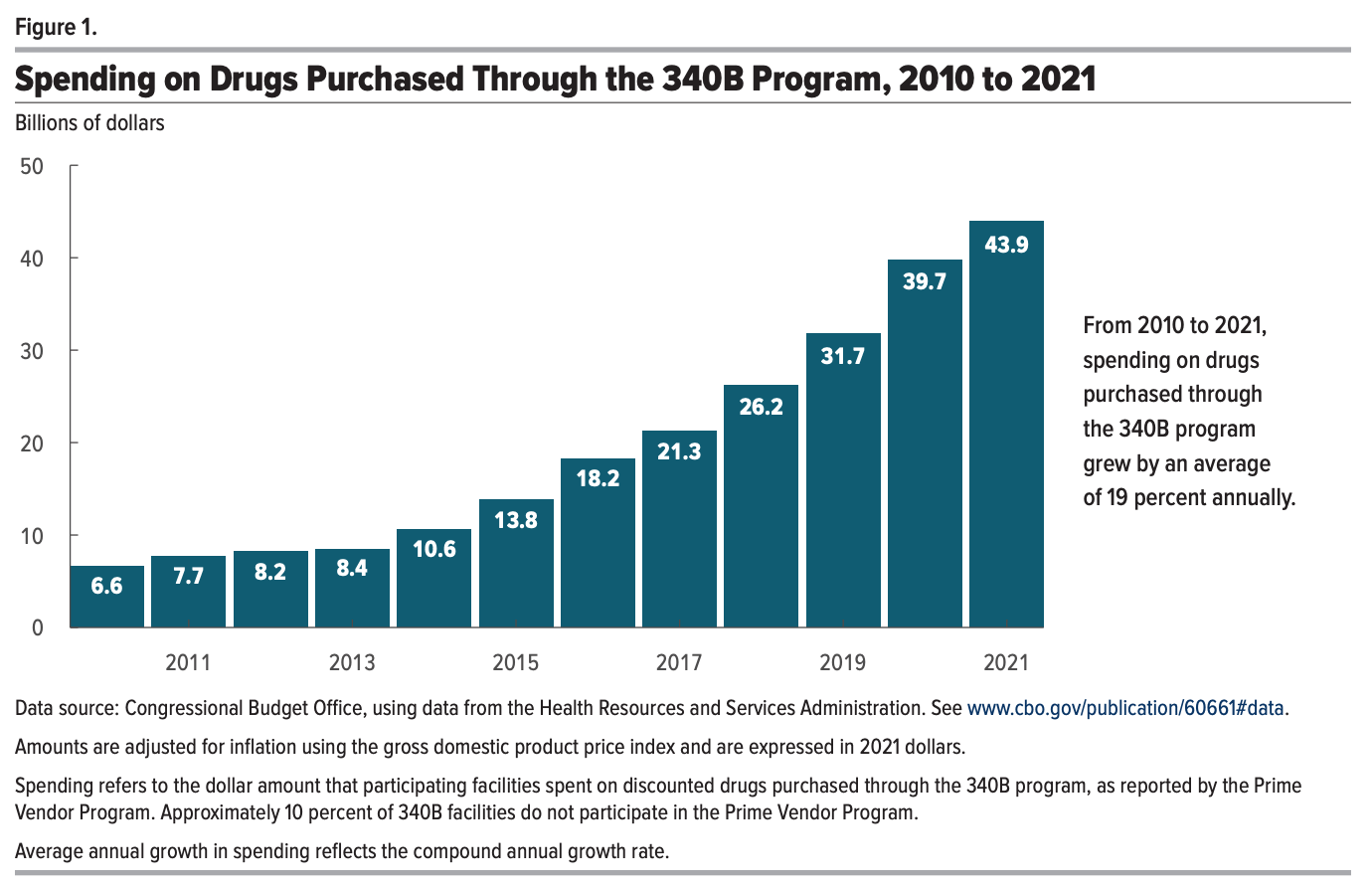

The CBO released a report this week looking at the growth of the 340B program, with this chart highlighting how the program has grown from $6.6 billion spent on drugs in 2010 to $43.9 billion in 2021. If you’re looking to better understand the 340B program, this document is a really good starting point.

The CBO broke down the growth of the program into two buckets:

One third of growth is attributable to two things: market-wide drug spending trends and disproportionate spending growth of some specific classes of drugs, including cancer and anti-infective drugs

Two thirds of the growth is attributable to three things: hospital and off-site clinic integration leading to more facilities becoming 340B eligible, the ACA, and a change that allowed hospitals to contract with multiple contract pharmacies.

The CBO suggests that the integration of hospitals and off-site outpatient clinics is the single largest contributor to growth of the program.

Other Top Headlines

In Medicare Advantage Star ratings news, Plan Preview 2 has opened for health plans, which helps them understand how their Stars scores are coming in for Star Year 2026 (which is payment year 2027). UnitedHealth’s stock was up 11% this week, partly on this data, as UHG issued an 8-K noting that it expects to have 78% of its membership in 4 star or higher plans. On the other hand, Humana’s stock slid 10% this week as the market reacted to the news that cut points will be harder to hit.

CMS provided new guidance last week that will make catastrophic plans more accessible for anyone who is ineligible for advance premium tax credits (APTCs) or cost-sharing reductions (CSRs). This HFMA article does a nice job explaining the change, noting that only 54,109 people out of 24 million exchange enrollees were enrolled in catastrophic plans. It seems this move was made in the event APTCs are not extended in order to offer a lower-cost option for consumers who would see their insurance costs skyrocket as a result. Perhaps not surprisingly, AHIP’s reaction to this move was tepid at best, as they push for Congress to extend tax credits.

PE Firm Patient Square Capital is exploring a potential take private acquisition of the GPO Premier. Premier’s stock is up ~24% this year and currently has a market cap of ~$2.2 billion.

Kaiser is entering the Nevada market via a joint venture with Renown Health. As part of the JV, Kaiser will take a majority stake in Renown’s health plan, Hometown Health. The two parties will also open ambulatory sites as well. It’s interesting that Renown specifically did not want to be part of Kaiser’s Risant effort, which is intended to scale Kaiser’s VBC model to new markets and counts Geisinger and Cone Health as partners. The article notes that Kaiser sees this as consistent with its VBC strategy on the whole, as they are testing new models and concepts. It’s not exactly a ringing endorsement for Risant.

The FDA announced it is cracking down on deceptive advertising, sending thousands of warning letters to pharma companies and issuing 100 cease-and-desist letters. I included an OpEd from FDA Commissioner Marty Makary in the “What I’m Reading” section below, where he calls out Hims & Hers by name for their Super Bowl ad.

OpenEvidence acquired Amaro, an AI-native advertising platform.

Value-based MSK provider TailorCare acquired Stabl, a remote patient monitoring technology.

Patient engagement platform Phreesia acquired AccessOne for $160 million in cash. AccessOne is a patient financing solution for health systems, managing receivables of $450 million today. The acquisition is expected to add $35 million of annualized revenue and $11 million of Adjusted EBITDA to Phreesia’s financials. This KFF article from two years ago included some of AccessOne’s contracts with public health systems, posing questions about charging interest on medical debt.

OhioHealth and Lifepoint formed a JV to operate two behavioral health hospitals. Two hospitals currently operated by Lifepoint Behavioral Health will join the JV, along with outpatient locations.

In the workforce management space, Ascend Learning acquired Laudio.

Verily is facing a whistleblower lawsuit arguing it covered up HIPAA breaches.

Funding Announcements

Strive Health, a value-based kidney care model, raised $550 million.

Harbor Health, a new clinical model based in Austin, raised $130 million.

Diana Health, a women’s health clinical model, raised $55 million. Diana partners with health systems to launch women’s health clinics. Per its website, Diana has nine clinics, one of which is opening soon. It appears that most of those locations are via partnerships with HCA and affiliated hospitals, AdventHealth, or Texas Health Resources.

XO Health, a value-based care network for commercial insurance, raised $52 million.

Penguin Ai, a startup creating AI agents to streamline back office workflows, raised $30 million. According to this Med City News article, Penguin is apparently attempting to build the “Epic of the backoffice” with rev cycle / coding tools for providers and prior auth tools for payers.

Optain, an AI-enabled teleophthalmology service, raised $28 million.

Daymark Health, a cancer care coordination model, raised $20 million.

Teton.ai, an AI platform for long term care and hospitals, raised $20 million.

TandemStride, a peer model for supporting trauma survivors, raised $5.5 million

What I’m Reading

Secretive vendors are exploiting a free money glitch in the U.S. healthcare system by Dan Snow

This is a really good read on a complicated nuance of the BlueCard system and how Blues plans handle paying claims for members in states outside of their home state with multiple plans. In states like California where there is more than one Blues plan that has negotiated rates with providers, providers will apparently pay up to 20% of a claim to vendors to ensure they’re billing the higher negotiated rate for Blues members from other states. When I think through all the dynamics here, it seems like a pretty rational decision for a provider to make given the circumstances. But the whole BlueCard concept in general makes my head hurt. Read more

Virtual GLP-1 startups: Pill mills or the future of obesity care? by Halle Tecco

Tecco and others break down the virtual GLP-1 market, looking at the guiding principles of “responsible” GLP-1 care. It’s a pretty logical list of items. I can’t help but wonder how this is all going to be regulated over time, and if companies practicing responsibly here will actually be more likely to “win”. I’d hope so, but I’m not entirely confident of that. Read more

I created my own AI medical team. It changed the way doctors treat my cancer by Steve Brown

For all the concerns I read about the implementation of AI and the nefarious ways in which it can be used, I can’t help but stop at an article like this. Steve Brown created his own multidisciplinary medical team of AI agents to help identify a diagnosis missed by doctors. Very cool, albeit anecdotal, use case. Read more

General Catalyst’s Hemant Taneja: AI investors are navigating ‘peak ambiguity’ by George Hammond

Given General Catalyst’s outsized role in the healthcare innovation landscape at the moment, I think it’s worth reading through how Taneja talks about the AI landscape in this interview with the Financial Times. It’s interesting to see his theory of change about focusing on organizations that have decided to outsource labor as a starting point, as that’s where it’s easiest to transition to AI. Also interesting to see him note that we are in an AI bubble, and that is actually a good thing. Read more

The FDA’s Overdue Crackdown on Misleading Pharmaceutical Advertisements by Marty Makary

In a JAMA opinion piece, FDA Commissioner Marty Makary argues that DTC pharmaceutical advertising has become a public health crisis that needs action by the FDA, including the issues posed by paid social media influencers. It specifically calls out Hims & Hers Super Bowl ad from earlier this year for not highlighting any side effects or disclaimers. Read more

How to discover competitors' pricing, the legal way by Sarah Cohan

A handy document from Out-Of-Pocket for anyone looking to do research on competitors, specifically focused around pricing. Read more

Featured Jobs

Head Actuary at Sana Benefits, an innovative health plan for small businesses. Learn more.

$225k - $290k | Remote

Policy Staffer for Senator Josh Hawley to handle health care, labor, and economic questions with a focus on Medicaid. Email Olivia for more info.

In-person (DC)

Operating Principal - Mindshare Institute at Intermountain Health, a Utah-based nonprofit health system. Learn more.

$168k - $238k | Hybrid (Salt Lake City, Utah)

Director, Governance, Risk, Compliance & Digital Operations at Reimagine Care, a provider of on-demand cancer care outside the clinic. Learn more.

Remote

Growth Lead at Tandem Health, an AI platform for prescription prior authorizations and pharmacy coordination. Learn more.

$160k - $220k | In-person (NYC)

Senior Associate, Strategy & Operations at Headway, a software-enabled national network of providers accepting insurance. Learn more.

$84k - $124k | Remote

Contact us to feature roles in our newsletter.

Want to share feedback with us?

Show your support by sharing our newsletter and earn rewards for your referrals!