Sponsored by: Ambience Healthcare

Ambience Healthcare, the leading ambient AI platform for documentation, coding, and clinical documentation integrity (CDI), just announced a $243 million Series C round to scale its AI platform for health systems.

The round was co-led by Oak HC/FT and Andreessen Horowitz (a16z), with participation from existing investors including the OpenAI Startup Fund, Kleiner Perkins, and Optum Ventures.

If you're interested in sponsoring the newsletter, let us know!

👋 Hey all! Kevin here. Welcome to this edition of my free weekly newsletter, where I share my perspective on healthcare innovation news from the past week that I found interesting. This weeks newsletter has a heavy focus on earnings reports across the industry - you can jump to specific sections here:

Reflection of the Week

This week I enjoyed spending some time digging into Vytalize Health, a VBC enabler that seems to have a lot of momentum at the moment. You can see my interview with Vytalize’s co-founders here, where I got to learn more about both their model but also the broader value-based care enablement landscape.

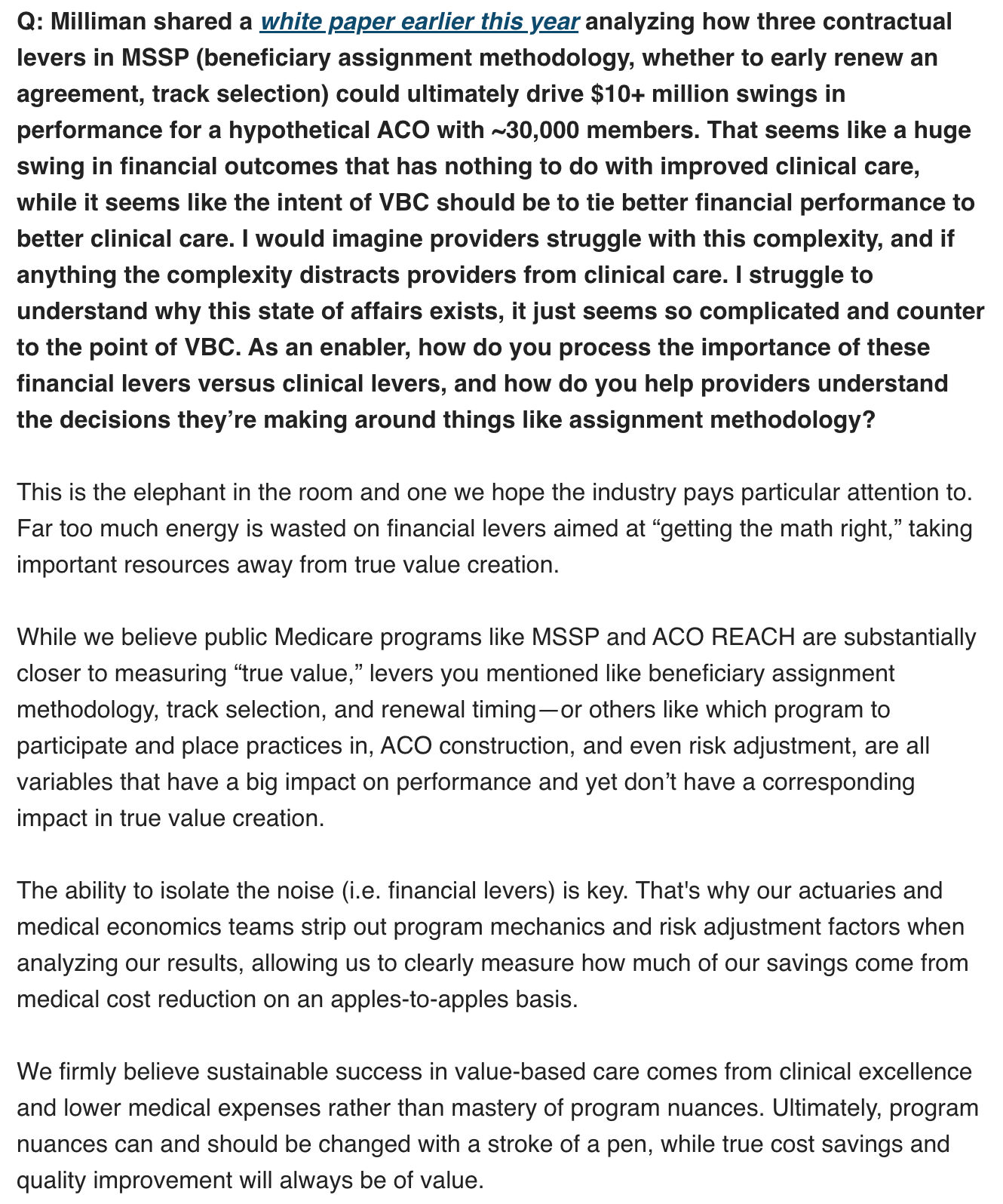

This exchange stood out to me in particular about how value-based care models can perform by pulling clinical levers or financial levers:

I was thinking about that response a lot this week, and this idea that VBC should be spending less time on optimizing financial levers and more time generating clinical value. I had that thought in mind when listening to the earnings calls discussing two of the leading value-based entities, Oak Street and Optum Health:

Oak Street was called out as one of the few things that was below expectations for CVS. Medical trend ran high, resulting in a $200 million downward revision of earnings. While there wasn’t much discussion of why Oak Street’s medical trend ran high specifically, CVS leaders did note that part of the problem is that Aetna’s membership is a minority of Oak Street’s membership, and that Oak Street’s other payer customers may not have reduced benefits like Aetna did.

Optum Health’s VBC business was one of many parts of UHG’s business that was below expectations. There was a lot of discussion why, with v28 playing a big role. But particularly interesting to me was the conversation around exiting PPOs — UHC and OptumHealth both got hammered by growth in PPOs and are broadly pulling back on those products.

I can see a theme across those two misses — v28 compressed revenue substantially, not all payers adjusted benefits quickly enough, and those losses are flowing through to VBC entities now because of global cap contracts. Alignment’s earnings call (discussed below) discusses a very similar dynamic, where provider organizations that have been taking global cap contracts are at odds with their payer partners because of the revenue and resulting margin compression brought on by v28. It’s a good reminder of the “stroke of the pen” risk at hand.

Given the premise of VBC, it’s odd to me that I can write that paragraph about financial performance of VBC entities with essentially zero conversation about what is happening from a clinical perspective.

If you go back to CVS’s $10 billion acquisition of Oak Street in 2023, it now seems as though the entire industry could have been paying more attention to the alarm bells that were starting to go off about v28. I went deep on this at the time of the acquisition, noting that America’s Physician Groups was projecting a 10% - 20% revenue decline for providers. With the benefit of hindsight, it certainly does appear that 2023 was indeed the “RIP Good Times” moment for MA.

Given all of this, it really resonates when I hear Vytalize’s co-founders suggest that the industry is focusing too much on financial levers — namely risk adjustment — in driving financial success. In so many ways this over-reliance on financial levers seems to have been the achilles heel of the VBC narrative up to this point in time.

As VBC models seek to recover in this post-v28 world, an increased focus on clinical levers that add real value seems like a pre-requisite for success.

UHG EARNINGS

UnitedHealth Group hits the reset button during Q2 earnings, stock falls another 16% this week

UnitedHealth hosted its first earnings call since withdrawing its guidance earlier this year and provided lengthy remarks with a host of updates across the business. The earnings call was a helpful overview of the business that is well worth listening to given the breadth of the business. UHG’s stock falling 16% this week hints at the challenges that Wall Street expects as UHG attempts to reorient the business over the next several years.

In many ways, the updates UHG across the business provided mirrored a similar narrative we’ve already heard from the other large managed care organizations as they’ve gone through resets in recent years — UHG got over its skis on growth in Medicare Advantage with PPO products. It is now struggling to manage costs after receiving a bunch of new members after other plans exited the market. It will need to exit those PPO plans moving forward while improving pricing and better managing costs. Similar struggles also emerged over in OptumHealth, where the new membership growth combined with the revenue hit from v28 exposed a business in need of an operational overhaul.

None of that should really come as a surprise given the issues we’ve seen organizations like CVS, Humana, agilon, and others face over the last several years. The biggest surprise in it all is that UHG is facing this issue now at this point in time. We’re seeing Humana, CVS, and others starting to recover from these headwinds after having seen these issues emerge in 2023 / 2024. It’s interesting to think about why UHG was unable to course correct to avoid this outcome given how many of its peer group had already experienced the exact same challenge. While this earnings call very much set up 2026 as a rebound year for the organization before returning growth in 2027, its clear there is a lot of work yet to be done. This perspective from former equity research analyst Ricky Goldwasser pondering whether UHG’s long term growth model will emerge intact after this reset was particularly interesting to think about.

As I shared in HTN Slack earlier in the week, here’s a quick rundown of the most interesting data takeaways across UHC and OptumHealth. I went much deeper into these and other takeaways from the call in that Slack thread if you’re interested.

UnitedHealthcare and OptumHealth collectively are missing their 2025 target by $13.1 billion.

UHC is off $6.5 billion in 2025 because of additional medical cost trends. $3.6 billion of this miss is in Medicare Advantage.

OptumHealth is off $6.6 billion in total, $3.6 billion of which was driven by its VBC miss. v28 is a substantial part of that VBC miss — VBC is now projected as an $11 billion hit to the organization in total, with $4 billion of that hit still to come in 2026.

Behavioral trend in Medicaid is running very hot for UHC, to the tune of 20%. UHC's core Medicaid business will be breakeven for 2025, but it will will go margin negative in 2026 as a result of rate increases lagging behind trend.

UHG is broadly stepping back from PPO products in favor of narrower networks on both sides of the business as it struggles to manage costs. UHC will be exiting a projected 600,000 PPO lives in MA, while OptumHealth is shedding 200k PPO lives in VBC contracts.

OptumHealth provided a more data on the state of its VBC business, which based on the numbers provided during the earnings call is roughly $65 billion of revenue in 2025. It’ll generate ~$650 million of operating income in 2025 across 5 million patients in global cap contracts. Even under the pressure it is currently facing, that is a substantial business. OptumHealth’s VBC margin is projected to be 1% in 2025, down from 3% last year and 5% in 2023. New members are close to double-digit negative margins, members in pre 2021 cohorts are at 8% margins. Optum plans to be more disciplined in taking on risk contracts moving forward. 5% is the new long term target range for OptumHealth’s VBC business, while the overall business is targeting a range around 6% to 8%.

There were a number of references to healthcare cost trend being so high as a result of provider actions in terms of coding activity, a theme that I saw in a number of other earnings calls as well. UHC is pricing for 10% trend in MA in 2026, after pricing for 5% trend in 2025 (and seeing 7.5% trend).

ALIGNMENT EARNINGS

Alignment’s Q2 outperformance highlights the winning playbook in MA moving forward

In contrast with the negative financial performance from recent payors earnings announcements (i.e. UHG, Elevance, Molina, Oscar and Centene), Alignment stands out in a positive way as it continues to outperform in the Medicare Advantage market. Alignment’s stock was up 10% for the week as it beat earnings expectations and raised guidance for the year. Alignment reported adjusted EBITDA of $46 million in the quarter, well above its guidance range of $10 million to $18 million. This was driven by improvements both in MBR and SG&A ratios. Alignment reported an SG&A ratio of 8.8% in the quarter, which has improved by 1.6% year over year. It is now projecting to be free cash flow positive in 2025.

Alignment has a ton of momentum right now in the Medicare Advantage market, centered around a compelling narrative that Alignment will stand out more and more compared to the rest of the industry as CMS makes needed changes to the program to improve the standard required to be successful. It’s hard to argue with Alignment’s thesis around a heavy emphasis on care management as the winning play in MA right now — both in terms of the financial performance Alignment is seeing but also in terms of the PR crisis the industry faces and how to change public perception. Whether Alignment can successfully scale this model into more markets seems like the biggest question for them to answer at the moment.

Digging into some of the more interesting nuggets from the call:

Alignment’s SG&A performance prompted a really interesting question and answer about how much room for improvement there remains in SG&A. Alignment is now projecting SG&A as a % of revenue at <10% for the full year, an impressive feat in the insurance industry — its something that Humana has apparently never done despite its scale advantage. Alignment’s answer as to what is driving this focused around its data architecture — the fact that it has clean underlying data means it does not need as many FTEs reconciling issues.

This was an interesting quote from Alignment’s CEO in response to a question around VBC related to the reflection at the beginning of this newsletter: “Four years ago, you had a lot more premium dollars to play with that you could, in fact, support effectively two insurance companies in that one supply chain. And what I'm talking about is the regulated health plan and then also the value-based global cap taking entity. With V28 and a tighter emphasis on quality, on Stars, revenue is getting tighter and so you can't afford just to pass risk down to a global cap entity. And so the entities in MA that can manage the risk, manage the risk while maintaining high star ratings, i.e., you can't just deny care, are going to be the ultimate winners in this space.”

Alignment noted that it is “increasingly becoming the preferred solution for providers aiming to grow profitably in Medicare Advantage” as its close alignment with providers is driving increased shared savings and profitability. Alignment is working with IPAs and medical groups to give them tools and data, citing its performance in admits per 1000 as an example of how they’re driving positive results here — this quarter it was low-140s versus a historical range around 150 - 160.

Alignment sees a large opportunity for growth in its existing 5 states in 2026 — expanding to all counties in those states would double its market to 4 million MA lives in 2026. It’ll expand states in 2027, and is investing a portion of its current outperformance in administrative automation and care navigation capabilities. They provided an interesting glimpse into some challenges other plans might have in MA moving forward, suggesting that a number of insurers with high Star ratings have passed costs down to global cap providers that are now facing pressure, and those relationships are going to have more tension as the global cap providers look to right-size their profitability. Alignment thinks it is in a good spot with its global cap providers, which sets it up better for long term growth.

Alignment mentioned that it’s put in some new core systems in the past year: an EHR (Athena), a HR system (Workday) and a claims adjudication platform (Facets)

Alignment refers to its utilization management programs as “concierge processes”. They view it as a concierge service and care navigation program for members moreso than traditional UM, pointing to the fact that denial rates are less than 2%. It’s another interesting example of how the company is attempting to reframe what it does as a Medicare Advantage plans. It seems like other MA plans would do well following Alignment’s lead here.

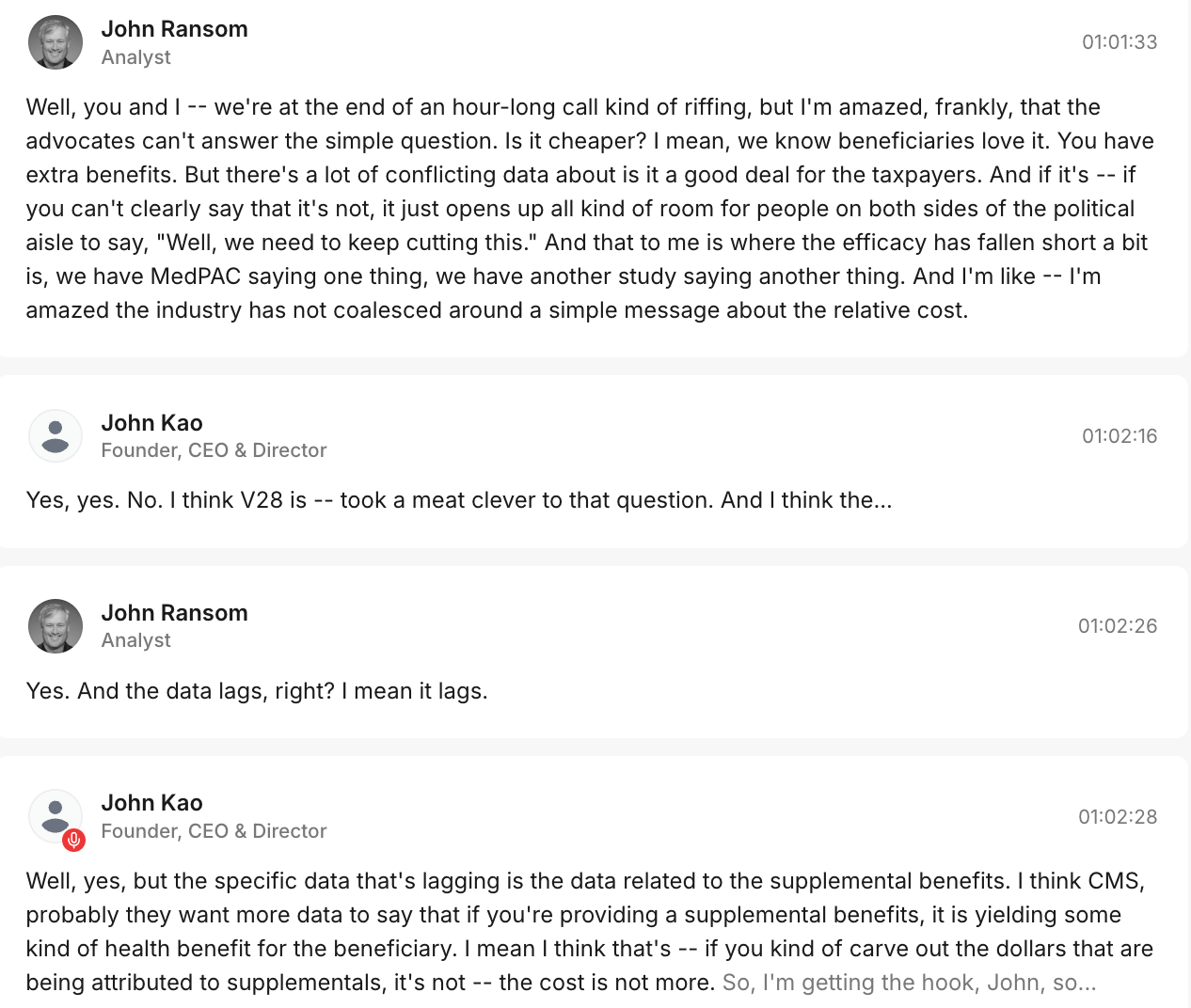

This was a really interesting exchange between John Ransom and John Kao. Ransom about a sentiment I think many of us share — confusion about why it is so hard to tell whether MA is cheaper or not. Kao’s answer about v28 taking a “meat cleaver” to the question seems telling:

Source: Quartr’s transcript of Alignments Q2 earnings call

EARNINGS RUNDOWN

A few nuggets from other earnings calls: Cigna, CVS, Humana, Teladoc, & Waystar

Cigna. Cigna’s stock dropped 12% on the week, which confuses me given it posted a solid Q2 and reaffirmed guidance for 2025. A few takeaways from the earnings call:

Cigna’s employer and stop loss insurance businesses are running at elevated trends, but in line with expectations. CIgna sees its self as winning share in the <500 life employer segment, while it views large group as a flat-to-shrinking market.

Cigna seems pleased with its decision to price for margin in the ACA market, mentioning that back in 2023 it served 1 million people before adjusting course there, now serving only 400,000 people in the ACA. While Cigna appears to have similar medical expense issues as the rest of the industry, it’s a smaller part of the business here.

Cigna spent a good deal of time in prepared remarks sharing with investors the market opportunity that it sees in helping health systems manage specialty pharmacy. Their CuraScript platform, which helps providers manage the supply chain for specialty medicines, has averaged double-digit revenue growth for the past three years and is now a $25 billion revenue business. In analyst Q&A, Cigna’s COO refered to CuraScript as “one of the most exciting growth opportunities” Cigna has moving forward.

Cigna noted that if you go back a decade ago, pharmacy was a 10% of overall medical spend, while today its grown to mid-20% range, and moving toward 30% of medical spend. 20% of an average employers total cost of care is in specialty drugs today.

Cigna noted that it is seeing “elevated billing sophistication harnessing AI” by providers, which is impacting commercial trend. Cigna also noted that it has a number of AI-related activities, some of which help it “counteract, address, and proactively engage very differently” with those providers.

Cigna sees a lot of interest in its stop loss business, which saw premiums grow 13% in Q2. It is in the process of repricing this business for margin, but the business is performing in line with expectations (and the AI coding above hasn’t impacted it).

CVS. CVS’s stock was up 3% on the week after briefly popping 6% on better-than-expected earnings and a guidance raise.

Aetna is making meaningful progress. Trend is elevated across the business, but in line with expectations. There were some one-time items in the outperformance, but the core business outperformed by $500 million in Q2. The beat was primarily driven by the individual MA performance discussed below.

Individual Medicare was modestly ahead of expectations, with outperformance in supplemental benefit offerings and Part D.

Oak Street is seeing pressure driven by higher MBRs, which is being partially offset by Signify Health’s positive performance. Oak Street’s pressure is driving a $200 million reduction in operating income guidance for CVS’s Health Care Services segment. The drivers of this miss in Oak Street weren’t discussed in depth. The changes they’re making to improve performance: investing in technology to improve operations, enhancing leadership with experience in VBC and population health, improving payor partnerships, and prioritizing patient growth inside of existing centers. Oak Street’s VBC membership was up 31% year over year.

The divergence in performance between CVS’s individual MA business and Oak Street’s VBC business prompted a question. CVS explained that the membership is very different — Oak Street has a higher acuity population, and while Aetna members at Oak Street are growing, they still represent a minority of Oak Street’s patients. So part of Oak Street’s issue is that other health plans didn’t pull back on benefits as Aetna did in 2025.

Trend in Group MA remained elevated, modestly higher than CVS’s expectations, prompting it to take a Premium Deficiency Reserve. It is on a journey to improving margins there, and half of its group MA revenue will reprice on Jan 1 2026.

Humana’s stock was up 3% this week as it beat expectations and raised guidance for the year. It’s outperformance was largely driven by two factors — Centerwell Pharmacy and its Individual MA business. The individual MA business is seeing a slightly smaller decline in MA membership than it originally expected. Humana now expects a membership decline of only 500k members this year versus the original expectation of 550k. That is driving higher revenue, while Humana’s MLR is in line with expectations. Centerwell Pharmacy is doing well on GLP-1s and specialty pharmacy, where they’re winning access to limited distribution drugs. Humana also noted its Medicaid business is performing as expected and it is committed to the strategy there. It is avoiding the issues some other Medicaid plans are having because of a few factors — it targets LTSS versus a broader Medicaid population, it’s focused on non-expansion states, and its VBC network design is supporting its performance.

Waystar reported a strong second quarter, raising guidance for the year, although the stock was down 2% on the week. Waystar’s earnings call was worth checking out if you’re interested in the AI automation space. It noted in earnings how its AI-powered platform has prevented almost $6 billion in denied claims. It does this by “identifying the correct insurance in as many as 55% of cases that would otherwise result in write-offs. The result, revenue is recovered in seconds with no manual effort required from the provider. For a midsized health system, this can drive upwards of $20 million in incremental annual reimbursement.” It’s platform also drives a 20% lift in patient collections, which can drive $8 million of incremental positive impact for a midsized health system. Almost $30 million of additional annual reimbursement for a typical midsized health system seems pretty meaningful. The discussion around use of AI was particularly interesting, with one analyst mentioning that MCO earning calls are “basically creating a commercial for Waystar complaining about how the impacts of AI and revenue cycle management tools are killing their cost targets.” Waystar mentioned its goal here is to create the perfect undeniable claim using AI.

Teladoc stock was down another 16% on the week despite beating Q2 earnings as BetterHelp continues to struggle, with Teladoc revising BetterHelp guidance downwards because of cash pay headwinds. Teladoc noted on the earnings call that BetterHelp is making progress ramping up its insurance product offering, soft launching the product in a single state in late June. BetterHelp is reaching out to its therapists to join the BetterHelp insurance network, and 2,000 of the 35,000 therapists have engaged there and are in the credentialing process. It both seems like good progress and also highlights the magnitude of change afoot at BetterHelp in moving from a D2C to insurance focused-business when your network of 35,000 therapists needs to agree to the change and go through the credentialing process. Teladoc expects to generate $10 million in revenue from BetterHelp’s insurance offering in 2025.

ACA Subsidy Poll Results

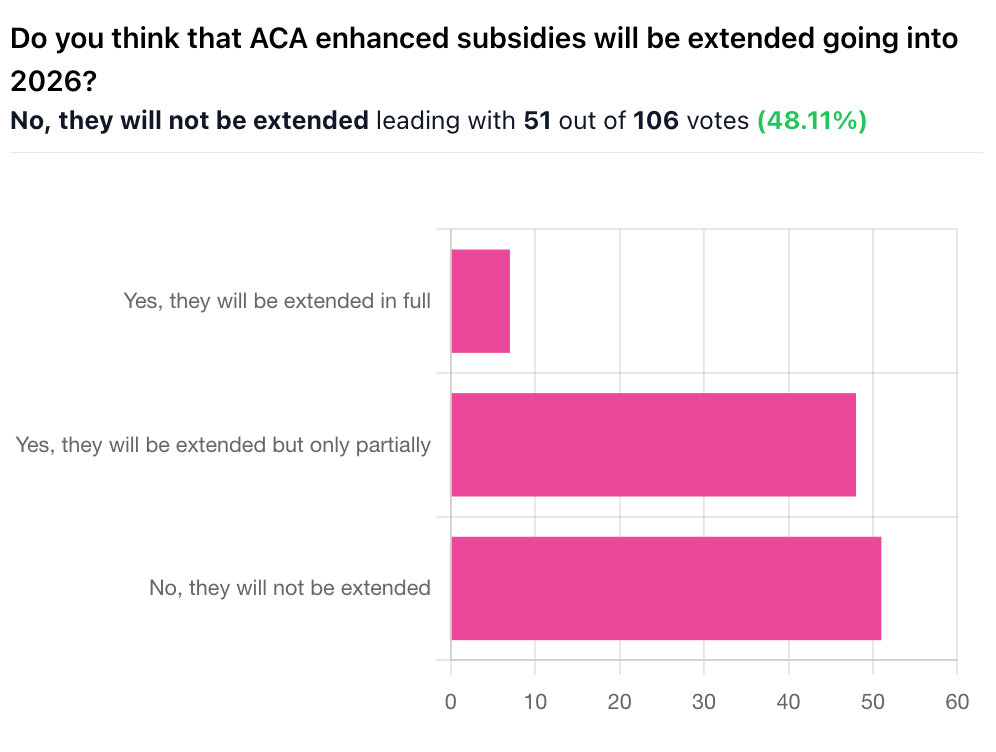

As promised, here are the results from last week’s question on whether ACA subsidies will be extended. Out of 106 votes, seven of you thought that subsidies will be extended in full, 48 partially, and 51 not at all. So it’s roughly a 50/50 split between whether this newsletter audience thinks they will be extended in some form or not.

It’s an interesting split from the Wall Street commentary recently, as companies and analysts have shared their expectation that subsidies won’t be extended. Perhaps that commentary is just decided to take a clear but conservative stance, setting expectations low and setting up a ‘beat and raise’ scenario.

A number of comments from you all focused on the political maneuvering likely to result in a partial extension of subsidies this fall:

“Everyone needs a win, so Republicans will claim that they reduced subsidies while Democrats can claim they protected them.”

“Republicans won't want to take the hit of cutting them completely, but could get the populace to swallow a partial loss of subsidies with good messaging. Dems won't be able to muster the strength to stop a partial loss of subsidies.”

I tend to net out in that camp as well, although I’ve heard the case that Democrats could attempt to inflict more pain on Republicans in the midterms by holding out and not agreeing to a subsidy extension. And given Wall Street’s expectation here, who knows.

Other Top Headlines

There was lots of excitement in the interoperability community this week as CMS announced an initiative to Make Health Tech Great Again. It is fascinating to see the federal government moving so quickly on efforts in digital health. The announcement this week centered on two key efforts — an interoperability framework and personalized tools for patients. Sixty companies pledged to work on this — you probably already saw a handful take to LinkedIn to share how excited they were to be invited to support this effort. While it’s always easy to be skeptical that efforts like this will amount to meaningful change, the optimism, excitement, and speed of this effort seem quite notable, and worth paying attention to. It certainly seems like there is a window here to make meaningful progress on the foundational efforts underway.

Forty two members of Congress signed a letter to Mehmet Oz and Abe Sutton urging CMS to halt the implementation of CMMI’s new WISeR model. As I noted in Slack, it’s interesting to see the tone of pushback in the letter. The letter not only rails against prior authorizations and the Medicare Advantage as expected, but it also makes an argument about how much seniors like traditional Medicare, suggesting we shouldn’t sully it with elements of Medicare Advantage. I remain surprised to see so much pushback against a model that is clearly targeted towards reining in questionable spending, but I suppose its a reminder of the general political climate around Medicare Advantage and prior authorizations at the moment.

CMMI was also in the news this week as the Washington Post reported on Friday there is a new model in the works that would expand coverage of GLP-1s in Medicare and Medicaid. The proposed pilot would begin in Medicaid April 2026 and Medicare in January 2027 and run for five years. It appears that states will be able to opt-in to the program, and will need to offer diet and exercise coaching for patients alongside the GLP-1s. It’s interesting to me to see that this is being tested via CMMI, given CMMI has a statutory goal of reducing costs, and increasing access to GLP-1s seems like it would inherently increase costs. Will be curious to see how the model addresses that assuming we hear more about it soon.

Novo Nordisk stock tanked this week, dropping 31%, after it announced a lower 2025 sales and operating profit outlook, driven by slower volume growth of Wegovy and Ozempic. Sales growth is now expected to be 8% - 14% versus previous guidance of 13% - 21%. Novo cited “unsafe and unlawful mass compounding” in the cash pay channel as a key issue. During an investor conference call discussing the revision, Novo noted that it thinks 1 million patients were using compounded GLP-1s prior to the end of the FDA grace period in May, and that while it expected those patients to move over to a branded solution, it has not seen that happen. Novo still thinks 1+ million patients today are taking compounded GLP-1s. Novo said repeatedly it will be very active from a legal perspective, which is not entirely surprising given the impact on the business here.

Community Health Network and GoHealth formed a JV to operate urgent care centers in Indiana. As part of the agreement, six existing Community MedCheck urgent care centers will be rebranded as Community-GoHealth Urgent Care.

A STAT report highlights how Medicare Advantage Majority, a dark money group, appears to be paying MAGA influencers to criticize members of Congress who are suggesting changes to Medicare Advantage. Members of Congress do not appear to be thrilled about this.

Sword Health announced it has launched a new division, Sword Intelligence, offering AI agents to support healthcare organizations in managing care operations. Sword referred to the launch as a “pivotal evolution” in its strategy, as it’s a notable business model shift for an organization that has been focused on virtual MSK delivery to date.

Lilly cut ties with Noom late last week as Noom continues to sell compounded GLP-1s.

Funding Announcements

Ambience Healthcare, an ambient AI platform, raised $243 million.

Equip, a virtual clinic for eating disorders, raised $47 million. Equip is available in all 50 states to 130 million people with commercial and Medicaid plans. It just treated its 10,000th patient.

Arbital Health, a VBC contracting platform, raised $31 million.

b.well Connected Health, a FHIR-based interoperability platform, raised $20 million.

C8 Health, a platform for sharing clinical best practices, raised $12 million.

JotPsych, an AI scribe for behavioral health, raised $5 million.

What I’m Reading

Breaking down CMMI’s new strategy with Abe Sutton and Farzad Mostashari, M.D. by The ACO Show Podcast

This was a helpful podcast talking through CMMI’s strategy moving forward. Given the news this week around WISeR and the potential for an upcoming GLP-1 model, it seems like a timely listen to learn more about how Sutton thinks about the role of CMMI. Listen here

Did They Just Announce TEFCA 2.0? CMS Aligned Network Opinion by Anthony Leon

A helpful perspective on CMS’s efforts announced this week and the implications for the interoperability community. Read more

AI for Medicaid work requirements: Why CHAI’s ‘tiger team’ faces an uphill task

I thought this was a good perspective on the challenges that we should probably expect to see when using AI to implement work requirements in Medicaid. The article references a fascinating failed effort in Amsterdam to use AI to administer its welfare program, which is worth checking out. Read more

Featured Jobs

Sr. Product Marketing Manager, AHS Central Marketing at Amazon Health Services, Amazon’s healthcare arm. Learn more.

$129k - $213k | Seattle

VP, Marketing at Virta Health, a metabolic health company. Learn more

$235k - $275k | Remote

Finance and Operations Analyst at Zerigo Health, a solution for chronic skin conditions. Learn more

Contact us to feature roles in our newsletter.

Want to share feedback with us?

Show your support by sharing our newsletter and earn rewards for your referrals!