Sponsored by: HLTH

We’re looking forward to attending HLTH again this year! We’ve experienced firsthand the opportunities this conference creates to reconnect with folks in a meaningful way.

With much of our work now taking place virtually, it’s a welcome nexus to hear from industry leaders, build and strength relationships, and get energized by the collective innovation in healthcare.

Prices increase at midnight on September 5. Register today and save over 20% on your ticket. Plus, HTN readers receive $250 off with code HLTH25_HTN!

If you're interested in sponsoring the newsletter, let us know!

👋 Hey all! Kevin here. Welcome to this edition of my free weekly newsletter, where I share my perspective on healthcare innovation news from the past week that I found interesting. Given the Labor Day holiday next weekend, I’ll be taking next week off the newsletter. We’ll see you back here in two weeks. Happy Sunday!

HOSPITALS

Fortune highlights NYU Langone’s turnaround over the past two decades

This was a fascinating read on the growth of NYU Langone over the last two decades, architected by CEO Robert Grossman and board Chair Ken Langone. Since Grossman took the helm as CEO in 2007, NYU Langone has grown from $2 billion of revenue to $14 billion of revenue, with the growth attributed here to a strong operating culture.

It’s an interesting read about how the organization transformed — in his early days as leader, Grossman fired most the existing management team, a day known as “Black Wednesday” at the institution. He also replaced a newly installed $35 million EMR with Epic. And he embarked on a strategy of building a network of outpatient facilities, versus the more typical approach of acquiring more hospitals. Early in his tenure as CEO, Grossman created a data dashboard that tracks 800 metrics across the system. A maniacal focus on that dashboard and tracking performance in general appears to permeate the system.

For the last set of financials reported, NYU Langone Health recorded an overall operating margin of 3.2% on revenue of $11.4 billion over the nine months ended May 31, 2025. Within that operating margin, its hospitals generated 7.6% operating margin, while the medical school generated a 5.1% operating loss.

I can’t help but read this article and think about what an article like this says about other health systems. Certainly, having folks like Ken Langone donating hundreds of millions to the system over the years can’t hurt. But moreso, it reads like a story of a leader who happened to be both a clinician and a good business operator. The turnaround narrative seems centered around having a clear vision and managing against that vision by managing the hospitals like a business.

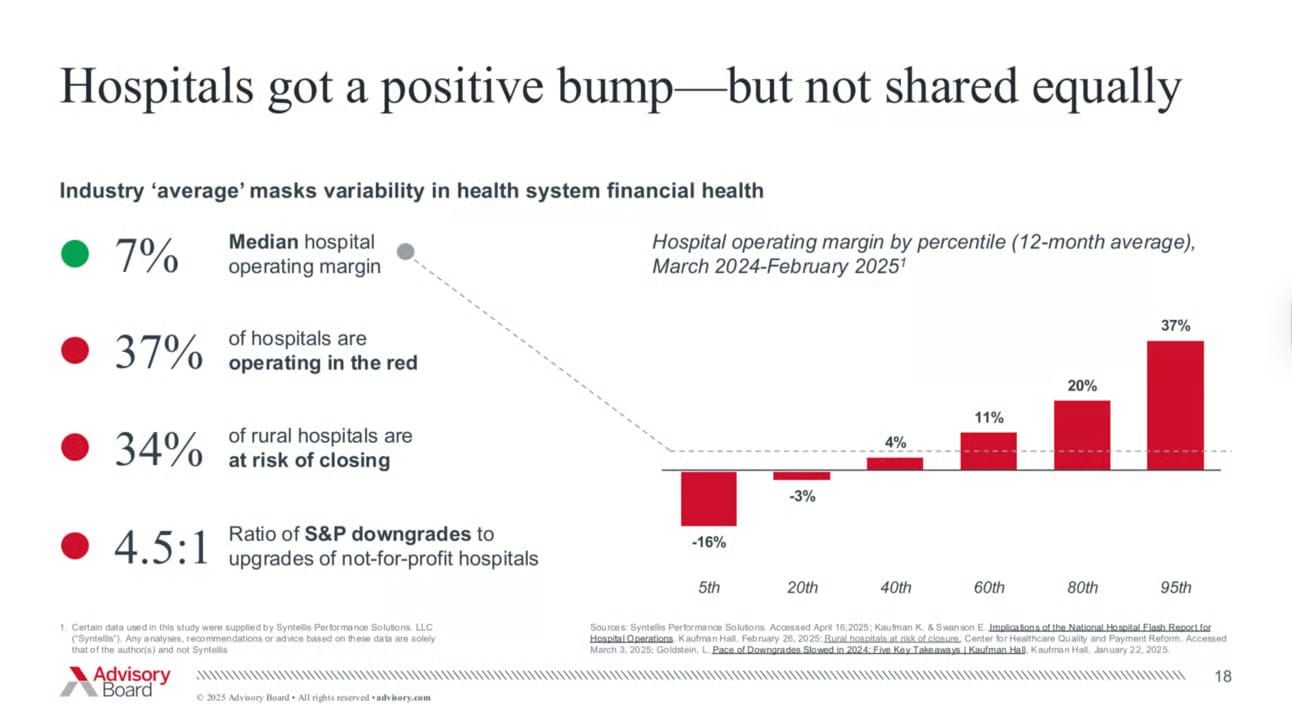

We talk so often about the challenges hospital face in terms of their margins, but I am also reminded of this chart from the folks at Advisory Board earlier this year, highlighting that some hospitals are actually performing quite well. If I’m looking at the chart below and financials above right, it would appear that NYU Langone’s hospitals are operating essentially at the median hospital operating margin.

MEDICARE ADVANTAGE

The Villages Health Chapter 11 case gets more interesting as BCBS FL and UHG file objections

The Villages Health (TVH), which filed for Chapter 11 bankruptcy on July 3rd after disclosing $360 million in overpayments from CMS for upcoding Medicare Advantage patients, is facing objections from UnitedHealth Group and Blue Cross Blue Shield of FL in its bankruptcy case.

UHG filed its first objection to the Chapter 11 process in late July, questioning why the sale process to CenterWell was being pushed through so hastily, particularly given TVH has no immediate financial issue other than the potential CMS claim, which is still in the settlement process. UHG’s objection noted the proposed sale has “every possible flashing red light”, given the rush to push through a sale, insider ownership, and history of corporate misbehavior. Notably, it appears that TVH’s bankers did not reach out to any other parties other than CenterWell in this process, and UHG was blindsided by the bankruptcy filing. UHG noted in its filing that it views all of this as particularly unusual given UHC is one of the largest insurers working with TVH and also has a close relationship with The Villages, including a perpetual exclusive marketing arrangement for UHC to underwrite Medicare Advantage plans with The Villages branding.

UHG then followed up with another filing last week, noting that it offered to lend TVH money on better terms than the insider-led financing option on the table, and that TVH’s representatives essentially didn’t even respond to the offer. TVH argued separately that UHG is withholding payments from TVH during the process, which caused its financing need to increase. In these follow-up filings, UHG explicitly called out the Morse family, the billionaire family that developed and owns The Villages, for taking a substantial portion of $183 million in payments out of TVH between 2022 and 2024.

While UHG’s objection questioned the sale process on the whole, Florida Blue’s objection focused more specifically on potential overpayments. After TVH initially disclosed the upcoding issue, Florida Blue apparently did an internal investigation and found that in 2024, TVH billed Florida Blue for $8 million in overpayments by falsely adding two diagnosis codes for patients. Florida Blue estimated based on this that it was over billed by $25 million between 2020 and 2024. It’s not immediately clear to me from the filings why both Florida Blue (and presumably other payers) and CMS would have claims against TVH in this case — it seems like double counting. But I can see why Florida Blue would want to recover those dollars

It all underscores a complicated legal process that is playing out, with at least some general sense of malfeasance on the part of the Morse family given the unanswered questions posed about the manufactured sense of urgency here. It is a bit hard to read in the legal filings about how much of this process is being driven by the pretense of continuity of care — i.e. TVH’s main rationale for expediting the sale process is to complete it before Open Enrollment starts, while UHG notes that if TVH were really concerned about continuity of care, it would have provided more notice of this process and sale.

It seems unlikely to me that continuity of care is the primary motivator for TVH in moving quickly here. As the conversation around upcoding and Medicare Advantage payments heads up in DC this fall, the case here provides a good under-the-hood view of the mechanics of what’s been happening in the market and where risk adjustment dollars have been flowing. It doesn’t quite fit the prevailing narrative given this is a provider group that has made hundreds of millions via upcoding with payers claiming they’ve been duped, but it seems indicative of the fact that upcoding may not only be an issue with payers but also provider orgs.

Healthcare’s Ten Highest Paid CEOs

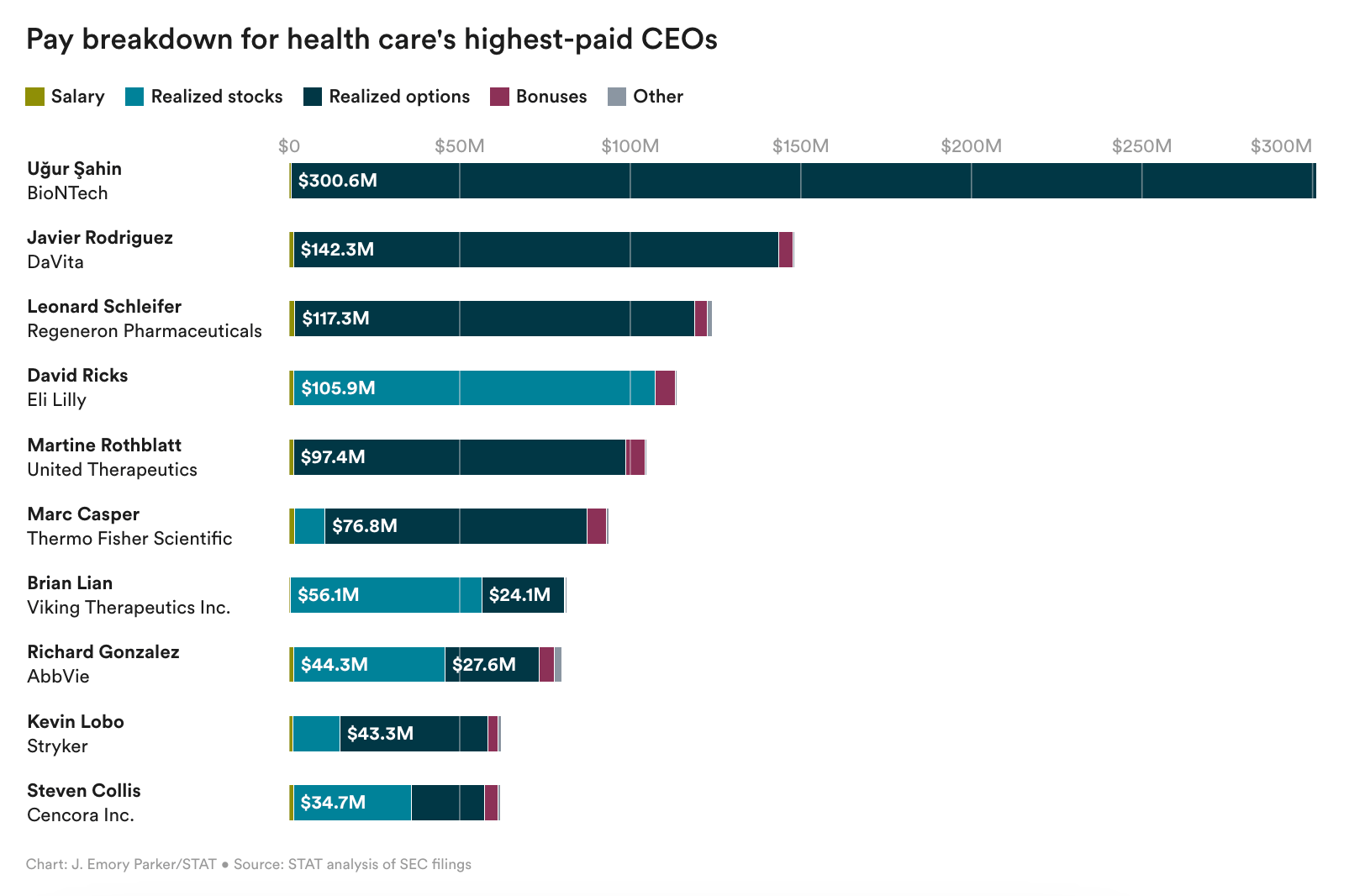

STAT compiled data on the top paid CEOs across 275 public healthcare companies in 2024. Combined, the group made $3.6 billion for an average of $13 million per CEO. And the NYU Langone article above provides a reminder that STAT’s list is by no means an exhaustive list of highly paid CEOs given it only looks at public companies — i.e. NYU Langone’s CEO made $22.8 million in 2023.

The list above reminds me that as much as healthcare services folks hem and haw about the challenges of patients versus profits, the life sciences industry appears to be navigating that challenge much more effectively.

Other Top Headlines

Tempus acquired AI pathology startup Paige for $81.25 million, mostly in Tempus stock. Tempus currently has a market cap of ~$14 billion, so this transaction represents <1% of the business. Paige originally launched as Paige.AI in February 2018 with $25 million in funding and an exclusive license to Memorial Sloan Kettering’s 25+ million pathology images. This launch generated a significant controversy over Paige’s relationship with Memorial Sloan Kettering and the three co-founders, who were employees of MSK. The MSK data set appears to be central to the acquisition thesis here, with Tempus seeking to build out AI tools on top of that data set. Paige raised $200+ million in capital over the last seven years, including a $100 million Series C round in 2021. The press release also notes that Tempus is assuming Paige’s remaining obligations under its Microsoft Azure cloud service agreement, which is an odd footnote to see. Presumably it indicates that Paige was running out of cash to fund its core business obligations.

Colorado’s Department of Insurance issued a press release this week sounding the alarm as UHC and Elevance notified the state that they intend to discontinue products serving 96,000 ACA members in Colorado in 2026, representing roughly 1/3 of the 280k ACA market in Colorado. The press release noted that 100k Coloradans will lose coverage because of the decision not to extend enhanced premium tax credits, and the majority of people who remain enrolled will see rate increases upwards of 100%.

GoodRx has partnered with Novo Nordisk, making GLP-1s available at $499 for consumers. The press release notes that 17 million people went to GoodRx last year for info on GLP-1s, which grew 22% over the prior year. GoodRx’s stock jumped almost 20% early in the week before ultimately ending the week down ~2%.

Elevance lost its MA stars lawsuit as a Texas judge eviscerates Elevance’s ability to do math. It’s a somewhat bizarre case to read that features a lengthy discussion of various mathematical approaches to rounding numbers, with the judge seemingly perplexed by Elevance’s argument that Elevance’s score of 3.749565 should round up to 4 rather than down to 3.5. While I think we can all agree that is a rather silly topic for a judge to opine on, it comes with meaningful financial consequences for Elevance as it will miss out on $375 million in revenue in 2026 as bonus payments for 4 star plans.

Blue Cross Blue Shield of North Dakota has formed a strategic affiliation with Cambia Health Solutions.

Epic hosted its annual Users Group Meeting, taking the opportunity to highlight over 200 AI features under development. This includes agents it calls Emmie, Art, and Penny, which respectively focus on handling patient questions, acting as a provider assistant, and supporting revenue cycle needs.

Modern Healthcare highlighted how variable copay plans are seeing strong growth in the commercial market. UHC’s Surest plan is its fastest growing commercial offering, with 25%+ of larger employers offering it, 11% in 2023. UHC is planning to roll out the capability to its other commercial products in the coming years. The article does a nice job explaining how variable copay plans can be popular with employers as it is a way to construct tiers of providers while allowing for a broad open access PPO network.

Teladoc acquired Telecare, an Australian virtual care clinic.

Eden Health acquired Contingo Compounding, a compounding pharmacy.

Funding Announcements

EliseAI, an AI agent for front office workflows in healthcare and property management markets, raised $250 million. Elise reportedly was generating $100+ million in Annual Recurring Revenue earlier this year.

Twin Health, an AI-based digital twin for metabolic health, raised $53 million at a $950 million valuation. Twin also published results from a peer-reviewed study in NEJM led by the Cleveland Clinic, which showed that 71% of participants achieved target A1Cs without medications like GLP-1s.

Medallion, a provider credentialing platform, raised $43 million.

Abby Care, a caregiving platform, raised $35 million. Sequoia Capital’s brief post on the round does a nice job explaining Abby Care’s model of helping caregivers in getting certified by state programs to get paid for caregiving.

Develop Health, an AI platform automating Rx prior auths, raised $14.3 million.

Cascala Health, an AI platform for post acute care, raised $8.6 million.

What I’m Reading

AI in Healthcare — From Noise to Meaningful Transformation by Define Ventures

An interesting read on how a early stage VC is thinking about AI investments and use cases — a personalized “front door” for patients to access the system, a unified data and insights extraction layer, and workflow automation. Read more

A New Reality for Terminal Cancer: Longer Lives, With Chronic Uncertainty by Brianna Abbott

This is a fascinating read in the WSJ about the various implications of people living longer with cancer. Read more

Employers brace for a 9% cost increase in 2026: Business Group on Health survey by Paige Minemyer

This Fierce Healthcare article highlights results from a recent survey of employers highlighting key trends in the employer market and where employers intend to focus in 2026 and beyond. Read more

As Sarepta Therapeutics fights for Duchenne therapy, a group of patients gets left behind by Jason Mast

This article in STAT does a nice job describing the challenges facing rare disease communities waiting on the drug development process for treatment options, focusing on Sarepta’s recent decision to pull out of developing a gene therapy for LGMD. Read more

Leveraging Transparency in Coverage Data to Reveal Actionable Information on Commercial Negotiated Rates by Trilliant Health

A helpful analysis of commercial negotiated rates with Aetna and UHC, finding wide variations in how much various procedures cost across the country. Read more

Featured Jobs

Vice President, Network Development at Medical Home Network, a network of Federally Qualified Health Centers (FQHCs). Learn more

$NA | Remote

Product Manager at Abby Care, a caregiver platform. Learn more

$NA | Hybrid / San Francisco

Business Development Representative at Stedi, a healthcare clearinghouse. Learn more

$110k - $125k | Remote

Head of Finance at Assort Health, an AI platform for specialty clinics. Learn more

$160k - $215k | San Francisco

Sr. Product Marketing Manager at Lumeris, a VBC enablement platform. Learn more

$114k - $155k | Boston

Contact us to feature roles in our newsletter.

Want to share feedback with us?

Show your support by sharing our newsletter and earn rewards for your referrals!