Sponsored by: Stedi

Stedi, the world’s only AI-enabled clearinghouse, announced a $70M Series B co-led by Stripe and Addition, with participation from USV, First Round, Bloomberg Beta, BoxGroup, Ribbit Capital, and other top investors.

As AI-driven RCM transformation continues, Stedi has become the go-to platform for startups and established companies alike. With best-in-class APIs plus their new Stedi Agent and Stedi MCP server, customers can build and deploy powerful AI to automate clearinghouse workflows.

PS: The Stedi team has long been active the HTN community, generously helping members navigate the RCM landscape in a thoughtful way—a testament to their team and product. We’re glad to see their continued success!

If you're interested in sponsoring the newsletter, let us know!

👋 Hey all! Kevin here. Welcome to this edition of my free weekly newsletter, where I share my perspective on healthcare innovation news from the past week that I found interesting. As earnings season wraps up, we’ll spend some time digging into the Highmark / Abridge partnership, Cardinal Health’s acquisition of Solaris, and more. Enjoy!

AI

Highmark and Abridge partner to streamline prior auths

Highmark Health and Abridge announced a new partnership this week to facilitate real time prior auths. According to the press release, the first phase of the partnership will roll out Abridge at Highmark’s provider entity, Allegheny Health Network (AHN). AHN will begin rolling out the tools at its outpatient locations, before eventually expanding across its 14 hospitals.

Abridge will then work with the Highmark insurance entity to automate the approval of prior authorizations, focusing on ensuring all needed information is collected at the point of submission. Highmark mentioned in the press release that this builds upon the Gold Carding program it has in place today, which already automates a high percentage of prior auths.

It strikes me that integrated payor provider models like Highmark should be among the best-suited entities to benefit from administrative savings via AI. This because of the underlying alignment these organizations have between the payor and provider. It seems quite logical that they should be able to remove a good deal of friction in that exchange. This is a core reason why I think larger, integrated organizations are well-positioned to win in an AI-centric world. In many ways I think the more interesting question is why does this sort of friction exist in an integrated payor and provider in the first place? It’s not like this is the first effort Highmark has undertaken here — i.e. see the Gold Carding program. I’d think that an integrated model should have already been more able to make progress here, which makes me curious how much AI will actually be able to solve the underlying friction.

Separately, Abridge’s CEO Shiv Rao shared in an interview on Friday a pretty broad list of where Abridge may seek to grow from here — claims, clinical decision support, and care management:

"We've got a lot of money in the bank, and we want to spend 80% of it just going deeper, and expanding from connecting conversations to clinical notes into claims, clinical decision support, and care management," he said.

Rao suggests they’re going to spend 80% of the $700 million in capital Abridge has raised to date on building internal tech, but the remaining 20% it will look to make acquisitions with. Will be interesting to watch how quickly Abridge chooses to expand, and whether they choose to build or buy in those areas.

M&A

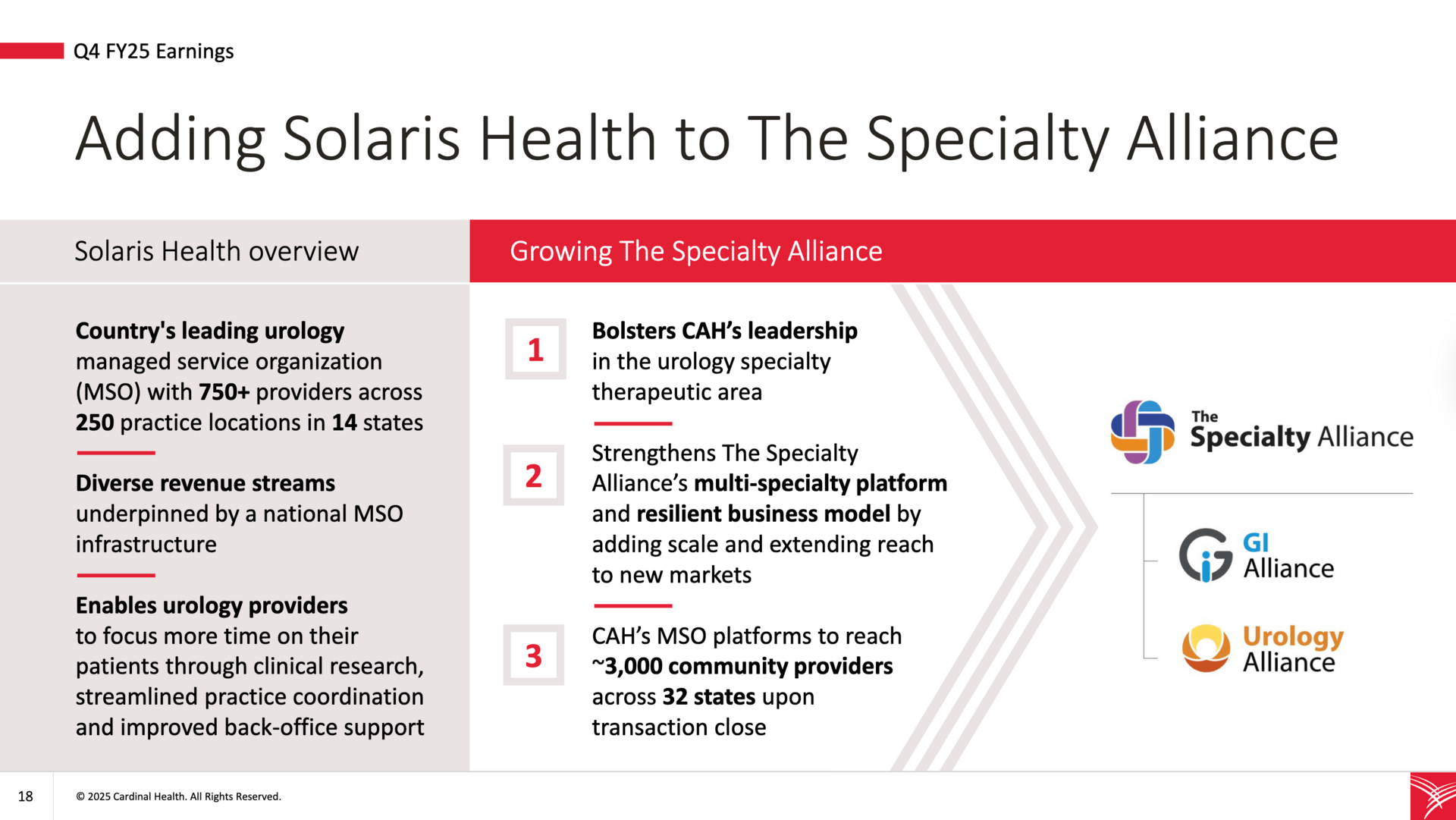

Cardinal Health announced Q4 results and acquired Solaris, a leading urology MSO

Cardinal Health stock fell almost 5% this week as it reported lower revenue than expected in its fiscal Q4 2025. It also announced that The Specialty Alliance acquired Solaris Health, a leading urology managed services organization (MSO). Cardinal paid The Specialty Alliance $1.9 billion to acquire Solaris Health, and as a result Cardinal now owns 75% of The Specialty Alliance. The slide below describes the high-level rationale for the transaction here, which adds 3,000 providers across 32 states to Cardinal’s MSO platform offering in the urology market.

It’s an interesting move as drug distributors like Cardinal and McKesson build out MSO capabilities. Cardinal has a specific focus on three specialty areas: autoimmune, urology, and oncology. As I shared in Slack, the news reminded me of this quote from Lisa Gill, JPMorgan’s head of health care services equity research:

You see today that a number of these companies continue to make acquisitions in the area of oncology but also other specialties. Buying MSOs where they are managing these organizations, and in our conversations with a number of different doctors - I was just recently at an oncology conference for VBC, where doctors came up to me and said, "oh I know that you cover McKesson and we're doctors from US Oncology, this has been great for us because its a company that is making investments in us, not just looking to sell the company, or us doctors struggling and trying to figure this out." So I think we're going to continue to see that, because doctors don't want to be bought by hospitals, they don't want someone telling them where they have to bring their services to, and so it gives them still some level of independence by being owned by a drug distributor but also giving them the capital that they need and the direction they need around running those businesses.

I think it underscores the trend here and what to keep an eye on — we’re increasingly seeing providers viewing pharma distributors as attractive employers. Cardinal shared the pitch to providers in their investor day, arguing that partnering with them as an MSO has the following key benefits: physicians maintain clinical autonomy, there is continued physician ownership and governance, access to growth capital, and complementary expertise. I think it’s interesting to think about the underlying drivers of why this pitch appears to be resonating, and what it means for the industry over the coming years. It seems like we’re in the very early stages of a massive wave of innovation and activity centered around high cost specialties.

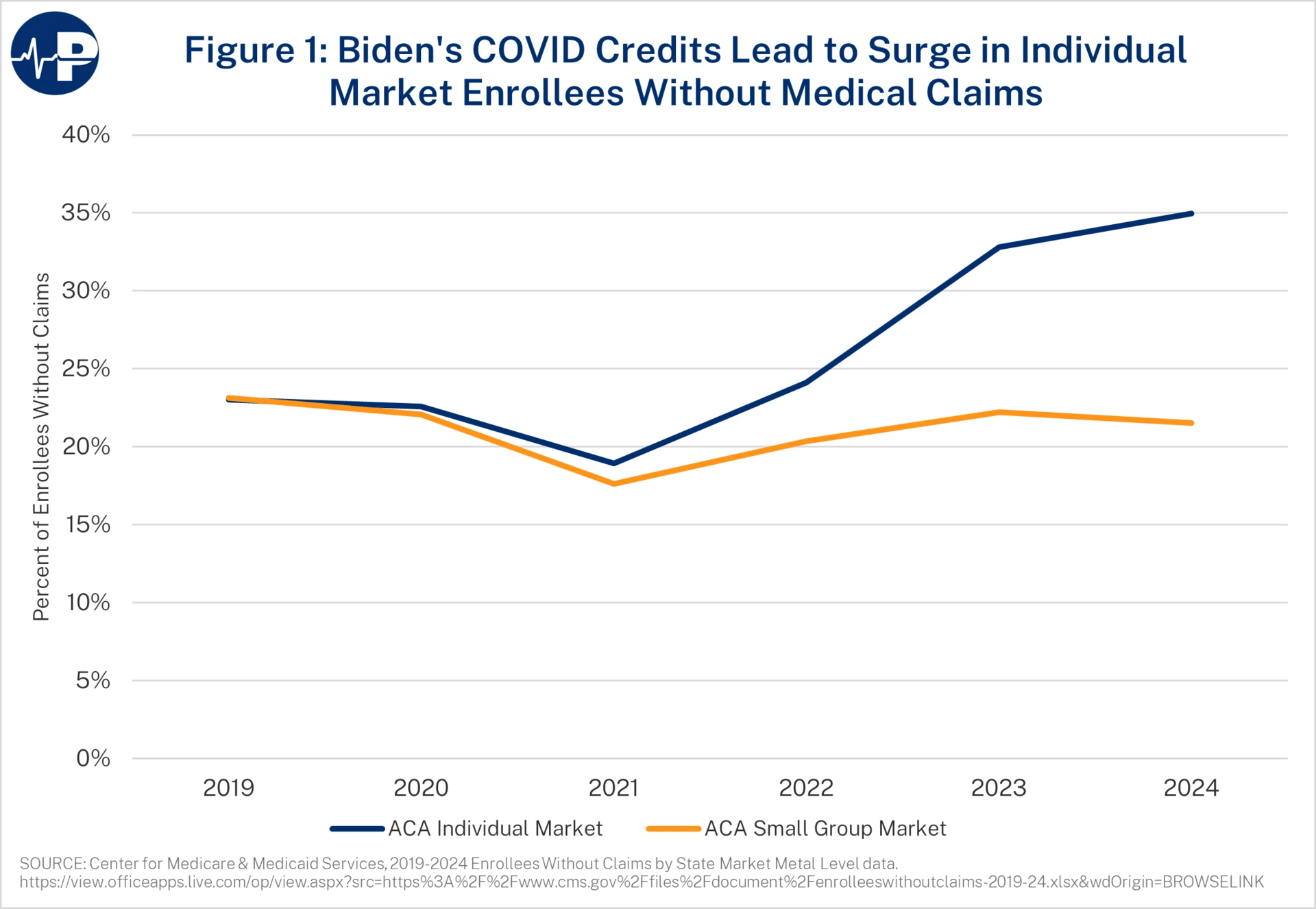

New ACA data highlights the dramatic rise in zero MLR enrollees

CMS released data this week that provided some insight into the growth of members with no medical claims, and it shows dramatic growth between 2021 - 2024. Almost 12 million people on the ACA had no medical claims during 2024, up from 3.5 million in 2021 (note this number doesn’t quite tie to overall enrollment figures because apparently this data is based on risk adjustment submissions which show ~33 million lives on the exchanges). Brian Blase at Paragon Health Institute penned a helpful report breaking down the data, highlighting in the chart below the rapid increase in enrollees with no medical claims in the individual market, while the small group market remained flat:

Fierce Healthcare also had good coverage of the CMS data, sharing a few perspectives on the challenges this could bring for the ACA market moving forward. I thought it was interesting to see this prediction from Ari Gottlieb, suggesting that Centene is going to emerge as the winner out of all of this:

Centene is an individual market leader, has access to broad data and has seemed most aware of the pressures it faces on recent earnings calls. That’s why you see it requesting higher rate increases than its competitors, said Gottlieb.

“I think we're going to see this dichotomy between Centene and everyone else,” he predicted. “Who are you going to bet on? I’m going to bet on Centene.”

Quote of the Week

Sanford Health Plan’s CEO Tommy Ibrahim was interviewed in Becker’s this week on the opportunity for growth in Medicare Advantage.

The interview included the quote below from Ibrahim, which was notable to me in that its the first time I’ve seen someone supporting Medicare Advantage cede the argument that it costs more, while making the case that its still preferable to traditional Medicare because of the outcomes.

We pride ourselves on being a 4.5-star plan. Compared head to head with traditional Medicare, the outcomes are significantly better.

The cost might be a little higher, and there’s evidence to support that, but it’s because of that bundled approach. Traditional Medicare recipients don’t have the same access. As more people opt for Medicare Advantage, they seek more services and use their benefits in a more holistic way. That drives costs up, but outcomes and quality of life improve significantly.

We feel strongly that MA will continue to be the preferred option for Medicare-eligible beneficiaries.

Other Top Headlines

Eli Lilly was sued by the State of Texas for violating an anti-kickback statute, accusing Eli Lilly of “bribing” providers to prescribe its medications. The case makes for an interesting read — Texas has taken issue with two programs that Eli Lilly offers to providers: one that offers free nursing services for patients enrolled in their medications, and another that supports providers working through prior auths and other administrative challenges. The case alleges that Eli Lilly knows providers lose money on these services, and so it offers those services free of cost to induce providers to prescribe their medications. It’s an interesting example of the tension that exists across healthcare today — is it really a bad thing that Eli Lilly is offering nursing support to providers who won’t otherwise be able to offer it? There’s a lot to unpack behind questions like that.

CMMI director Abe Sutton and Paragon Health Institute President Brian Blase took to LinkedIn this week in support of CMMI’s recent model, WISeR.

Optum Health acquired Holston Medical Group, a 200 provider medical group in Tennessee.

STAT dug into how UnitedHealth Group is supporting research that helps make the case for Medicare Advantage. I’m not sure it’s all that newsworthy that a company is likely to support research that supports its cause, but the sheer size and breadth of UHG’s various business at the moment makes it stand out. I can’t help but look at the photo of America’s Physician Groups make-shift tiki bar at its annual conference — cited as an indicator of the extravagance that UHG is funding here — and wonder what the authors would think of HLTH.

Kaiser Permanente shared Q2 2025 financial data, reporting $1 billion of operating income and $2.2 billion of non-operating income for a total of $3.3 billion in the quarter. Kaiser noted it was happy with the quarter but expects a shifting landscape ahead, driven by an aging population, changing consumer expectations, and the OBBBA.

Oracle announced a new voice AI-driven EHR.

UnitedHealth Group shares jumped 10+% on Friday after Warren Buffett’s Berkshire Hathaway reported buying 5+ million shares last quarter for ~$1.6 billion.

Funding Announcements

What I’m Reading

Sina Haeri, CEO of Ouma Health, on building a new maternity model by Martin Cech, Sina Haeri, and me

Sina Haeri shared his reflections on building a maternity care model, the Medicaid landscape, and the implications of the various changes afoot. Was interesting to hear that Ouma is seeing more activity from payers looking to partner post-OBBBA.

Read more

The Starfield Signal: A Shared Vision and Roadmap for AI in Primary Care by

Chris Lew, Katie Drasser, and Tiffany Marie Ramos.

A Rock Health team published a white paper in conjunction with the American Academy of Family Physicians on how AI will reshape primary care. It does a nice job summarizing the challenging facing PCPs and how AI can, and can’t, help solve those challenges. Read more

If Americans want abundant primary care, health care needs a YIMBY moment by Dan O’Neill

A good perspective from Pine Park Health’s Dan O’Neill on the challenges of entering markets as a new provider. It does a nice job providing tangible examples of the administrative issues new entrants come across when attempting to work with incumbents. Read more

The future of a new insurance model hinges on a market in meltdown by Shelby Livingston

A look at how the ICHRA market is reliant on the ACA market and how high projected price increases in the ACA market could make ICHRA a tougher sell. Read more

Featured Jobs

Chief of Staff to CEO at Habitat Health, a Program of All-Inclusive Care for the Elderly (PACE) model. Learn more.

$144k - $199k | Hybrid / San Francisco

Director of Product Marketing at Firefly Health, a virtual payvidor. Learn more.

$NA | Remote

Director of Clinical Quality at Positive Development, an autism therapy provider. Learn more.

$NA | Remote

Staff VP, Carelon Behavioral Health National Partnerships, Payment Models and Network Strategy at Carelon, Elevance’s health services business. Learn more.

$221k - $398k | Multiple locations

Contact us to feature roles in our newsletter.

Want to share feedback with us?

Show your support by sharing our newsletter and earn rewards for your referrals!