Sponsored by: Ubiquity

Impatient patients aren’t a future threat — they’re already here waiting. 71% want healthcare to be as seamless as their favorite brands, and 25% have already switched providers over poor experiences. Meeting patients’ expectations as consumers is an imperative for provider organizations moving forward.

Ubiquity’s latest white paper breaks down patient expectations and how modern care models are delivering fast, frictionless experiences that boost loyalty — without adding internal operational strain.

If you're interested in sponsoring the newsletter, let us know!

👋 Hey all! Kevin here. Welcome to this edition of my free weekly newsletter, where I share my perspective on healthcare innovation news from the past week that I found interesting. This weeks newsletter again has a heavy focus on earnings as Q2 earnings season wraps up, along with a discussion of the GPT-5 launch, ACA rates in Arkansas, my reflection on conversations around ‘good’ versus ‘bad’ healthcare innovation, and more. Enjoy!

A reflection on “Good vs Bad” healthcare innovation

This week I found myself having a conversation with an entrepreneur building a new ASC model. Very much taking the playbook I’ve heard Tenet executing on so well over the last few quarters of focusing on moving high acuity cases into lower cost settings. This startup is focused specifically on one of the core profit centers that keeps many hospitals afloat, with the basic thesis is that there is a wave of life sciences innovation coming to market in the coming decade that will drive significantly more demand from the general population and will create an opportunity for this specialty to open “focused factory” ASCs to drive volumes of these procedures.

Conceptually, it seems like an idea that has a high likelihood of success to me. The idea moving care delivery to the lowest cost setting where it can be delivery safely seems like a macro trend that is not going anywhere, particularly when I consider the tension that exists between the cost crisis healthcare faces and rapidly advancing innovation in life sciences. Placing bets aligned with moving care to lower cost settings seems like a wise move for entrepreneurs / investors / execs, so long as you time it right.

We spent some time discussing the business questions you’d expect in launching something like this — i.e. do you partner with health systems in various markets or compete with them directly? Getting that market entry playbook right seems like the most important question for a model like this, but that’s a conversation for another time.

At one point, this entrepreneur asked me: “Kevin, do you think what I’m building is a good thing or bad thing?” On the one hand, as they articulated, patients who go into one of these ASCs is being treated for a major health issue and should walk out and see a meaningful improvement in their quality of life. That seems like a very tangible and good thing, right? On the other hand, the crux of this model succeeding financially is that the increase in volumes in this specialty will more than make up for the price decline from performing procedures in the ASC, so the specialists who work there will end up making more. That dynamic has a high likelihood of increasing costs to the system.

And this is where it gets tricky. Increasing access to healthcare seems like a good thing. That seems fairly obvious. But who defines what is needed and at what cost? Is the growth in the skin substitutes market a good thing? What about the skyrocketing costs in the autism therapy market?

Hal Andrews published a particularly poignant piece on a similar theme this week, discussing his personal experience with his late son and the recent controversy around Sarepta and Vinay Prasad’s (now short-lived) resignation from the FDA. One WSJ editorial piece last week referred to Prasad as a “one-man death panel,” over his questioning of whether some treatments are economically worth it. It’s the kind of politically loaded phrase that seems intentionally designed to stop any real conversation dead in its tracks.

The reality of a clinical model like the ASC model described above is that it “wins” over time (in the financial sense) if the providers consistently make more money by working at this startup compared to their other employment options. It’s some flavor of: do more volume, make more money, recruit more docs, build more locations.

So back to question of whether this sort of activity is good or bad. My answer is that it is inevitably some of both, and where you net out depends on how you weigh the tradeoffs involved. You can see that play out in all of the examples above. The reality is that these are the incentives — both in terms of clinical and financial outcomes — that exist in American healthcare. We spend so much time debating whether various actors have good or bad intentions, and I’m not sure it is a productive conversation. As Charlie Munger would say “show me the incentive and I’ll show you the outcome”. As I’ve traversed the healthcare industry, I’ve found that nearly every person I’ve met working in the industry shows up with good intentions, and also wants to make a living. You quickly find yourself optimizing for a local maxima in terms of prioritizing patients and profits. Therein lies both the good, and the bad, of healthcare innovation in this country.

DIGITAL HEALTH EARNINGS

The recent digital health IPOs, Hinge and Omada, both jump on a solid first earnings report

Hinge and Omada both reported quarterly earnings for the first time in Q2 and both did a good job posting solid membership and revenue numbers during the quarter. Hinge’s stock is up 22% on the week, and is now up 77% from its IPO price per share of $32. Omada’s stock is up 9% on the week, and is trading flat to its IPO price per share.

Hinge (Earnings release, Earnings script)

Hinge provided an update on the HingeSelect launch, with HingeSelect playing a key role in Hinge becoming a “one-stop shop for anything related to MSK, both in-person and digital care. It connects Hinge members with in-person providers for services at contracted rates typically 50% below insurance rates. Hinge is starting a pilot of this in 2025, expecting a broader launch in 2026, noting it has contracted with providers at 2,100 locations at the end of Q2. It should see revenue from this in 2027, and it’ll be a high margin revenue stream as they report an admin fee as a % of the claim as revenue.

It saw strong performance in LTM calculated billings, noting that this is the result both of higher eligible lives in existing / new clients, but also better-than-expected enrollment yields.

Omada Health (Earnings release, Earnings transcript)

Omada referred to 2025 as “the year of the G” - GLPs and GPTs, and the earnings call focused heavily on those two topics for the organization. Omada is seeing a lot of momentum in GLP-1s, noting “our customers have asked us decisively to support their members on GLP-1s.” It sounds like it is still a relatively small business for Omada, with the GLP-1 Care Track still a minority of the volume of new members coming into the platform. On the AI front, Omada called out its new OmadaSpark product, an AI-agent providing nutritional guidance

Omada saw strong revenue and member growth, calling out three factors — increased penetration of multi-condition offerings, GLP-1 adoption, and improved marketing campaigns. In 2024, Omada improved member outreach productivity and effectiveness by 60%+ year over year. Omada noted that last year it sent over 100,000,000 emails across 5,000 different campaigns across 2,000 customers.

PROVIDER ENABLER EARNINGS

The tale of the two enablement plays, agilon and Privia, shows FFS remains undefeated

agilon and Privia’s respective earnings calls provided another reminder of just how far apart the two now are from a performance perspective. Privia posted a solid quarter as the model chugs along, with its stock up 8% on the week. Meanwhile agilon’s stock dropped another 49% as it reported a huge miss because of risk adjustment challenges, pulled guidance for the year, and its CEO departed the business.

agilon’s market cap is now hovering around $400 million, which given it is sitting on about $300 million of cash, would imply the enterprise value of the business is only ~$100 million at this point. It feels like agilon is on a trajectory similar to NeueHealth at this point, and a take private transaction could be a logical solution here. Seems worth noting that CD&R, the private equity group that formed agilon back in 2016, appears to remain the largest shareholder of the business at ~24% today.

The relative performance of these two businesses over the past few years underscores the challenges in the VBC market. Privia’s strategy, centered around supporting the whole practice and entering VBC only when it has confidence it can perform and usually in upside-only arrangements, is clearly proving to be the dominant financial strategy in the market. More on each earnings call below.

Privia (Earnings release, Earnings slides, Earnings script)

Privia’s quarter can be summed up in the slide below, highlighting how it has continued solid growth again in 2025, resulting in Privia noting it should come in above the high end of guidance for 2025 on a number of key metrics.

I thought the quote below was an interesting explanation of Privia’s model during the earnings call, comparing bringing a practice under Privia’s model to converting an Uber drivers car from a UberX to a premium SUV, so they can get paid 10% - 40% more. It’s a helpful analogy that I think highlights the core value prop here for PCPs: get paid more for doing the same thing. I also think that if you think long enough about that value prop, you inevitably start questioning how durable it is as Privia scales.

“Some patients come in, and we get that fees. It is very consistent over any economic, regulatory, whatever is happening in the health care environment cycle. I mean that's a simple payment stream. I think if you then see how we organize these providers into our medical group entities, they are being credentialed in those medical groups. They are led by a common governance structure. I think that's very important and underappreciated because we effectively go in and change the engine of the car, back to my analogy with Uber and Lyft. We change the chassis. The UberX converts to a premium SUV, and they are paid a higher 10%, 20%, 30%, 40% higher fees for every encounter. And Privia has taken a piece of that every day of the week.

Setting aside more macro questions about the Privia model, Privia clearly has momentum in the market at the moment as its FFS-centric model has stood up to market headwinds significantly better than the VBC-centric models that have shown to be over-indexed on capitation payments. A lot of the earnings call Q&A for Privia was about business development and the opportunity that Privia sees in the market. It seems logical that if everything Privia is saying is true, it seems as though we should see an acceleration in implemented providers.

Privia noted it is aggressively pursuing both existing market penetration and entering new markets, and doesn’t think of it as an either / or. They’re working to build density in states, and they also feel like they’re seeing every deal that is on the market. They noted they’re seeing “many situations” where a provider group is working with another enabler on VBC but wants to partner with Privia for the entire book of business. And as PE and other buyers that were chasing the market leave, Privia sees itself as a natural consolidator, buying EBITDA / cash flow at a reasonable price.

agilon (Earnings release, Earnings transcript, Earnings slides)

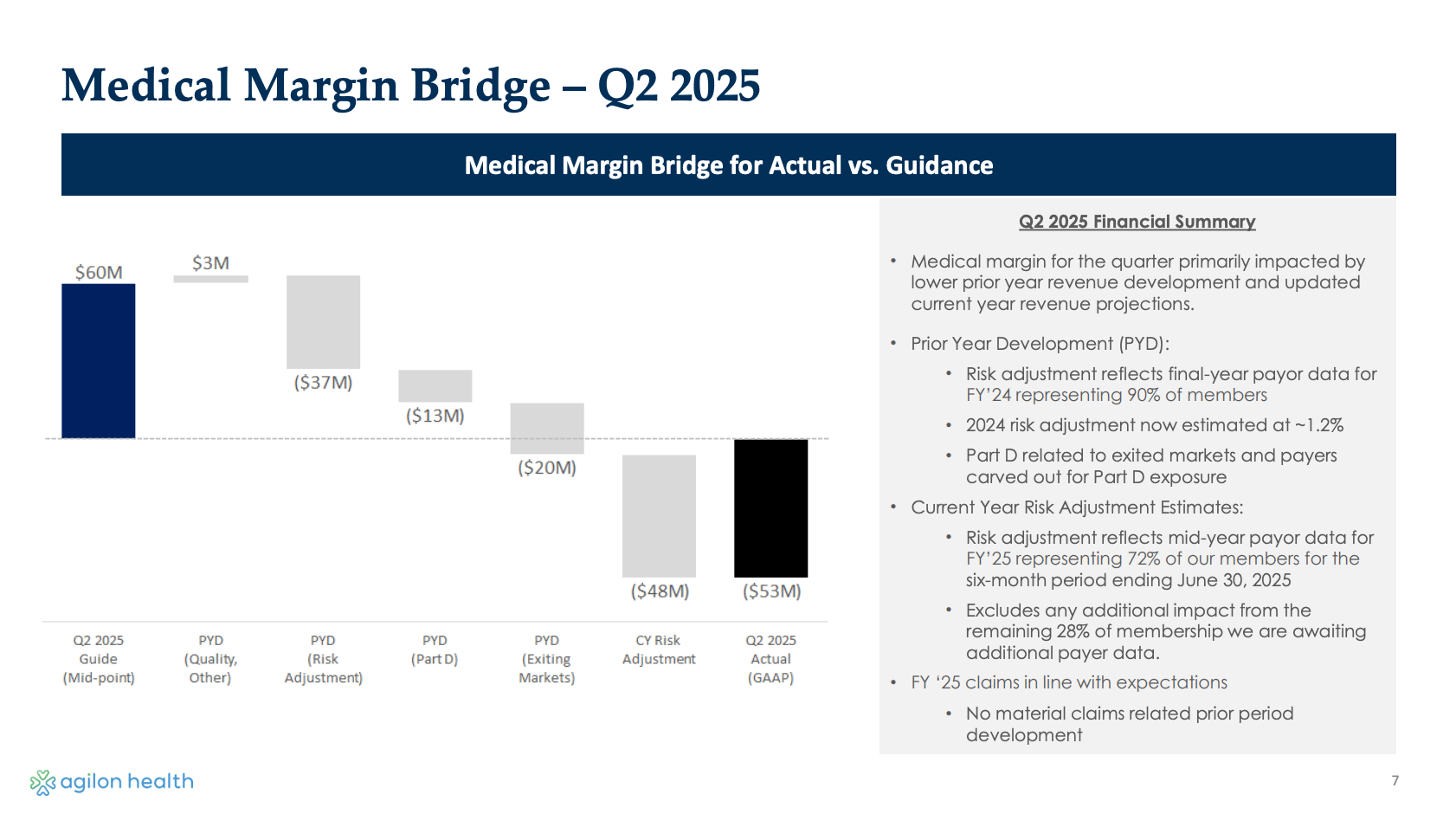

Meanwhile, agilon’s quarter can be summed up in the slide below, highlighting how it reported -$53 million of medical margin for the quarter, a -$113 million swing off guidance that it would be at $60 million for the quarter. The biggest driver of this swing was that agilon now has payor data for 90% of members for 2024, and risk adjustment numbers came in lower than expected for 2024, which both drove a loss for 2024 and also for 2025.

While cost trends were in line during Q2, agilon’s enhanced data platform began providing more visibility into its underperformance, and as agilon put it “the data we do have indicates that the burden of illness assessment work our physician partners performed in 2024 did not yield the expected increase in 2024 and 2025 revenue” If you’re wondering what exactly that means, I don’t think you’re alone there. An analyst asked a follow up question in the Q&A asking for more clarity on what happened, and I’m still not sure what exactly happened here. It’s a pretty confusing gap in the general narrative to me. Like, for a VBC enabler that is supposed to partner with the best independent PCP group in a market and enable high quality care, saying you didn’t do a good job identifying conditions like heart failure, COPD, and dementia or enrolling those patients in appropriate care just is not an explanation that makes any sense to me. It seems to me that any sufficient explanation of the issue at hand needs to include the phrase “v28”. Here’s the quote:

Q: you commented that the burden of illness assessments done last year did not yield the risk adjustment revenue you estimated for '24 and '25. Can you be more specific on the drivers of that downward revision? Did you not have the documentation necessary to support the diagnosis codes or were codes rejected by CMS? Any additional color there will be helpful.

A: … as you think about 2024 risk adjustment performance, I think what we're trying to say is, is that we didn't do as good a job of identifying the conditions that our patients had and then enrolling them into the appropriate care. I don't think this is a codes got rejected by CMS or anything of that nature. It goes back to, I would say, we started up some of these new clinical programs really to attack the disease burden of our existing patient population, and really get them to the care that they need to reduce the burden of illness and ultimately have better health outcomes and lower overall costs. So I think that's really what we're talking about. We've talked about new programs that we've implemented either late last year or this year, specific to heart failure, COPD, dementia. I think these are clinical pathways that we have here that ultimately will serve to identify these conditions where patients have those and treat that accordingly.

agilon’s talk track for fixing this issue contains similar themes to other underperforming VBC entities, centered around a need to change culture and orient around urgency, accountability, and performance. It has a variety of initiatives underway to improve profitability — improved payer contract terms, an enhanced data platform and burden of illness program, reducing exposure to things agilon doesn’t control, and expansion of quality programs internally.

While the rest of the business sinks, agilon’s ACO REACH business has been performing quite well, generating $10 million of EBITDA in Q2 2025, and tracking to $35 to $40 million of EBITDA contribution for the year.

agilon noted it expects that as payer bids focused on improved margin performance, that this change to benefits will help agilon’s profitability. This prompted an interesting exchange in Q&A with Justin Lake, who pressed them on this point. Lake noted that Humana, one of agilon’s biggest payers, has said publicly that they’re not cutting benefits, asking if that means agilon will need to potentially walk away from membership there. agilon agreed conceptually that if a payer doesn’t have the right economics, it will walk away from a partnership. This seems like a noticeably different tone than past earnings calls and discussions of negotiations, where it has seemed that payers were very willing to provide improved rates to enablers like agilon as a strategic play to support independent PCPs.

AI

OpenAI’s GPT-5 launch and healthcare focus causes a stir

Jessica Hagen of MobiHealthNews provided good coverage of Open AI’s GPT-5 launch here, noting that Sam Altman called health one of the top use cases for GPT-5 in the launch video. The launch caused at least some OpenAI users who preferred GPT-4o to revolt, with Reddit comments like this one:

During the launch video of GPT-5, they spent ~5 minutes sharing the example of the spouse of an Open AI employee who used ChatGPT to help make decisions and advocate for themselves in their health journey. It’s a good example of how GPT-5 can be helpful — this patient received an email with lab results telling them they had cancer, took a screenshot of the report and put a screenshot of it into ChatGPT, which translated the report into plain language for them to understand. Three hours after receiving the results and using ChatGPT to understand them, they were able to get their provider on the phone to discuss the results. If I put myself in the shoes of that person, I can immediately see the utility of ChatGPT in that case — the fact that we have a healthcare system that emails people lab results informing them they have cancer followed by their provider calling three hours later seems so completely backwards. It strikes me that we are just approaching the first inning of how tools like this will reshape healthcare delivery and the ripple effects that will be felt from these tools.

The launch also prompted concerns in the healthcare community over issues like privacy and how these models are trained. This started a good conversation in HTN Slack, mixed with optimism, skepticism, and concern toward the change afoot in healthcare as a result of tools like this.

It is clear to me that tools like this are here to stay, and that I think it is a net positive that people have access to tools like this. It is equally clear to me that if these tools are not implemented thoughtfully, the horror stories about how these tools can go awry will cast a shadow over the progress made here. I am not smart enough to have the answers for how to do that well. But as a consumer, I do know that I’m going to keep going to ChatGPT to ask it questions when my toddler has a bug bite, or I have back pain, or whatever else I want to know about before I reach out to a doctor.

Given that I don’t think I’m the only person in that camp, I am hopeful that the smart folks working on these models will choose to do so responsibly. I also have a feeling we’re going to see a lot of politicians getting involved in this conversation (see the Illinois discussion below), which will definitely help put some rails around the use of AI in care delivery, although I’m not sure in a productive way. It seems inevitable that AI will be held to a much higher standard than the industry currently is — when you go back to that example of a person sitting for three hours with an email telling them they have cancer, it’s a reminder of how much opportunity good can be done here.

ACA RATES

Arkansas picks another fight with insurers, this time over ACA rate increases

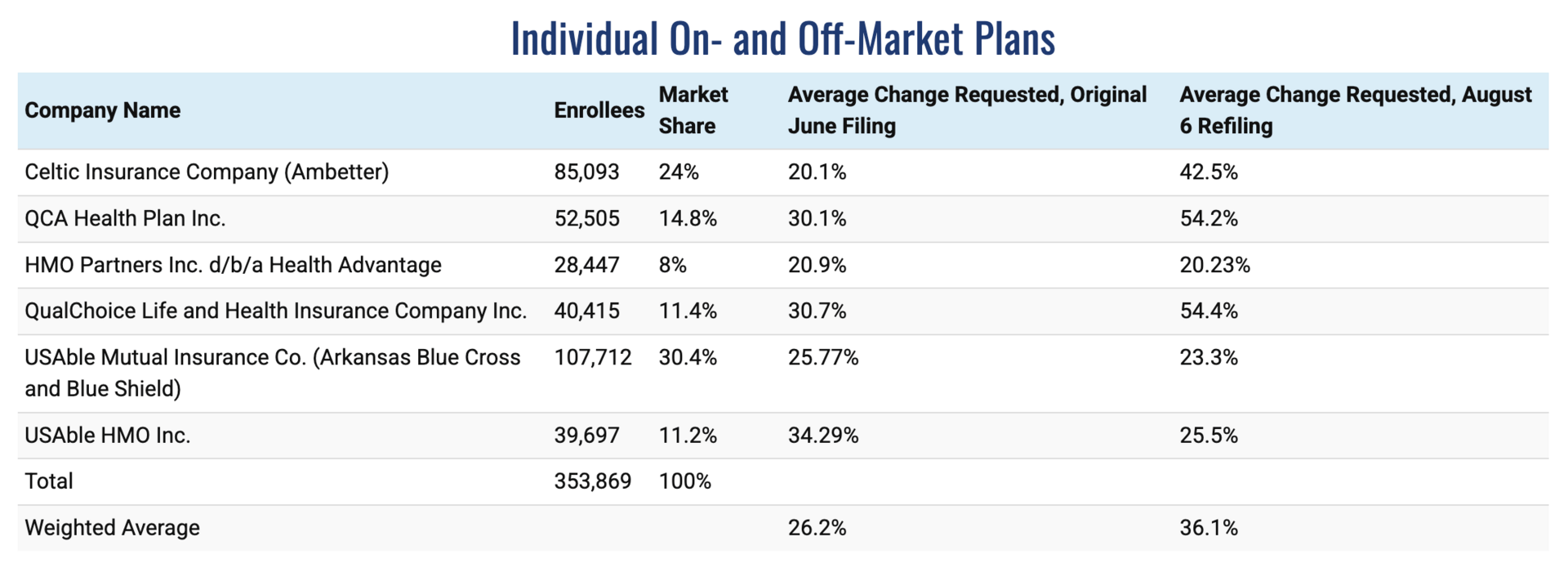

The state of Arkansas is again in the news for picking fights with insurers, this time as Governor Sarah Huckabee Sanders publicly called for her state Insurance Commissioner to reject the “insane” proposed hikes from Centene and Arkansas Blue Cross Blue Shield (ABCBS). Centene and ABCBS are the two largest ACA plans in Arkansas. ABCBS has the second lowest rate increased requested out of six plans in the state, while Centene has the fourth lowest request.

It is interesting to look at the chart below walking through the various proposed rate filings from insurers, noting the change from the original rate requests filed in June, prior to the Wakely data about the market morbidity increase, and the revised filings as of August 6th.

It seems worth noting that while Centene’s rate request increase went from 20.1% to 42.5%, ABCBS’s requested rate increase actually went down from 25.8% to 23.3%. Choosing to call out Centene and ABCBS while leaving out the two plans with the highest rate requests certainly makes Sander’s statement this week seem even more like political theater to me, specifically designed to leverage the generally negative public sentiment against brand name insurers to score some political points.

I’ll be curious to see what the Insurance Commissioner ends up doing here — for as much as a 36% average rate increase might not be appealing politically, actuarial math tends to be pretty rigid and I can’t imagine the state wants to end up in a place where insurers are insolvent. On that note, it also seems worth noting here that ABCBS lost $226 million in 2024 and is again expecting a loss in 2025. All-in-all, it’s another reminder of just how challenging the insurance landscape is going to be over the next few years.

Other Top Headlines

Evolent’s Q2 earnings report caused its stock to drop 10% on the week, apparently because it missed revenue estimates for the quarter, even though it raised profitability estimates for the year. While the market reacted negatively, when I listen to Evolent’s earnings call I can’t help but hear a massive opportunity for the business moving forward. The struggles for health plans are a growth opportunity for Evolent, noting that between risk adjustment shortfalls, medical utilization trends, and membership pressure from legislative changes, it should be a very strong selling environment for Evolent over the coming years. Evolent is also quickly rolling out AI, intending to “become a leading AI-first company over the next 24 months,” targeting 80% of current authorization volumes to be auto approved. Given the rapid advancements of provider AI tooling, it seems that Evolent positioning itself as the AI partner of choice for payers is a strong place strategically. Evolent also mentioned the WISeR program as a tailwind for the business, which I expect indicates we should expect to see them as part of it.

Oscar’s stock increased 13% this week after reporting Q2 earnings in line with its recently revised guidance. As confused as I am that Evolent’s stock dropped 10% this week, I’m equally confused that Oscar is up 13% — the market must be optimistic about eAPTCs? Oscar made the case that while the exchanges are in a reset moment, it expects 2026 to stabilize as double digit rate increases to address morbidity issues and program integrity. Oscar also noted it is seeing growing support to renew eAPTCs. Oscar noted it is rightsizing the SG&A cost of the business in 2H 2025 in preparation for 2026 as it focuses on the things it can control, with a combination of AI operations efficiencies, affordability initiatives, and a reduction in headcount. This will eliminate $60 million in administrative costs for 2026. Oscar also doubled down on the ICHRA opportunity, announcing it acquired an individual market brokerage, a direct enrollment tech platform, and a consumer education website. Oscar shared it is partnering with Hy-Vee to launch a Hy-Vee branded ICHRA plan in De Moines Iowa for 2026. The Hy-Vee plan includes “concierge medicine at an affordable fixed price through Hy-Vee Health Exemplar Care clinics”. Perhaps I’m a little too cynical this Sunday morning, but I’m not sure I buy that a Hy-Vee branded plan in Des Moines that is being pitched as concierge medicine at affordable prices is what I think of as a proof point for a product that is supposed to be upending the small group market.

Hims & Hers stock dropped 19% on Q2 results as the business faced headwinds in its GLP-1 and sexual health business lines. Monthly average revenue prescriber fell from $84 to $74 in the quarter, the result of off-boarding GLP-1 customers. Hims still believes its weight loss offerings will deliver $725 million of revenue in 2025, and it will be at $2.3 - $2.4 billion of revenue for 2025. Hims made the case strongly that its consumer-centric model is the future of healthcare, despite pushback from incumbents. It was interesting to see Hims focus the earnings call prepared remarks on the positive data its weight loss program is showing, noting among other things that only 25% of its customers have discontinued treatment after six months, versus an 80% discontinuation rate cited in some studies. Hims makes the case this is due to three things: 1. provider accessibility, 2. customization, and 3. an app based experience. Hims noted that users have an average of six interactions with a provider within three months of starting a GLP-1 on Hims.

Clover stock dropped 24% on Q2 results despite strong membership growth as it updated 2025 guidance to reflect higher medical expenses for the year which appeared to worry investors. While Clover generally seeming happy with performance in the business, it called out Part D in particular as a big unknown for 2H 2025, although it expects that pressure to be alleviated in 2026. With Clover moving to 4 Stars in 2026, it should set up for increased profitability for the business, but you can see analysts asking questions about whether Clover was able to capture this increased medical trend in its 2026 bids. Clover remains full steam ahead on its PPO offering, which will be interesting to watch while others in the market pull away from PPOs. The next few years seem like they will be telling regarding Clover’s narrative around its Counterpart platform enabling it to perform in PPOs in a way no other payers seem able to.

Illinois governor JB Pritzker signed a new law prohibiting the use of AI for mental health, with the state press release noting in part: “This will protect patients from unregulated and unqualified AI products, while also protecting the jobs of Illinois’ thousands of qualified behavioral health providers.” Violations will result in a fine of up to $10,000. The whole situation here provides a really good example of the coming battleground we’re going to see between AI and providers, and why the obvious path forward is that AI will be used to support providers. This article from back in June about the bill provides a glimpse of the arguments — with Slingshot AI’s cofounder arguing that their AI tools can help with accessibility and affordability while the Illinois Chapter of the National Association of Social Workers argued that AI should only be used to support licensed professionals, with NASW arguing it is not anti-AI but rather pro-accountability. Think what you will of the various arguments, it seems like a talk track we are going to hear ad nauseam on both sides over the coming years.

Doximity stock was up 14% this week as it announced Q1 2026 results and “acqui-hired” Pathway, an AI-based clinical reference platform, for $63 million. The purchase price consists of $26 million of cash and up to $37 million in additional equity grants. Pathway’s CEO noted in the press release that it has hundreds of thousands of users, with thousands paying $300 per year for its premium product offering. This which would seem to imply Pathway’s revenue is somewhere around $1 to $2 million annually (at 10,000 users paying $300 a year it’d be at $3 million of revenue), assuming that is its core revenue stream. Doximity noted it expects no revenue contribution and will offer this product free moving forward.

UHG and Amedisys appear set to move forward with closing their planned merger as they reached a settlement with the DOJ requiring UHG and Amedisys to divest 164 home health and hospice locations that represent ~$528 million in revenue annually.

Modern Healthcare reported that Aetna notified brokers this week that it will end 90 Medicare Advantage plan offerings for 2026, the majority of which are PPO products. Aetna responded saying it hasn’t made any announcements for 2026 yet, but that it is making some plans zero commission starting in September.

Carlyle acquired Pyschiatric Medical Care from Consonance Capital. The Axios reports notes this deal was at a 20x EBITDA multiple on EBITDA just short of $25 million, implying a $400 million valuation.

Epic is reportedly going to launch its own AI scribe product offering later this month.

Virtual mental health provider Cerebral acquired Resilience Lab, a clinician development platform.

Funding Announcements

Positive Development, an autism therapy model, raised $51.5 million.

Artisight, a smart hospital platform, raised $40 million.

August Health, an AI platform for senior living facilities, raised $29 million.

Skylight Health, a specialty care VBC platform, raised $13 million.

Elion, a healthcare IT marketplace, raised $9 million.

Translucent AI, an AI-based financial analyst for provider organizations, raised $7 million.

What I’m Reading

Unpacking ICHRA with Amanda Harlan from Sandbox Advisors by Claire Trautz

This was a really helpful interview providing an overview of the state of the ICHRA market, digging into the state of the market today and where its potentially heading in the coming years. Read more

Making Sense of This Year’s Healthcare Headwinds by Duncan Greenberg

Oak HC/FT’s Duncan Greenberg is now the clubhouse favorite for my visual of the year for the chart in this post explaining how various payers (plus Optum Health) performed in Q2 across the various lines of business and performance relative to expectations. Read more

AI Doctors Won’t Work For Free by Sebastian Caliri

An interesting perspective on how CMS could implement payment mechanisms to pay for AI delivering care. It does a nice job explaining how care delivery is paid for today and how it is slowing down AI adoption in care delivery. Read more

A Father’s Perspective on Specialty Pharma: The Elephant in the Room, and a Bull in a China Shop by Hal Andrews

As already referenced above, this is a really thoughtful, poignant post on the tensions inherent in the specialty pharmacy market. It shines a light on the very real world implications of when business interests and patient interests collide. Read more

Blue Cross NC CEO: The $5 trillion question — Why does health care cost so much? by Tunde Sotunde

It’s interesting to see how a payer CEO is attempting to explain why healthcare costs so much to their local market. Sotunde makes the case that the Blue Cross Blue Shield NC is collecting only 1% margin on the healthcare dollar. Read more

Featured Jobs

Policy Manager, Mental Health - Trust and Safety at TikTok, the social media platform. Learn more.

$117k - $270k | San Jose

Director, Sales & Strategic Partnerships at Cleerly, a FDA-cleared AI algorithm for coronary artery disease. Learn more.

$315k | Remote

Executive Director, Specialty Care Solutions at Oak Street Health, CVS’s value-based primary care organization. Learn more.

$132k - $303k | Remote

Director, Business Operations and Strategy, Care Enablement at Virta Health, a virtual metabolic care model. Learn more.

$165k - $195k | Remote

Contact us to feature roles in our newsletter.

Want to share feedback with us?

Show your support by sharing our newsletter and earn rewards for your referrals!