Sponsored by: Medallion

Big ideas. Crafted cocktails. One unforgettable event.

Join Elevate — Medallion’s free virtual event on September 17 — where operators, innovators, and health tech leaders explore how to align teams, leverage AI, and drive real change. With sessions from UPMC, Samsung Digital Health, and others, plus a hands-on mixology class to close. Elevate delivers strategy with a twist.

If you're interested in sponsoring the newsletter, let us know!

👋 Hey all! Kevin here. Welcome to this edition of my free weekly newsletter, where I share my perspective on healthcare innovation news from the past week that I found interesting. This week I dive into the following topics (click the links to go straight there):

In addition to round-ups of other headlines, funding rounds, interesting opinions, and jobs.

MY REFLECTION ON THE WEEK

Healthcare’s Hunger Game Vibe

One of the things that stood out most to me this week: as the Federal government appears to be indicating its no longer ok with footing the bill for the $4.8 trillion in healthcare spending in this country, incumbent payers and providers are embroiled in what feels like a really messy Hunger Games-esqe battle for survival in DC.

The cuts to ACA and Medicaid markets in the OBBB are already creating substantial uncertainty in the public markets. Centene’s projected 2025 pre-tax net income of $4.55 billion was completely wiped out by $4.7 billion of ACA and Medicaid pressure (Centene is making back some of that in SG&A and Medicare). Eking out a low-single digit margin across ACA, Medicare, and Medicaid businesses feels like an accomplishment these days for payers as many are operating in the red.

Even as Tenet reported a great quarter this week, uncertainty about 2026 and beyond caused its stock to drop 8%. It’s not hard to imagine generalist investors choosing to opt-out of the healthcare sector entirely in this environment given the uncertainty. There is anticipated legislation coming around Medicare Advantage this fall, with the Ways & Means Subcommittee hearing this week provided some indication of the potential changes being considered to the program.

This all seems to be following the pattern of DC negotiations under this administration — threaten to cut everything while simultaneously waging a PR battle via social media and media outlets. Then use the initial extreme position and public pressure to bring the industry to the table to make concessions and meet somewhere in the middle so that everyone can feel like they’ve won a little. It’s a strategy that seems to be working pretty well thus far, and I’m not sure why it’d stop now. See, for example, Centene talking on its earnings call about how the Medicaid cuts in the OBBB are a win compared to some of the more draconian cuts initially discussed.

It also seems that these battles are still ramping up as payers and providers alike are grappling with the implications of the threatened cuts and what to concede in order to protect as much of their core business as they can. It’s all shaping up for what appears to be a critical few months for healthcare in this country as Republicans look to enact a bi-partisan health package before the end of the year while Democrats look to play hardball. An overhaul of Medicare Advantage appears imminent, the ACA enhanced subsidy conversation needs a resolution, and Republicans are already walking back some changes to Medicaid. These are all huge structural changes that the markets are grappling with.

Given all that, perhaps it’s not a surprise we’re seeing a boom in the healthcare lobbying industry as payers and providers show up to DC in an effort to ensure their (already slim) margins survive upcoming policy changes. Seems worth noting here that PhRMA spent $7.58 million on lobbying in Q2 while AHIP spent $4.05 million and AHA spent $6.15 million.

MEDICARE ADVANTAGE

The state of Medicare Advantage is discussed on Capitol Hill

The House Ways and Means Joint Health and Oversight Subcommittee hosted a hearing on Tuesday discussing the state of the Medicare Advantage program with a handful of witnesses across payer, provider, and policy perspectives. The session presented an interesting view into how politicians in DC are viewing the issues Medicare Advantage faces and some of the potential changes we might see to the program this fall. Lots of questions on Stars, prior auth, Stark law changes, how AI is being used by plans, and coding. A quick rundown of my takeaways from the four hour session:

A number of members of congress noted their general support for the idea of managed care conceptually, but then also expressed their dismay at the current implementation of Medicare Advantage and the desire to reform the program.

Does MA cost more than traditional Medicare? Fielder highlighted MedPAC’s analysis finding that MA costs 20% more than traditional Medicare and that we’re not getting our money’s worth on MA. Miller made the point that we need to do a better job of comparing populations — its not even ‘apples to oranges’ today, it’s ‘apples to kumquat trees’ in Miller’s point of view. Fun false analogies aside, I remain extremely confused by the answer to this question.

The use of AI by insurers is going to be a fascinating political debate to watch. There was at least one member of Congress who pushed against the use of AI in Medicare Advantage. Yet the general sentiment of the witnesses was that it would be a mistake to not leverage AI and make automation the default for processes like automation. That seems like a reasonable position to me.

There were a number of questions about the Star rating program and how options to improve Star ratings. A number of folks questioned how quality is measured in the Medicare Advantage program today and how performance of plans is measured. Given all the lawsuits around cutpoint shenanigans in the last cycle, it’s not hard to envision some change here as it seems like an easy place for politicians and industry to find some win-wins.

The topic of adjusting Stark laws came up twice, with Miller making the case that a Stark law waiver in managed care settings would be a wise move to promote independent practices as a viable alternative to health system employment for providers and a key step to “make private practice great again”.

Not surprisingly, prior authorizations came up over and over. Safe to say that nobody is defending the current state of prior auths and there was recognition the process needs to change.

The topic of coding intensity / upcoding came up often. There were some suggestions for how we could reform the coding process, with some suggestions to automate the coding process at the point of care under the purview of the provider. In general, you get the sense there is the perception there are a few bad actors driving a lot of the problem here.

CMMI’s WISeR model came up, with a member of Congress pushing back on it as implementing MA prior auth tools in traditional Medicare. I think it’s an interesting example of the different goals different people have in these conversations — when I look at WiSeR I see a no-brainer to reduce fraud in markets like skin substitutes. But I also understand the pushback that this is creating the same sort of prior auth incentives that exist in MA.

It’s interesting to see just how much members of Congress are influenced by the Wall Street Journal articles covering Medicare Advantage. On a number of occasions, members of Congress made points specifically based on WSJ reporting, and introduced WSJ articles into the record. On other occasions, they quoted data from these articles. It’s clear those articles are having a big impact on politicians, and underscores the PR game that insurers are losing at the moment.

Links to the written testimony from each witness:

STARTUP FUNDING

Regulatory uncertainty is the theme of Q2 earnings calls this week, particularly for the payers as they cut earnings forecasts

There’s a pretty straightforward overarching narrative that is emerging for Q2 earnings season — payers are facing pressure across all lines of business and are increasingly focused on 2027+ to hit target margins. Conversely, everything seems to be going right for providers in the current moment, but the same political uncertainty raises questions about future performance. Everyone is trying to digest the impacts of the OBBB, and in particular what the expiration of enhanced subsidies will mean on the various markets — both for payers attempting to manage profitability of their book and providers trying to avoid a revenue hit as people lose coverage.

I’ll dive deep into the payer earnings calls below as they had a number of interesting elements, Tenet and HCA are covered more briefly in the Other News section below.

Molina (earnings release, transcript)

Molina stock dropped ~9% on the week as it reported Q2 earnings and had to adjust 2025 earnings downwards again, after already having done so once when it pre-announced Q2 earnings earlier this month. As of July 7th, it pre-announced that it was reducing its earnings target to $21.50 - $22.50, that was down from initial guidance of $24.50. In its earnings report, Molina shared a new earnings target of at least $19.00, which it now views as the floor for 2025. Molina expects to generate ‘low-single digit’ pre-tax margins across all three lines of business, below long-term targets and the result of elevated MCRs across all of the businesses.

Interestingly, Molina noted that it expects the impacts of the OBBB to be felt after 2028, and that the impact on Medicaid will be modest and gradual. It expects work requirements will eventually impact 10 - 15% of its 1.3 million members in the Medicaid expansion population. Molina also noted there will be indirect impacts how states will respond to the reduction in federal funding — limiting eligibility, reducing benefits, or seeking additional revenues. Molina believes these changes will be implemented starting in 2027 into 2029.

Molina mentioned it does not expect ACA subsidies to be extended.

Molina sees a strong strategic M&A pipeline, as the market dislocation is creating multiple opportunities with smaller health plans needing to evaluate strategic options.

Medicaid is seeing cost pressures across the board — behavioral, pharmacy, inpatient and outpatient. A typical set of challenges were cited — high cost oncology and HIV drugs, supply and demand side in behavioral health, higher complexity inpatient stays, and increased primary care visits leading to specialty care in outpatient.

One analyst asked about why trend is elevated across the lines of business, with Molina noting that while it has its arms around the ‘what’ that is driving trend, it thinks the entire industry doesn’t understand the ‘why’ yet.

Molina repeatedly mentioned its “small, silver and stable” approach to the ACA business as being the right one. I can’t help but note the quote in Centene’s earnings call about changing silver plans as a key driver of healthy individuals leaving the market driving up medical costs, and wonder if Molina is going to have a major challenge here in 2026 as a result of that strategy.

Centene (earnings release, transcript)

After a midweek slide, Centene’s stock jumped 6% on Friday after reporting Q2 earnings, seemingly easing some investor concerns about the path forward for the business. Centene shared on its earnings report that the ACA and Medicaid miss essentially wiped out its entire earnings forecast for 2025 — Centene had previously forecast $4.45 billion in pre-tax income for the year. Centene sized the ACA miss at $2.6 billion and the Medicaid miss at $2.1 billion, which would put them at -$150 million in income. Outperformance in Medicare and SG&A management to the tune of $700 million and $500 million respectively will keep Centene in the black. Between the two, they’re forecasting a $4.7 billion hit to earnings — ACA is $2.6 billion, Medicaid is $2.1 billion — and the previous earnings estimate for 2025 was $4.45 billion. They’re still projecting ~$1.1 billion in earnings, a result of $700 million favorability in Medicare and $500 million in SG&A savings.

Here’s a quick rundown by line of business:

ACA: will be slightly negative margin this year versus 5% - 7.5% target. While the Wakely data suggests a market average morbidity increase of 8%, Centene noted some states are at 17% - 18%. An interesting quote on this below. Centene sees three issues in ACA: 1. healthy members leaving, 2. sicker members coming in, 3. providers coding more aggressively.

Medicaid: missed on MLR in the quarter, posting 94.9%. The issue was driven by three categories: behavioral (50%), home health (30%), High cost drugs (20%). In behavioral, ABA is the biggest issue, with the Florida program alone driving a 40 bps miss in the quarter. On home health, home and community based services were the biggest driver, with New York state driving a big part of the miss. On high cost drugs, cancer and gene therapies were called out.

Medicare: Seems like this is actually going pretty well, at least relatively speaking, in that it is performing slightly favorable to expectations. Centene noted it will be hard to hit its target of 85% of members in 3.5 Star plans given where cutpoints are coming in, but that it still expects to get back to breakeven in 2027 in Medicare.

Centene’s call included two particularly interesting quotes, which I highlighted in HTN Slack on Friday. I won’t include them here in full because they’re quite long, but the basic gist:

On ACA, federal exchange states where there was a change in one of the two low-cost Silver plans saw significantly higher morbidity shifts (up to 17% higher) as the 2025 program integrity changes caused low-utilizers to leave the market and not join. In markets without those changes, low-utilizers could re-enroll in their existing plans without issue. Presumably that churn will happen in 2026 in those markets

On Medicaid / ACA, Centene noted it isn’t seeing a shift from Medicaid coverage to ACA coverage as driving ACA trend. Instead, they think it is more macroeconomic uncertainty — people concerned about losing coverage, providers concerned about losing revenue

STARTUPS

Medicaid startup Fortuna Health raises $18 million for eligibility determinations

Medicaid enrollment startup Fortuna announced $18 million in a Series A funding round led by a16z this week. Given the amount of dialogue about the Medicaid program at the moment — just reference the earnings calls above for a good example — it seems like a really good example of a startup going after a meaningful problem at the right time in the market. KFF’s coverage last fall of Deloitte’s $6 billion business managing state eligibility programs and the errors in those programs highlights the need for a model like this. It’s particularly interesting to note the Tradeoffs podcast below about how a rural provider thinks they’ll be required to staff up to support Medicaid eligibility determinations and how models like Fortuna fit into that process moving forward.

Fellow nerd Martin Cech and I had the chance to ask Fortuna’s CEO Nikita Singareddy about the Fortuna model and the broader Medicaid landscape this week. Check it out below if you’re interested. She has a unique perspective on the broader Medicaid market, and it was fun to get to learn from her perspectives here:

Question of the Week

One of the bigger questions for the industry at the moment is whether ACA subsidies will end up getting extended or not. It was discussed at length on a number of earnings calls this week, with both analysts and Molina expressing the sentiment that they do not expect an extension. Yet I’ve also heard from folks who are equally as confident that subsidies will continue in some form as Democrats and Republicans work through another health package this fall.

I thought I’d do a pulse-check of this community and see what we think — will share results next week:

Do you think that ACA enhanced subsidies will be extended going into 2026?

PS - if you have a perspective you want to share beyond those options above feel free to reply to the email with your thoughts 🙂

Other Top Headlines

Tenet reported a solid second quarter, beating estimates for the quarter and raising guidance for the year. It’s core strategy of focusing on high acuity ambulatory surgery centers is in full stride at the moment. Yet despite the performance and improved outlook for 2025, Tenet’s stock still dropped ~10% on the earnings announcement. It’s not clear to me why. The most plausible strategic explanation is that investors are worried about the political uncertainty in 2026, particularly around exchanges. A number of analysts asked about the impact of subsidies and other changes ahead, and Tenet rather tersely replied with a version of “no comment”.

HCA similarly posted a solid quarter and increased guidance for 2025. There was a lot of discussion about OBBB, and specifically around the exchanges and the expiration of enhanced subsidies. HCA didn’t give much clarity on the impacts of those changes yet, beyond noting that they have a remediation plan in place to offset OBBB, and they’re going to wait to see what’s going on with the enhanced subsidies. You could see analysts trying to size the impact here — one asked about HCA’s exchange business going back to 2019 (before enhanced subsidies) to get a sense of what that business might look like moving forward. Another analyst at one point said they’re not baking in subsidies at all moving forward, so you can tell where Wall Street perceives the market to be at the moment.

Healthcare payments platform Waystar acquired Iodine Software for $1.15 billion. The transaction is 50% cash and 50% stock, with Iodine’s primary investor, Advent International, and other large shareholders owning ~6% of Waystar moving forward. As described in the merger deck, Iodine will provide Waystar with AI-enabled capabilities in utilization management and clinical documentation integrity.

Oscar pre-announced Q2 results and a downward revision of earnings estimates, becoming the latest insurer to take a hit because of ACA market morbidity issues. Oscar now expects a loss from operations of $200 to $300 million in 2025, down from its earlier financial guidance of $225 million to $275 million of earnings from operations. Despite taking that $500 million hit to operating income for the year, Oscar’s stock was actually up 8% on the day, potentially indicating the market expected worse. It’s stock was down 8% the following day though, so… I have no idea what the market is doing.

Humana, which had its Star rating lawsuit dismissed last week on procedural grounds, refiled a version of the lawsuit this week.

UnitedHealth Group filed an 8-K disclosing that it is cooperating with DOJ criminal and civil requests following WSJ reporting on the matter earlier this year.

Doximity launched a free AI scribe tool for providers, providing a potential indication of where that AI scribe market will head moving forward as it increasingly becomes a feature for broader platforms.

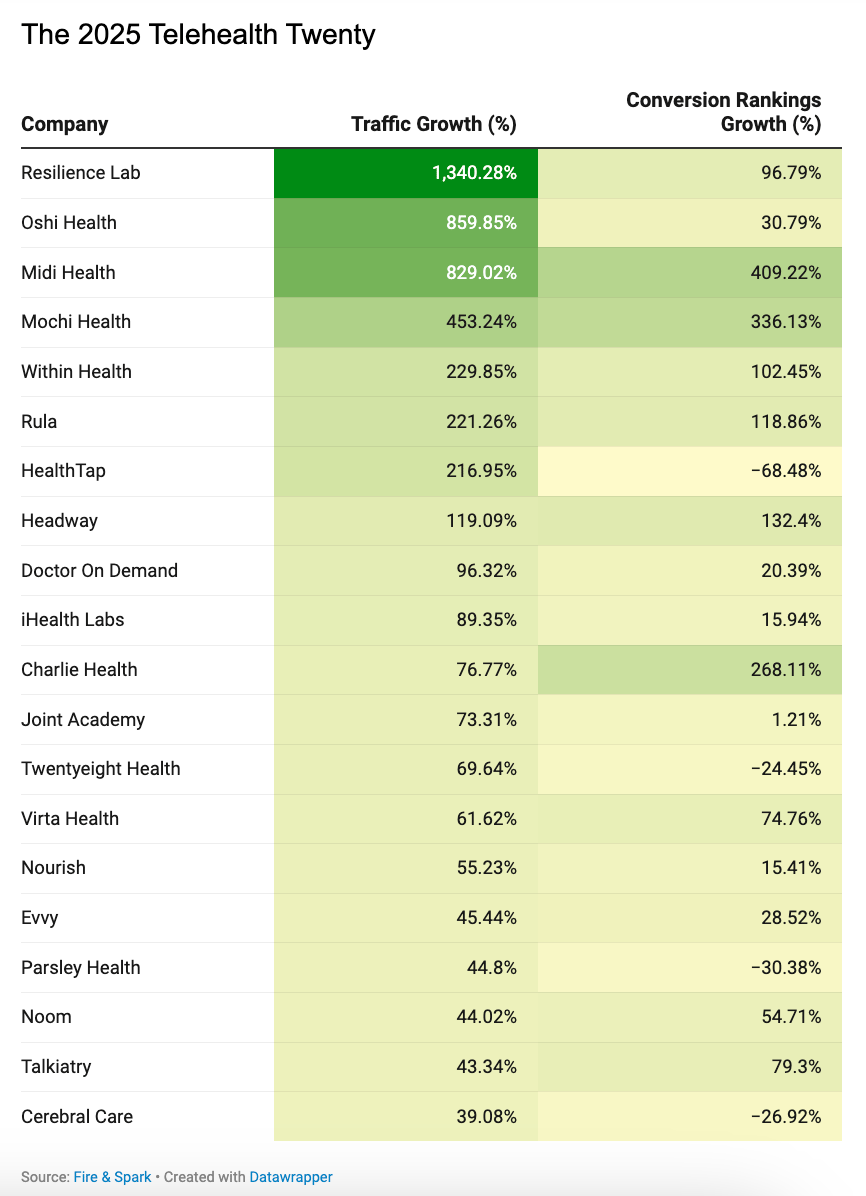

Chart of the Week

A report from Fire & Spark looking at drivers of SEO success included the interesting chart below looking at traffic growth for various telehealth startups. A number of familiar names are on the list, along with some new ones for me:

What I’m Reading

Are Hospital Acquisitions of Physician Practices Anticompetitive? by Multiple Authors

The answer: Yes. At least that’s the conclusion this NBER paper reaches, finding that consolidation leads to higher prices with no change in quality. In related news that I think will surprise nobody, the American Hospital Association thinks the study is flawed, per this HealthcareDive reporting on the paper. Read more

A Rural Hospital in Kentucky Prepares for Medicaid Losses by Melanie Evans and Dan Gorenstein (Tradeoffs)

A good interview by the Tradeoffs crew with a Kentucky rural hospital leader, highlighting the headwinds facing independent rural hospitals. In particular, I found the discussion about how the hospital expects to staff up to support patients determining Medicaid eligibility to be interesting. Read more

Cooperation Is the Key to MAHA by Marty Makary and Mehmet Oz

Makary and Oz make the case in the WSJ that the federal government can be more effective by working with industry to drive change versus relying on regulatory changes. Read more

The Return of the Death Spiral? by Hal Andrews

An interesting read from Andrews, the CEO of Trilliant Health, suggesting that the individual market might be in a death spiral, and that there will be a huge push by the industry to extend ACA subsidies before the end of the year. Read more

2025 Individual Market Risk Pool Conversations by Michelle Anderson, Chia Yi Chin, and Michael Cohen (Wakely)

A Wakely team issued a report describing how ACA market morbidity rose ~8%. It notes that morbidity grew more in states that have not expanded Medicaid, which have an 11.6% increase over 2023. Read more

Level‑5 Healthcare: Why Prescribing Will Decide When AI Becomes a Real Doctor by Myoung Cha

Cha explores how AI can potentially begin diagnosing and prescribing medications, and the onramp to allowing that. It is a pretty logical case for using AI in my opinion, although I think the political pushback will be fierce as AI enters the prescribing realm. Read more

Medicare's WISeR Model: Technology-Enhanced Review for Wasteful and Inappropriate Services by Lisa Bari

Bari provides a helpful rundown of CMMI’s WISeR programs and the broader implications of it. Read more

Funding Announcements

Aidoc, an AI model that assists physicians with clinical decision making, raised $150 million, including a $40 million credit facility. General Catalyst led the round, with a number of health systems participating as well. Advocate Health (link) and Sutter Health (link) both announced enterprise-wide rollouts of Aidoc in the last month (Sutter is one of the investors here as well).

AbsoluteCare, a care model for dual eligibles, raised $135 million. CVS Health Ventures was one of the four investors in the round.

Slingshot AI, a AI therapist chatbot, raised $50 million. The Stat article provides a good explainer of how Slingshot is building a large language model trained on hundreds of thousands of hours of therapeutic conversations, versus more general LLMs.

Fellow Health, a male fertility platform, raised $24 million.

Charta Health, a AI chart review platform, raised $22 million.

Fortuna Health, a Medicaid eligibility platform, raised $18 million.

m7 Health, a nurse staffing platform, raised $10 million.

Featured Jobs

Director, Digital Product Strategy at Highmark Health, an insurer and integrated delivery network. Learn more.

$126k - $236k | Remote

CEO and Co-Founder at StealthCo, a pharma payment integrity company backed by Alloy Ventures. Learn more.

$NA | Remote

Senior Director, Clinical Operations at Zócalo Health, a provider for the Latino community. Learn more

$NA | Remote

SVP, Chief Operations Officer, CenterWell Home Health at CenterWell, Humana’s senior-focused primary care business. Learn more

$NA | Remote

Operations Lead at Fortuna Health, a Medicaid enrollment platform. Learn more

$130k - $150k | New York

Contact us to feature roles in our newsletter.

Want to share feedback with us?

Show your support by sharing our newsletter and earn rewards for your referrals!