Sponsored by: Ubiquity

Retail clinics are playing a growing role in the healthcare landscape, winning patients over with fast, convenient care. Yet, all too often, retail models falter because they fail to execute on the promises of the model, resulting in inconsistent performance and lower profitability.

Ubiquity released a white paper highlighting the promise of retail clinics and how Ubiquity's HIPAA-compliant outsourced back-office solution can help to streamline operations for retail clinics and other consumer-oriented care models. The result? High-quality patient interactions, better patient loyalty, and ultimately improved profitability for clinics.

If you're interested in sponsoring the newsletter, let us know!

👋 Hey all! Kevin here. Welcome to this edition of my free weekly newsletter, where I share my perspective on healthcare innovation news from the past week (in this case, two weeks) that I found interesting. Buckle up, this is a long one at ~3,700 words.

With the One Big Beautiful Bill becoming law on July 4th, the past few weeks have been a whirlwind of news as everyone digests the most consequential piece of healthcare legislation since the ACA.

One of the more interesting dynamics I’ve heard a few times this week is the perspective that the OBBB is just the first inning of a much broader reform of healthcare markets in this country. Between the chaos in the ACA market (more on this below in the Centene discussion), the cuts to Medicaid, and the reform in Medicare Advantage, I don’t think it is hard to imagine a scenario where the next few years will bring significantly more change to healthcare markets in this country. I’m not sure there’s a single insurance market that is on solid footing at the moment.

What might that change look like? Ezekiel Emanuel published a thought-provoking piece this week arguing how Democrats need to use the OBBB as an opportunity to move towards universal healthcare. I’d highly recommend reading it. Central to the argument is the creation of a single national health exchange that combines Medicaid, CHIP, and the ACA. This would create a more actuarially sound — and simpler — exchange covering 120 million Americans. Emanuel’s proposal goes into a handful of other specifics — i.e. limited competition, longer-term contracts, and standardized benefits. I have lots of questions about how the specifics would play out, but it doesn’t seem hard to imagine a scenario where multiple stakeholders, including insurers themselves, could prefer this single national exchange approach moving forward. While Emanuel’s proposal didn’t touch on ICHRA, would it be that hard to imagine a scenario where the small group insurance market moves into that exchanges as well? All of a sudden you have the beginnings of a very American-flavor of a single payer system, right?

While so much attention has been on health policy at home over this year, I also spent a good amount of time this week perusing the 10-year plan that the NHS published for fixing the NHS. The document outlines how the NHS is in a dire state — starting off acknowledging that nobody defends the status quo, and it needs to implement radical changes as it chooses whether to “reform or die”.

Leaving aside for now the questions I have about how a system like the NHS gets to a place where nobody will defend the status quo, the document outlines three “radical” changes to fix things: 1. Move from the hospital to the community. 2. Implement new technologies and move from analog to digital. 3. Focus on prevention versus treating people when they’re sick. All very logical, and all very obvious. So obvious, in fact, its a similar narrative to the last long term plan the NHS shared back in 2019 for fixing the system. The urgency appeared to be less at that time, but the key points remain, which makes me question whether the approach is right. It reminds me of that old saying about the definition of insanity being doing the same thing over and over and expecting different results.

Anyways, as it seems clearer and clearer that we’re move toward massive structural change in healthcare markets here in the US in the next few years, I think the crisis the NHS is currently facing provides an interesting lens on the changes that need to happen in the US.

Enough single payer musing for now, on to the other news of the week!

Kevin

ACA CHALLENGES

Centene stock drops 40%+ amid ACA market morbidity challenges

Centene’s stock plunged over 40% on July 1st after issuing a press release that it was pulling its guidance for 2025. The core issue appears to be that Centene received its first view of Wakely’s risk adjustment data (I believe it is the WNRAR report), which indicated that overall market growth for the ACA exchanges was lower than expected and the aggregate market morbidity is “significantly higher than, and materially inconsistent with, the Company’s assumptions,” per Centene’s release. That note on morbidity seems like a massive issue, both for Centene and the exchanges more broadly, as it would seem to imply that actuaries mispriced the market in general. Will be interesting to see the insurers discuss the “why” behind this issue in upcoming earnings calls.

While the ACA issue was the central part of the press release, Centene noted a few other items in the press release as well:

In addition to the ACA challenges, it is seeing a “step-up” in Medicaid cost trend from Q1 to Q2. The core drivers were behavioral health, home health, and high-cost drugs. New York and Florida were specifically called out as issues because of carve-ins for services without sufficient risk adjustment.

Medicare Advantage and Medicare PDP are bright spots, performing better than expected in Q2.

Back on the ACA topic… Wakely’s WNRAR provided sufficient data for 22 of the 29 states that Centene operates in — representing 72% of Centene’s ACA membership — for Centene to project that it will see a $1.8 billion reduction in risk adjustment transfer and negative EPS impact of $2.75 on those 22 states. That is a ~40% hit to Centene’s previous earnings guidance for the year of $7.25+ earnings per share. Centene also noted it expects this issue to get worse, as presumably this issue also exists in the other seven states with 28% of Centene’s membership where it doesn’t yet have data.

It’s a dramatic shift for Centene only two months after reporting positive Q1 2025 earnings at the end of April. At that time, Centene noted it was seeing stronger-than-expected revenue and membership growth, while reiterating its earnings target for the year of $7.25+ earnings per share. No indication of the issues to come in the ACA.

Centene’s release also sent other ACA insurers tumbling — Oscar’s stock dropped 20% and Molina’s stock dropped 22% on July 1st.

✍ Going Deeper

I can’t help but wonder if the ACA market is in real trouble at this point. In the last newsletter before the holiday, you may recall the discussion of Wakely’s white paper about the changes the One Big Beautiful Bill could have on the ACA market. At the time, I noted how this quote below brought back memories of 2017-era ACA death spiral conversations:

Given the large enrollment losses, issuer exits are likely, which should put further downward pressure on enrollment and upward pressure on premiums, potentially exacerbated by less competition.

Now, on top of the issues the OBBB presents for the market in 2026, it appears the exchanges are already facing critical issues around market morbidity in 2025. The combination of the two certainly indicates what appears to be in store for the ACA: Insurer market exists. Massive premium rate hikes. Shrinking and sicker populations of enrollees.

It is not hard to imagine a scenario where the viability of the ACA exchanges is in serious question in 2026. As noted in this Modern Healthcare article discussing the ACA market, uncertainty is at an all-time high in the ACA market. That is saying something when you consider the crisis the market was in back in 2017.

Stepping back, it is a stark reminder of how hard it is to operate an insurance business and why insurers have diversified so heavily over the past decade. While the general public perception of insurers seems to be that they’re raking in excess profits, I think it’s worth asking is this actually a business you’d want to be in yourself? Here is a public company that is blindsided six months into the year, learning that almost 50% of its expected profits for the year have evaporated as a result of risk adjustment. How do you operate a business like that? Mind you that in good years, you’re talking a profit margin of a few percent to begin with. It’s not hard to envision a scenario where there are more market exits moving forward.

It’s shaping up to be another interesting earnings season for the payers. In particular, it’ll be worth watching how Oscar Health navigates all this given its exposure to the ACA as its single line of business.

MEDICARE ADVANTAGE

The Villages Health enters bankruptcy after self-disclosing $350+ million in overpayments from CMS, CenterWell bids to purchase assets

The Villages Health (“TVH”) announced on July 3rd that it has filed for bankruptcy and that Humana’s CenterWell has placed a bid to acquire the assets of TVH. Per the asset purchase agreement, CenterWell will be paying $50 million in cash, plus transferred contracts, plus assumed liabilities. TVH appears to have virtually no meaningful liabilities outside of the $361 million due to the federal government and a $39 million credit facility from a lender that appears to be owned by TVH insiders. TVH currently sees 55,000 patients, most of which are Medicare Advantage. We were trying to do the numbers on the valuation per acquired life in Slack this week, and it seems like it will net out in the low thousands per member — i.e. $50 million / 55,000 would imply $909 per member. It seems like the enterprise value will end up slightly north of $50 million though, putting the valuation just higher than that.

While technically TVH is open to other bidders as part of the bankruptcy process, it appears everyone involved thinks the CenterWell acquisition is a done deal — i.e. see Latham and Watkins announcing on LinkedIn that it advised CenterWell on its acquisition of TVH. It’s a bit odd to see lawyers talking publicly about a transaction as a done deal when that company is still in the middle of an auction process.

The bankruptcy documents note that TVH has been facing financial pressures and attempting to sell the business going back at least three years, when it originally engaged Evercore as an investment bank in 2022. CenterWell had signed a term sheet in April 2024 to acquire TVH (a stock purchase not an asset purchase), before this upcoding issue was apparently discovered in August 2024. TVH self-disclosed the issue to the OIG in December 2024 and notified patients at that time.

While the specific coding issue wasn’t identified in the bankruptcy documents as far as I can tell, TVH noted it was submitting codes that were not clinically validated and was making retrospective adjustments to codes beyond 90 days that were inconsistent with CMS guidelines. These coding practices must have been pretty widespread at TVH — by my math it appears that the $361 million liability is roughly 15% of TVH’s revenue during the 2020 - 2024 period that it reported this was ongoing.

The math: TVH reported $485 million in revenue in 2024 per the bankruptcy filings. If you assume revenue was flat during the period, that means TVH did $2.425 billion in revenue from 2020 - 2024. $361 / $2,425 = ~15%

✍ Going Deeper

The transaction here seems like a sign of the times in the VBC Medicare Advantage market. It’s worth going back in time to 2020 — in that era, Bright Health had just acquired Brand New Day, a California-based Medicare Advantage plan, for roughly $15,000 per member. Clover was going through the SPAC process at a valuation around $65,000 per member. Fast forward five years and you have TVH selling for something closer to $1,000 per Medicare Advantage life to avoid bankruptcy. What a long strange trip its been.

Nonetheless, it is confusing to me that TVH and CenterWell both appear so confident that no other buyer will emerge before bids are due on August 20th. Just conceptually, if I think about why the VBC Medicare Advantage thesis should work, TVH seems like the best positioned asset I could possibly imagine in that market. Providing value-based primary care to a captive population like The Villages seems like a no-brainer, right? And particularly if the government liability doesn’t transfer via an asset purchase, I’d think you’d at least have a few entities bidding here, no?

The whole timeline here strikes me as a bit odd. The fact that TVH has had Evercore engaged for three years seems telling that TVH was not in a rush to get here. Then all of a sudden you have a bankruptcy filing on a holiday seemingly trying to avoid the news cycle while positioning the deal as done despite an upcoming auction process. Beyond the obvious incentive of trying to avoid a massive payment to the government, why the rush here to fire sale these assets now versus letting the process play out? Is the government really just going to let TVH off the hook for this upcoding issue because of some astute legal maneuvering by TVH and CenterWell here? It all has me a little confused.

Microsoft’s research prompts a discussion about AI and “medical superintelligence”

Microsoft’s AI team caused a kerfluffle before the 4th, publishing new research in a blog post titled “The Path to Medical Superintelligence”. Perhaps not surprisingly given a title like that, the work invited a large amount of pushback from the medical community online. The criticism was highlighted well in this Stat article, which I’d summarize in two parts:

Complex cases like the NEJM cases chosen for the research are not normal medical practice

Providers were hamstrung in the exercise by not being able to use reference resources they typically use in day-to-day work

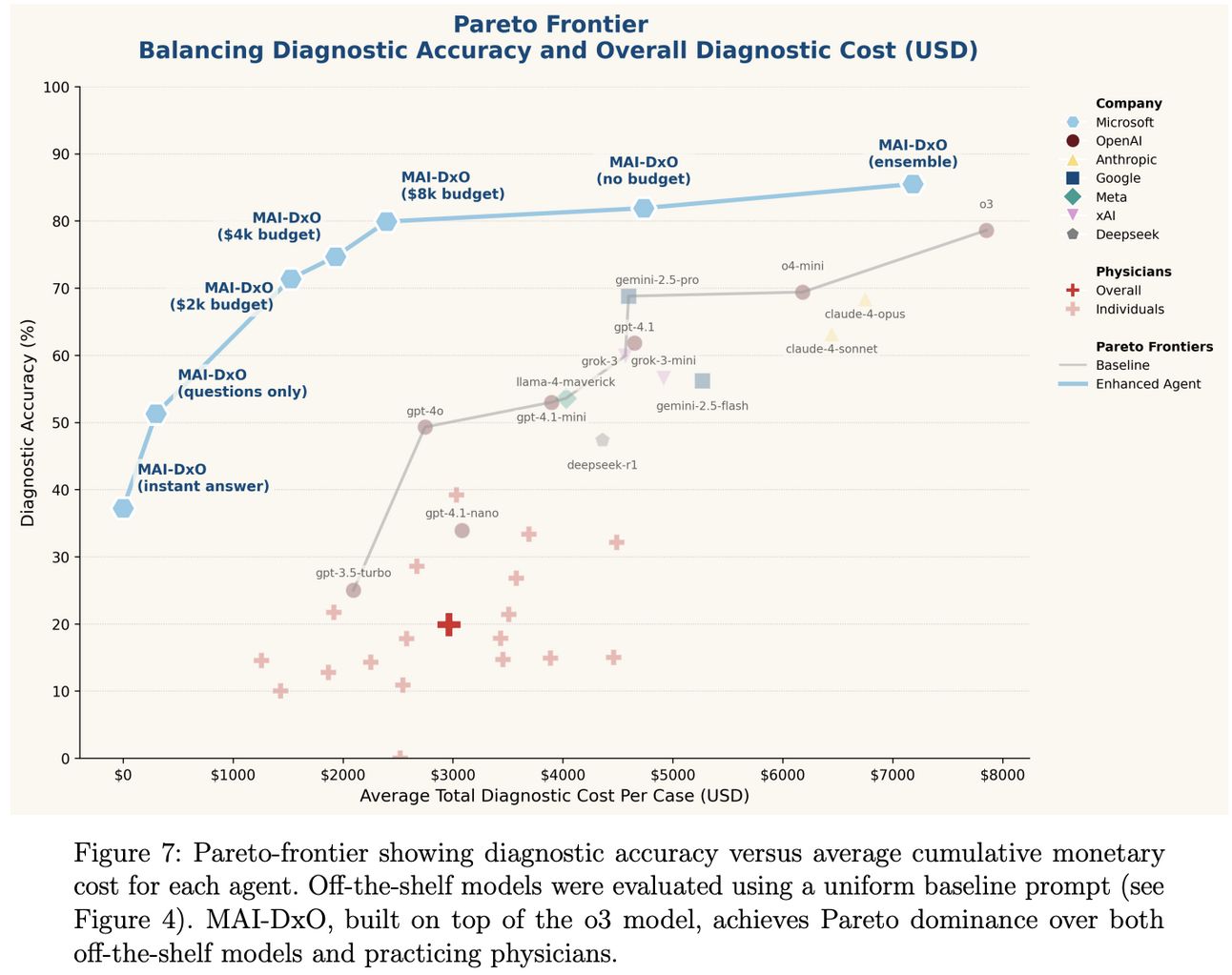

This chart highlights the takeaways from the work, which in part is notable because of the cost estimates it applies to these diagnoses:

The criticism of the work does seem valid, but for me it also doesn’t take away from the work itself. While much of the criticism centers around the notion that the AI performance is overblown and that AI won’t be replacing doctors anytime soon, it actually seems like the Microsoft team agrees with that. Check out this Q&A from the Microsoft blog post:

I think the Microsoft team absolutely has it right in suggesting that AI will be a complement to doctors, rather than replacing doctors. For the folks who think that AI will indeed replace doctors, I think this research actually presents a really good case study in why that seems far-fetched to me. It has less to do with technological capabilities of AI and more the human side — and specifically the PR battle — associated with all this change.

I think this recent NYTimes article talking about how the Mayo Clinic radiology department has grown by leveraging AI provides a good example of how we should expect providers and AI to co-exist in the coming years (and who will benefit from that change). While thinking of AI as the next generation of clinical decision support is not as headline grabbing as the idea of medical superintelligence, it does seem like the path this is all headed down.

Other Top Headlines

This Washington Post article highlights the efforts of a two-year investigation dubbed Operation Gold Rush, which revealed an elaborate medical fraud scheme involving individuals buying small companies with Medicare contracts and using them to fraudulently bill for urinary catheters and other DME. The story includes examples of companies like Priority 1 Medical Billing, a front in Bowling Green, Kentucky that was purchased for $200k in early 2024. Priority 1 was then used to bill Medicare for $667 million as it falsely claimed to provide catheters and glucose monitors to 50,000 Medicare beneficiaries. Officials estimated that they were able to stop roughly $10 billion in fraudulent Medicare payments, but the conspirators still collected ~$1 billion from other insurers.

KPMG and Hippocratic AI announced a new partnership where it appears KPMG will do consulting work with provider organizations to identify opportunities for Hippocratic AI’s agents to help augment existing workforce with AI. Nothing screams healthcare innovation quite like big consulting firms identifying opportunities for AI agents, right?

In a big exit in the VBC analytics market, Nordic Capital announced it is acquiring a majority stake in Arcadia, a population health and analytics company that works with payers, providers, and ACOs. Terms weren’t disclosed.

Walgreens shareholders voted to approve Sycamore Partners $10 billion deal, expected to close later in 2025.

Commure and Canopy announced a new strategic partnership in what appears to be a rather amicable resolution to the legal battle between the two parties over Commure’s Strongline product offering, a panic button for clinical staff. It appears that Canopy will essentially be taking over operations of Strongline moving forward, ending the stalemate between the two organizations. Back in May, Business Insider reported on how Commure was ordered to stop selling Strongline, which was reportedly Commure’s only growing product when it merged with Athelas at a $6 billion valuation in late 2023.

Mayo Clinic announced a $50 million philanthropic gift to support Mayo Clinic’s Innovation Exchange, a marketplace connecting innovators with Mayo Clinic expertise.

Samsung acquired Xealth, a digital health platform that embeds third-party digital health tools into provider workflows via EHR integration. Xealth was the first spin out of Providence Health back in 2017 with the idea that providers could prescribe apps like they could medications. It’s an interesting move by Samsung, indicating its ambition to build a connected care platform.

Rush Health is partnering with Fabric Health to launch Rush Connect+, a DTC telehealth product. Members will pay $19 per month for access to 24/7 virtual urgent care nationally.

Healthline Media agreed to a $1.55 million settlement with the State of California over deceptive advertising tied to sponsored content.

CVS Health’s Omnicare subsidiary will pay $948 million in a False Claims Act settlement to resolve allegations of dispensing prescriptions without valid physician orders, among other violations. The case stems from whistleblower complaints dating back years, and the nearly $1 billion penalty puts it among the largest ever under the False Claims Act.

Lorient Capital, a healthcare investment firm, closed a $500 million fund to invest in healthcare companies.

Funding Announcements

Phil, a software platform that helps pharma companies drive access to and commercial success of speciality medication, raised $60 million.

Vytalize Health, a VBC enablement platform for providers, raised $55 million. The Axios report noted that Vytalize turned profitable this year, projecting to generate $40 million of EBITDA on ~$3 billion of revenue. It expects to use the funding to pursue acquisitions.

Circulate Health, a startup offering a plasma exchange therapy for the longevity market, raised $12 million.

What I’m Reading

The Vertical Review: Voice AI in Healthcare by Euclid Insights

A solid Q1 roundup on voice AI in healthcare, with $2.7 billion raised across 150+ deals. Read more

H1 2025 market overview: Proof in the pudding by Rock Health

The Rock Health crew shared data from the first half of 2025, highlighting among other things the buzz around AI funding. Read more

What WISeR Gets Right About Medicare Reform by David Ohta

A really helpful breakdown of CMS’s new WISeR model, which brings prior auth into Original Medicare using AI and machine learning. Ohta makes the case that this one might actually work, since it’s targeting a few very specific, high-waste areas like skin substitutes and knee arthroscopies. It seems like a CMMI model that feels both focused and operationally doable. Read more

How Public Health Discredited Itself by John Tierney

A rather thought provoking piece in The Atlantic, arguing that public health has become increasingly politicized and needs to return to original principles in order to restore trust. Read more

VC-Backable TAM in Healthtech: Challengers and Enablers by Julie Yoo

This lays out a helpful framework for how to think about venture-scale outcomes in healthcare innovation and how both “challenger” (companies that take on incumbents directly) and “enabler” (companies that provide infrastructure) models are needed in the ecosystem. Read more

Transforming Employer Health Benefits: Large Employers’ Activist Role by a team at McKinsey

This McKinsey piece looks at how large employers are getting more hands-on with their benefits strategies, integrating navigation, shifting toward outcomes-based contracting, and trying to move past the one-off point solution mess. Read more

High-cost claim and Injectable Drug Trends Analysis by Sun Life

Sun Life’s stop-loss data provides a helpful window into where employer-sponsored plans are feeling pressure. The latest report shows continued growth in high-cost injectable drug claims, especially from specialty and cell and gene therapies. Read more

The Rise of Healthcare Jobs by The New York Times

An interactive breakdown of how healthcare has become the fastest growing sector in the U.S. labor market since 2020 with strong gains in roles like nursing and home health aids and slower growth in other areas like support staff and technicians. Read more

Featured Jobs

Vice President, Government Relations - DC Office at Kaiser Permanente, an integrated healthcare provider and health paln. Learn more

$390k - $440k | Washington DC

Director of AI Transformation, Remote at Aledade, a VBC enablement platform for PCPs. Learn more

$NA | Remote

Director of Product Management – AI & Healthcare Innovation at Evolent, a specialty care management platform. Learn more

$130k - $160k | Remote

Contact us to feature roles in our newsletter.

Want to share feedback with us?

Show your support by sharing our newsletter and earn rewards for your referrals!