👋 Hey all! Kevin here. Welcome to this edition of my free weekly newsletter, where I discuss the key healthcare innovation news from the past week.

This week’s edition is only being posted to our website, although I anticipate we’ll be back to sending to your inbox next week (or maybe the following). Omada’s IPO was the big positive news of the week, marketing the second successful health tech public offering over in past few weeks. In the Medicare Advantage market, the challenging headwinds continue as Congress potentially seeks to cut upcoding in an effort to past the big beautiful bill. It seems as though change is inevitable there, but, as always, it’ll be curious to watch how the political process plays out from here.

Happy Sunday!

Kevin

PUBLIC MARKETS

Omada Health successfully completes its IPO

Omada joined Hinge in successfully entering the public markets on Friday. After pricing its IPO at $19 per share on Thursday, it went public Friday AM at $23 a share. Don’t ask me to explain the mechanics of how the stock went up $4 per share between the pricing of the IPO and Thursday evening and it starting trading on Friday AM. It traded up to around $28 during the day before closing back around $23 at the end of the day on Friday. This means both Omada and Hinge are trading above their IPO pricing ranges at the moment, which seems like a great outcome for the broader health tech startup ecosystem.

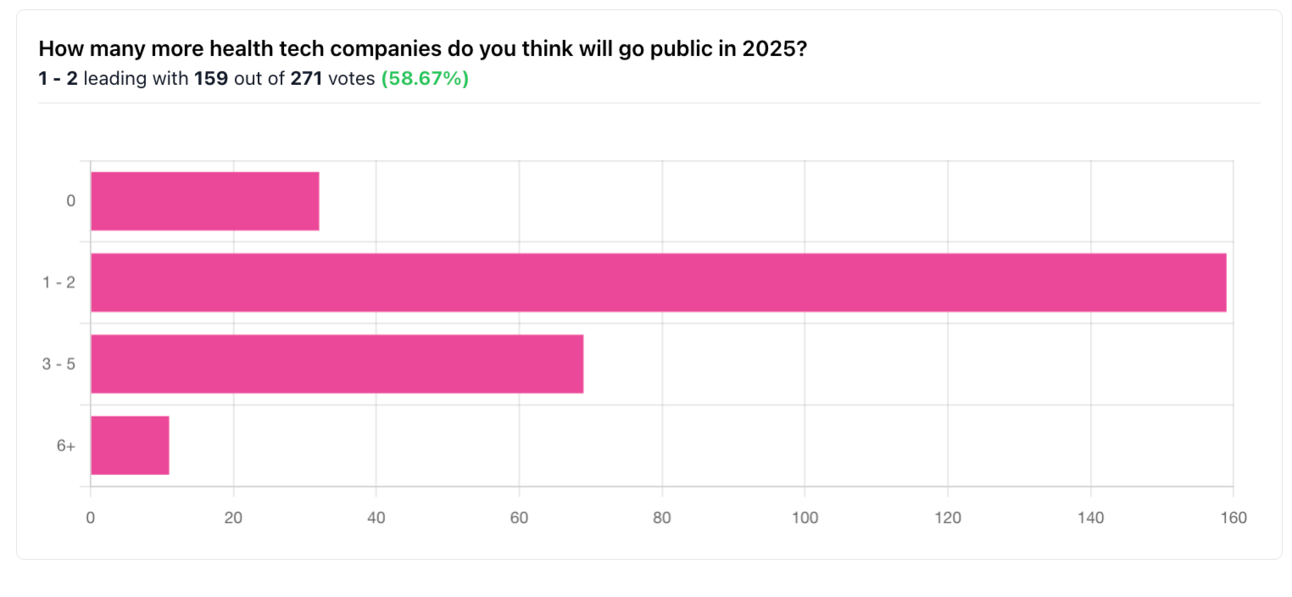

Given the success of the Omada and Hinge IPOs, I’d have to imagine every late stage private health tech Board is talking to banks about whether now is the window to go public. Given that, it’s interesting to see the results from the poll I put in the newsletter last week — most of the 271 NL readers who responded this week think that only 1-2 more health tech companies will go public this year:

Source: HTN Newsletter Poll

Personally, I was surprised to see 1 - 2 as the dominant choice. Given the general sense that there has been a backlog of companies waiting for the IPO window to open, now that the window appears to be open, I’d think we’d see a number of fast-follows. My response would be 3 - 5, given the backlog of companies. If you go back to the private company presentations at JP Morgan’s Healthcare conference from earlier this year, there’s a pretty clear list of companies that would make sense as potential IPO candidates, and I’d have to imagine we’ll see public S-1 filings from at least two companies in the next six months.

For many of these private companies, it’ll be interesting to watch if they do choose to go public now that the window appears open. If not, I think it is interesting to think about why not, particularly in an environment where many of their early investors are potentially past typical private investment hold periods, and almost certainly have LPs seeking liquidity. If you’re not going public now, what is the liquidity event for those investors you’re waiting on? I imagine that in some cases those companies are not going public because of challenging business dynamics, i.e. profitability or growth aren’t where these businesses feel that they can go public. In other cases, I could see sector specific headwinds playing a role in the decision, i.e. challenges in the value-based care market. But I would think that if the company profile and market dynamics are favorable, you’re at least working on an S-1 filing at the moment.

MEDICARE ADVANTAGE

Congress looks to add Medicare to BBB cuts in effort to pass bill; Humana and UHG propose risk adjustment changes

On Thursday, Politico reported that Medicare is potentially going to be added to the list of topics on the cutting block as part of Republican efforts to get the Big Beautiful Bill through Congress. The Republican party line feels similar to Medicaid cut conversations over the past several weeks — Republicans are ok with cutting dollars to these programs as long as they are focused on fraud, waste, and abuse, even if nobody knows exactly how to articulate specifically what that phrase means. Reports note a proposal from Senator Bill Cassidy (R-LA) is apparently drawing bi-partisan support — I assume the proposal is either Cassidy’s proposed No UPCODE ACT legislation, or something very similar, although have not seen that confirmed specifically. This quote from Senator Kevin Cramer (R-ND) seemingly sums up the whack-a-mole sentiment in DC at the moment:

“There’s a legitimate debate about, ‘Can we do more with Medicaid? Are we doing too much with Medicaid? How much waste, fraud and abuse is there in Medicare? Why don’t we go after that?’ I think we should”

Also on Thursday, the WSJ reported that Humana apparently shared with Congressional staffers that it would be ok with limiting risk adjustment payments associated with home health visits, after working on potential ideas for reform for the last six months. UHG followed suit on Thursday, recommending to Congress that diagnoses identified in home health visits need to be confirmed by a non-home health provider within 18 months.

Other Top Headlines

CMS hosted an in-person listening session this week, discussing its recently released RFI. CMS shared it plans to move forward five key initiatives, which includes an interoperable national provider directory among other efforts. This quote from Brendan Keeler in the Endpoints newsletter on Thursday seems to sum up the energy well: “It was frantic, last-minute, and rough around the edges — and all those things sound negative, but they’re not,” attendee Brendan Keeler, who leads the interoperability practice at consultancy HTD Health, told me. “To me, it was like, this is what they’re going to do the entire administration, which is not wait for perfection and full consensus to make progress because they realize alignment is fleeting.”

While annual shareholder meetings usually include very little in terms of interesting strategic business updates, UHG’s meeting on Monday was notable as it marked Steven Hemsley’s second time speaking to investors publicly after returning to the CEO role. It’s worth paying attention to the comments he made about how the organization is seeking to earn back the trust and confidence of investors. Specifically, Hemsley called out two core efforts around improving UHC’s pricing discipline and driving consistent performance at Optum Health, while also recognizing that UHG is implementing a review of all practices and processes around risk assessment, managed care practices, and pharmacy services.

Per Bloomberg, Ascension is in advanced talks to acquire AmSurg for $3.9 billion. AmSurg operates 250 ambulatory surgery centers, after emerging from the Envision Healthcare bankruptcy in 2023. AmSurg purchased the 250 ASCs from Envision as part of that restructuring process for $300 million plus a waiver of intercompany loans. Envision previously was acquired by private equity firm KKR in 2018 via a leveraged buyout that valued the Envision business at $9.9 billion.

Data analytics platform H1 announced the acquisition of Veda Data Solutions, a provider data platform. Both Veda and H1’s recent acquisition of Ribbon will expand H1’s capabilities supporting health plans in managing provider information. Veda had raised $45 million Health acquired Veda as it continues to build out its data automation solutions - financials of acquisition were not disclosed (that I can see). Veda had raised $53 million in capital, including a $45 million Series B led by Oak HC/FT in 2021.

Hims & Hers announced it is acquiring ZAVA, a telehealth platform with 1.3+ million customers primarily in Europe. It’s a 100% cash acquisition funded by Hims cash on hand, and Hims expects the deal to be accretive in 2026.

Quantum Health announced it is acquiring Embold Health. Embold will expand Quantum’s AI product offering for employee health benefits navigation.

Pyx Health announced the purchase of FarmboxRx, along with a $47.5 million strategic investment it used to fund the purchase.

Sutter Health received a $110 million gift, the largest in the history of the health system, which it will use to expand access in Northern California.

Aveanna Healthcare acquired Thrive Skilled Pediatric Care for $75 million. Thrive offers pediatric home care services across 23 locations in seven states.

JAMA (the Journal of the American Medical Association) partnered with OpenEvidence for all JAMA content to be used to inform answers on the OpenEvidence platform.

Stat of the Week

10.9 million

The non-partisan Congressional Budget Office (CBO) released a report estimating that 10.9 million Americans would become uninsured over the next decade, primarily due to Medicaid and ACA cuts.

Chart of the Week

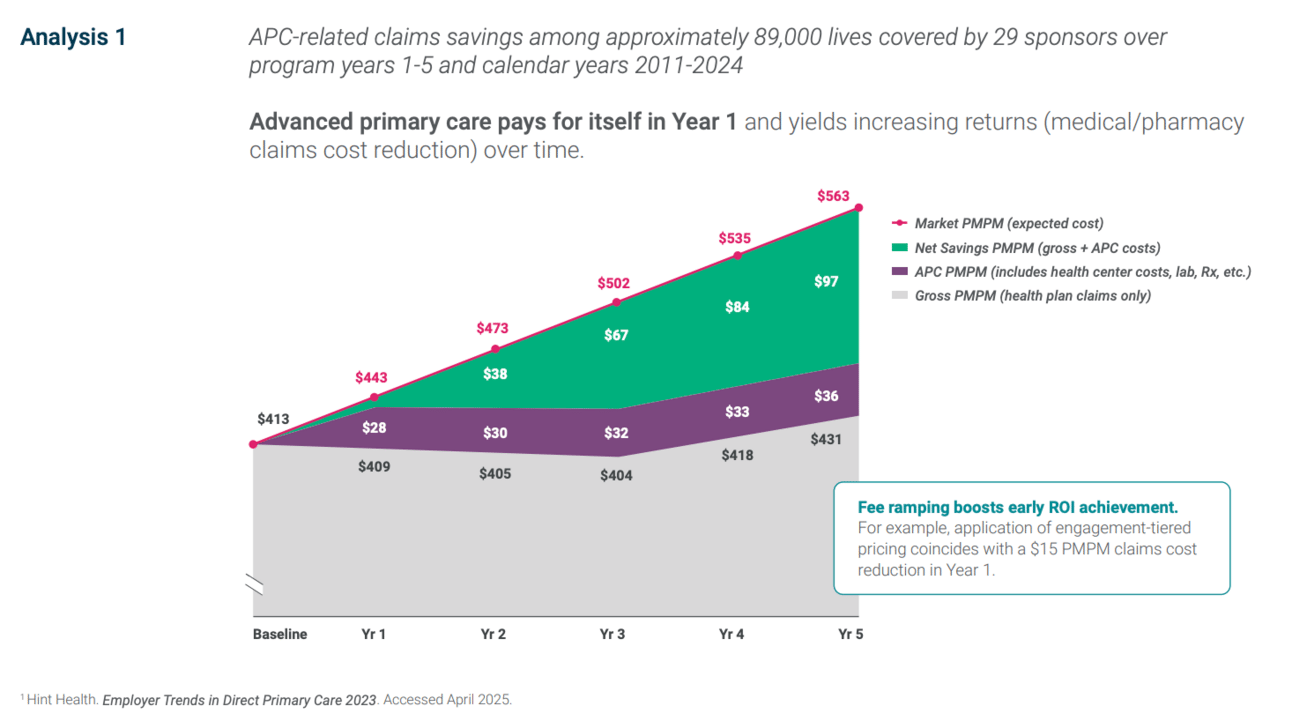

Marathon Health makes the case in a new white paper that its Advanced Primary Care model drives claims savings in year 1, and a 3.7x return on investment by year 5, as seen in the chart below:

Long time readers of HTN will remember that I’m pretty skeptical these savings are actually there in commercial models, but interesting to look at the case Marathon makes here nonetheless. If employers are indeed seeing these levels of savings from APC models, I’m not sure why every employer in America isn’t offering this to employees.

Funding Announcements

MyLaurel announced earlier this week it raised $12 million from Deerfield and GV to grow its hospital-at-home program, with the press release noting that this capital will support expansion via its partnership with Oschner and also growing in other existing and new markets.

It's interesting to see this news coming on the heels of Best Buy’s earnings report the other day about needing to restructure the Current Health business given the challenges around slow provider partnership growth. It would seem given this funding that MyLaurel is seeing more success here; will be worth keeping an eye on how this market evolves.

Canid, a vaccine management platform for pediatricians, raised $10 million.

Aeon, a Swiss-based Ai-powered whole body MRI checkup, raised €8.2 million.

ArcheHealth, an AI platform for hospital supply chain management, raised $6.7 million.

Amperos Health, an AI billing platform helping providers with claims collection, raised $4.2 million in seed funding.

Salvo Health, a digital health company focused on digestive and metabolic conditions, raised $4 million.

What I’m Reading

Chasing Big Money With the Health-Care Hustlers of South Florida by Zeke Faux and Zachary Mider

This Bloomberg article takes the cake for the wildest healthcare story I’ve read in 2025, and probably longer than that. It tells the story of the shenanigans that happen in the South Florida ACA broker market, focused on Enhance Health. As I shared in Slack this week, the most interesting part of this piece is the role that Bain Capital played in funding and launching this business. Seems like there were a lot of very bright red flags they missed along the way here. Read more

Medicare Site-Neutral Payment Policies: Effects Of Proposals On Hospitals And Beneficiary Groups by Multiple Authors

This article in Health Affairs looks at the effects of three different potential site-neutral payment policies, finding that annual Medicare payments could be reduced between $212 million to $7.36 billion, depending on the scope of the legislation. Read more

Make American Health Care Affordable Again by Larry Levitt

Levitt, KFF’s EVP for Health Policy, argues in JAMA Forum that the administration should spend more time addressing healthcare prices, in addition to the energy it is spending on MAHA, particularly with potential cuts to federal funding likely making healthcare less affordable for many in this country. Read more

Ambient Scribes: A Reasonable Bet, With Conditions by David Ohta

A clear-eyed view looking at the investment opportunity for AI scribes, why recent valuations might make sense as a wedge into adjacent opportunities, and some of the challenges ahead. Read more

Ohio’s Cleveland Clinic faces questions over booming subsidies by Mary Schladen

A good look at how the Cleveland Clinic has benefitted from the 340B program, highlighting how it received almost $1 billion between 2020 and 2023., according to this recent Senate committee report. Cleveland Clinic did not pass on any of those savings directly to patients because the statute doesn’t require that. Read more

The Dizzying Rise of MAHA Warrior Calley Means, RFK Jr.’s Right-Hand Man by Katherine Eban

A fascinating, and long, article in Vanity Fair exploring Calley Means’ rise to prominence driving the MAHA movement. Read more

Featured Jobs

VP, National Medicaid Finance at Kaiser Permanente, a managed care payer / provider. Learn more.

$297k - $371k | Oakland, CA

Director, Primary Care Consulting Portfolio (New York/Tri-state area) at Primary Care Development Corporation, a non-profit supporting primary care access. Learn more.

$150k - $165k | NYC

Partner Operations Director at Abridge, an AI platform for providers. Learn more.

$153.5k - $170.5k | Remote

Director, Revenue Operations at UniteUs, a social determinants of health platform. Learn more.

$140k - $160k | Remote

Director of Clinical Operations Transformation at Hazel Health, a virtual provider of school-based healthcare services. Learn more.

$150k - $175k | Remote

Contact us to feature roles in our newsletter.

Want to share feedback with us?

Show your support by sharing our newsletter and earn rewards for your referrals!