This week's newsletter is sponsored by: Behavioral Health Tech

Register today for Behavioral Health Tech 2024 (Nov 5-7 in Phoenix), an impactful annual conference for innovation in behavioral health. It’s put on by some awesome folks in our community and we’ve only heard good things.

Bringing together 1,200+ leaders from payors, providers, digital health cos, and benefits consultants, BHT 2024 offers valuable insights, actionable learnings, and meaningful connections.

HTN readers get $200 off registration with code HTNBHT24 but tickets go fast (it sold out last year) so we recommend securing your spot soon.

If you're interested in sponsoring the newsletter, let us know here.

Top News

Sharing our perspective on the news, opinions, and data that made us think the most this week

Walmart exits its Walmart Health clinic and virtual care businesses

Summary:

Walmart announced it is closing Walmart Health’s 51 clinics and Walmart Health Virtual Care after determining that “there is not a sustainable business model”. Walmart Health launched back in 2019 with the goal of becoming “America’s Neighborhood Health Destination”. Only a year ago, Walmart anticipated having 75 clinics open at the end of 2024:

Going Deeper:

I’m not sure I can recall a single piece of healthcare news with more public reactions over the course of a week than this Walmart news. The general takeaways across all of those takes seem to be as follows:

It’s disappointing Walmart wasn’t able to execute on its vision given the impact it could have on rural and underserved communities

Operating care delivery businesses is challenging, particularly when you’re used to running a retail business

Given this is Walmart’s fifth failed attempt at entering care delivery, the outcome probably shouldn’t be a surprise here

Those three points seem like they encompass the breadth of learnings here well. Between the news of Walmart’s closure and Optum shutting down its telehealth unit last week, it certainly feels as though we are closing a chapter on telehealth innovation. Given the amount of coverage on this topic already, rather than rehashing that further I’ll link to some good reads / perspectives below. We’ll link to a number of the perspectives on this news below.

Links:

Advisory Board perspective on the announcement. A good summary of the news

Robby Knight’s LinkedIn post (ex-Walmart Health employee). Provides a good reminder of the myriad challenges the effort ran into over time

Christina Farr’s Second Opinion Post. Explores some of the challenges the telehealth business faced

CVS stock drops almost 20% on Medicare Advantage losses

Summary:

CVS missed Q1 revenue and earnings targets and also cut its full year 2024 profit target on Medicare Advantage losses. CVS had previously expected to break even on its Medicare Advantage business this year, shared that it now expects to lose $1.8 billion this year on MA and it is embarking on a 3 to 4 year margin recovery effort.

Going Deeper:

It’s worth remembering that during their Q4 2023 earnings call in February, CVS leadership suggested that its Medicare Advantage book of business would be “marginally profitable” in 2024. So within a three-month period, CVS leadership saw the Medicare Advantage book of business go from a 0% profit margin expectation to a -3% to -4% profit margin expectation for the year. On top of that, given the headwinds the business faces in 2025, CVS doesn’t expect to be able to get to profitability until 2026. Even with a meaningful pricing action in 2025, they expect to improve profitability by up to 2%, meaning they’ll be around -1% in 2025. By my math, that means CVS is looking to at least 2027 before it is back to its profitability target of 4% to 5%. All of that just goes to highlight how big of a miss this was here. Here were a few other takeaways on the miss:

MA spending in the quarter came in $900 million over expectations, and spending on outpatient, supplemental benefits, and inpatient all came in high. $500 million of that was seasonal, including respiratory and RSV costs. Inpatient, RSV vaccines, and other pharmacy benefits were all "new" pressures that emerged in Q1. Inpatient admits were up "high single digit" percentage YoY, meaningfully above expectations.

In supplemental benefits, CVS noted that its fitness benefit had very little to do with the cost pressures in Q1. Dental was cited a few times as a much bigger issue.

The MA pressure is on the entire book of business, they aren't noticing any particular adverse selection in newer members versus older members.

CVS wasn't very clear about Medicare Advantage membership targets for 2025. They did share they are contemplating leaving counties, and it sounds like they expect to have a membership reduction. The amount of the reduction will depend on competitor pricing decisions.

There was also a $400 million guidance reduction in healthcare services, the majority of that coming in healthcare delivery. Within healthcare delivery, the largest part of the reduction was from CVS Accountable Care, which is seeing a lower savings rate because of utilization.

There was not much discussion of the Oak Street clinic expansion strategy on the call. CVS did mention they're still planning to add 50 to 60 clinics in 2024, and that Aetna won't plan to exit counties that have an Oak Street presence.

Links:

Public Company Earnings Updates

A rundown of key earnings takeaways from the week

Alignment stock jumps 25%+ on Medicare Advantage outperformance

If you’re looking for an optimistic take on the Medicare Advantage insurance space, Alignment provides exactly that. They exceeded expectations in Q1, and seem confident they are well-positioned to outperform the market in 2025. It highlights the benefits of running a well-managed HMO plan in a limited set of geographies. Geographic expansion will be interesting to watch for Alignment moving forward - it appears it will enter new markets in 2026 with health system partners.

Links:

Cigna raises 2024 guidance after a strong quarter despite VillageMD writedown

Cigna’s earnings call was very focused on specialty benefits and the biosimilar market in particular. On the care delivery front, Cigna followed Walgreens in writing down its VillageMD investment, taking a $1.8 billion writedown on the investment in the quarter.

Links:

Charts

A visual or two we found helpful this week

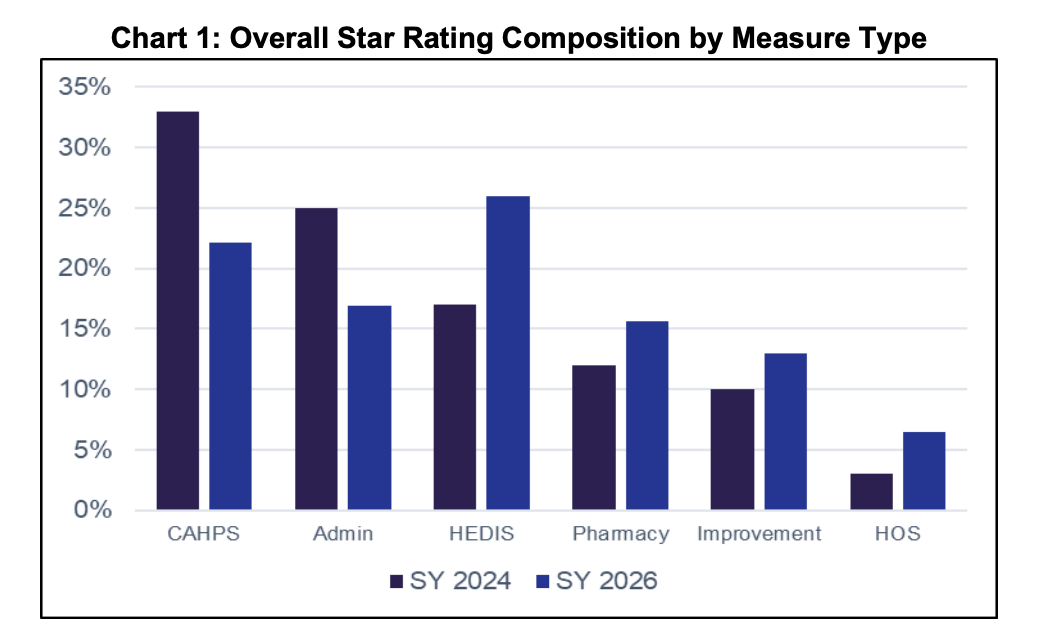

Wakely highlights the changes in Star ratings for the 2024 measurement year

This Wakely report does a nice job highlighting the changes to Star Ratings as they’re becoming harder to achieve. The chart above shows the changes in relative weights of various Star Rating components over time, with CAHPS declining and HEDIS rising.

Other News

A round-up of other newsworthy items

Aledade acquired Medical Advantage, a provider organization in Michigan. The acquisition will help Aledade grow from 35 physician partnerships in Michigan to 700. Link

UnitedHealth’s CEO Andrew Witty testified in front of the Senate Finance Committee on Wednesday regarding the Change Healthcare cyberattack. The 2.5 hour session meandered through some good challenging questions, some incoherent questions, and some political theater. Link

The most interesting takeaway from the session was Witty’s response to questions about UHG’s size, as he noted multiple times that United employs fewer than 10,000 physicians, and that another 80,000 physicians choose to affiliate with UHG.

CVS acquired Medicare Advantage brokerage Hella Health. Link

Pfizer is planning to launch a D2C service before the end of the year, similar to Eli Lilly’s LillyDirect model. Link

Funding

Notable startup financing rounds across the industry

Innovaccer, a data platform for value-based care, is in talks to raise $250 million at a $2.5 to $3 billion valuation. Kaiser is rumored to be among the lead investors according to TechCrunch. Link

Transcarent, Glen Tullman’s employer healthcare platform, raised $126 million at a $2.2 billion valuatoin. STAT reports that Transcarent had $100 million in the bank before the funding, and will use the capital at least in part to acquire companies with new customers. The article notes that Transcarent now has 300 customers representing 4 million employees. Link

SDoH platforms GroundGame.Health and SameSky Health merged and raised $17 million. Link

Trovo Health, a platform building AI assistants for clinicians, raised $15 million. Link

Livara Health (formerly SpineZone), a value-based care model for MSK, raised $15 million. Link

Piction Health, a virtual dermatology platform, raised $6 million. Link

Writers Guild

Thought-provoking posts from the broader healthcare community

What’s behind all these assessments of digital health? by Matthew Holt

This piece offers a good, critical perspective on the recent Peterson Health Technology Institute that panned digital diabetes solutions, building on Brian Dolan’s work questioning the one study chosen to evaluate clinical impact.

Navigating the Mental Health Tech Ecosystem: A Primer by Alex Muir

A nice market map and primer of startup activity in the mental health market.

Featured Jobs

Head of Revenue Cycle Management at Amae Health, a care model for serious mental illness.

Investment Associate, Healthcare (Pre-MBA) at B Capital, an investment firm.

Healthcare Innovations Specialist at Centene, a managed care organization.

Creative Operations Manager at Maven Clinic, a women’s health platform.

First Sales Hire at Photon Health, a platform that simplifies prescribing workflows.

Contact us to feature roles in our newsletter.