This week's newsletter is sponsored by: Blaze.tech

Blaze.tech is a no-code platform with in-house support and other valuable tools to help launch HIPAA-compliant apps 10x faster. Healthcare companies who use Blaze.tech have a 100% success rate in launching their apps.

What can you build with Blaze?

Tools that improve team productivity and streamline operations

Custom proprietary software that can be sold to healthcare customers

Apps that integrate with 30+ pre-built integrations or any API

And more!

If you have an app idea you’d like to get to the market or to your team faster, Blaze.tech is a great option.

If you're interested in sponsoring the newsletter, let us know here.

Public Company Investor Updates

A rundown of key investor-related events from the week

Payors and providers shared key strategic updates at the Bank of America healthcare conference

A number of incumbent payors (CVS, Humana, and UHC), health systems (HCA, Tenet), and newer public co’s (Alignment, Astrana, Clover, Oscar) discussed strategic updates at the Bank of America conference this week. I followed along with the nine sessions above and wrote up some of the key points each company brought up. Here’s a brief version of the summary takeaways:

Is Medicare Advantage cost trend potentially coming back to earth? Early indications from payors in Q1 2024 make it seem like it might be, which could give payors some financial cushion later this year.

Is UHG positioned to take more MA share without chasing growth? With Humana and CVS indicating they could each potentially lose sizable chunks of their MA membership, UHG could stand to grow substantially.

The inpatient hospital sentiment: “rumors of my death are exaggerated”. That was the quote HCA’s CEO used to describe the state of the business. HCA and Tenet both projected confident growth strategies moving forward.

Clover and Oscar pursuing SaaS growth strategies. Both make good enough sense in theory, but both also have had enough hiccups that they’re going to be in “prove it” mode for a while to demonstrate the commercial viability of their software platforms.

What’s in the water in California? Alignment and Astrana both seem very bullish on their Medicare Advantage opportunities in 2024 and 2025, very different from the rest of the industry.

If you want to go deeper into the takeaways, or check out the individual company write-ups, check out the writeup we published on Friday below (for HTN members only):

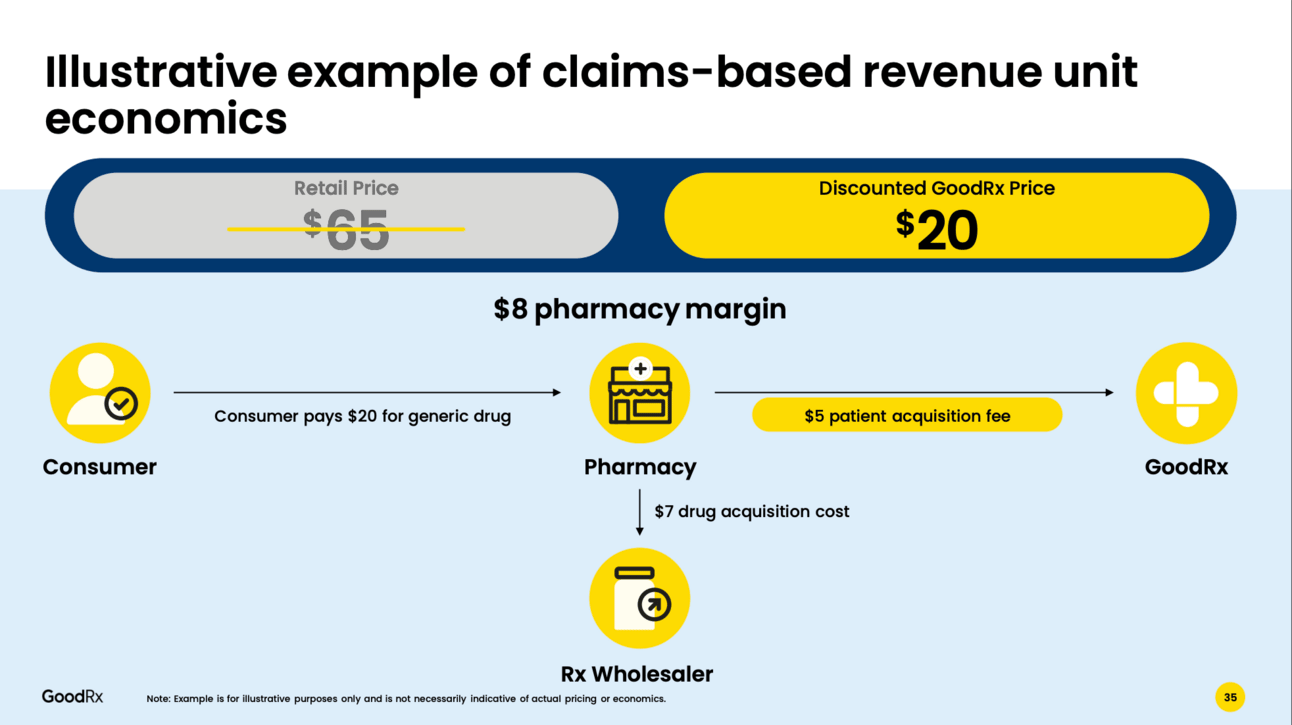

GoodRx’s Investor Day

I spent more time this week focused on the BofA presentation so I haven’t dug deep into the GoodRx Investor Day yet, but even perusing the slides is a helpful activity if you’re trying to understand the GoodRx model. They do a nice job articulating the various components of the business. For instance, see the slide below describing the dollar flows for GoodRx’s claims-based revenue model, which is the majority of revenue for GoodRx:

Links:

Charts

Compelling visuals that help convey data, trends, or topics

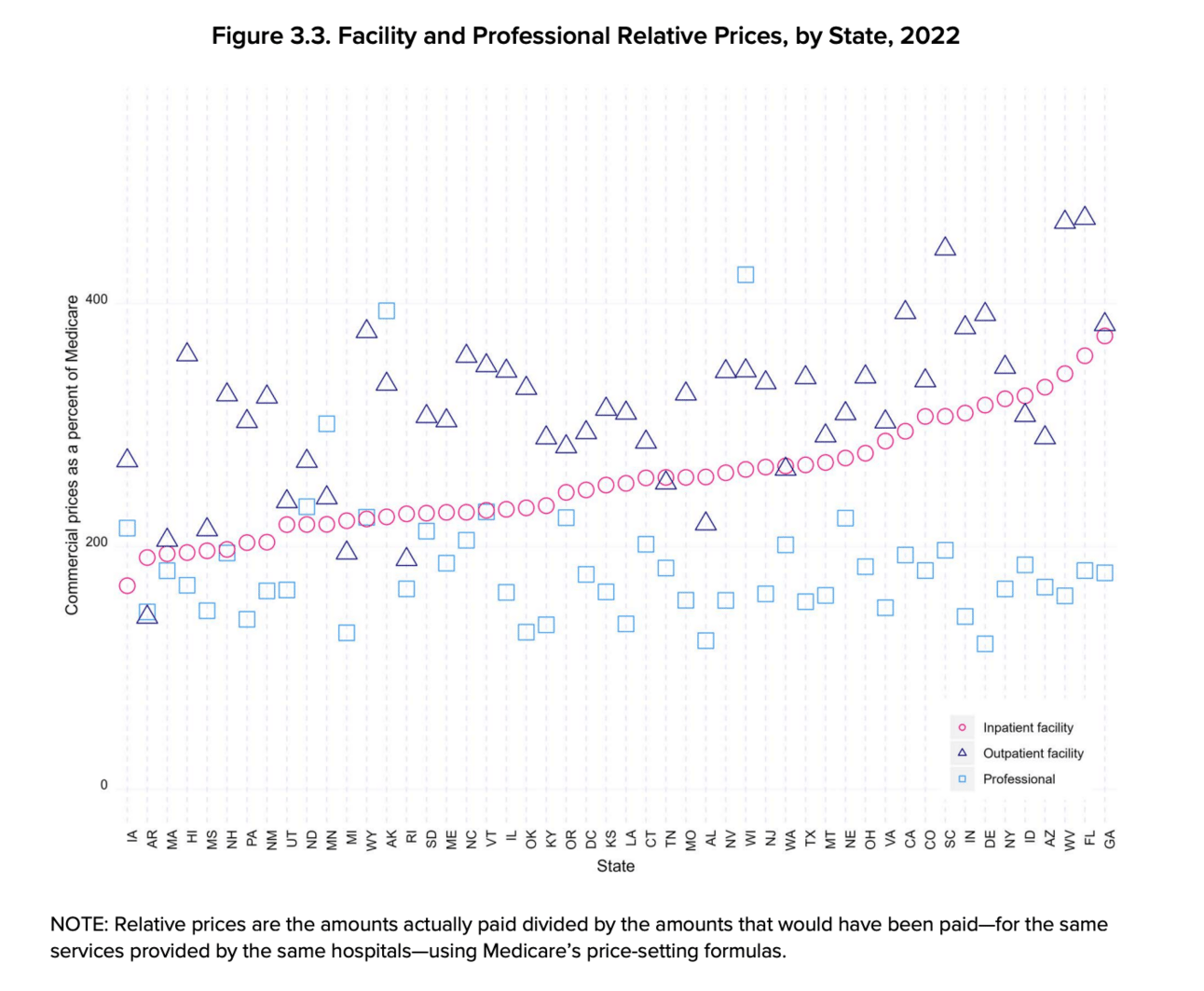

Rand data on what hospitals are paid by employers by state

The latest data from Rand presents and interesting view into what hospitals are paid by employers. The chart above, which displays commercial rate as a % of Medicare by state, highlights the variability across states and also the differences between the prices of inpatient facility, outpatient facility, and professional rates compared to Medicare. Seven states had relative prices above 300% of Medicare.

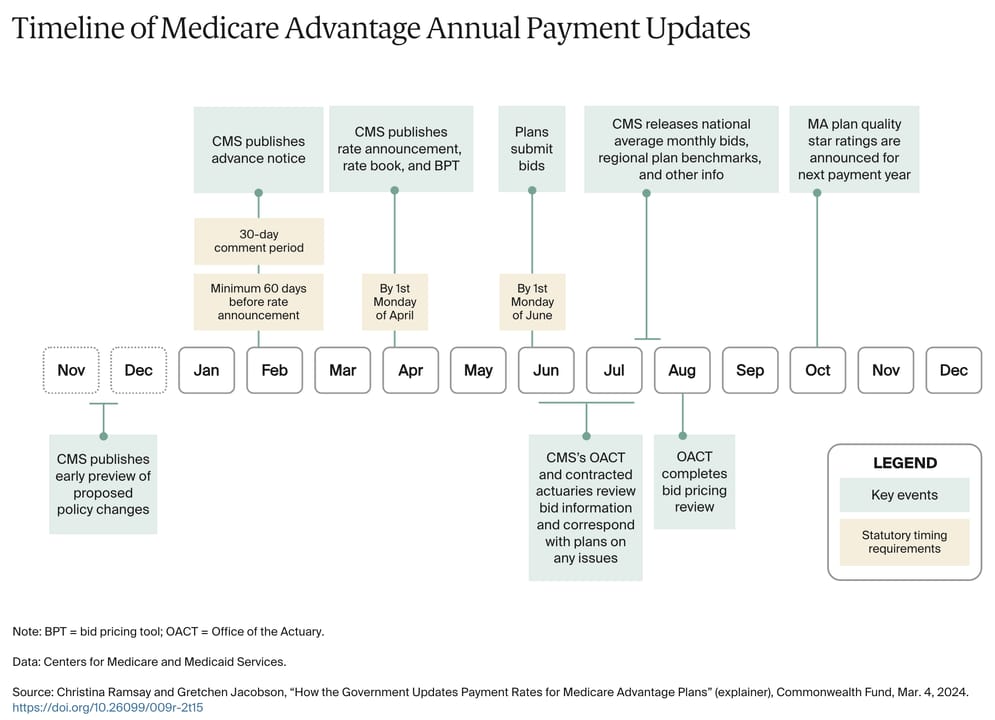

The Medicare Advantage pricing process timeline

We get asked regularly about the timeline for Medicare Advantage bids. I thought this was a nice visual of the timeline, along with a helpful overview of the process from Adam Solomon on LinkedIn.

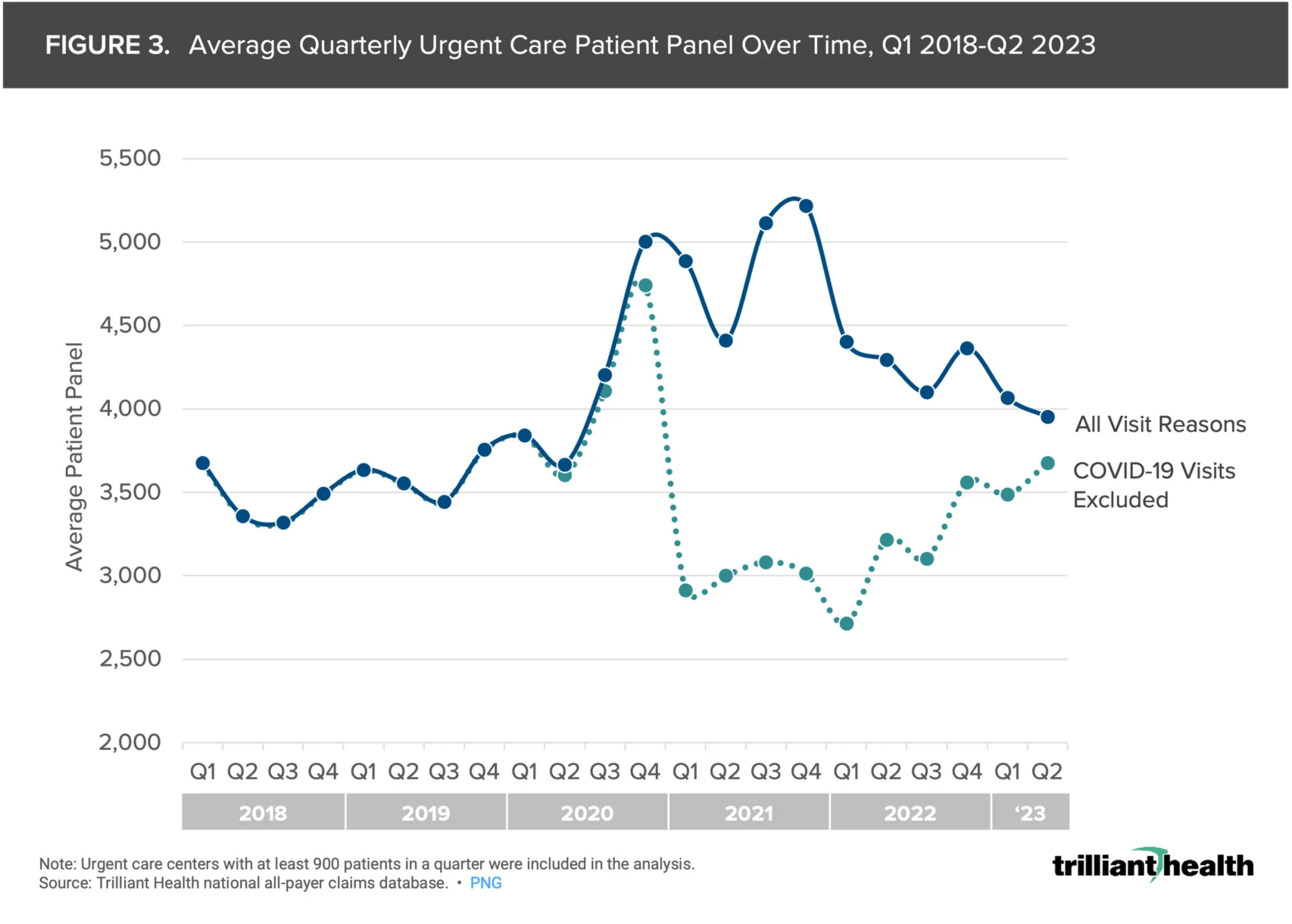

A look at the shifts in urgent care utilization over the past five years

Sanjula Jain published another excellent report looking at the changing urgent care market landscape over the past several years. The chart above highlights how visits spiked during COVID as a result of COVID-19 volume, but has been reverting back to pre-pandemic levels over the past few quarters.

Other News

A round-up of other newsworthy items

A judge dismissed the FTC’s antitrust case against Welsh Carson for its role in US Anesthesia Partners (USAP). The case against USAP was not dismissed and will proceed. The court memo makes for an interesting read, for a few reasons:

In the original complaint, there were a number of redacted sections regarding an anticompetitive market allocation agreement with an anesthesia competitor. In this memo, the Judge shared that agreement involved USAP paying Envision Healthcare a sum of $9 million to not enter the Dallas market for five years. USAP wanted to pay Envision to not enter the Texas market entirely. Maybe it’s just me, but paying a competitor $9 million to sit on the sidelines in a market so that you can jack up prices because you’re the only game in town seems like a problem.

The case gets into a lot of legal discussion of other cases interpreting antitrust law. The conversation specific to Welsh Carson revolves around whether Welsh Carson can commit an antitrust violation with a minority stake in a business. The answer generally seems to be no according to this Judge, which seems like a nice early win for the private equity industry.

The Judge seemed much more skeptical of USAP’s arguments than Welsh Carson’s. At various points the Judge’s tone feels almost derisive in response to USAP’s arguments — seemingly the judge did not think very highly of any of the arguments made. Reading the response to the tone seems as if there’s a real chance USAP loses the case to the FTC. Ultimately, if that comes to fruition, this still feels like a loss overall for private equity as it becomes that much harder to deploy the playbook behind USAP.

Transcarent launched a new AI-based chatbot this week to help employees navigate their healthcare issues. Transcarent’s CEO Glen Tullman referred to the 98point6 acquisition as a “golden asset” because it gives Transcarent access to years of patient-provider conversations to use as inputs for the chatbot. The amount of coverage this chatbot received this week certainly makes it feel as though AI-anything is near the peak of the hype cycle. And the excitement is understandable given the potential for driving efficiency and improved experiences. Yet on the other hand, it is pretty easy to imagine the impending disillusionment phase when you read sentences like this one from the Forbes article regarding the chatbot:

it struggled with some complex questions, flubbing when asked to find a Spanish-speaking orthopedic surgeon in the Bay Area, instead recommending a psychiatrist.

Hold on a second. This AI chatbot is returning a psychiatrist when you ask it to find you an orthopedic surgeon? Of all of the complex questions I’d imagine you could ask a chatbot, that question seems pretty straightforward. I can take 5 seconds to type that question into Google and get a better response. So while the vision Tullman articulates certainly gives all the warm fuzzies about a better future system, the description above makes me wonder how real any of it is.

Waystar is again looking to move forward with its IPO plans, with the WSJ reporting that it is planning an IPO for early June at a $5 billion to $6 billion valuation. Link

Uber Health is launching a new caregiving product feature, Uber Caregiver. The feature will allow caregivers to manage transportation, deliveries, and other healthcare items in the Uber app. Link

US News released its first-ever ranking of ASCs. Link

Funding

Notable startup financing rounds across the industry

SmarterDx raised $50 million to help hospitals automate their medical coding process and collect more on claims.

Chapter, a platform for Medicare Advantage brokers, raised $50 million.

Watershed Health, a care coordination platform, raised $13.6 million.

Switchboard Health, a clinically integrated network for value-based specialty care models, raised $6.5 million.

This was a nice post from Arif Sorathia at Route 66 Ventures discussing why they incubated Switchboard. It provides some good insight into how a VC views the opportunity in the specialty care market.

Daffodil Health, a platform automating out-of-network and reference-based pricing, raised $4.6 million.

Crosby Health, an LLM model that helps automate insurance appeals for providers, raised $2.2 million.

Writers Guild

Thought-provoking posts from the broader healthcare community

Housing As A Health-Related Social Need: Lessons From North Carolina’s Healthy Opportunities Pilot by Dori Glanz, Reyneri Mandy Ferguson, and Melinda Dutton

This article builds upon another article earlier in the year highlighting North Carolina’s Healthy Opportunities Pilots program. This article focuses on three aditional takeaways - 1. establishing hubs to support a network of community-based organizations; 2. the benefits of starting small and expanding; 3. this can’t be a Medicaid-only effort.

Second Quarter 2024 Update on Health Care Trends by Paul Mango

This is a nice summary of what’s been happening in the markets over the past few months - Medicare Advantage challenges, ACA and commercial markets doing well, health systems in a good position, uncertainty around ACA subsidies, and more.

The Evolution of Value-Based Care: MSSP, ACO REACH, and Beyond by Pearl Health

The Pearl Health team provides a good quick overview of the current state of MSSP and ACO REACH models.

Featured Jobs

Director of Growth at Arise, a virtual care delivery model for eating disorder care.

Director Office of Burden Reduction & Health Informatics at the Centers for Medicare and Medicaid Services.

Principal, Venture Capital at Corewell Health, a health system in Michigan.

Strategic Partnerships Director at Iris Telehealth, a virtual mental health provider.

VP of Finance at Sprinter Health, a home health company.

Contact us to feature roles in our newsletter.