👋 Hi! Kevin here. Welcome to this edition of my free weekly newsletter, where I discuss the key healthcare innovation news from the past week.

This week featured a heavy dose of Q1 earnings, Medicare Advantage updates, and GLP-1 formulary news. While earnings reports brought positive news for MA as it seems like most the MA industry is performing in line with or beating expectations, a DOJ complaint against a handful of payers and brokers presents a critical view of industry behavior designed to drive profits at the expense of MA members. It seems like the DOJ complaint is one of those things we’ll be discussing for some time.

Happy Sunday!

- Kevin

Sponsored by: Castlight

Navigating healthcare shouldn’t feel like guesswork.

Castlight simplifies the experience with curated benefits and personalized care—helping members connect to the right care, at the right time, with confidence. Our platform cuts through the noise with expert benefits guidance, increased engagement, and seamless access to high- quality care.

New virtual urgent care, allowing members to receive fully integrated clinical care with a touch of a button—from booking to a personalized treatment plan—in just 15 minutes.

If you're interested in sponsoring the newsletter, let us know!

MEDICARE ADVANTAGE LAWSUIT

The DOJ files complaint alleging Aetna, Elevance, and Humana of paid Medicare Advantage brokers hundreds of millions in illegal kickbacks

In a 217-page DOJ complaint, the government alleged that Aetna, Elevance, and Humana paid hundreds of millions of dollars in kickbacks to Medicare brokers eHealth, GoHealth, and SelectQuote between 2016 and 2021 in exchange for driving enrollments and also steering disabled members away from the plans.

The document is full of detailed conversations between the payors and the brokers that make a compelling case that the various parties at the very least knew they were coloring outside the lines of CMS rules. The business incentives are pretty clear behind it all. The payers did not hide their desire to boost growth, seemingly at any cost, and particularly when those payers knew their product offering was sub-par and wasn’t going to grow just on the merits of the product. It also appears that brokers were willing to sell just about anything to seniors on behalf of the highest bidder.

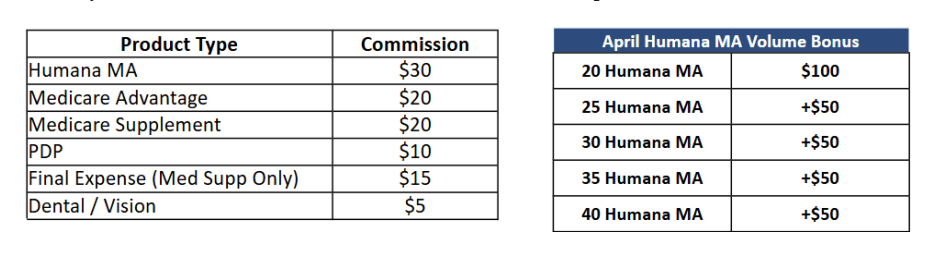

The document itself provides a fascinating look into the world of brokers and the economics at play here. While in aggregate here we are talking about hundreds of millions of dollars of payments flowing from the three payers to the three brokers involved in the case, the actual commission payments made to agents selling the MA policies are very low. The chart below is example from Humana and GoHealth, where Humana’s payments to GoHealth led GoHealth to increase commissions for its agents for Humana policies. We’re talking about a difference of $10 per commission — Humana’s commission increased to $30 per sale versus other MA plans at $20 per sale, with some volume bonuses for Humana:

Source: DOJ Complaint, page 31

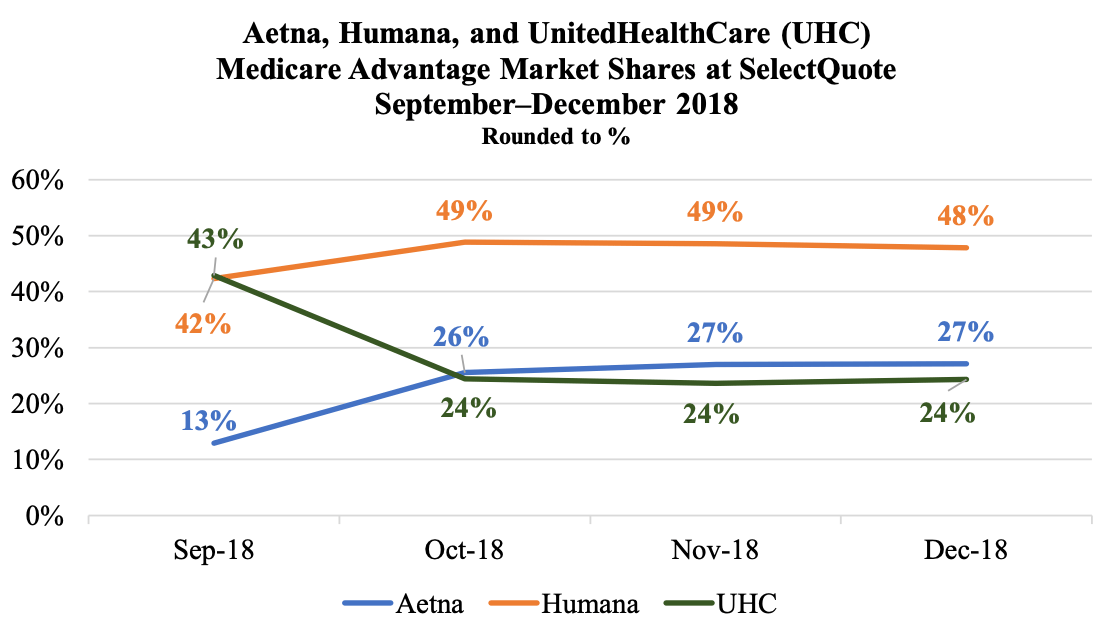

These small shifts in compensation strategies for agents selling policies could drive meaningful shifts in business for the MA payers. There are some interesting charts interspersed throughout the document that underscore how quickly these call centers could redirect enrollments. For instance, here is a chart looking at the market share of plans sold by SelectQuote each month during 2018 open enrollment:

Source: DOJ Complaint, page 99

You can see that within a month SelectQuote, drove UHC share down almost 20% while increasing share for Aetna and Humana, which are the relationships discussed in the complaint. If you read starting at page 95, it seems pretty clear that this shift in market share happened because Aetna started paying SelectQuote more for these sales, and so SelectQuote essentially “shut off” UHC sales. Despite public claims that brokers are impartial, these sorts of shifts make it pretty clear that is anything but the case.

From a legal perspective, CVS, Elevance and Humana have all denied the claims and said the they will “vigorously” defend themselves. But irrespective of the ultimate legal ramifications, it would seem this case will have ripple effects on the industry for some time. Scott Matthews, CEO of Medicare broker Keen Insurance Services, shared this helpful perspective on LinkedIn, which included these points about the impacts of the case:

5) These programs resulted in front line agents pressuring beneficiaries into less suitable Medicare Advantage polices which led to high levels of beneficiary complaints and member churn (which I expect contributed to the notable LTV loss, revenue restatements, and stock price declines these brokerages later experienced)

6) Not only was this program harmful to consumers and and the tax payer, but it was also highly uncompetitive against carriers that did not participate in such programs and other brokerages which were not large enough to garner such carrier attention. It also has significant implications for providers whose payment for services is directly tied to which plans beneficiaries select.

Overall this is a bombshell to the industry that will have long lasting implications. Where it goes from here is uncertain, but I expect this will have significant regulatory and operational implications that will be felt for years to come.

To the first point Matthews made in the quote above, we’ve already seen the issues created by these efforts going back to Humana’s earnings calls in 2022. Humana emphasized across multiple earnings calls that year that it was strategically shifting away from call centers as a sales strategy in part because it was seeing 4% lower retention rates from call centers versus internal sales channels (see the Q4 2021 earnings transcript as an example here). Humana also noted it was working with call centers to reduce complaints to CMS and provide a better member experience. In hindsight, it would make sense that Humana needed to make that shift because those call centers were driving members into Humana plans for financial reasons versus those plans being right for members, which intuitively would lead to higher churn.

This complaint is a bad look for everyone involved in it — the Medicare Advantage payers, the Medicare brokers, and particularly the many individuals mentioned by name throughout the document. In an industry facing so much scrutiny at the moment, this certainly stands out as profit-seeking behavior that runs against the intent of the MA program. Perhaps it is all in the past now as hopefully companies have moved away from this, but it will be worth watching if this invites even more regulatory scrutiny on brokers moving forward. Certainly the market reacted negatively to the news this week, with the stocks of all three brokers involved in the case down more than 15% on the week.

CVS EARNINGS

CVS posts a Q1, announces it will be exiting the ACA market in 2026

$CVS ( ▼ 3.66% ) released earnings on Thursday (earnings release, earnings transcript). It had a strong start to the year and increased its 2025 EPS guidance. The decision to exit the ACA market was the most interesting piece of strategic news on the call IMO, which we’ll dive into below.

CVS shared that it decided to leave the ACA at the end fo 2025 as it has experienced poor performance int hat market over the last few years, despite many other insurers seemingly performing quite well. CVS expects to lose $350 to $400 million on the business in 2025, and established a Premium Deficiency Reserve of $450 million for 2025 coverage. It was fascinating to see that analysts didn’t ask a single question about the strategic rationale for the market exit during the Q&A, indicating they viewed it as a non-event, instead choosing to focus the Q&A on other items.

This Modern Healthcare article picked up on the exit and did a nice job discussing the strategic implications further, noting that Aetna had a net loss of ~8% on the exchanges last year, with an MLR of ~96%. It appears the uncertainty around enhanced subsidies may have had something to do with this decision. The article speculated that given CVS’s small membership pool on the exchanges, if the exchanges shrink in the coming years and CVS is potentially left with a smaller, sicker population, profitability challenges could get even worse. Given that, I can see why CVS would choose to leave the market in the short term.

Beyond the ACA decision, here were a few other takeaways:

CVS noted that its Medicare Advantage book of business performed in line with expectations, but it did note seeing “some signs of pressure” in medical cost trends for Oak Street Health during the quarter, which it will be monitoring closely. CVS also noted that Oak Street grew its at-risk member base by 37% year-over-year.

CVS announced a new partnership with Novo Nordisk to help members access Wegovy. This prompted a few questions from analysts. More on this move in later in the newsletter.

CVS joined UHC in directly critiquing Arkansas’s recent PBM decision. CVS noted it will leave 10,000+ people in Arkansas with complex conditions in a bind, as independent pharmacies don’t often stock specialty medications. They did note they’ve seen other states reject the approach Arkansas is taking here and seem to view Arkansas as an outlier.

While Medicare trend was elevated, it was modestly better than CVS’s expectations. The trend is high across inpatient, outpatient, and pharmacy. Part D performance was better than expected, but CVS noted that is likely a seasonality change with the program.

MEDICARE ADVANTAGE EARNINGS

Humana and Alignment both outperform in Q1 as MA utilization issues seem isolated to UHC

Humana and Alignment’s earnings reports this week put to rest any lingering questions about whether UHC’s Q1 earnings miss would be indicative of other what other Medicare Advantage companies would experience. Both Humana and Alignment reported strong results for the quarter, indicating they’re seeing medical trends as expected. I’ll dive into briefly below:

$HUM ( ▼ 3.6% ) (earnings release, earnings transcript)

The general theme of Humana’s earnings call is summed up in this opening comment from Humana’s CEO: “I think the best way to describe where we are at, at this moment, is that while there are still challenges to navigate, there are no surprises.” The earnings call was relatively straight forward as Humana works its way back to its 3% target margin in Medicare Advantage in 2027. Humana seems to feel good about the trajectory of the business and getting back to that margin target, with the Stars lawsuit outcome being the biggest unknown at the moment. A few notes below:

Humana outperformed in Q1 but declined to increase full year guidance, noting that some of the outperformance during the quarter was timing-related, particularly due to changing consumer behavior because of the Inflation Reduction Act.

Humana noted it is seeing medical cost and pharmacy cost trends as expected. On medical cost, it is expecting mid-single digit trend. On pharmacy it is expecting low double-digit trend.

There were a handful of questions from analysts about Centerwell and how much success the organization is having in VBC arrangements. Humana noted it is seeing strong patient growth, both due to new clinics and increasing patient numbers at existing clinics. They’re seeing clinics performing consistently with the profitability J-Curve that Humana expects.

$ALHC ( ▼ 1.51% ) (earnings release, earnings transcript)

Alignment has a ton of momentum as it beat expectations on every key metric and is raising guidance for the year. It saw 32% growth in membership year-over-year, while also beating MBR expectations for the quarter. Given the outperformance in Q1, it was surprising to me to see the stock was down ~12% on the week.

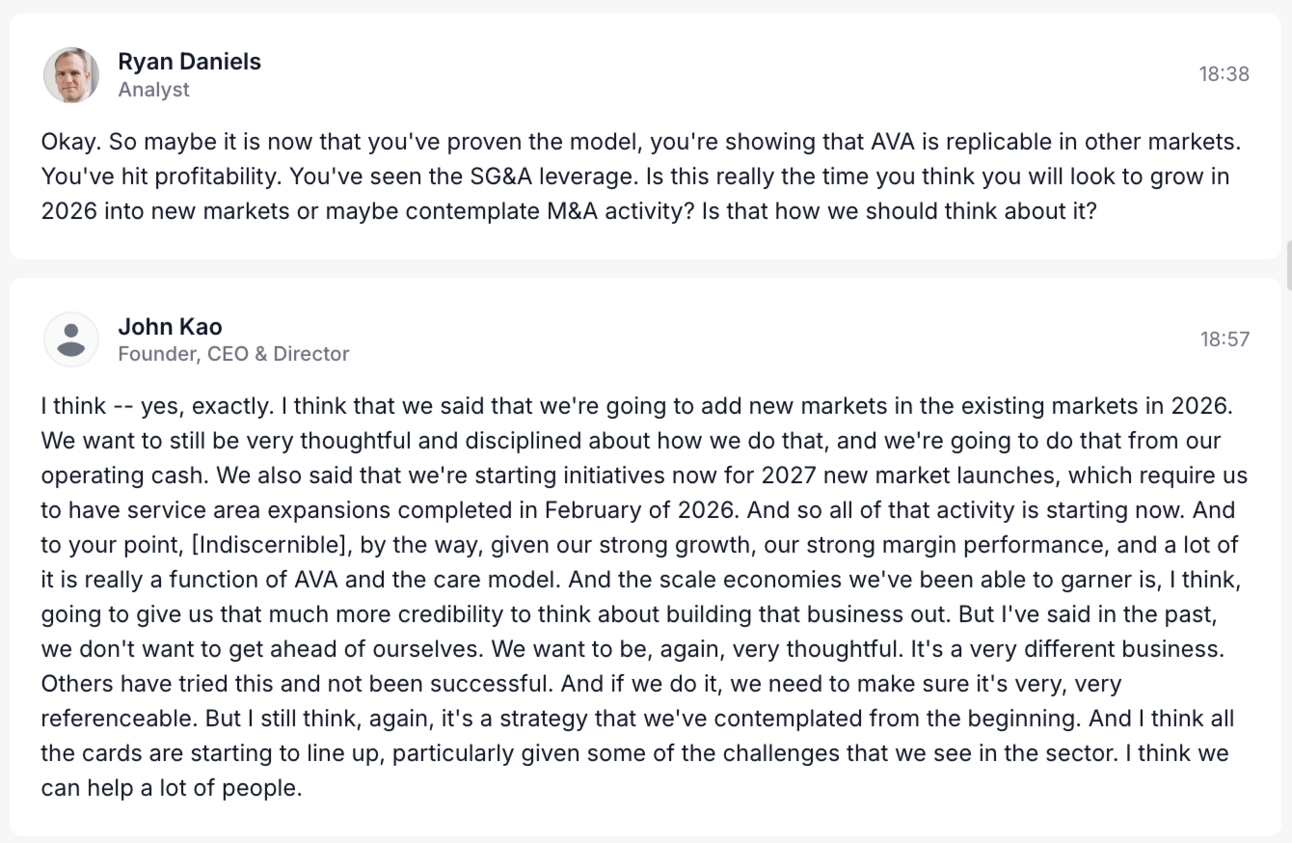

Alignment is one of the few MA payers that isn’t just weathering the storm in the industry, but rather it seems well positioned to grow given the challenges other payers have been facing. Alignment has demonstrated consistent positive results. This Q&A with an analyst and Alignment’s CEO illustrates how the question at hand for Alignment is really about how it successfully scales its model from here:

Source: Quartr Transcript

Given the challenges other payers have had with growth over the last several years, it will be worth keeping an eye on how well Alignment is able to continue growing into new markets and taking share while continuing to execute on the model. Alignment seems like the most compelling narrative in the MA market at the present moment, with a huge opportunity in front of it as the rest of the industry works through the challenges of the last several years.

Other Headlines From the Week

Tenet reported strong Q1 earnings results early in the week. Tenet significantly outperformed analyst expectations driven by strong performance across the board. It seems like everything went right for Tenet financially this quarter — same-store revenue growth, high patient acuity, favorable payer mix, and cost management all drove the earnings beat. Tenet said it would not address full year guidance until later in the year, which prompted a number of questions on the earnings call wondering why Tenet wouldn’t raise full year guidance given how good of a Q1 it had. There wasn’t much of an answer beyond they chose not to address it. Tenet noted it continues to see opportunity for M&A in the ambulatory space, and it intends to spend $250 million on acquisitions each year.

Teladoc acquired mental health provide Uplift for $30 million with a potential $15 million earn out. Uplift is an in-network provider for health plans with a network of 1,500 mental health professionals and contracts for 100 million covered lives, which will accelerate BetterHelp’s strategy of working with insurers. Teladoc announced the news as it reported Q1 earnings, and it discussed the strategic rationale behind the move on the earnings call. Uplift generated $15 million of revenue in 2024 and Adjusted EBITDA of -$6 million across ~114,000 completed sessions. Teladoc expects to see Adjusted EBITDA dilution of $10 - $15 million in 2025 as it invests in scaling insurance business functions along with the Uplift losses. It was interesting to see an analyst question about the M&A strategy for Teladoc — it is acquiring businesses at 2x revenue (Uplift and Catapult), but Teladoc is trading at <1x revenue, which prompted the analyst to wonder why Teladoc is not buying back stock instead. It sounds like Teladoc is actively discussing this and might be doing so in the future.

Novo Nordisk announced that CVS Caremark will make Wegovy the preferred GLP-1 on its commercial templated formulary. This news caused a drop in Eli Lilly’s stock price, which ended the week down 5%. In Lilly’s earnings call, which was the same day as the CVS Caremark announcement, analysts asked a number of questions about the implications the move has on formulary strategy. Lilly leadership seemed to think this move is not a big deal, noting that CVS’s templated formulary is largely used by small groups with low opt-in rates. Investors seemingly were significantly more concerned than Lilly leadership that this move could be a sign of added price pressures on GLP-1s with PBMs pitting Novo and Lilly against each other. CVS noted on its earnings call that the templated formulary has tens of millions of lives on it, and they view this as a step in making GLP-1s more affordable for its clients. It’s interesting to see the different positioning here across the various parties.

Novo Nordisk also announced it will offer Wegovy via D2C partners including Hims, Ro, and LifeMD, causing Hims stock price to jump 28% on the news. Consumers can access Wegovy via NovoCare for $499/mo. Ro is also charging consumers $499/mo for Wegovy, while Hims is charging $599/mo. It’ll certainly be interesting to watch how all of this plays out — I’m not sure I really understand why a consumer would spend an extra $1,200 a year to access Wegovy via Hims versus Ro or NovoCare. It seems like a steep premium to pay for the Hims brand if you just want to access a medication.

The WSJ highlighted how the pharmaceutical industry has successfully spent millions lobbying against PBMs in 2025, pointing the finger at middlemen for rising costs in the industry.

The Supreme Court issued a 7-2 ruling against hospitals in a case about how disproportionate share hospital (DSH) payments were made from 2006 to 2009. This Healthcare Dive report does a nice job summarizing the implications of the ruling, noting that safety net hospitals were disappointed because they believe HSS is underrepresenting the number of patients that should count towards DSH, which is reducing hospital revenue by $1.5 billion each year.

The French medical system is apparently facing major issues, including four people dying in emergency rooms while waiting for care over the last few weeks in Nantes, the sixth largest city in France. This article suggests the issues are at least in part in part due to the system being stretched beyond capacity by the rapid growth of a program that provides free healthcare to undocumented migrants, including people who are coming from the US for cheaper access to healthcare.

Funding Announcements

Plenful, a back-office automation platform that helps providers manage 340B compliance and Rx prior auths, raised $50 million.

Blooming Health, an AI platform helping people connect with social services, raised $26 million.

HealthPlan Data Solutions, a pharmacy data analytics platform, raised $15 million.

Trek Health, a data analytics startup that helps providers negotiate better rates with payers, raised $11 million.

Noma Therapy, a virtual ketamine-assisted therapy provider, raised $4.25 million.

Other Good Reads

What Medicaid Cuts Would Do to My Rural Hospital by Kevin Stansbury

This is a good guest essay in the New York Times by the CEO of a 25-bed hospital in rural Colorado, highlighting the challenges that Medicaid cuts would pose for the financial viability of the hospital. It would seem there are going to be many hard questions to ask and answer over the coming years about the financial viability of rural healthcare in this country. Read more

The Corporate Backdoor to Medicine: How MSOs Are Reshaping Physician Practices by Hayden Rooke-Ley, Megha Reddy, Neil Mehta, Yashaswini Singh, and Erin C. Fuse Brown

A Milbank Memorial Fund article does a nice job looking at corporate-owned MSOs and the role they play in managing practice operations. It suggests more oversight of these models via policy interventions can help ensure that MSOs drive better quality care. Read more

Long-Term Spending of Accountable Care Organizations in the Medicare Shared Savings Program by Amelia Bond, Yasin Civelek, William L. Schpero, et al

This article in JAMA Network finds that ACOs generated meaningful savings during MSSP’s first decade, with those savings increasing over times. Physician-group and smaller ACOs generated more savings.

Read more

Featured Jobs

Director, Government and External Affairs at Ro, a D2C healthcare company. Learn more

$184k - $216k | Washington DC or Remote

Director of Sales for Value Based Care and Partnerships (Cardiology/Imaging) at Cleerly, an AI-driven cardiology diagnostics platform. Learn more

$300k | Florida metros

Senior Product Manager at Seven Starling, a virtual maternity behavioral health provider. Learn more

$130k | Remote

Company Strategy & Operations Lead at Nourish, a network of registered dietitians. Learn more

$NA | New York

VP Product, Member Experience at Spring Health, a virtual mental health provider. Learn more

$254k - $339k | New York / Hybrid

Contact us to feature roles in our newsletter.

Want to share feedback with us?

Show your support by sharing our newsletter and earn rewards for your referrals!