Welcome to this week’s free weekly newsletter, where we share our perspectives on some of the key healthcare related news of the week. To get access to exclusive paid content, learning and networking opportunities, and a vibrant community of 5,000+ other folks in this space, join the HTN community.

This week's newsletter is sponsored by: Candor Health

Candor’s healthcare intelligence platform directly addresses the issue of reliable provider data. Drawing from over 1,000 sources, more than 40 million records are refreshed monthly, offering high quality data via API, flat file, or their own AI-powered search platform.

Payers, health systems and health tech companies are leveraging Candor to build provider networks, efficiently manage rosters, automate plan to provider matching, staff clinical teams, and more.

Want to learn more and try it for yourself? Connect with their team–they’re offering a free trial for HTN readers.

If you're interested in sponsoring the newsletter, let us know here.

News

Sharing our perspective on the news, opinions, and data that made us think the most this week

Why it matters:

CMS had the Medicare Advantage world abuzz as it issued both its final rate notice for 2025 as well as its final Final Rule. The rate notice on Monday sent insurer stocks down as CMS didn’t budge from advance notice. With this being an election year it feels like this debate is far from over, with both sides arguing over how to ensure “stability” of benefits for seniors.

Going Deeper:

With CMS releasing both the final rate notice and the Final Rule this week, it’s a bit confusing everything that has gone on. There’s a lot of nuance to what came out from CMS this week, so I’ll break it down into a few sections below:

CMS’s Final Rate Notice

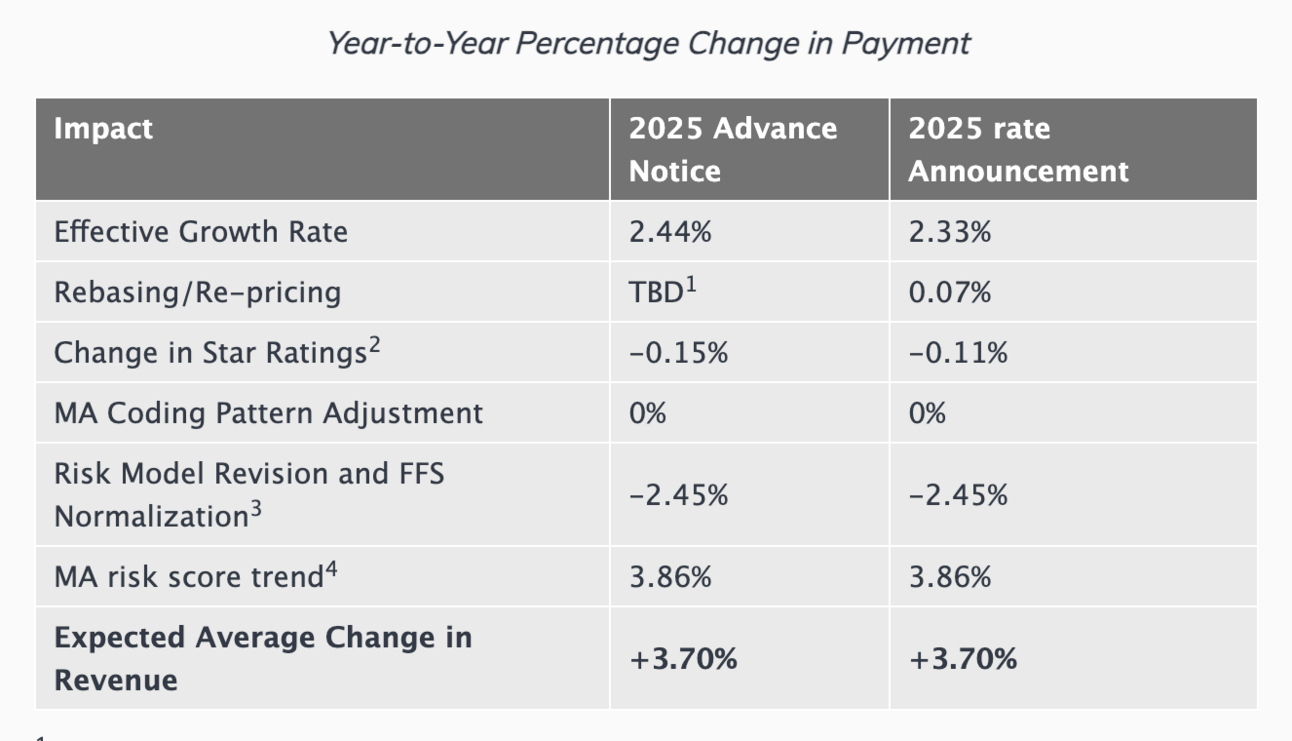

Historically, CMS has typically revised the final rate notice to be more favorable to payors than the advance notice that came out earlier in the year. This year, though, CMS revised very little, as you can see in the chart below:

This move by CMS sent insurance company stock prices tumbling on Monday. For the week, UnitedHealth was down 7.4%, Humana was down 10%, and CVS was down 6%. Particularly interesting in this news is that CMS isn’t adjusting the rate in large part because it hasn’t seen the uptick in utilization in Medicare FFS claims that many payors noted in Q4.Breaking with other insurers, Clover’s CEO Andrew Toy shared a post in support of CMS’s move to not increase rates. He shared an interesting hypothesis that payors are struggling to manage utilization on PPO networks, which have gained popularity in recent years over HMO networks. Toy also shared that idea on Clover’s Q4 earnings call, giving you a sense of how Clover is attempting to position itself versus the market. Link

It’s going to be really interesting to watch how payors respond to this final notice on upcoming earnings calls. We’ve already seen reports that the advance notice would lead to benefits cuts to members of around $33 per member per month. In an election year, you can imagine taking benefits away from 33 million seniors becoming a key topic of debate. I think we’ll be hearing a lot more about this in the coming months.

CMS’s Final Rule

While the final rate notice has huge strategic implications for payors (and providers), the Final Rule also finalized some interesting changes for the space. This was a good, quick rundown of the various changes in the Final Rule. This article in Fierce Healthcare also provided a good summary with some perspectives on the various changes proposed, calling it one of the more impactful final rules of the last twenty years. Three changes that caught my eye:Broker Changes. CMS is moving to rein in broker expenses, mandating that all carriers pay the same flat rate to a broker per enrollment. The bigger change is that CMS is eliminating a loophole that in years past payers would use to pay for things like golf trips for brokers by labeling it an “administrative” expense. CMS is also limiting the ability of Third Party Marketing Organizations (TPMOs) to share beneficiary data without written consent

Duals. CMS is encouraging enrollment in MA plans that are affiliated with Medicaid managed care plans.

Behavioral Health. CMS is adding network adequacy standards for outpatient behavioral health providers.

Charts

Compelling visuals that help convey data, trends, or topics

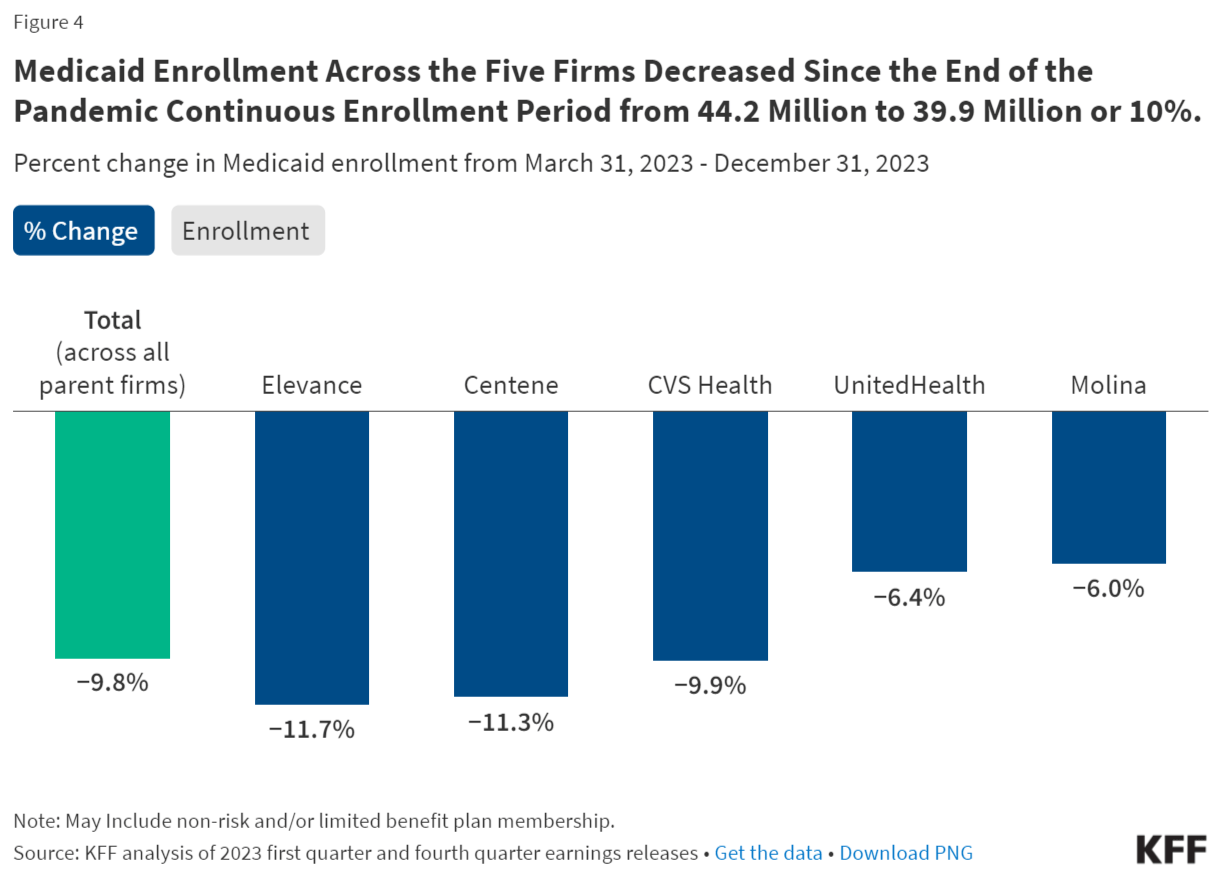

Impact of the unwinding on the five largest publicly traded Medicaid managed care organizations

Source: Kaiser Family Foundation

This was an interesting analysis from KFF looking at the impact of the Medicaid redeterminations (“unwinding period”) on the five largest publicly traded companies that operate Medicaid MCOs. The analysis found that enrollment decreased by nearly 10%, down to 39.9 million across the five orgs. The report has a few other notable charts digging into the companies’ geographic reach in Medicaid, the impact of the unwinding as reported on earnings calls, and market shares of total MCO enrollment.

Other News

A round-up of other newsworthy items

The idea of VCs engaging large incumbents in co-creating new ventures continues to gain steam, as this week Aegis Ventures launched a health system consortium with nine health systems, including Oschner, Stanford, and Northwell. The consortium will be led by John Noseworthy, who was formerly Mayo Clinic’s CEO. He noted that the key to success of this consortium will be getting buy-in from front-line employees who will be using the tools. But at the same time, the article frames the consortium essentially as a free option for health systems to take meaningful equity stakes that leave them with double-digit ownership of startups without paying management fees. Link

Surescripts, an electronic prescribing platform, is exploring a company sale and is likely looking for a private equity buyer. The sale is reported to be a potentially complicated one given the complex ownership structure involving CVS Health, Express Scripts, and various trade groups. Link

Costco will begin offering Ozempic to members via its partnership with Sesame. Costco and Sesame initially partnered six months ago on a virtual primary care offering. Link

Kaiser Permanente closed its acquisition of Geisinger which will formally launch its new hospital operator, Risant Health. Over the next five years, Risant is targeting 4-5 additional health system acquisitions and reaching up to $35 billion in total revenue. Link

Walmart is scaling back its clinic footprint slightly, pausing four clinics in Oklahoma City and pushing back six clinic launches in Phoenix to 2025. Given the broader industry dynamics and Walgreens’ decision to reduce its clinic aspirations dramatically, it will be interesting to keep an eye on what Walmart does from here. Link

Senior Whole Health, a Molina health plan for duals, announced its strategic partnership with Cityblock to enhance care quality for its Massachusetts-based dually eligible members, offering them access to primary care, behavioral health, community health partners, pharmacy navigators, and more. Link

Talkiatry, a virtual mental health provider, partnered with Cedar, a healthcare financial engagement platform, to streamline the company’s patient billing experience. Link

MedStar Health, a DC-based hospital system, announced its partnership with DispatchHealth, an in-home acute care provider. The collaboration will bring at-home acute care services to patients across Washington D.C. who have recently been discharged from hospital care to reduce care gaps and hospital readmission risks. Link

Ophelia, an opioid addiction care startup, announced its partnership with Highmark Wholecare, a Highmark health plan serving 400,000+ Medicaid and dually eligible members. The partnership will provide members access to Ophelia’s telehealth OUD treatment services. Link

CMS shared acceptances to the GUIDE program this week, which creates an alternative payment model focused on supporting people living with dementia and their caregivers. CMS does not appear to have released a list formally, but at least eleven companies announced on LinkedIn that they were accepted to the program. Slack

Funding

Notable startup financing rounds across the industry

Biolinq, a company developing a digital continuous glucose monitor, raised $58 million to advance its US-based clinical trial and support its FDA submission. Link

Praia Health, a consumer platform for health systems, raised $20 million in Series A funding. The company, which recently spun out of Providence, launched its digital health partner ecosystem with 17 startups, including Omada Health, Wildflower Health, Season Health, Fortuna Health, and more. Link / Slack (h/t Rik Renard)

AITRICS, a predictive medical analytics platform, raised $20 million in Series B financing. The startup’s platform leverages AI to predict the likelihood of patient health deterioration, using various data types including various vital signs, blood test results, age, and more. Link

Aligned Marketplace, a network of value-based primary care providers for self-insured employers, raised $8 million in Seed funding. The company has built a network of 3,000+ primary care clinics — including Aledade, Carbon Health, Marathon Health, and more — to provide employers with access to the network of providers. Link

Beanstalk Benefits, a health benefits platform, launched out of Redesign Health with $7.5 million in funding. Link

HealthArc, a virtual care startup, raised $5 million in funding to enhance its care management platform. Link

Glen Tullman launched a new $100 million fund, 62 Ventures, which will focus investments in companies that exist outside the traditional digital health scope of his other fund, 7wireVentures. Two early investments include a health and social benefits navigation platform and an integrated care company. Link / Slack (h/t Samir Unni)

Writers Guild

Thought-provoking posts from the broader healthcare community

I am sorry - Digital Health Diabetes Management should have been "dead" before the category even got started by Sami Inkinen

Virta’s CEO Sami Inkinen penned a response to the Peterson Health Technology Institute report that found that aside from nutritional ketosis and Virta, other leading diabetes digital health solutions deliver no clinical benefit and increase costs. Inkinen suggests we should shift strategies to focus on preventing and reversing Type II diabetes, with Virta playing a central role in that.

Growth of the Healthcare Business in a Box Model by Chris Turitzin

This report analyzes the growth of the “business in a box” model, which refers to health tech platforms that aim to help independent physicians manage clinic business operations like compliance, marketing, insurance contracting/billing, and more. The analysis looked at 77,100 clinician profiles to understand the adoption of these “business in a box” platforms like Headway, Greater Good, Finni, Rula, and more.

Hospital care costs are out of control. Price caps can help by Roslyn Murray and Andrew Ryan

An interesting look at how Oregon’s state employee health plan put a cap on hospital prices for its 300,000 employees. It discusses a recent report in Health Affairs which found that the state saved $107.5 million in two years, the equivalent of 4% of total spending.

Immigration to address the caregiving shortfall by Benjamin H. Harris and Liam Marshall

This commentary does a nice job highlighting the caregiver shortfall we’re likely to experience in the coming years in this country as the population ages. It discusses how this shortfall will likely increase the cost of care and result in more of the caregiving burden falling on family members. It suggests immigrant caregivers as a partial solution to the problem.

Featured Jobs

Product Manager/Senior Product Manager - Patient Experience at Rula, a mental healthcare marketplace. Link

Senior Manager, Provider Operations at Parsley Health, a hybrid care provider. Link

Contact us to feature roles in our newsletter.