This week's newsletter is sponsored by: McDermott Will & Emery

McDermott’s Value Based Care Symposium is back in Nashville on Fri, May 17 and HTN readers get 50% off! Join c-suite leaders, investors, operators, and counsel for a deep dive into the key business and policy issues shaping VBC. Here’s what to expect:

Eight sessions with VBC leaders representing a wide range of perspectives from organizations like CMMI, Intermountain, Harbor Health, Oak Street, and Triple Aim Partners

Networking opportunities with 400+ senior decision makers working on incorporating VBC in their orgs

A number important VBC topics will be covered, including specialty care models, finding success in primary care, oncology models, and payer and investor views on the VBC landscape.

If you're interested in sponsoring the newsletter, let us know here.

News

Sharing our perspective on the news, opinions, and data that made us think the most this week

Bridges Medical Group sued Aetna for using supplemental benefit chargebacks to reduce shared savings payments

Summary:

The headline is that Bridges Medical Group, a Pennsylvania provider network that includes ~400 PCPs, saw $6 million in chargebacks from Aetna associated with supplemental benefits, up from only $300,000 three years prior.

Bridges believes Aetna improperly added these expenses to medical costs under the terms of their VBC contract, thereby reducing the shared savings payment that Bridges is owed by Aetna.

The lawsuit here feels indicative of the challenges facing payors and providers regarding VBC contracts as the financial upside in these contracts get squeezed

Going Deeper:

The full complaint, linked below, provides an excellent example of the complexity of a payor and provider working through the mechanics of a VBC contract. I’d recommend reading it quickly though — on Friday Bridges submitted a request that the complaint be sealed. It appears that Aetna informed Bridges that the complaint contains confidential information.

If that’s any indication, the complaint is full of helpful details about the relationship between the two parties, including the entire VBC contract that Aetna and Bridges signed in Exhibit A.

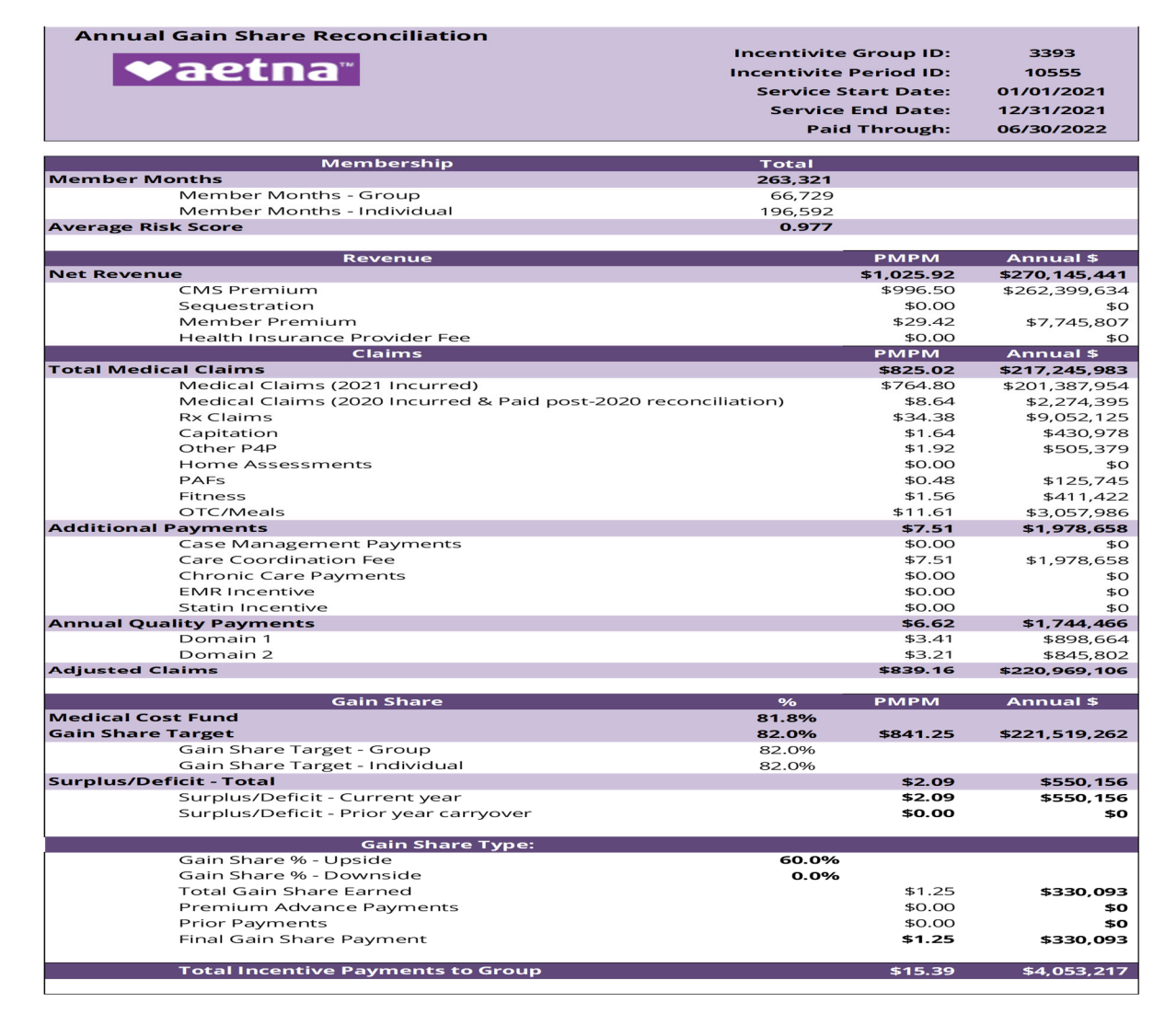

In the complaint, Bridges dives into how Aetna calculates its shared savings payment and shares extensive detail about how the calculation occurred for 2021. The output of the calculation is a file like the one below that Aetna shared with Bridges. It indicates that Aetna owed Bridges $330,093 in a shared savings payment for 2021, which is substantially less than Aetna had previously estimated as the case dives into. The complaint also indicates Aetna added over $4 million dollars into medical expense line items for things like capitation payments, other P4P, PAFs, fitness, and OTC/meals, as you can see below:

Those line items are the crux of the complaint, as Bridges argues that the costs are supplemental benefits that Aetna unilaterally decided to offer for marketing purposes, and weren’t intended to be passed through to Bridges.

While this case is just one specific contract that’s being disputed, it will be fascinating to watch how widespread these sorts of issues become between payors and providers as profitability gets squeezed. We’ve all seen the headwinds that the Medicare Advantage market now faces, but those headwinds still appear to be working their way through these complicated contract negotiations. It all hints at the potentially massive upheaval ahead in VBC contracts as payors and providers both start to pay more attention to the details.

Given Aetna’s membership growth in Medicare Advantage this year, combined with their profitability targets on the MA membership, it certainly seems like this will be worth watching for CVS in particular moving forward.

Relevant Links:

Bridges complaint. This link should take you to the Allegheny courts page. Enter GD-24-004347 for the case number and it should take you to a page that has the complaint linked as an attachment. Voila! The complaint goes into a wealth of detail about the VBC contract and how both parties managed the relationship.

Modern Healthcare coverage. This article provides some good context and quotes on the issue at hand specifically related to the broader industry implications.

Bridges press release. Bridges perspective on the complaint.

Q1 Earnings Updates

A rundown of key earnings takeaways from the week

United’s stock jumped after reaffirming guidance for 2024 despite a massive loss associated with Change

United kicked off the Q1 2024 earnings season on Tuesday, surprising Wall Street by reaffirming its 2024 earnings target despite the Change cyber attack and Medicare Advantage headwinds. United’s stock was up almost 8% on the news. A couple of key themes from the session:

While Change will have a material negative impact on the business in 2024 — to the tune of $1.15 to $1.35 per share for the year — United is expressing confidence that business will be back to normal by 2025 and that customers will come back online.

MA utilization patterns are consistent with what was expected, and while United was a “little disappointed” with 2025 rates for MA, it is managing through the changes and focused on providing stable benefits for seniors.

Aside from those two headwinds, United’s other core businesses appear to be growing quite nicely - commercial grew by 2 million members, Medicaid has won a number of RFPs, Optum Health is on track to hit 5 million VBC members this year, and the Optum Insight backlog (excluding Change issues) grew by $2 billion.

Elevance stock jumps after increasing earnings target for 2024

Elevance stock jumped ~5% after earnings as Elevance shared it is increasing its adjusted EPS target for the year after a solid Q1. The biggest topic of the earnings call was the decision to partner with PE firm Clayton, Dublier, & Rice (CD&R) to build out a value-based primary care platform. Elevance shared during the call that it expects to have full ownership of the platform in the next five years. More on this transaction below.

The opening remarks on the call sounded like the business is hitting on all cylinders - Carelon assets are doing well, commercial membership performance is improving, and they’re seeing solid growth in the ACA, employer, and Medicaid markets.

Similar to UHG’s commentary, Elevance shared that they were disappointed by the 2025 final Medicare Advantage rates, but remain committed to the seniors that they serve.

Charts

Visuals that caught our attention this week that help convey data, trends, or topics

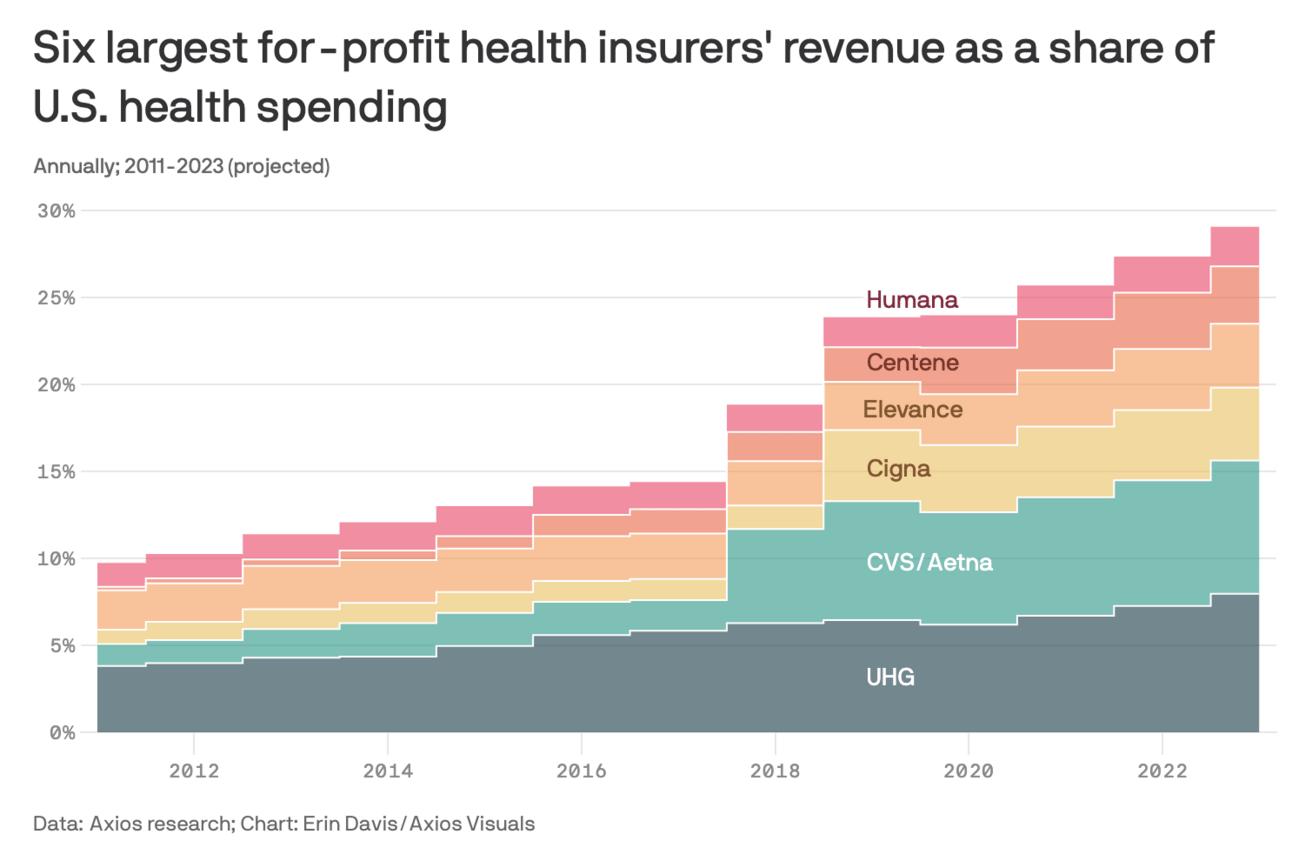

A visualization of the growth in health insurer profits since 2011

This was a nice visual from Erin Davis at Axios highlighting profits have grown over the last fifteen years for the six largest insurers - they’ve gone from just under 10% of US health spending to almost 30% in that period. The bigger jumps jumps appear to be associated with major merger activity, i.e. the CVS / Aetna merger in late 2017.

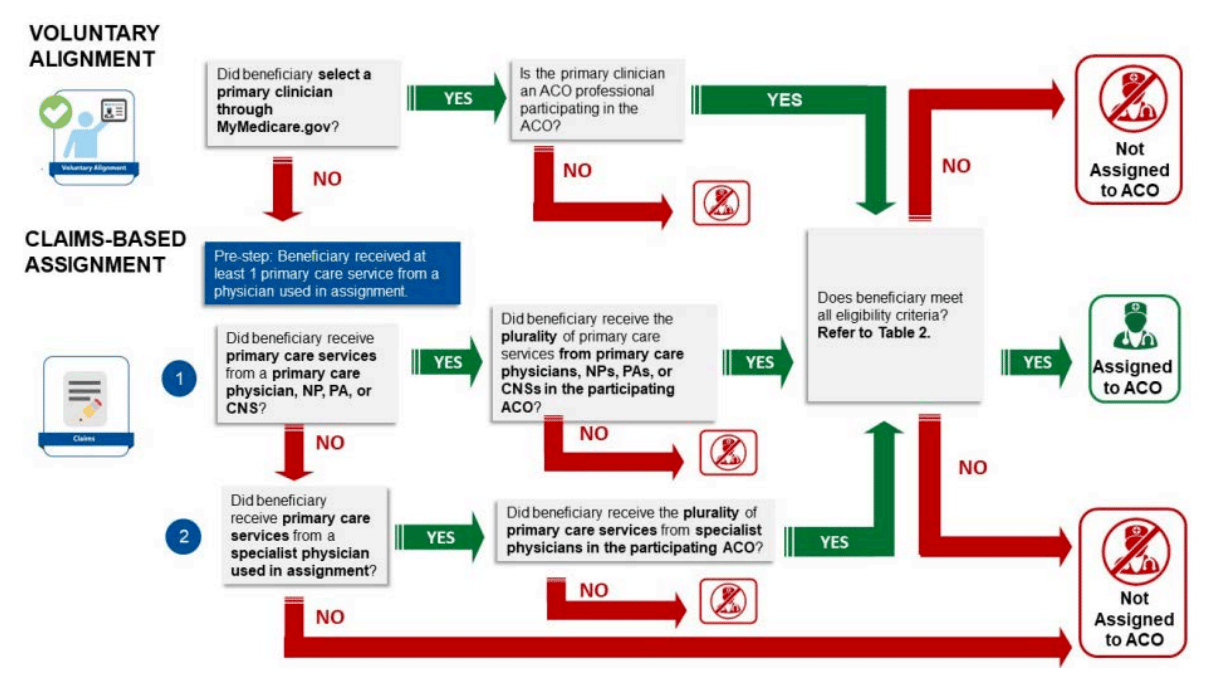

A flowchart for how patient alignment occurs in the MSSP program

NAACOS, AHIP, and the AMA released a very helpful playbook highlighting best practices for succeeding in VBC. It covers several key topics in VBC contracts - including things like attribution, risk adjustment, benchmarking, payment accuracy, and timing. Among other helpful graphics is the one above that outlines the flow of how patients are aligned to providers in the Medicare Shared Savings Program.

Other News

A round-up of other newsworthy items

Elevance released an exceptionally vague press release on Monday this week announcing a strategic partnership with Private Equity firm Clayton, Dublier & Rice. The partnership will combine CD&R’s portfolio companies apree health and Millenium Physicians Group with care delivery and enablement assets from Carelon. Elevance’s earnings call shared more details related to the structure of the platform, most notably that Elevance currently owns a significant minority share and is planning to fully acquire the combined entity over the next five years. Analysts had several good questions for Elevance about the strategy, particularly given that Elevance has focused more lately on 1. specialty VBC and 2. local provider enablement. Elevance’s answers didn’t provide me with a ton of confidence that Elevance knows what the detail is beyond the overarching narrative here. It feels a bit like an opportunistic financial maneuver to move to a minority stake in care delivery assets for the next several years while rebuilding a full ownership stake over time. Link

Mental health provider Cerebral was in the news again this week, as the FTC has proposed an order that Cerebral stop using sensitive data to market to consumers. The FTC ordered Cerebral to pay roughly $15 million in penalties, but that amount is being reduced to $7 million as Cerebral doesn’t have the money to pay the full penalty. The complaint provides a lot of detail on Cerebral’s activities, including the fact that it spent $211 million on advertising in 2022, compared to $1.6 million on safety and quality. A lot of the attention in the complaint was on the activities of former CEO Kyle Robertson, who, among other things, appears to have actively encouraged the organization to employ tactics such as making cancellation nearly impossible to improve retention rates. Link

Cerebral isn’t the only D2C healthcare startup to face a penalty like this from the FTC recently. Monument, which provides virtual alcohol addiction treatment, was also recently banned from using patient data for advertising purposes. Link

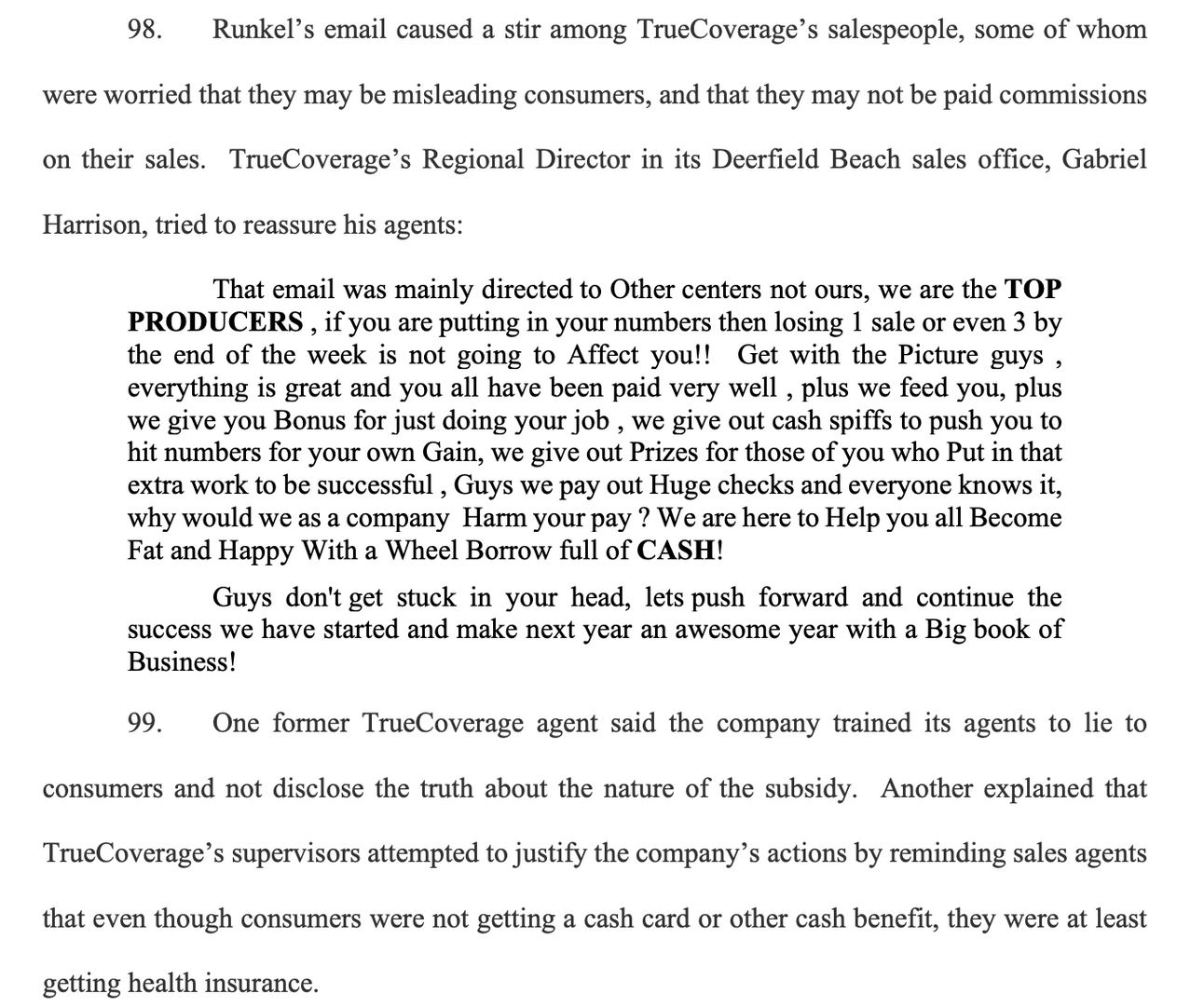

In other lawsuit news this week, two ACA broker call centers, TrueCoverage and EnhanceHealth have been sued for a scheme to dupe low-income individuals into ACA plans they didn’t know they were signing up for. EnhanceHealth is a notable name as Bain Capital launched the business back in 2021 with $150 million in capital. The complaint walks through how these brokers and a few other parties enticed individuals with the promise of free benefits that didn’t exist and then also switched plans on individuals without consent. Link

The complaint shines a spotlight on some of the shenanigans going on in the broker market. See the screen grab below as an example below. It highlights an email from a TrueCoverage regional director to sales reps who were concerned about whether they were misleading customers. It feels like it should be mounted on the walls of brokers’ offices around the country as an example of exactly what not to do. If you’re Bain Capital, this has to be the worst outcome imaginable here. The company you launched with $150 million is now facing RICO charges with another company that has emails like this in the public record talking about giving brokers a “Wheel Borrow full of CASH!” (yes, that’s actual text from the email)

Katie Jennings penned a fascinating piece exploring how Veradigm, formerly known as the EHR vendor Allscripts, is attempting to reinvent itself as an AI business selling data to pharmaceutical companies. Veradigm acquired ScienceIO earlier this year for $140 million to be the core AI technology for the business. The article does a nice job highlighting some of the nuances of the plan - including the fact that Veradigm, unlike other EMRs, owns the medical record data. It’ll be an interesting pivot to watch play out. Link

While the Change Healthcare update on the UHG earnings call focused on how the business returning to normalcy, Wired reported this week that a cybercriminal gang called RansomHub claims to be selling patient information from the breach. Link

23andMe filed a report with the SEC that its CEO Anne Wojcicki intends to take it private. 23andMe stock jumped 50% on Wednesday on the news. Link

CVS Accountable Care announced a new ACO REACH partnership with inVio Health Network in South Carolina. inVio, a clinically integrated network affiliated with Prisma Health Upstate and Prisma Health Midlands Networks, has grown to manage 60,000 lives in the MSSP program since launching in 2015. Link

Virtual opioid use disorder treatment model Ophelia has become a statewide COE in Pennsylvania. It’s the first virtual-first COE as part of Pennsylvania’s managed Medicaid program. Link

Included Health launched a virtual specialty clinic, rolling out models for cancer care, metabolic health, and women’s health. It’s interesting to note that the press release describes this clinic as an evolution of Included’s expert medical opinion service, formerly known as Grand Rounds. Link

ABOUT Healthcare, a platform that helps hospitals manage patient flow acquired Edgility, an analytics platform to manage operations in real-time. Link

Funding

Notable startup financing rounds across the industry

Virtual mental health provider Two Chairs raised $72 million in equity and debt financing. Link

Avive Solutions, a next-generation AED device and software platform, raised $56.5 million. Link

LunaJoy, a maternal mental health provider, raised $4.2 million. Link

Ilant Health, a value-based obesity care model, added $2 million to its seed round. Link

The Writers Guild

Thought-provoking posts we noticed in the broader healthcare community

Roadmap to the Quadruple Aim—A Framework for Minimizing Physician Burnout During the Transition to Value-Based Care

by Alexander Beschloss, and Alexander Ding

An interesting perspective looking at how the transition to VBC might be leading to increased provider burnout. It takes HCP-LAN payment models and creates a matrix of how individual physician incentives within each of those payment models can lead to increased or decreased levels of burnout.

Consumers rule: Driving healthcare growth with a consumer-led strategy

by Jessica Buchter, Jenny Cordina, and Jillian Eckroate

A McKinsey team explored a few key trends with consumer health behaviors and offered some suggestions for how healthcare companies can act in a more consumer-centric manner.

Why did they do it that way? Home and community-based services

by Hannah Maniates

This is a good read on how Medicaid pays for home and community-based services, going back into the history of how this policy emerged, how it varies across states today, and the various pathways for these services to be supported.

Featured Jobs

Senior Director, Product at Thirty Madison, a family of D2C virtual health brands (Keeps, Cove, Facet, NURX). Link

Director, Strategic Growth & Engagement at Habitat Health, a PACE provider. Link

Director, Client Solutions at Cohere Health, an intelligent prior auth platform. Link

Senior Manager - Member Experience Operations + Strategy at Seed, a microbiome science company. Link

Chief of Staff to COO at Abridge, an AI-for-clinical-documentation platform. Link

Contact us to feature roles in our newsletter.