👋 Hi! Kevin here. Welcome to this edition of my free weekly newsletter, where I discuss the key healthcare innovation news from the past week. This weeks edition is a particularly long one checking in at 5,000+ words as I catch up on the last two weeks after taking last weekend off for the Easter holiday.

Covering two weeks of news feels like an eternity these days given all of the uncertainty in the broader market, and that certainly trickles down into healthcare news. On top of the slate of earnings calls, uncertainty in DC, and everything going on in AI, I spent a lot of time this week looking at Connecticut’s recent efforts to contain costs in the state, which have been met with some predictable outcomes. More on all that and the other news of the week below.

Happy Sunday!

- Kevin

Sponsored by: Vanta

To scale your healthcare company, you need compliance. And by investing in compliance early, you protect sensitive data and simplify the process of meeting industry standards—ensuring long-term trust and security.

Vanta helps growing healthcare companies achieve compliance quickly and painlessly by automating 35+ frameworks—including HIPAA and HITRUST.

And with Vanta continuously monitoring your security posture, your team can focus on growth, stay ahead of evolving regulations, and close deals in a fraction of the time.

Start with the HIPAA checklist to break down the process.

If you're interested in sponsoring the newsletter, let us know!

HEALTHCARE COSTS

Connecticut’s efforts to manage healthcare cost growth

The Connecticut Office of Health Strategy recently issued a report exploring the impact of the state’s Cost Growth Benchmark program, an initiative that’s been in place the last few years to limit healthcare expenditure increases in the state. Connecticut Inside Investigator provides a nice overview of the findings here.

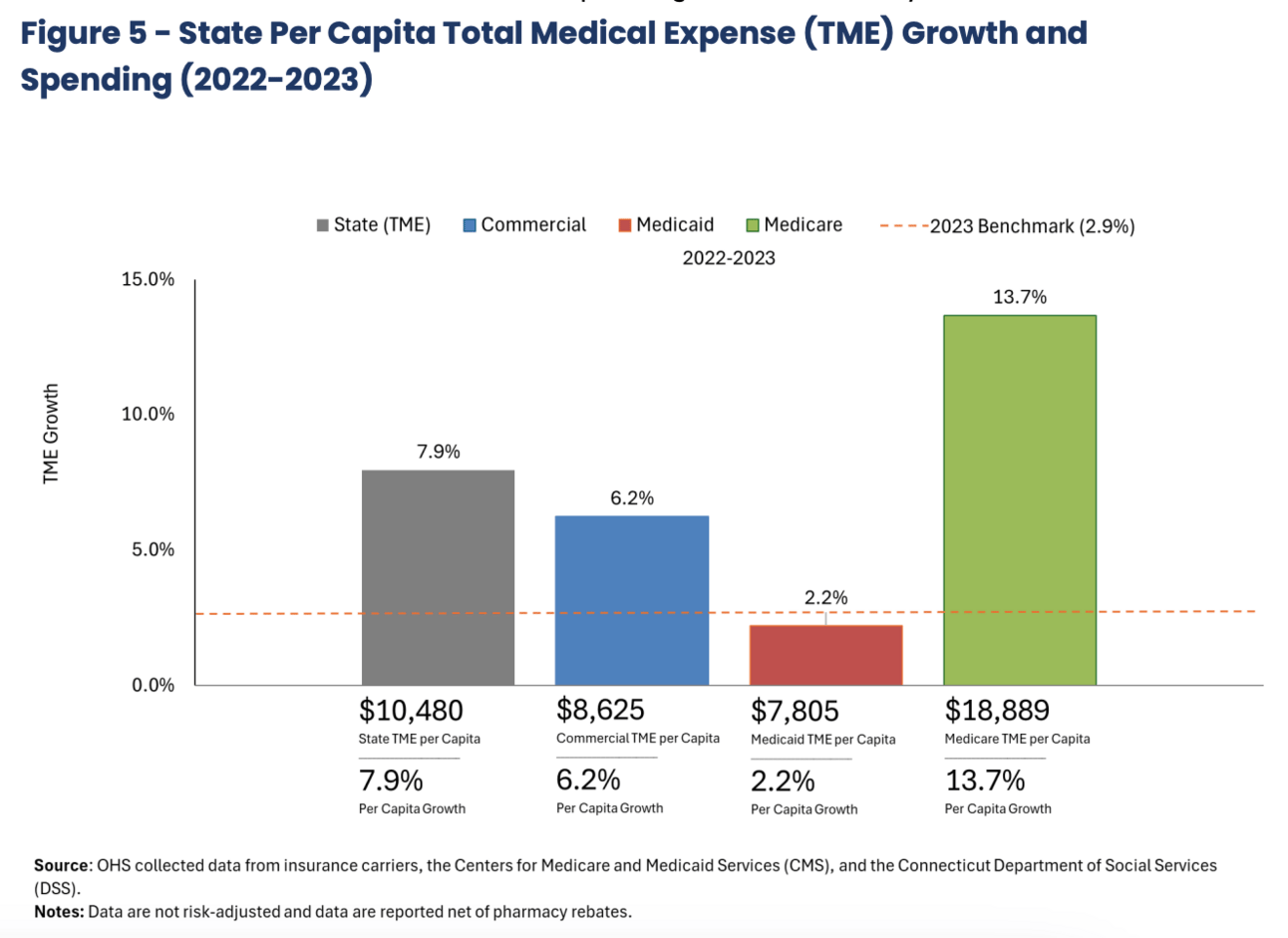

Perhaps unsurprisingly, state healthcare expenditures have still risen by more than the benchmark trend in each of the three years, even though 2022 was close to achieving the target trend. The results for 2023 saw a big spike as total medical expenses increased 7.9%, well in excess of the benchmark growth rate of 2.9%. You can the growth in medical expense across payer lines of business below:

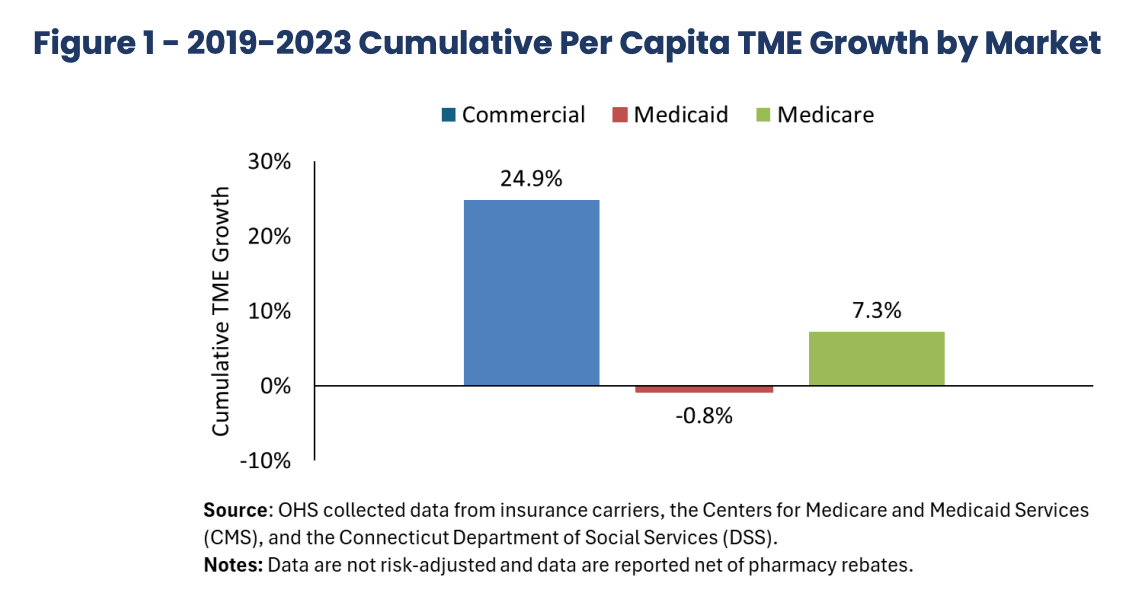

As you can see, the Medicare increase in 2023 was massive, growing 13.7%, while Medicaid was actually below trend. The commercial business in the state has been consistently growing above trend, at 6.2% in 2023, while its grown a total of 24.9% from 2019 to 2023, as shown in the chart below:

The increase in costs in 2023 was attributed to a handful of core drivers:

Commercial market spending increases, where every major payor exceeded the benchmark. This was driven by provider network cost growth, particularly providers affiliated with hospitals.

A spike in Medicare Advantage, driven by primarily by UHC flipping its OptumCare contract from FFS to percent-of-premium. Aetna also saw a dramatic increase in expenses after winning the state retiree contract (the state switched from UHC in 2022, which probably says something about how Aetna’s business performed here).

Retail pharmacy spending, in particular utilization of GLP-1s.

Hospital outpatient spending, with ambulatory surgery and administered drugs (chemotherapy and infusions) being called out as two key drivers here. Outpatient spending on the whole has increased 41% between 2018 and 2023, with utilization growing 17% while price went up 20%.

It’s fascinating to see that Medicare Advantage point in particular, especially as we get into Q1 earnings season and see how the various payers report earnings results and the challenges UHG noted it is seeing in the group MA business and the VBC business. Conceptually, it is difficult for me to square the idea that VBC is reducing costs when I see Connecticut reporting a 13.7% cost increase in Medicare primarily driven by a switch from a FFS contract to a VBC contract. At the same time, Connecticut is a market where primary care is facing some serious challenges (Connecticut also published a great read on the primary care landscape in the market), and VBC feels like it should be part of the solution.

Stepping back from any one particular market segment, the report underscores the broader challenges a regulator faces in trying to manage overall healthcare expenses. Despite attempting to hold medical expense growth in check, you have three years of that not happening, and it appears every major player in the healthcare ecosystem has some accountability for that. The report notes at the end that “it is time to take additional policy steps to slow healthcare spending growth, particularly in the commercial market, to stem continuing losses in healthcare affordability for Connecticut residents.”

I’ll be curious to see what additional policy steps Connecticut takes here to manage healthcare spending growth.

INSURANCE EARNINGS

UHG earnings miss prompts questions about MA and VBC; other insurers seem unaffected

Here’s a rundown of the earnings reports from Centene, Elevance, and Molina this week, which saw all three reaffirm guidance for the year even as they adjust to some underlying changes in the businesses. While the markets in general didn’t react favorably this week, they provided a more stable outlook on the insurance market as compared to UnitedHealth’s unsettling earnings miss from last week (which I’ll also include a few thoughts on at the bottom of this section):

Centene (transcript, earnings release)

$CNC ( ▼ 1.2% ) reaffirmed its earnings outlook for the year, noting it is doing so while seeing market volatility that is “unmatched in recent history”.

Centene had stronger-than-expected membership growth in Q1 which are causing it to increase its premium revenue for the year, but it is also increasing its medical cost expectations for the year, driven by three things: new ACA members coming in with higher costs, higher-than-expected influenza costs in Medicaid in Q1, and high utilization of specialty drugs for Part D members.

Medicaid costs came in high as the company saw $130 million more than expected in influenza costs. Centene is pleased with the progress it is seeing on Medicaid rates, noting that 4/1 rates saw a 5% increase, and it expects to see a full year rate increase of 4%+ for the bull business.

Centene saw strong exchange growth with 1.9 million new marketplace members in Q1, but it also saw higher medical costs as those members are utilizing more care than its new membership last year.

Centene continues to see its Medicare Advantage business on a path towards breakeven in 2027, and it is increasing its 2025 revenue outlook by $1 billion for the business given stronger-than-expected member retention driving additional growth.

Centene did note the exchanges could see high single digit price increases in 2026 even before any trend adjustments or the impacts of tariffs. This is due to two factors — one is the expiration of subsidies, and the other is a Marketplace integrity rule that was released in March. Centene seems optimistic there will be some relief for subsidies, but they are still submitting two sets of rates to states and over half of states have accepted the two rates, which adjust for the enhanced subsidies expiration.

Elevance (transcript, earnings release)

$ELV ( ▼ 1.13% ) reported a relatively uneventful quarter after it issued an 8-K last week pre-announcing earnings given UHG’s challenges had a material impact on Elevance’s stock price.

UHC’s challenges were referenced often in the analyst Q&A for Elevance. The first analyst question was about Elevance’s MA trend given UHC’s challenges, and Elevance noted that it is not seeing anything changed versus what it expected to start the year. Costs are elevated overall, but as anticipated. Later on, another couple questions came in about risk coding and Elevance’s experience with new members versus existing members, seemingly also driven by UHC’s challenges. Elevance noted in response that membership growth has been consistent with what it expected, but didn’t go into much detail on specifics. Another question also came up on group MA and whether anything is trending differently there. Elevance noted that it is not seeing any meaningful acceleration in group MA, which accounts for 15% of its overall MA business.

Elevance’s healthcare services business, Carelon, had solid growth in the quarter at 60%, and it tracks to 50%+ growth for the year. It noted that it is seeing solid growth internally and externally. Carelon noted particularly strong growth in its oncology model, which is expanding from commercial to Medicare, and in its serious mental illness offering for Medicaid.

Elevance is seeing solid growth in the ACA, growing 11% sequentially, although it is seeing member effectuation lower than anticipated, which will drive a mid-single digit drop in membership in Q2.

Molina (transcript, earnings release)

$MOH ( ▲ 0.89% ) stock was flat this week on an earnings report saw no change to guidance, but underneath that some moving variables:

Molina reiterated guidance, but noted that EPS guidance now includes a higher-than-expected revenue trend increase from states, which Molina is offsetting by increasing its outlook for medical cost trend as well.

It’s interesting to see how Molina discusses the strategic (un-)importance of the ACA exchanges in the Q&A — they refer to it as a “residual market” that captures the excess from when other things in the economy go up and down. Implication being that it will have more volatility than other insurance markets, and that while Molina views it as synergistic with the rest of the portfolio, it will always be a small portion of the portfolio where Molina prices for margin and let membership fall out where it may.

Molina saw an as-expected increase in medical costs during the quarter. specifically across LTSS, high-cost drugs, behavioral health, and seasonal illness. It noted that cost trend was as expected. Flu costs were $10 - $15 million was higher than a normal season, but that was anticipated.

Molina sees Medicaid rates getting closer to be adequate, noting that it needs 2% - 3% rate increases in excess of medical trend to be where they should be, at which point Molina should be back to performing at a 89% MCR

Check out Molina’s opening remarks on potential changes to Medicaid from DC: “We continue to believe that any changes to the Medicaid program in the near term will be marginal.” It makes sense that Molina would seek to calm investor anxiety towards potential shifts in the market as they note that any changes to membership volume or acuity will not disrupt the trajectory of the business. Given the broader tone of the dialogue around Medicaid cuts, it seems notable that Molina is signaling this to the market.

Molina noted that all the uncertainty in the market today is increasing the M&A opportunity to acquire single-state Medicaid businesses that are struggling with the uncertainty of the market and would benefit from the diversification of Molina. They continue to expect that 1/3 of future growth will come from M&A.

UnitedHealth (transcript, earnings release)

A lot has already been made of UNH’s miss and the nearly 30% decline in stock price since last week, so I’ll just note a few observations I took away from the key strategic issues that UHG noted across MA and Optum that I think will be worth paying attention to for anyone in the industry moving forward:

On Medicare Advantage, UHC saw unit prices as expected, but care activity was twice as high as last year. UHG called out increased elective care activity in its group MA product driven by broader Medicare funding cuts and the higher member premiums as a result — i.e. since people are paying more, they’re going to use it. This increase came with a retention rate of 98%, meaning the same group of members are using more care. Given that hypothesis, it’ll be interesting to keep an eye on the other MA plans and what they’re seeing. Elevance already noted it did not see a similar dynamic play out in group MA. I’d watch what other plans note next week as well.

Optum saw an influx of new Medicare patients from plans that exited markets last year and apparently had a lack of engagement, leading to lower risk adjustment levels and revenue for Optum. Optum remains on track to add 650,000 net new patients to VBC deals this year, and presumably this should be a correctable issue for 2026 as Optum engages those patients in 2025.

Also on the Optum Health front, it apparently is not transitioning as well as it should to the CMS risk adjustment model changes from v24 to v28. This seems like a more concerning issue than the prevoius one. It’s unclear to me from the call why those issues would be cropping up now as we’re midway through the transition, but UHG noted that it is investing in improving clinical workflows in order to better provide insights to providers. It seems like this challenge is similar to those that many care delivery organizations have faced over the years in terms of aligning various groups of acquired and aligned physicians. It’s vaguely reminiscent of the narrative from agilon when it began experiencing issues with managing its VBC book of business — all of a sudden it becomes more important to implement standardized workflows with providers, which it inevitably turns out is more challenging than anyone expects. agilon is still not recovered from those issues over a year later.

It was interesting to see an analyst ask UHG for a refresher on why moving towards VBC is the best move over the long term. It’s clearly a question that is on the minds of many on the public markets and beyond as VBC has increasingly been under fire for the last few years. Optum has stood out in the public (and private) markets as the only company to really demonstrate that it can succeed in achieving consistent positive financially performance in VBC contracts at a meaningful scale. With Optum now facing challenges as well, it seems like a major concern for the broader VBC market, one that overshadows the recent 2026 rate tailwind. It’s a turbulent time for the entire concept of VBC, and I’d imagine Optum’s results over the coming quarters will have large ripple effects on the industry that will be felt for the years to come.

Next week we’ll see another batch of insurers report Q1 results — Humana, CVS, and Alignment. Will be interesting to watch.

PBM LEGISLATION

Arksansas’s PBM legislation draws ire of UHG, CVS

Arkansas adopted a new law that will prohibit a PBM from having both a retail and mail-order pharmacy presence in the state in a move designed to limit the power of PBMs. This action was similar to a letter that 39 state attorney generals sent to Congress last week where they argued that PBMs have harmed independent pharmacies as a result of anti-competitive practices and that PBMs should not be able to own or operate affiliated pharmacies.

The Arkansas legislation prompted a scathing response from the industry, with CVS calling the move “bad policy”, and Optum Rx CEO Patrick Conway sharing this perspective during the $UNH ( ▼ 0.47% ) earnings call last week:

The last thing I'd just call out just because it's new and it concerns us significantly is the Arkansas legislation that the governor signed yesterday around PBM and pharmacy ownership. We're honestly not sure what problem they're trying to solve, but let me be clear on the impact on patients. When you do that, we have general pharmacies in the state, providing integrated mental and behavioral health care. This could cut off access for those patients with things like schizophrenia, severe depression. You have specialty medicine where we may have been serving a patient with cancer for years. And imagine that patient now not getting their medicine in their home. You have home infusions for elderly Americans or they may not be able to get out of their home, and we're providing their medication. And you have home delivery for people in rural parts of Arkansas. We're significantly concerned about this. We'll work with the state and the regulatory process post legislation to try to address those populations and maintain access. But we want you to hear clearly from us that our concern is about patients and maintaining access to patients across the nation to these medicines.

UHG and CVS will need to close a number of pharmacy related assets as a result — CVS stated it will need to close over 20 of its 23 pharmacies in Arkansas and that over 100 mail order pharmacies will close, while UHG will potentially need to close 11 Genoa pharmacies.

Policy changes like these are always fascinating to me because I think they present really complex questions to think through — namely, how do you move forward if both parties are partially right in the cases they’re making? I am willing to believe the Arkansas argument that PBMs have been bad for competition and hurt independent pharmacies. I am also willing to believe Optum Rx and CVS that this move in Arkansas will cause patient harm as they shut down offerings. How do you resolve those conflicting points in a more productive way than appears to be occurring in Arkansas?

THE EPIC PODCAST

Acquired goes deep on Epic’s history

I’m a big fan of awesome long form content like the Acquired podcast, which I imagine will come to the surprise of nobody who reads 2,000+ here every weekend. So naturally I spent a good deal of time this week listening to the entire four-hour long episode on the history of Epic.

I’d highly recommend listening if you’re thinking about growing a business in health tech. If you’re feel like you already know the Epic history, you might find it a bit repetitive and not worth investing four hours. That said, I think it provides a great narrative around how Epic has driven growth over the long term, particularly around a few key inflection points for the growth of the business — winning the Kaiser contract and the HITECH Act. Not surprisingly, policy changes like the HITECH Act and the ever-increasing need documentation (mostly for billing purposes) play a huge role here in driving growth for Epic, and that invites a lot of questions that come along with it.

It is fascinating to see the difference in tone in a podcast like this takes versus something like the well known All-in Summit talk by Bill Gurley that railed against Epic for regulatory capture a year ago. It goes to show that storytelling is an art, and how surfacing information and your willingness to remain curious to the narrative behind it can make all the difference. In case you can’t tell, I think good, nuanced long form content like this Acquired podcast is more important than ever these days.

(Two) charts of the week

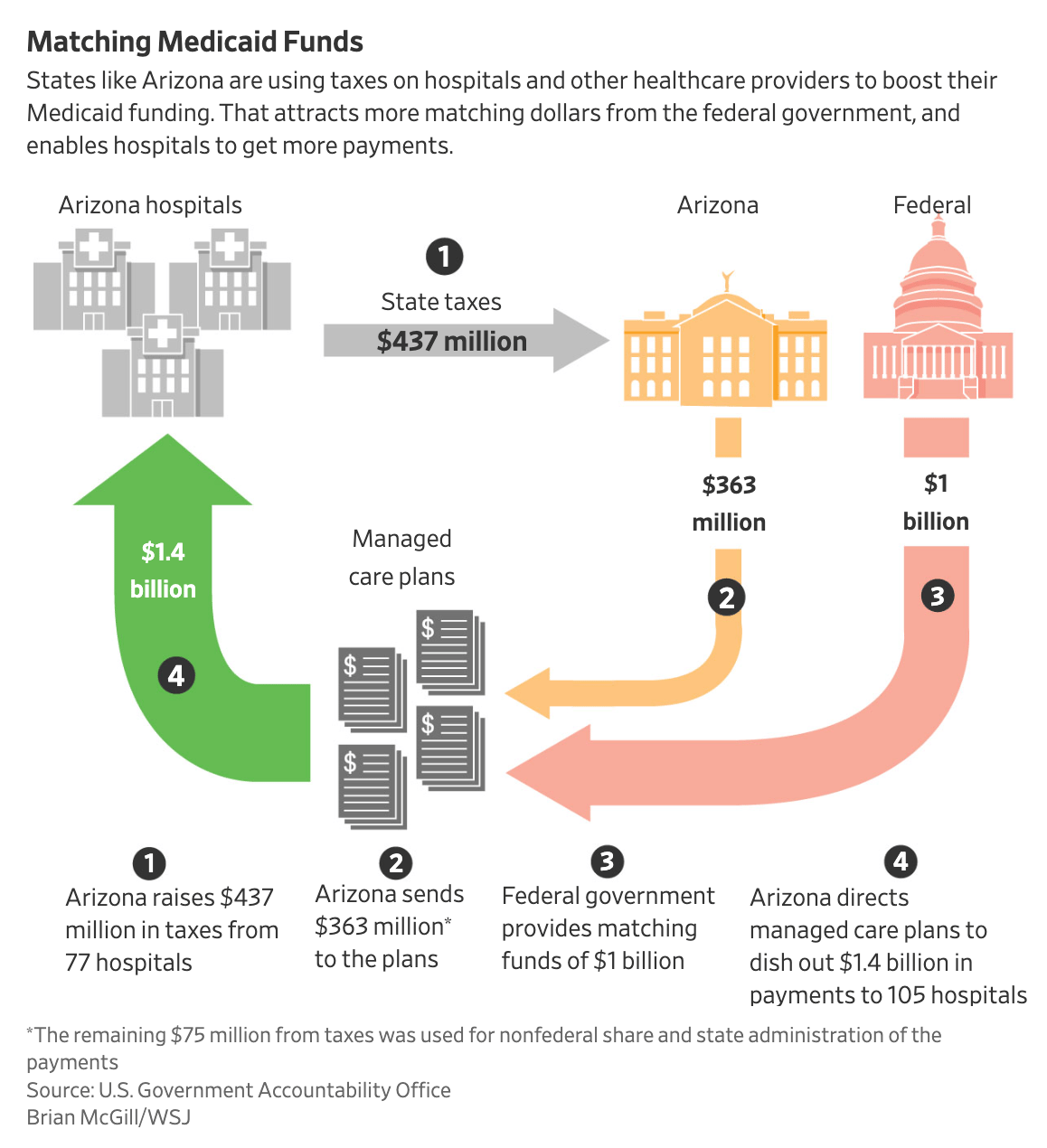

The WSJ highlighted how state provider taxes drive Medicaid funds flowing between hospitals, states, the federal government, and managed care plans in the image below. It highlights the example of Arizona in 2022, where the state collected $437 million in taxes from hospitals in the state and in turn those hospitals received $1.4 billion in payments, largely because of how the federal government matches funding. The CBO estimates that removing this loophole would save $600 billion for the federal government over a decade.

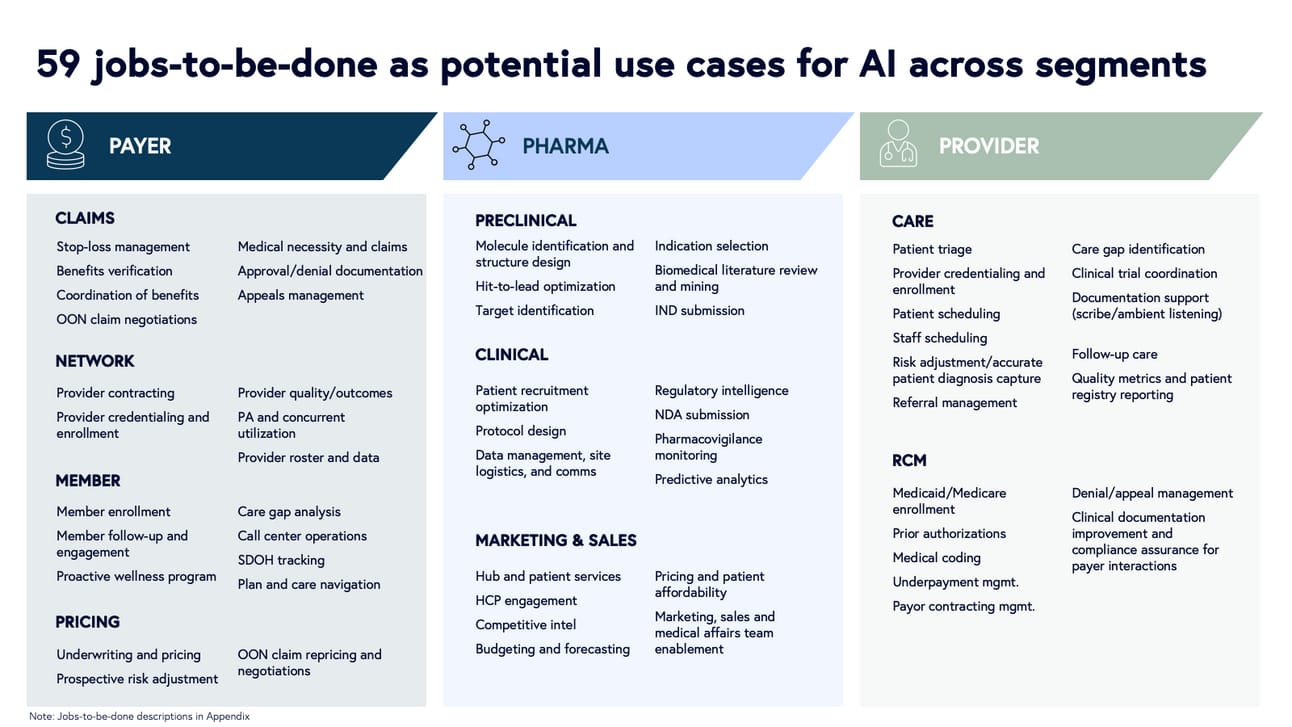

Bessemer’s AI report last week made for excellent reading on the opportunity for AI in healthcare. I thought this slide did a nice job summarizing various jobs-to-be done for AI across payer, provider, and pharma use cases:

It’s worth perusing the entire report to get a sense of how the industry views the potential impact of AI. One other chart I’ll call out — when discussing the impact AI can have on the industry, ~80% of payor, provider, and pharma execs all seem to agree that GenAI will both: A. drive incremental revenue and B. drive cost savings for their organizations. It’s another friendly reminder of the likely impact of AI on the industry — increasing profit pools.

Other Top Headlines

HCA’s stock dropped 4% on Friday after reporting Q1 earnings, ~4% despite relatively solid numbers. HCA noted it was pleased with volume growth and expense management, while revenue was inline with expectations and it reaffirmed its 2025 outlook. Despite all that, I’d imagine the stock decline had something to do with the uneasiness around the policy environment at the moment as described in the earnings call. The opening commentary from HCA’s CEO highlighted the level of uncertainty to analysts: “I know you would like us to size the potential impacts of health policy risk and now tariff risk, but we are not comfortable with providing estimates at this time. We just do not have enough insight into what might happen.” So while HCA confirmed guidance for 2025 for now, it seems like the door is open for that to potentially change at some point depending on which way the wind blows out of DC over the weeks ahead.

This was an interesting interview with the CEO of BCBS Idaho in Modern Healthcare. BCBS Idaho is now facing a multi-year turnaround after it ran a -20% operating margin in 2024, losing $465 million for the year, driven by $380 million of losses on its 750,000 Medicare Advantage members. The interview notes a few things in particular — MA losses were driven by utilization, noting MSK and GLP-1s; BCBS Idaho is aiming to get to breakeven in 2026 before returning to profitability in 2027; and on the exchange market, BCBS Idaho is pushing for the re-introduction of enhanced short-term plans for the non-subsidy market. Going back to Modern Healthcare’s 2019 coverage of these plans, you can see the general pitch — 40% cheaper than ACA-compliant plans in the state because BCBS can price discriminate by health status and have a 12-month waiting period for coverage of pre-existing conditions.

Eli Lilly is suing four telehealth startups that are selling compounded versions of Zepbound and Mounjaro. It’s interesting to see that the case against two startups focuses on corporate practice of medicine issues given that they are not owned by physicians. Moving past the irony of a $840 billion market cap publicly-traded company suing startups over corporate practice of medicine issues, it seems like these cases will be interesting to watch for the broader telehealth industry given the questions around non-physicians making decisions about drugs being prescribed.

Humana’s lawsuit against CMS over Star rating calculations faced a major setback last week. A CMS Hearing Officer issued a decision that it would not revisit Humana’s Star rating, unless the CMS Administrator decides to revisit that within 10 days. The HealthcareDive reporting does a nice job highlighting the business impact this Stars decision has for Humana — it represents a revenue swing of $1 billion - $3 billion for Humana in 2026.

Stat dug into how Eton Pharmaceuticals is raising the list price for a drug that treats a rare growth disorder in children that impacts only 200 children a year in the US, 60 of whom are prescribed this drug. Eton will increase the price by 150%, from $5,882 to $14,705, in order to ensure it can keep the drug on the market. This move will cause it to pay a Medicaid penalty where it will lose $2,100 per drug for Medicaid patients, but it will recoup all of those losses via commercial insurance plans paying more for the drug. It’s a fascinating strategy conversation about pricing strategy — Eton expects commercial insurance plans to bear the cost of this drug because its for a small population and there’s no alternative to it.

Continuing on the topic of drug prices, this was an good read on the role copay assistance programs play in paying for drugs in Bloomberg. It highlights the story of how a patient got stuck with a $250,000 bill for her Crohn’s disease treatment after her employer worked with Payer Matrix, a copay assistance program, in an effort to help the patient access the drug at a lower price. It’s another reminder of how patients are often the ones left bearing the brunt of challenging conversations about how to manage the high costs of healthcare in this country.

In an interview with TIME earlier this week, President Trump briefly indicated that he would veto any legislation that cuts Medicaid. Trump noted his perspective that the House Republican budget isn’t actually proposing $800 million in Medicaid cuts, rather it is going after fraud, waste, and abuse in the program.

Propublica featured a deep dive on Blue Cross Blue Shield of Louisiana and their legal battle with a breast center in Louisana that BCBS Louisiana thought was overcharging for procedures. It’s a really good read on the complexities of how healthcare is paid for with a high-end provider that charges a premium for those high-end services.

UPS is acquiring a Canadian medical transport business, Andlauer Healthcare Group, for approximately $1.6 billion, as part of its broader growth strategy in the healthcare industry.

CardioOne acquired CardioDiagnostics, a cardiology remote monitoring platform. CardioOne will integrate the technology into its practice support platform for independent cardiology practices.

Hinge Health announced a new relationship with Cigna, providing Cigna’s self-insured clients with access to Hinge’s MSK platform.

Quote of the Week

Here is investor Bill Trenchard describing Assort Health’s growth trajectory in a recent Fortune article about Assort’s $22 million Series A:

“It’s early for this company,” said Bill Trenchard, partner at First Round. “They’re one of the fastest-growing companies we’ve ever had, including Uber or Roblox. It’s such a pain point for clinics and it shows how well they’re adopting the solution so quickly.”

The article noted that Assort Health has seen 8x revenue growth since Q4 2024. By my quick math, this would imply that Assort has grown from ~$14k a month of revenue to ~$112k a month of revenue over the last six months. (here’s the math: assume Assort’s Series A dilution is at the median of Carta’s data, 19.5%. That implies a post-money of $135 million. Assume the round is at 10x current ARR, that implies current ARR is $13.5 million, so current monthly revenue is $112k and in Q4 it was around $14k a month). If anything those guesses seem a little high, but directionally accurate.

Assort appears to be going after a distinct use case from much of the AI activity in the space currently, helping providers manage inbound patient calls to schedule patient visits more efficiently. It’s not hard to see why a model like this with a relatively distinct offering in the AI landscape and early traction like that would get investors so excited.

At the same time, it feels very peak hype cycle-y to see a tech investor comparing the growth trajectory of a HCIT startup to Uber and Roblox.

Startup Funding Announcements

Chapter, a Medicare navigation platform, raised $75 million.

Nourish, a network of registered dietitians, raised $70 million at a $1+ billion valuation. The company employs 3,000 dietitians, currently serving hundreds of thousands of patients covered by commercial, Medicare, and Medicaid insurance.

Healthee, a benefits navigation platform, raised $50 million.

hellocare.ai, an AI virtual care platform for hospital rooms, raised $47 million. The platform is currently deployed at 70+ health systems with Advent Health deploying it across 50 hospitals and 13,000 patient rooms.

Superpower, a consumer health platform, raised $30 million. This funding announcement seemingly took over social media this week, as Superpower articulates a vision of being a new front-door to a healthcare system that is designed for people to manage their own health. It’s a big vision that I imagine will have a lot of healthcare folks skeptical (including myself), but also one that would be very cool to see materialize. I’ll be very interested to watch their next steps towards accomplishing the vision as they move past the initial longevity-focused early adopter audience into a broader market, which is where the turbulence seems to inevitably crop up with these types of models.

Assort Health, an AI platform for provide call centers, raised $22 million.

Overture Life, an IVF automation model, raised $20.6 million.

Brellium, an AI-based chart review platform, raised $16.7 million.

Ascertain, an AI case management solution for providers, raised $10 million from investors including Northwell Heatlh.

Lena Health, an AI care coordination platform, raised $2 million.

Paradigm Health, a clinical trials platform, raised an undisclosed amount of growth funding from DFJ Growth.

LucyRx, a next-gen PBM, raised an undisclosed amount. It has now raised over $500 million in total.

Other Good Perspectives

Leading through the reset: 8 implications of the VC market contraction for healthcare leaders by Ezra Mehlman, Dan Mendelson, and me

Clearly I’m biased here having helped out in this one, but I thought this was a good discussion of the changing funding landscape in healthcare and the implications that has for the CEOs of health systems, payers, and employers as they think about working with startups. Read more

Tax Exempt Status for Not-for-Profit Hospitals: The Debate Ahead by Paul Keckley

Keckley takes a look at the headwinds facing not-for-profit health systems, and the activities they should take to ensure not-for-profit statuses continue in the future. Read more

Rewriting Healthcare’s Foundation: The HHS Reorg’s Potential Impact on Value-Based Care and APMs by Diane Ligman

This is a great read on the structural changes being made at HHS, focused on the changes in VBC and data standardization. Read more

Is your women's health business venture-backable? by Carolyn Witte and Leslie Schrock

A helpful series on starting a women’s health business and seeking capital associated with that business. Read more

Why I stopped angel investing after 15 years (and what I'm doing instead) by Halle Tecco

For anyone considering angel investing in digital health in an effort to generate positive returns, this is a really good perspective on the challenges in doing so. Read more

Featured Jobs

Head of Operations at Vector Health AI, a company that helps hospitals secure financial aid for patients. Learn more

Remote

Vice President, Strategic Partnerships at Lumeris, a value-based care platform for providers. Learn more

$175k - $249k | Remote

Director of Business Development at Dandelion Health, a platform for real world patient data. Learn more

$175k - $250k | NYC or remote

Vice President, Data and Analytics at Habitat Health, a PACE provider. Learn more.

$200k - $250k | Remote, California preferred

VP, Finance at Parsley Health, a functional medicine provider. Learn more.

$170k - $200k | Remote

Contact us to feature roles in our newsletter.

Want to share feedback with us?

Show your support by sharing our newsletter and earn rewards for your referrals!