Welcome to this week’s free weekly newsletter, where we share our perspectives on some of the key healthcare related news of the week. To get access to exclusive paid content, learning and networking opportunities, and a vibrant community of 5,000+ other folks in this space, join the HTN community.

This week's newsletter is sponsored by: Blaze.tech

Have an app idea for your customers or team, but not sure where to start? Blaze.tech offers a no-code platform that healthcare orgs can use to build HIPAA-compliant apps and forms, plus an in-house team and customizable templates if you don’t want to go at it alone.

Blaze has prebuilt integrations (including Epic) and robust security that can be used to create patient portals, onboarding forms, healthcare marketplaces, custom web and mobile applications, and more. Whether you have a small business or a unique app idea, Blaze can be a valuable partner in turning your vision into a reality.

If you're interested in sponsoring the newsletter, let us know here.

Top News

Sharing our perspective on the news, opinions, and data that made us think the most this week

Why it matters:

This NewCo will partner with local providers to launch PACE programs, starting with Kaiser. The launch underscores the buzz around the PACE program at the moment. PACE provides a much-needed care model for complex senior populations, paid for via a global cap payment from Medicare and Medicaid of $100k+ per member per year.

Going Deeper: The PACE (Program for All-Inclusive Care for the Elderly) program is small but mighty. It only has ~70,000 enrollees in the US today, despite 2.2 million people being eligible for PACE (generally speaking seniors who are eligible for nursing home care but want to age independently qualify for PACE).

The National PACE Association estimates that PACE will grow to 200,000 enrollees by 2028, which would make it a $20 billion market. If all 2.2 million PACE-eligible people were enrolled in the program, it’d be a $220 billion market. With a TAM like that you can see why investors are excited here. Adding to that, the program has been around since the 1970s, and has really solid clinical and financial evidence behind it.

Given all that, the challenge with PACE models like Habitat isn’t proving that the clinical or financial model should work. The challenge is in recruiting patients at scale in a cost-effective manner. The largest company in the PACE market, InnovAge, only has ~6,700 patients (but it is a public company with just 6,700 patients). Enrolling people in PACE has proven quite challenging, evidenced by the fact that only 70,000 out of 2.2 million people eligible for the program are in it.

This is where the Habitat Health platform makes for an interesting play, because the thesis seems to be centered around setting up joint ventures with local care partners to leverage their trusted brands to help with member recruitment. Kaiser is the first partner for Habitat, and they will launch PACE centers in Sacramento and Los Angeles in 2025. Per the press release, the Kaiser partnership is intended to serve as a model for future such partnerships with other provider organizations in different parts of the country.

It’s a logical thesis to test in this market - see if partnering with a trusted local brand can help solve the enrollment challenges in this market. Andy Slavitt’s quotes in the Modern Healthcare article linked below suggest this is exactly what Habitat is trying to solve. It’ll be worth watching if Habitat can successfully scale by taking this approach.

Relevant Links:

Modern Healthcare coverage. Provides some good insight into the investment thesis behind Habitat Health including how the Kaiser partnership can potentially help with marketing to members.

Town Hall Ventures blog. Town Hall’s perspective on why they invested here: a macro trend of an aging population, a proven model in PACE, and a brand name partner in Kaiser. Makes a ton of sense.

InnovAge’s 2024 Investor Day. InnovAge, the biggest company in the PACE market, hosted its first investor day as a public company in February. It provides an excellent overview of PACE and what a PACE model looks like.

Next Thurs, Apr 4th, at 12:15p ET CareOps is hosting Oak Street Health to discuss the intricate process of designing and optimizing care flows in senior care. If you’ve ever wondered how top care orgs leverage tech and measure success/impact, now’s your chance to hear directly from Oak’s Chief Clinical & Technology Officer, Dr. David Buchanan, and Head of Product, Colton Ortolf. Join the conversation.

Charts

Compelling visuals that help convey data, trends, or topics

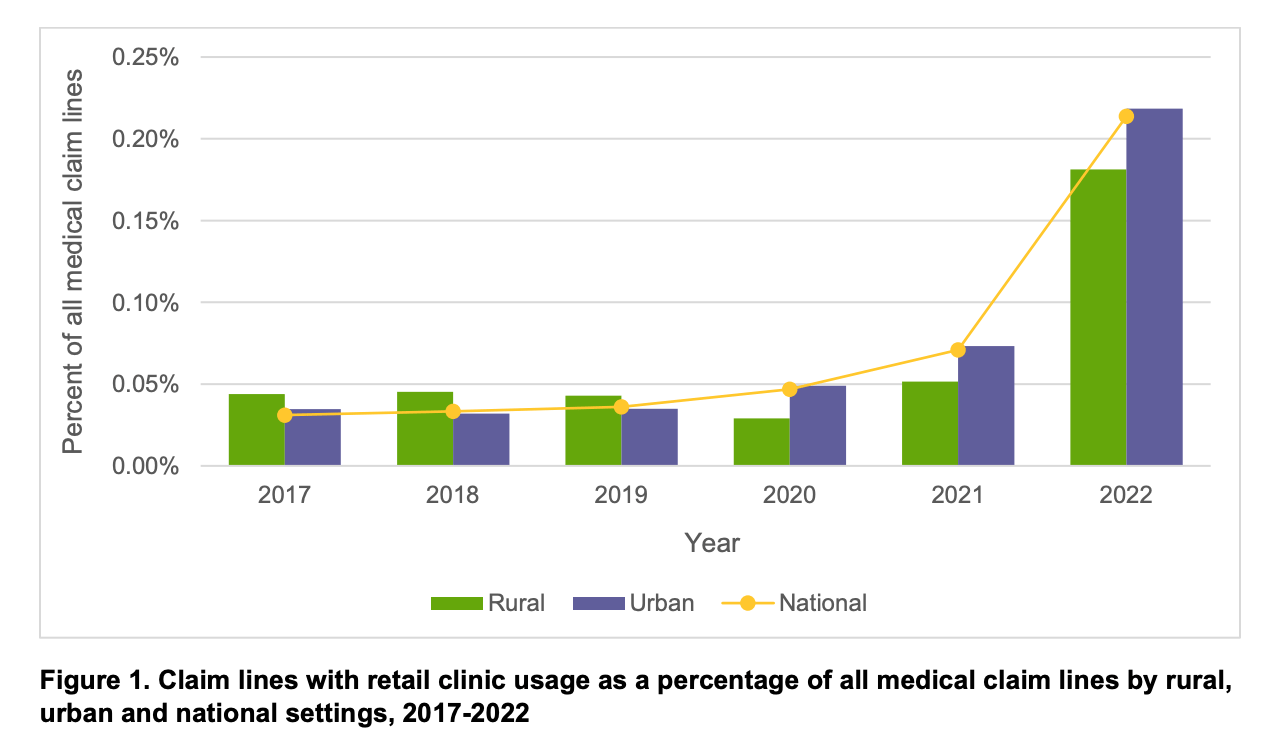

Fair Health claims analysis explores utilization in alternative sites of service

Fair Health published a report looking at the utilization of care delivery in alternative sites of service. The chart above stood out to me - both for how low the numbers on the y-axis are and also for how much retail clinic utilization increased in 2022. It appears to have grown by over 200% but still represented only ~0.2% of claims in 2022.

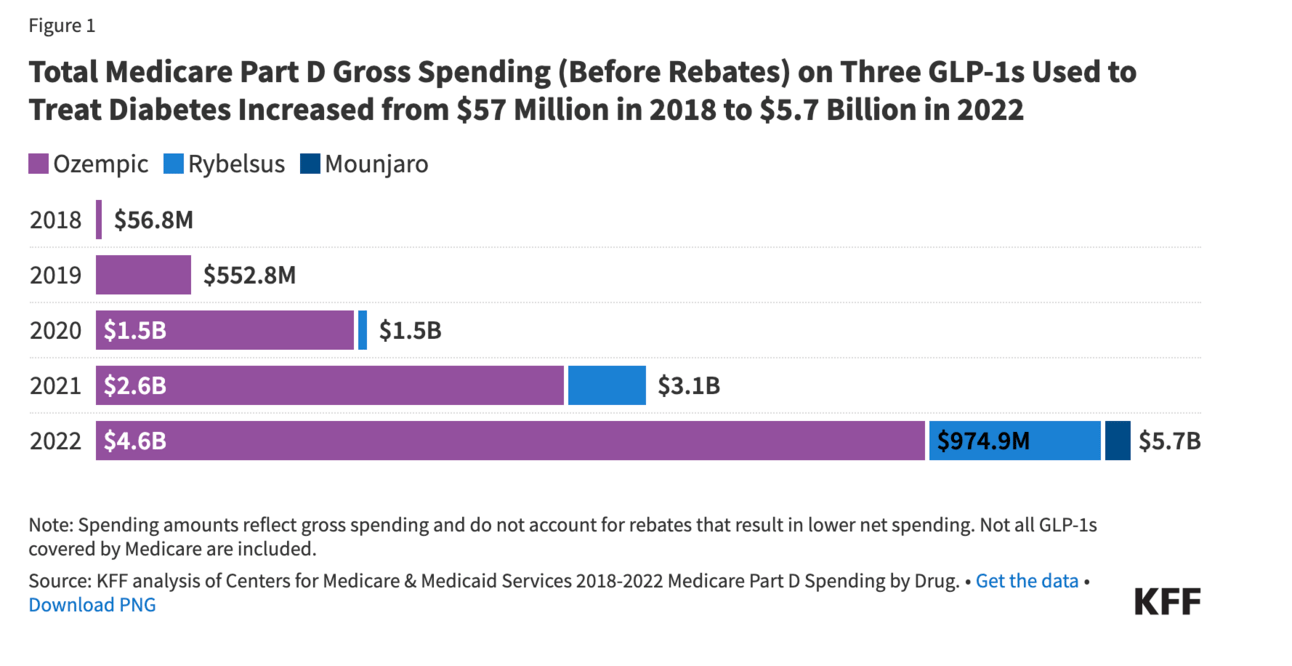

Medicare spending on GLP-1s increased to $5.7 billion in 2022

The chart above from this KFF article highlights the rising gross spending associated with GLP-1s in Medicare. As big as those numbers are above, it’s worth noting that Ozempic was still only number six on the list of top ten drugs by Medicare Part D gross spend. Number one on the list was Eliquis, which cost $15.2 billion by itself, an increase of $2.6 billion year over year. That said, GLP-1s are prohibited for weight loss treatment in Medicare, so the costs here could still increase substantially.

Other News

A round-up of other newsworthy items from the week

Walgreens reported its FY Q2 2024 earnings this week, announcing among other things that it has taken a $5.8 billion write-down on VillageMD and has already shut down 140 clinics this year (it had previously shared plans to shut 60 clinics). The write-down came after VillageMD revised its internal financial model downwards in February, noting the Medicare headwinds, clinic closures, and slower-than-expected ramp of patients as key challenges. The commentary about the slow ramp of patients provides another hint as to why Walgreens has abandoned the owned-clinic strategy. Walgreens instead appears to be focused strategically on winning as the leading retail pharmacy in the industry. It’s fascinating to compare the tone of Walgreens’ and CVS's earnings calls these days - one sounds very much like a retailer talking about consumer purchasing behaviors (Walgreens) while the other sounds very much like an insurance business (CVS). Link (Earnings Transcript) / Link (Press Release)

Optum Care is acquiring Steward’s physician group, Stewardship Health, pending regulatory approval. Stewardship includes Steward’s primary care providers and specialists across nine states, so essentially the non-hospital assets. Massachusetts regulators appear set to scrutinize the deal closely after Optum closed on the acquisition of Atrius in 2022. I can understand why regulators are worried about competitive issues with Optum acquiring these providers, but what’s less clear to me is what the alternative would be here aside from bankruptcy. Link

Amazon launched same-day prescription delivery in NYC and LA with plans to expand the program to more than a dozen cities by the end of 2024. Link

Curai Health, an AI-enabled virtual primary care startup, announced its partnership with Tufts Medicine. The partnership will integrate Curai Health’s services into the Tufts patient portal and provide patients across Massachusetts and New Hampshire access to virtual care via Tufts. Link

Sutter Health partnered with Abridge, a generative AI company, to offer Abridge’s AI clinical documentation platform to Sutter physicians across California. Link

Funding

Notable startup financing rounds across the industry

Pelago (fka Quit Genius), a virtual addiction clinic, raised $58 million in Series C funding. The company provides digital CBT programs to treat people with tobacco, alcohol, and opioid addictions and has recently expanded its offerings to adolescents. Link

InStride Health, a pediatric mental health startup, raised $30 in Series B funding to expand into new markets. The company serves nearly 1,000 patients and works with 16 major insurers across states in the Northeast, including Connecticut, New Jersey, Rhode Island, and more. Link / Slack (h/t Rik Renard)

Intellihealth, an obesity care platform, raised $24 million in financing. Link

Tennr raised $18 million in Series A financing to leverage machine learning to automate fax reliance issues in healthcare. Link

Float, a home-based care staffing platform, raised $10 million in Series A financing. The startup contracts with registered nurses to deliver in-home specialty care to help manage patients with chronic conditions. Link

Goodbill, a platform that helps self-insured employers identify claims errors from providers, raised $2 million. Link

Writers Guild

Thought-provoking posts from the broader healthcare community

A first look at outcomes under the No Surprises Act arbitration process by Matthew Fiedler and Loren Adler

This article looks at the results of CMS’s Independent Dispute Resolution process as part of the No Surprises Act. It finds that providers appear to be generally coming out on top of this arbitration process. As a result, the No Surprises Act may end up increasing in-network prices for care and insurance premiums, much to the chagrin of everyone who thought price transparency would inevitably reduce costs.

Re-Imagining the Healthcare Delivery Journey with Generative AI by Nick Chedid, MD, Ambar Bhattacharyya, and Justin Norden, MD

This report does a nice job highlighting nascent areas of opportunity for AI to improve the patient journey in hospitals. It focuses on breaking down processes across three buckets: pre-hospital tasks, in-hospital tasks, and post-hospital tasks.

Estimated Sustainable Cost-Based Prices for Diabetes Medicines by Melissa Barber, Dzintars Gotham, and Helen Bygrave

This JAMA Network Open article looks at what it likely costs to manufacture GLP-1s, finding that manufacturing costs would range between $61 per year and $111 per year.

Featured Jobs

Strategy Manager at Lark Health, a chronic disease management platform. Link

Senior Associate, Product Management Care Collaboration at athenahealth, an EHR platform. Link

Senior Population Health Manager at Signify Health, a VBC care management platform. Link

Contact us to feature roles in our newsletter.