👋 If you enjoy the free weekly newsletter, consider joining the Health Tech Nerds Community, a members-only Slack community designed for networking and knowledge sharing!

Sponsored by: McDermott Will & Emery

From May 6-9 in Nashville, 2,000+ attendees will gather at McDermott HealthEx for a conference spotlighting care delivery and payment innovation. Join 750+ executives, 500+ providers, and 70% of the most active healthcare PE firms.

Organized by McDermott Will & Emery, a leading law firm for healthcare ventures, the conference features:

In-depth programming on chronic care, diagnostics, hospital at home, value-based care, and other topics shaping tech-enabled care delivery

C-suite speakers from leading payers, providers, health tech, and digital health companies

Curated social events to reconnect with and expand your network plus live music by rock icons!

If you're interested in sponsoring the newsletter, let us know! Limited availability through Q2.

PUBLIC MARKETS

Walgreens agrees to go private for up to $23.7 billion in enterprise value

You’ve likely already seen this week’s big headline that Sycamore Partners is taking Walgreens private. Sycamore, a PE firm that specializes in retail turnarounds, is purchasing Walgreens for $11.45 per share plus an additional potential $3.00 per share based on future distributions from divesting Village Medical, Summit Health, and CityMD. The deal values Walgreens at ~$10 billion in equity value and ~$24 billion in enterprise value (which includes net debt, the present value of the opioid liability, and the Everly settlement, among other things).

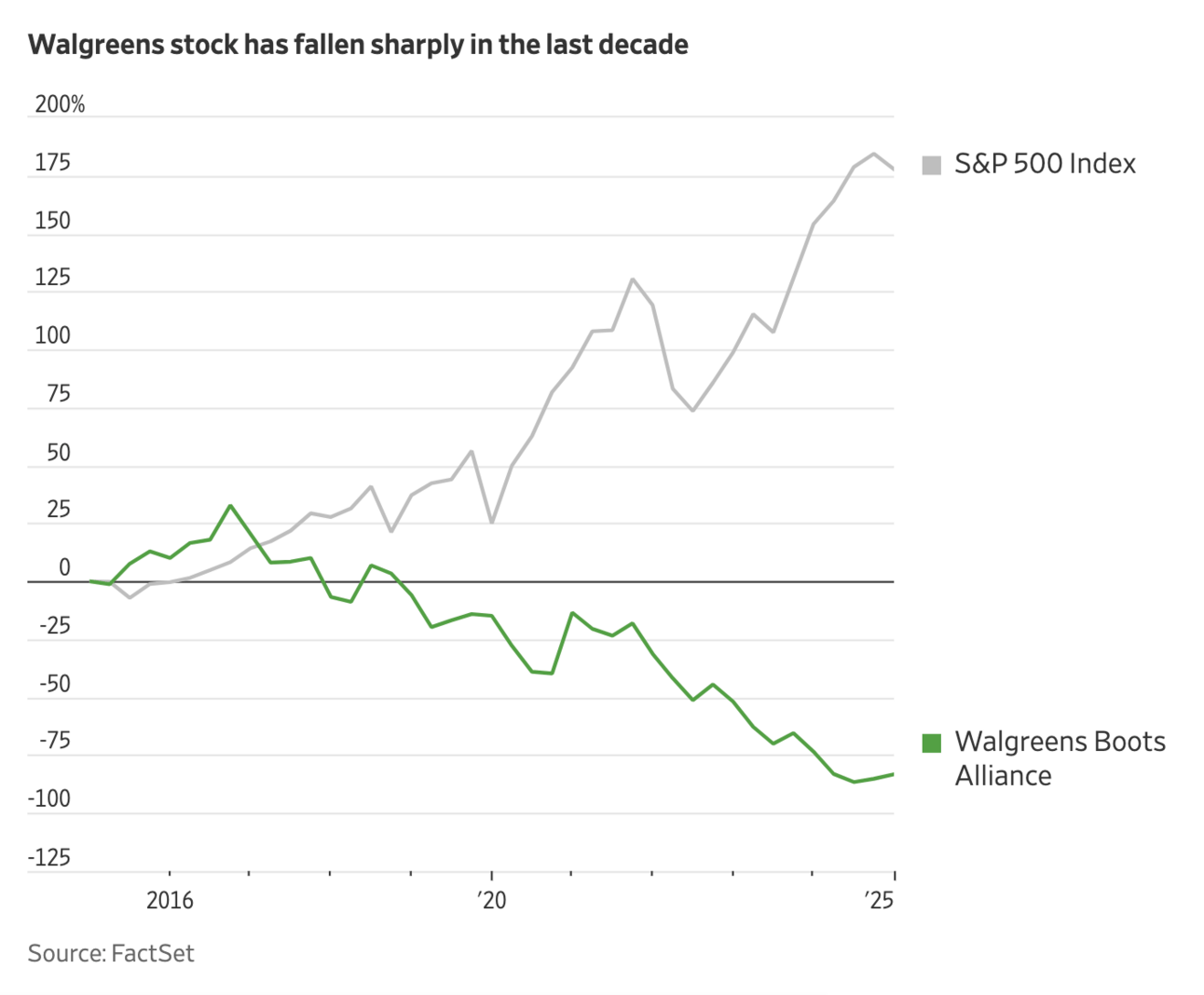

The WSJ published an interesting article looking at the unique deal-making journey of Stefano Pessina, the architect behind the Walgreens Boots Alliance business. It highlights how the company’s valuation has steadily declined over the past decade, falling from a peak valuation of around $100 billion in 2015. In 2019, there were rumblings of KKR potentially taking Walgreens private at a $70 billion valuation. The stock price decline over the last decade is eye-opening, particularly when you compare it to the performance of the S&P 500 over that period, as the WSJ did in the chart below:

✍ Going Deeper

Perhaps not surprisingly, the deal announcement includes virtually no information on the strategy for Walgreens moving forward. Getting out of the public eye seems to have been a key motivator for Walgreens in doing this deal now. Walgreen’s CEO said as much in his message to employees announcing the transaction:

I can promise you that one of the real benefits of becoming a privately held company is the ability to focus on that without the distraction of being a public company and all that comes with that.

If you read the rest of the brief message to employees, that appears to have been the only benefit articulated at this point in time, beyond a general excitement about having found a new partner.

The investor presentation filed with the SEC as part of the transaction provides a good example of the benefits of being a private company while attempting to turn around the business. The presentation is six slides long, with three slides providing transaction details and three slides discussing the DAP Right that Walgreens shareholders will have from divesting VillageMD (which includes Village Medical, Summit Health, and CityMD). In other words, there was zero info provided on the core business moving forward.

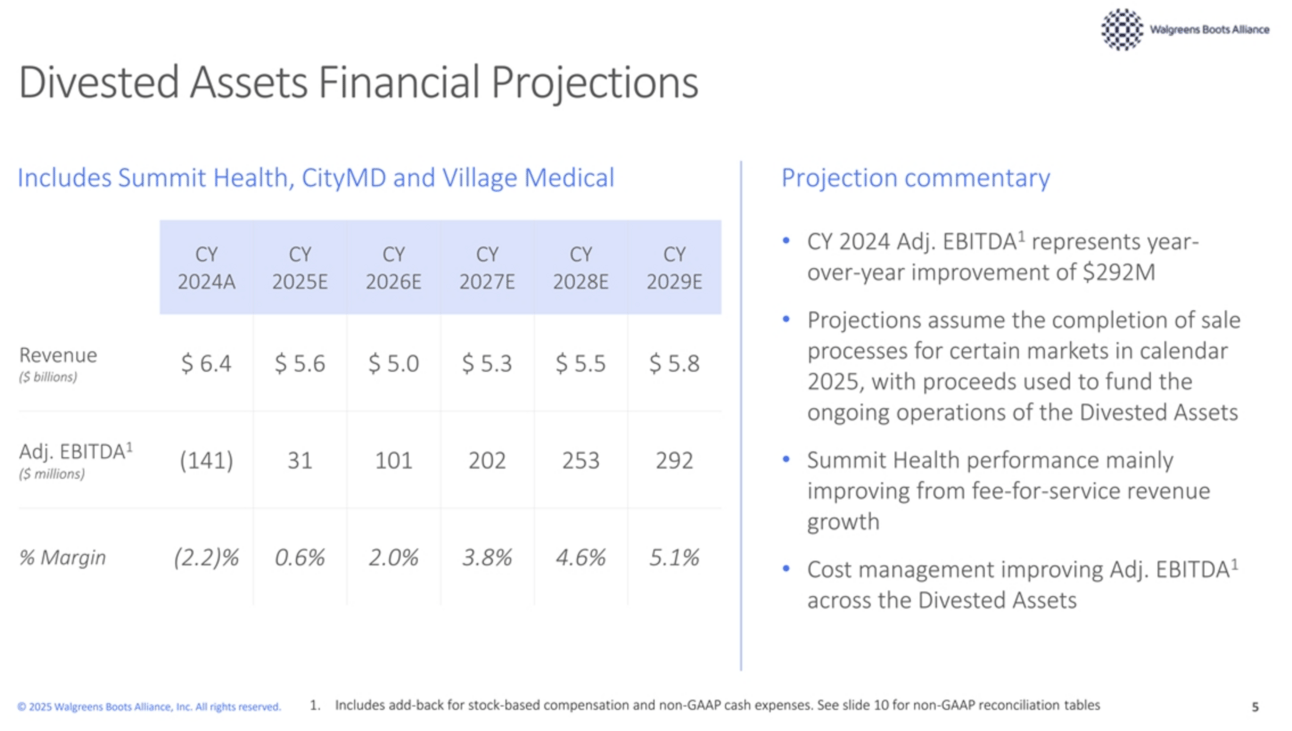

The discussion of the DAP Right does provide some interesting insight into the VillageMD businesses, with this slide in particular highlighting financial projections for the care delivery assets:

As you can see, Walgreens expects a 22% revenue decline over the next two years, dropping from $6.4 billion in 2024 to $5.0 billion in 2026. This comes as it attempts to get the business to Adjusted EBITDA breakeven — in 2024 it ran at a -2.2% margin. While the slide above doesn’t show 2023 data, the appendix slide notes that Walgreens lost $433 million in Adjusted EBITDA on the businesses in 2023, underscoring the magnitude of the challenges that they have faced over the last several years.

On top of those financial challenges, the presentation notes that VillageMD owes Walgreens $3.4 billion in debt at the time of the transaction. As Walgreens presumably finds buyers for Village Medical, Summit Health, and CityMD, the entire amount of that $3.4 billion in debt will be paid out first. The debt payout will then be used to fund the DAP right that Walgreens shareholders are entitled to as part of the transaction — 70% of the debt proceeds will go to DAP rights, capped at $3.00 per share. When you couple that with the news from a few weeks back that Walgreens had engaged restructuring partners to assist in the sale of VillageMD, it would appear unlikely that VillageMD will be able to pay that debt back in full. The DAP Right seems like a rather creative way to finance additional value for Walgreens shareholders in a transaction like this.

Stepping back from the financial discussion of what happens to the VillageMD assets as part of this deal, it must be a very uncertain time for the clinical teams providing care to patients amid so much swirl about the performance and future of the businesses they work for. While concepts like DAP Rights and financial projections are at the center of a transaction like this, they also feel worlds away from the care these teams continue to provide, which seems unfortunate for all parties involved.

Other Top Headlines

Novo Nordisk launched NovoCare Pharmacy, offering D2C Wegovy at $499 per month for cash pay consumers. The press release takes a shot at compounding, noting the dangers of fake or illegitimate compounded semaglutide. The offering is in partnership with Humana’s CenterWell Pharmacy, which will fulfill the shipments to consumers’ homes.

Telehealth providers Teladoc and LifeMD have signed deals with Eli Lilly via LillyDirect to offer branded Zepbound to self-pay patients.

UHC won a key finding against the DOJ in a decade-long case that claimed UHC overbilled CMS by $2.1 billion in Medicare Advantage payments. A Special Master’s report recommended that the judge grant UHC’s motion for summary judgment, finding that the DOJ’s case lacked any evidence that UHC violated the False Claims Act. The report provides an insightful look into the chart review process and how codes get submitted to the government for risk adjustment. There are a few head-scratching pieces of the DOJ’s case to me — from the DOJ not providing a single medical record that did not support a code, to the RADV audits that seem to support that most codes were supported, to the email correspondence between UHC and CMS where UHC seems to have laid all out the process pretty plainly.

Two conservative think tanks, Paragon Health Institute and the Economic Policy Innovation Center (EPIC), published a report finding that Medicaid made $1.1 trillion in improper payments over the last decade. This number is significantly higher than previous estimates, which the report argues is mainly because the Obama and Biden administrations didn’t audit eligibility determinations. This STAT article did a nice job summarizing the report and the implications for political discussions about financing the Medicaid program.

Blue Cross NC is the latest Blues plan to restructure as it has established a new parent holding company, CuraCor Solutions. This change comes after North Carolina passed legislation in 2023 allowing Blue Cross NC to transfer assets into a holding company.

Wellvana acquired CVS Health’s MSSP business in an equity transaction that will give CVS a minority stake in Wellvana. This appears to be the former Caravan Health business, which was initially acquired by Signify Health in 2022 for $250 million in cash and stock upfront with a $50 million earn out. CVS also announced it will exit the ACO REACH program, although Oak Street will remain a participant.

Memora Health’s sale to Commure was apparently a fire sale for $30 million in Commure stock, according to this excellent reporting in Axios by Erin Brodwin. It appears that Memora meaningfully overstated both its client counts and revenue over the last several years. As just one example from the article, Memora’s former CEO told investors that its ARR in 2022 was $20 million, while documents show that actual revenue was only $1.2 million in 2023.

Innovaccer, fresh off $275 million in funding, shared at HIMSS that it plans to acquire three businesses this year following its acquisition of Humbi AI in January. It’s targeting acquisitions of early stage companies with complementary products where Innovaccer can help grow market share.

Mayo Clinic set a new record for operating profit, generating ~$1.3 billion and $18.8 billion of revenue in 2024 on the back of double digit growth in outpatient and hospital visits since 2022. It’s net assets also grew by $2.9 billion in the year. As the article notes, given Mayo is a not-for-profit it doesn’t distribute those dollars to shareholders, but instead it reinvests those dollars into operations, in this case supporting a new $1.9 billion campus being built in Phoenix.

New Mountain Capital backed out of the bid to acquire 23andMe last Friday, prompting Anne Wojcicki to submit another bid to purchase 23andMe. The Board quickly rejected the revised bid, noting the revised bid was an 84% decrease from the previous offer, going from $2.53 per share previously to $0.41 per share in the most recent offer.

Monogram Health and Memorial Hermann launched a joint venture to provide in-home care for commercial and MA members of Memorial Hermann’s health plan. It seems that the first stage of this partnership will focus on CKD patients, but the overarching goal is improving care for polychronic patients. Memorial Hermann invested in Monogram’s $375 million funding round in early 2023 alongside a number of other strategic investors. Monogram noted in the press release it now covers 200,000 patients across 36 states.

Funding Announcements

Bluebird Kids Health, a pediatric clinic model, raised $31.5 million. Bluebird launched last year and currently treats 20,000 kids at three clinics in Palm Beach County that are focused on addressing pediatric care deserts. Bluebird plans to expand to additional locations in Florida as well as other states.

Freed, an AI scribe, raised $30 million. Freed notes that 17,000 clinicians have used it, and that clinicians are paying $99 a month.

Lumata Health, a care extender for ophthalmology practices, raised $23 million.

Ataraxis AI, an AI model for identifying optimal cancer treatment pathways, raised $20 million.

Heidi Health, an AI scribe, raised $16.6 million.

GEM HEALTH, a virtual sleep clinic, raised $7 million.

Keebler Health, an AI tool for automating medical records reviews for providers in VBC contracts, raised $6 million.

ModMed, a maker of specialty-specific EHR platforms, raised an undisclosed amount of growth capital.

Ria Health, a telehealth clinic for alcohol use disorder treatment, raised an undisclosed amount of growth capital.

If you're interested in hosting or sponsoring, let us know!

Other Good Reads

2025 Reflections and Predictions by Health Enterprise Partners and LEK Consulting

This is a helpful look at expected activity in the innovation space in 2025, including a survey of 64 executives’ opinions on the market. Lots of interesting insights across how payers and providers are viewing innovation opportunities — payers are significantly more likely to seek consolidation in vendor relationships than providers (pg 18); AI is driving an RCM arms race (pg 23); payers are very interested in AI for risk adjustment, Star ratings, and VBC enablement (pg 24) and more. Read more

One Potential Benefit of RFK Jr.’s Crusade Against Outside Influence by Ezekiel Emanuel

A good read in The Atlantic on how the new administration could overhaul the RVU system and why that seems like a much needed change in how we compensate providers. Read more

The Cost of Eliminating the Enhanced Premium Tax Credits by Commonwealth Fund team

This post from a group at The Commonwealth Fund looks at the various economic implications for states in the scenario where ACA enhanced subsidies are not extended. The projected loss in GDP for a number of states like Texas seems like another good indicator that the enhanced subsidies will be likely extended in some form or another, as some public healthcare companies have suggested. Read more

Undue Duplicity: The False Promises of Phantom Debt Relief by David Johnson

I learned a lot reading this post about debt relief models, specifically exploring how Undue Medical Debt’s model might not have as much impact on medical debt in this country as I think many, including myself, may have thought. Read more

California, Massachusetts and Texas Introduce Legislation Targeting Private Equity Investments and Corporate Structures in Health Care by Bass, Berry & Sims

This post provides a helpful summary of bills proposed in a few states that would impact corporate structures in healthcare. Read more

Featured Jobs

Director of Product, Clinical User Experience at Clover Health, a Medicare Advantage insurance and physician enablement company. Learn more.

Remote

Manager, Strategic Operations at Hopscotch Primary Care, a rural primary care provider. Learn more.

Remote

Director, Client Strategy and Growth at Hello Heart, helping high-risk patients manage heart health. Learn more.

$185k — $210k | Remote

Senior Vice President, Government Markets at Blue Shield of California, a California-based managed care company. Learn more.

Hybrid (CA)

Chief of Staff at Cerbo, a cloud-based EHR company. Learn more.

Remote

Contact us to feature roles in our newsletter.

Want to share feedback with us?

Show your support by sharing our newsletter and earn rewards for your referrals!