Welcome to this week’s free weekly newsletter, where we share our perspectives on some of the key healthcare related news of the week. To get access to exclusive paid content, learning and networking opportunities, and a vibrant community of 5,000+ other folks in this space, join the HTN community.

This week's newsletter is sponsored by: Medallion

As care delivery organizations onboard new providers, many organizations must write off new provider revenue for over 60 days due to lengthy enrollment processes. Given providers average nearly $2,000 in revenue per day, that delay can equate to a loss of $120,000 per provider.

With Medallion, this doesn’t have to be reality. In their on-demand webinar, credentialing experts from Medallion will share practical strategies for achieving “day one revenue” and how one organization achieved multiple wins leveraging their provider network management solutions.

If you're interested in sponsoring the newsletter, let us know here.

News

Sharing our perspective on the news, opinions, and data that made us think the most this week

News

SCAN and CareOregon call off proposed $6.8 billion merger, originally announced in 2022

Summary: California-based SCAN Health Plan and CareOregon called off their proposed merger after facing criticism from regulators. The combined entity would have been known as HealthRight Group, combining CareOregon's ~500,000 largely Medicaid members and SCAN's ~287,000 Medicare Advantage members. Oregon's Medicaid Advisory Committee shared "serious concerns" about the transaction, centered around Medicaid dollars moving out of the state of Oregon and CareOregon no longer being locally controlled. The public comments on the transaction shared recently made for interesting reading. Oregon's former governor, who architected the Oregon Health Plan, also expressed his opposition to the deal late last year. His concerns were similar to those voiced above, also noting that the narrative that CareOregon "must choose the “lesser of two evils”— merging with a multi-state, multi-billion-dollar Medicare Advantage company like SCAN, or being purchased by an even bigger for-profit insurance company, such as UnitedHealthcare" is a false choice and a hypothetical concern.

My Reaction:

It's fascinating juxtaposing the failure of this deal in Oregon while also watching Optum attempt to acquire Corvallis Clinic in the state. While Corvallis Clinic and CareOregon appear to be on very different financial footing - the tone of public commentary pushing back on the deal is very similar. One thread of comments caught my eye in particular - from an individual named Paul Schlegelman who originally voiced his opposition to the deal in a comment, and then submitted a second comment supporting it. The reason he changed his opinion was because after talking with clinic staff, doctors, and patients, he learned that the clinic was losing $1 million a month, and would either need to sell or shut down. Another comment mentioned that Optum was the only potential buyer to express interest. Seeing all of that, it is hard for me to understand the SCAN / CareOregon merger commentary about it being a hypothetical concern - the Oregon market is seeing another entity having that play out in real time. I'm not sure what the answer is here, clearly the concerns of local constituents are real, and loud, but waiting until local institutions are on the brink of collapse doesn't seem like the answer either.

This makes for an interesting strategic setback for SCAN, which has been attempting to execute on an ambitious strategy to scale a regional not-for-profit health plan to compete with the for-profit plans that are dominating the space. The crux of the strategy relies on the idea that a not-for-profit plan is not beholden to shareholders, and therefore should be able to act in a manner more aligned with the needs of the community than the big national for-profit plans. Yet Oregon's regulator, and public commentary, don't seem to place any weight on that argument, at least in part because they think CareOregon is doing just fine as a standalone entity. Instead, it seems the perception is that SCAN is attempting to execute on a risky, unproven growth strategy and despite its not-for-profit status is still an out-of-state consolidator that would put public health at risk in Oregon. If you're on SCAN's Board, do you still have the appetite for another year-plus long process like this one that has the risk of failing? All of it underscores just how hard it is to execute on a growth strategy like this, even if the theory behind it is valid.

Relevant Reads:

HTN Slack Convo (h/t Samir Unni)

Charts

Compelling visuals that help convey data, trends, or topics

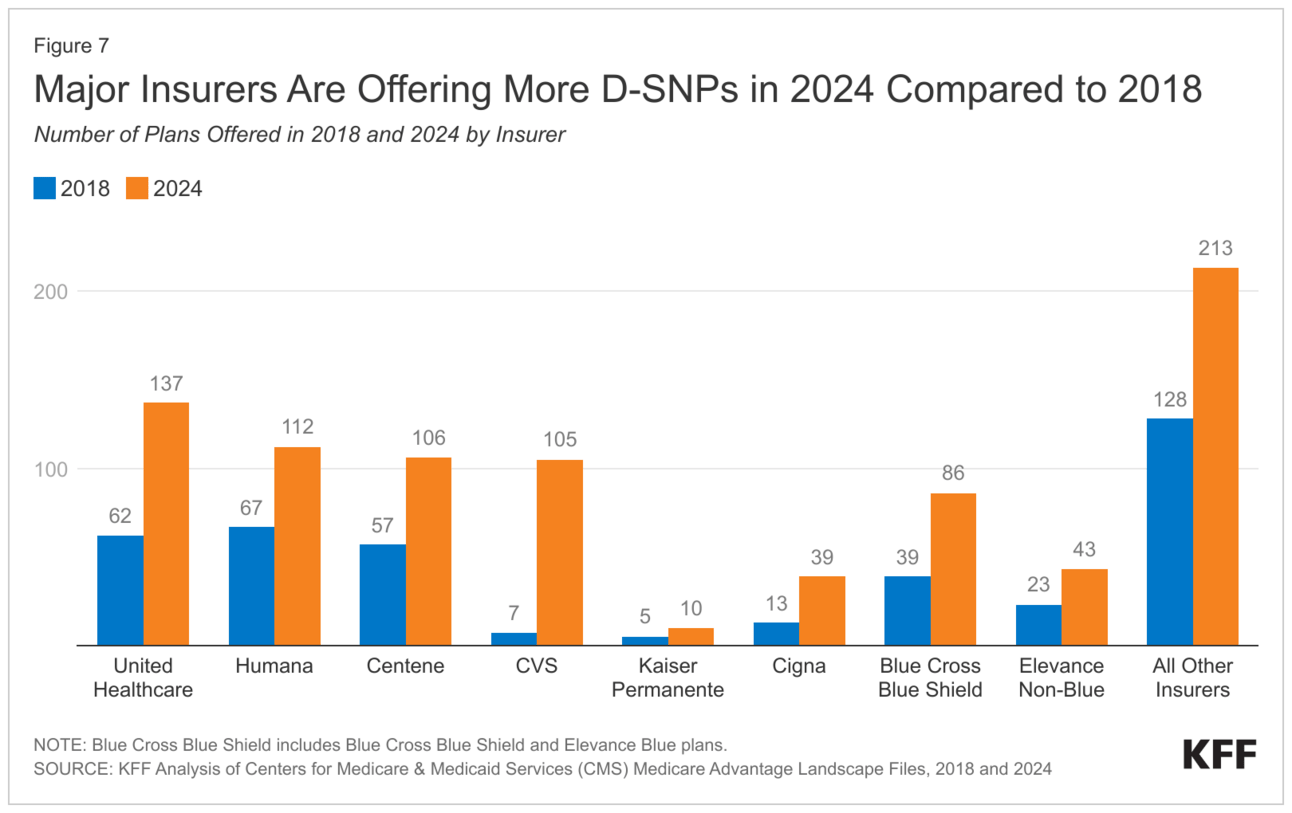

Health plans offered to D-SNPs from major insurers is on the rise

Some fresh data from KFF on Medicare Advantage Dual-Eligible Special Needs Plans (D-SNPs) came out last week and includes 10 interesting trends in the space. One chart in particular that caught our attention was the one above, looking at the number of D-SNPs specific plans being offered by major insurers. Notably, it was interesting to see that virtually every major insurer in the D-SNP market has at least doubled the number of plans they offer since 2018.

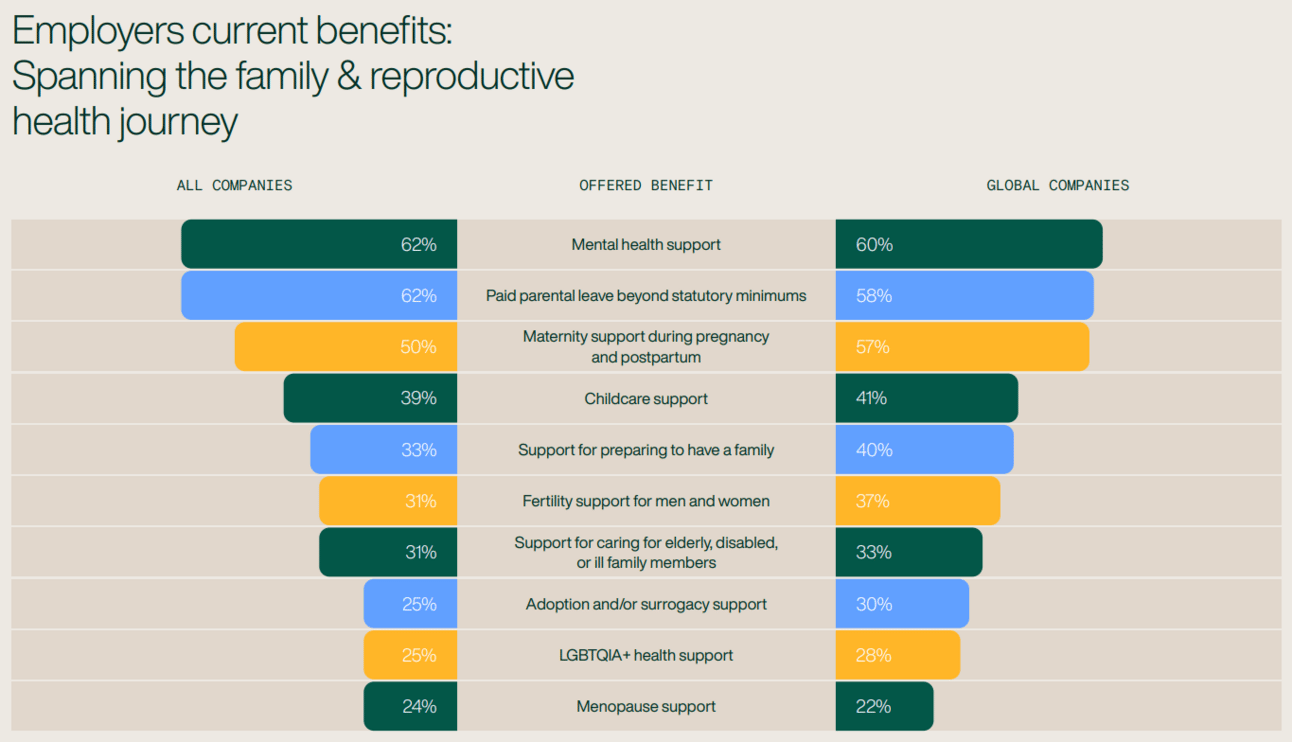

Data on women's and family health benefits offered by employers

Source: 2024 Maven Report State of Women’s and Family Health Benefits

This was a comprehensive report on the state of women's and family health benefits from the Maven team, looking at rising costs of healthcare, consolidation benefits trends, employee benefit demands, and more. The report combines results from two surveys conducted from October to November 2023 - with the first collecting data from 1,233 adults in the U.S. and U.K. whose primary area of work is related to the HR and benefits departments and the second aggregated info from 3,077 adults in the same geographies who are employees at companies greater than 500 people. The chart above provides a solid overview of the concentration of current company benefit offerings looks like.

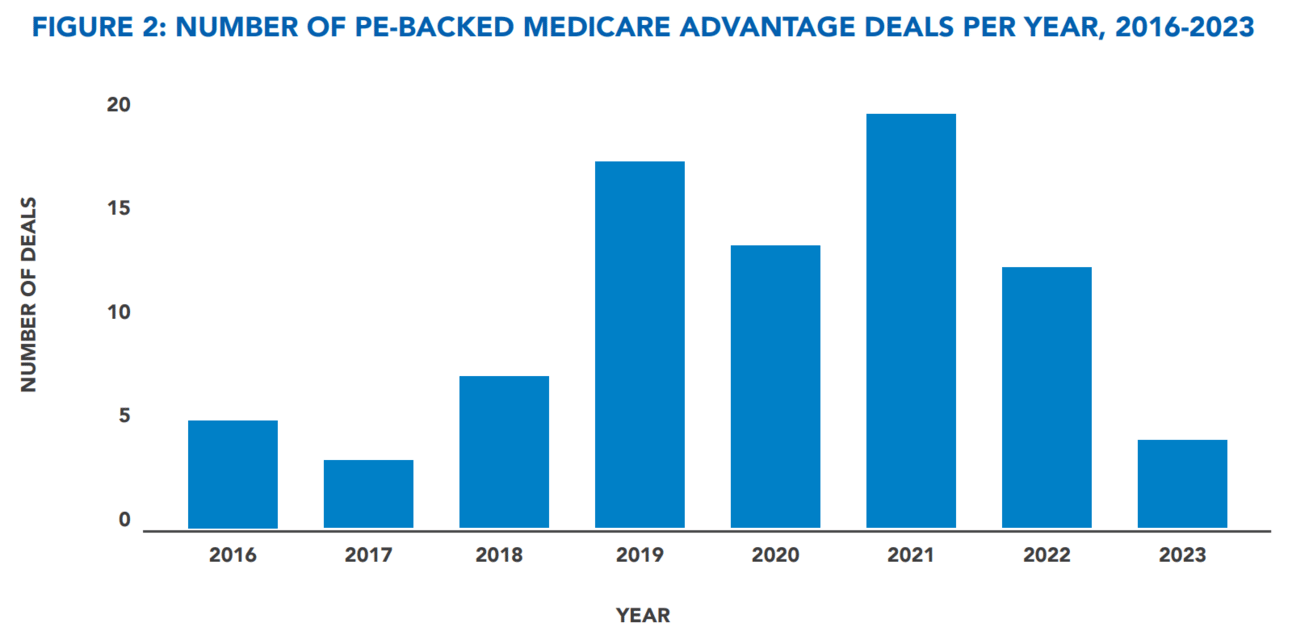

Diving into private equity activity in Medicare Advantage

Source: Private Equity Stakeholder P

An interesting deep dive into private equity's involvement in the Medicare Advantage market, looking at deal activity trends, investment drivers & deterrents, company case studies, and more. It's a really great explainer on PE's historical involvement in MA and unpacks how firms actually make money in an ecosystem that is oversaturated by incumbent insurance carriers.

Other News

A round-up of other newsworthy items

A recent article from KFF looks at the impending squeeze on state Medicaid programs and budgets, signaling a decline in federal Medicaid funding to states' matching funds. The report calls out one particularly concerning number from the recent Congressional Budget Office's Budget and Economic Outlook report - detailing that the CBO projects that states will receive $58 billion less in federal Medicaid outlays in FY 2024 as compared to 2023.

Another healthcare merger fell through this past week with the BCBSLA / Elevance deal being called off. This is the second time in less than a year that the $2.5 billion sale of BCBSLA to Elevance has been scrapped after facing political pushback regarding concerns of the deal's effects on cost and competition in the state.

This week was a big week for lawsuits in the news as Advocate Aurora faced a class action for its contracting strategies in Wisconsin. The lawsuit is worth a read if you're looking to understand health system contracting strategies, including things like all-or-nothing clauses and anti-tiering / anti-steering provisions.

Funding

Notable startup financing rounds across the industry

Freenome, a liquid biopsy company, secured $245 million to advance the development of its single- and multi-cancer detection blood tests.

Anatomy, an AI-enabled financial automation platform, raised $7.6 million. The startup automates healthcare back-office functions by connecting key financial data streams to provide insights into billing and insurance processes.

Dina, an AI-powered care coordination platform, secured $7 million in Series A financing to enhance its platform, expand its national network, and develop new digital care workflows for conditions like chronic congestive heart failure and COPD.

Ilara Health raised $4.2 million in pre-Series A funding. The Kenya-based startup helps private clinics access various medical resources, such as diagnostics devices and pharmaceutical products.

TORTUS, an AI-copilot, secured $4.2 million in fresh capital to build its AI assistant that helps clinicians automate administrative tasks. The company has launched a pilot with Great Ormond Street Hospital for Children NHS Foundation Trust to evaluate the tech in a real-world setting.

.406 Ventures raised $265 million for its fifth fund, with healthcare as one of its three core verticals.

Writers Guild

Thought-provoking posts from the broader healthcare community

Who Pays for Healthcare AI (Part II) by Morgan Cheatham

The second part of the three part series diving into payment models for healthcare AI. This article covers linear, usage-based, volumetric, bundled services, managed sevices, and device-maintenance pricing models.

Insights from our Expert Roundtable Series on Oncology by Flare Capital Partners

A great recap of insights and takeaways from Flare Capital's recent Q4'23 roundtable series on oncology. The discussions covered a range of topics, including biopharma & life sciences, plans & providers, startups, technology, and AI.

Featured Jobs

Chief Medical Officer (CMO), Medicare Advantage Plan at Clover Health, an insuretech company. Link

Contact us to feature roles in our newsletter.