Sponsored by: Lyft Healthcare

Transportation is one of the most solvable barriers to care, yet traditional Non-Emergency Medical Transportation (NEMT) solutions often fall short due to outdated technology, unpredictable wait times, and advanced scheduling requirements.

In the last ten years, Lyft Healthcare has helped 4,000+ healthcare organizations manage transportation reliably at scale. Lyft offers flexible solutions designed for providers, plans, and transportation benefit managers that integrate into existing workflows and adapt to patient needs.

The result: expanded access to care, better outcomes for vulnerable populations, and cost savings for healthcare organizations.

If you're interested in sponsoring the newsletter, let us know!

Welcome to February 2026! In this edition of the newsletter, we’re trying something a little different from a linking perspective — we’re linking to Slack conversations on these topics to make it easier for members to navigate to and join the conversations the community is having on the topics discussed below. Please share feedback on this change if you like or don’t like it 🙂

As always, there’s a lot of nuance and detail to explore behind these various industry shifts, from Advance Notice to AI everything to startup M&A to new commercial plan designs. If one thing is clear through it all, it is that change is afoot. If you want to go deeper, I’d encourage you to join the community. It’s a lot of fun to dig into these topics and learn from perspectives across the industry every day.

A MUSING

2027 Advance Notice: The ripple effects from erasing $100 billion of market cap overnight

I’m sure everyone here has already heard that CMS released its 2027 Advance Notice for Medicare Advantage on Monday evening, with a 0.09% effective average change for payors, a major negative surprise for the industry.

Analysts and other industry observers appeared to expect an overall change in the mid single digits, with one analyst on Humana’s Q3 earnings call back in November speculating that we could see an effective growth rate of 9+% based on cost trend increases. The effective growth rate came in at 4.97%.

The roughly 5% swings in rates highlight the unpredictability of the market at the moment, which seems like a huge problem in a market that has 1. played a major role in supporting startup innovation in healthcare over the last decade and 2. been perceived by many as returning to stability in 2027 as it moves into a post-v28 world. Regardless of where the final notice comes in a few months, the Advance Notice took a sledgehammer to the concept of stability and predictability in this market, which seems to run counter to its general strategy towards working with industry.

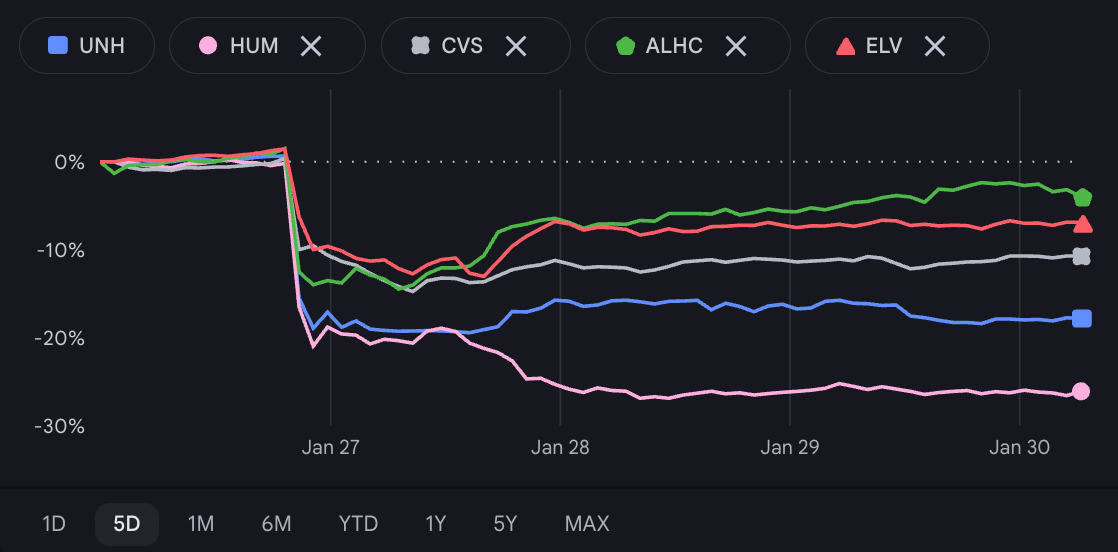

The stock market reacted swiftly to the news, with the public MA stocks all dropping 10%+ on the announcement. The WSJ did the math, reporting that this drop erased ~$100 billion in market cap overnight for the large four players alone (UNH, HUM, CVS, ELV). Aside from Alignment, no MA plan saw a bounceback later in the week (Elevance reported earnings on Wednesday, which drove its uptick midweek). Humana’s stock actually continued to drop on Tuesday, ultimately ending the week down 26%.

Source: Google Finance

It wasn’t just a drag on the public insurers, either. The Advance Notice also prompted the Alliance of Community Health Plans — a group of provider-sponsored health plans in various regional markets — to issue a statement calling the Advance Notice “disappointing and wholly unrealistic,” noting that it expects more carriers will exit the market if these rates are finalized. It’s worth noting in this statement that ACHP also said it supports CMS’s efforts to modernize risk adjustment, which seems like an important point here — the blowback isn’t about risk adjustment, it’s about the overall math.

Regional health plans have already been under financial strain, with a HealthScape Advisors report noting a few months ago suggesting that over half of regional plans don’t have the capital reserves to make it through 2027. And that was prior to this news. So if the intent was to level the playing field in the MA market, this seems problematic.

Klomp’s Commentary on Tuesday

Given the magnitude of the reaction to the news and the confusing strategic implications, it was particularly interesting to listen to Chris Klomp on a webinar with Paragon Institute’s Demetrios Kouzoukas on Tuesday, just after the news was released. 44 minutes into an hour-long conversation, they finally got to the topic of Advance Notice, and here’s what Klomp had to say:

I want to be clear because obviously much has been made about the advance notice since it was released after market close yesterday, including questions raised — is the administration not supportive of Medicare Advantage, or did the market simply misread, or is this a sign of unfriendliness on hostility to come to the market? We have communicated, I believe, clearly and transparently about this. The Administrator has communicated clearly and transparently about this. But in no uncertain terms, let me make clear that we continue to believe Medicare Advantage will and must play an important role in the future of Medicare. We are focused on ensuring that it continues to provide excellent value to our beneficiaries. The 68 million beneficiaries whom we are charged to serve. What does that mean? That they have the best possible healthcare experience that they can. That they get the care that they need. That its done cost effectively. That its the right care so that they can lead their healthiest lives possible. While at the same time ensuring the long term sustainability and stability of the program. In keeping with those goals, we’ve proposed some modifications relating to, as you’ve mentioned, coding for unlinked chart review. What is the goal of that? It is to ensure that program incentives reward activities that actually improve beneficiary care.

…

Make no mistake. Let me not mince words in the least. We are massively in support of Medicare Advantage. It is a critical component of the future of Medicare.

This is where my head really starts to hurt. On its face, it seems incongruent to be vociferously supporting the Medicare Advantage market on the same day that you’ve wiped out $100 billion in market cap from public insurers, while regional insurers issue statements saying this move threatens their very existence. By all accounts, Klomp and other CMS leaders are both extremely sharp and excellent communicators, particularly in playing out their negotiations with the private markets — MFN seems like a good example here. That seems to be a hallmark of this administration. So what exactly is CMS signaling that it supports here, given the seeming incongruency?

As Politico noted this week, Klomp himself said at JPM only a few weeks ago that Medicare Advantage has been destabilized, that stability and predictability are needed in the market, and that CMS will pay consistently. I suppose that, in some sense, this could be interpreted quite literally as CMS paying consistently, since it is not changing what it pays plans between 2026 and 2027. But nerdy jokes aside, this doesn’t add up to me. This move was anything but stable and predictable, as indicated by the various reactions.

There are two potential narratives in my head that I can come up with to resolve the incongruency in my mind in terms of what happened on Monday:

CMS is signaling its desire to reset the Medicare Advantage industry and ripped the band-aid. Klomp has shared on multiple occasions the view that CMS has not been a good steward of taxpayer dollars in the Medicare Advantage program, and this move is indicative of re-prioritizing exactly that. The era of Medicare Advantage as a high-growth, investor-friendly market is over, with CMS clearly indicating it wants to take dollars out of the program to make it more sustainable in the long term for taxpayers. A new period of austerity is upon us, despite expectations that a Trump administration would be friendly to MA. Naturally, making this shift will come with dislocation in the market, but it is fairly predictable how the market will respond — plans will pull back benefits, there will be market exits, and markets will consolidate. Those are all challenges that need to be addressed in time, but can only be addressed after making the new baseline clear. Klomp is publicly supporting MA to lead through the change ahead and bring various stakeholders back to the table.

CMS miscalculated here and underestimated the impact of actuarial math. Klomp’s commentary clearly indicates the primary intended change in Advance Notice was to level the risk adjustment playing field through the chart review change. At one point in the Paragon conversation, Klomp shared that: “the rest of Advance Notice is just math. As you know, actuaries are determining underlying medical cost trends. They put that in the effective growth rate, and the math flows out in the rest of the advance notice from that.” Reading that, it’s not hard to imagine a scenario in which the primary intent behind Advance Notice was to level the playing field between large public players and smaller regional players. Yet as it so often turns out in insurance markets, actuarial math isn’t just a small piece to something like Advance Notice. The inputs and assumptions that feed that math equation are actually everything, as we’ve seen in this Advance Notice reaction. Writing off the rest of the Advance Notice as simply actuarial math turned out to be a major tactical error, because CMS actuaries and industry actuaries are doing very different math. Specifically, if the goal was to level the playing field and drive competition among insurance plans, causing market exits and consolidation among regional plans would seem to defeat the purpose.

Both of those explanations would make sense to me, although I have no idea which of those two narratives is more likely at this point. It is also entirely possible that I am missing another explanation; this is just what my brain has been able to work through this week. Back to the underlying point about stability and predictability — the divergence in underlying explanations here seems like a huge challenge for the industry.

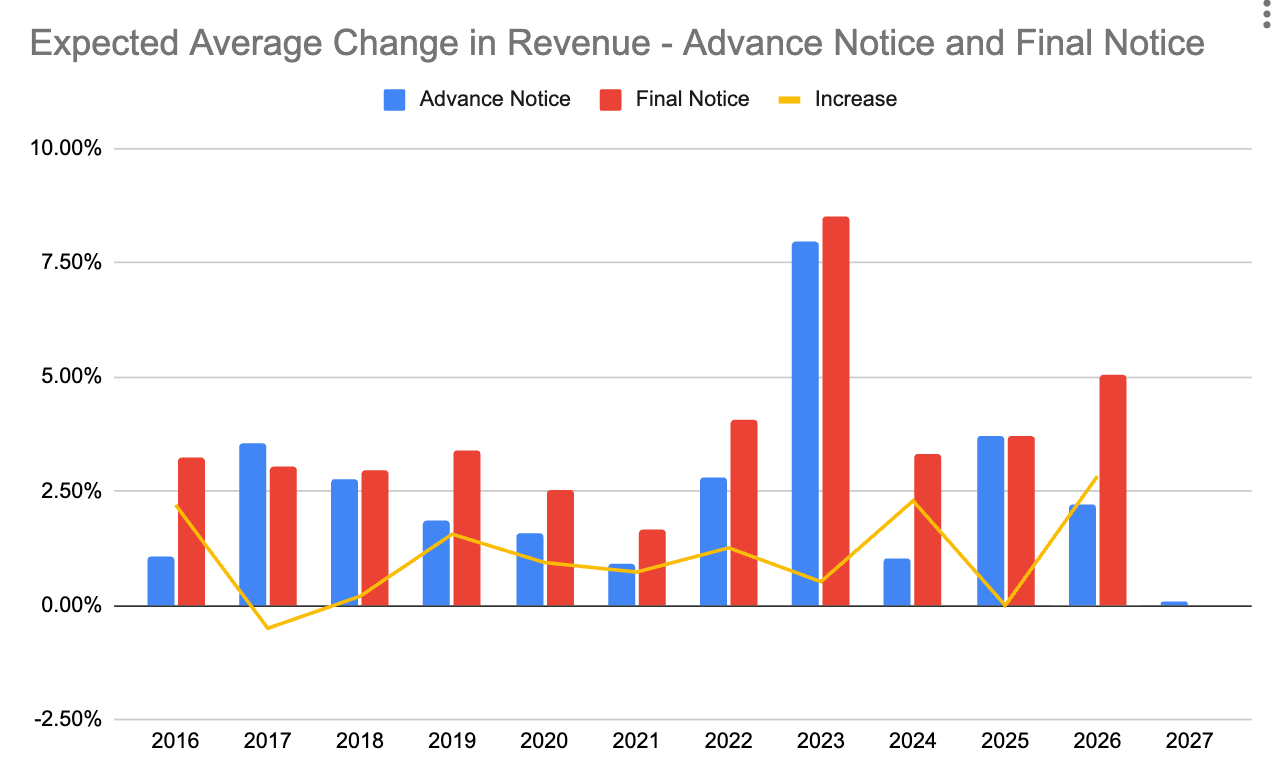

It seems that when Final Notice comes out in a few months, we’ll get a better indication of what is actually happening here. As many commentators have noted this week, Final Notice has historically been ~1% higher than the Advance Notice. Here’s the data from the past decade of Advance Notice and Final Notice:

Source: my Google Sheet files & CMS data

If the Final Notice comes in relatively flat, it would seem to be a clear indication that this is indeed a hard reset for the market. If the Final Notice comes in at the high end of historical increases, it may signal that CMS may not have intended to cut so deeply here and risks throwing out the baby with the bathwater. Given the trend in MA insurer stock prices this week, Wall Street appears to have tipped its hand on the expected outcome.

The ripple effect for startups and investors

Irrespective of the Final Notice outcome, it seems hard to overstate the ripple effects from this sort of market dislocation in Medicare Advantage. If you go back and look at large exits in healthcare services over the last decade, so many of them have been on the backs of the MA market — i.e. Oak Street, Signify, VillageMD, Landmark, and CareBridge, just to name a few of the unicorns that were built primarily off the success of the MA program. If you’re an investor in these sorts of businesses, I think you need to ask yourself whether the government is signaling it no longer wants to fund these outcomes with taxpayer dollars. If that’s the case, with an IPO market that is still frozen and the only group of strategic acquirers crippled, what exit potential is there for companies working on government programs moving forward? This seems like a huge potential issue for the private markets on top of an already challenging environment.

If you work at a venture-backed startup that has been innovating for a complex and/or senior population over the last decade, there’s a good chance that your startup exists, either directly or indirectly, as a result of the success of the MA program over the past decade. Sometimes people ask me about why I talk about insurance markets so much in this newsletter. It’s because of this dynamic — the insurance markets, and specifically Medicare Advantage, are the key engine behind a lot of the startup activity in the market. This sort of dislocation in the MA market will inevitably cause ripple effects felt well beyond the MA plans themselves. The first wave will hit VBC providers, as it did with v28, and subsequent waves will hit the various solutions selling into those markets. Needless to say, it will be interesting to see how CMS addresses these challenges, as it also indicates that it wants to broadly fund innovation and risk-taking generally moving forward.

It feels like we are at a tipping point, potentially moving very quickly towards a two-tier healthcare system in this country — a cash pay/commercial insurance market for individuals and companies who can afford it, and a large government-funded risk pool for the rest of the country. How specifically those risk pools emerge over time will be interesting to watch, but if one thing is clear at the present moment, it’s that the federal government is trying to be a better steward of taxpayer resources.

The juxtaposition of headlines across those two tiers this week seems to tell the story about the state of innovation in various markets quite well — while ACA, Medicaid, and Medicare markets are getting hammered, Ro and Hims are both sharing details of their forthcoming Super Bowl ads, with Ro breaking down how it is paying north of $15 million dollars all-in for an ad. It all seems like a telling example of American healthcare, for better and worse.

Question of the Week

Given all of the various dynamics at play above, I thought it’d be interesting to poll the community here. How much would you expect the Final Notice to increase the Expected Average Change number?

Where do you expect the Final Notice to come in relative to the Advance Notice?

- Essentially flat (0% to 0.1% increase from 0.09%, only 2017 as precedent)

- Slight increase (0.1% to 0.75% increase, low end of historical outcomes)

- Moderate increase (0.75% to 1.25% increase; average historical outcome)

- Large increase (1.25% to 2.5% increase, high end of historical outcomes)

- Even larger increase (2.5%+ increase, only 2026 as precedent)

Q4 Earnings Season

Advance Notice dropping on Monday night certainly set an interesting stage for earnings season, which started on Tuesday with UHG and HCA reporting results. Elevance also reported on Wednesday. It’s a fascinating juxtaposition of earnings calls — while HCA is being asked by analysts whether it can sustain a 20% operating margin over time, UHG and Elevance are being pressed on whether their various mid-single-digit margin targets are even achievable over the long term. If you’re thinking about how dollars flow in healthcare, I think there’s a lot to dig into there.

Here’s a quick summary of each, with more in the community:

UHG kicked off the Q4 earnings season, highlighting that 2026 will be about refocusing the core businesses across UHC and Optum. UHG is forecasting a slight decline in revenue in 2026, which Bloomberg noted would be the first annual revenue decline for UHG in over 30 years. UHC shared that it repriced the insurance book and expects to see margin improvement in 2026. Its Medicare Advantage membership loss is larger than originally anticipated, but UHC expressed confidence in the approach and noted that market dynamics drove more shopping than expected. Optum will take more time than UHC to improve margins. Optum Health expects a modest margin improvement in 2026 and will build on that in 2027, citing results in a Texas market as a data point indicating its ability to achieve target margins. As one analyst noted, Q4 was a challenge as Optum Health underperformed by ~$600 million in the quarter. It’s all indicative of the change afoot in the organization as it repositions itself moving forward. UHC addressed the 2027 Advance Notice head-on in the prepared remarks, noting that it “simply doesn’t reflect the reality of medical utilization and cost trends.”

Elevance’s stock rebounded up 7% in the back half of the week after its earnings call on Wednesday morning. It is forecasting an adjusted EPS decline in 2026 as it stabilizes the core business while planning to get back to 12% EPS growth in 2027 and beyond. Similar to UHG, Elevance seemed ok with higher-than-expected declines in its MA business as it repositions around HMO contracts and D-SNP populations moving forward. It noted it is seeing strong growth in the ASO market as a result of the ‘second blue bid’ phenomenon. It still views Medicaid as a trough year, and by our math, Elevance shared that it expects it could see up to 38% attrition in the ACA market this year as a result of the subsidy expiration. All-in-all it seems indicative of the challenges facing the insurance market ahead, with positive momentum in the Carelon business offsetting that.

While the insurance companies tread water, HCA posted a banner quarter, with its stock briefly jumping 11% post earnings. HCA beat analyst estimates, with one analyst ending the call asking if it can sustain a margin north of 20% moving forward. That question seems to indicate how well HCA is performing lately, in an industry where most hospital systems are talking about barely breaking even on operating margins. While HCA didn’t want to give an answer there, and it also noted during the call a number of policy headwinds that will add up to a $600 to $900 million negative impact on its Adjusted EBITDA in 2026, it seems like the company is executing quite well at the moment.

Chart of the Week

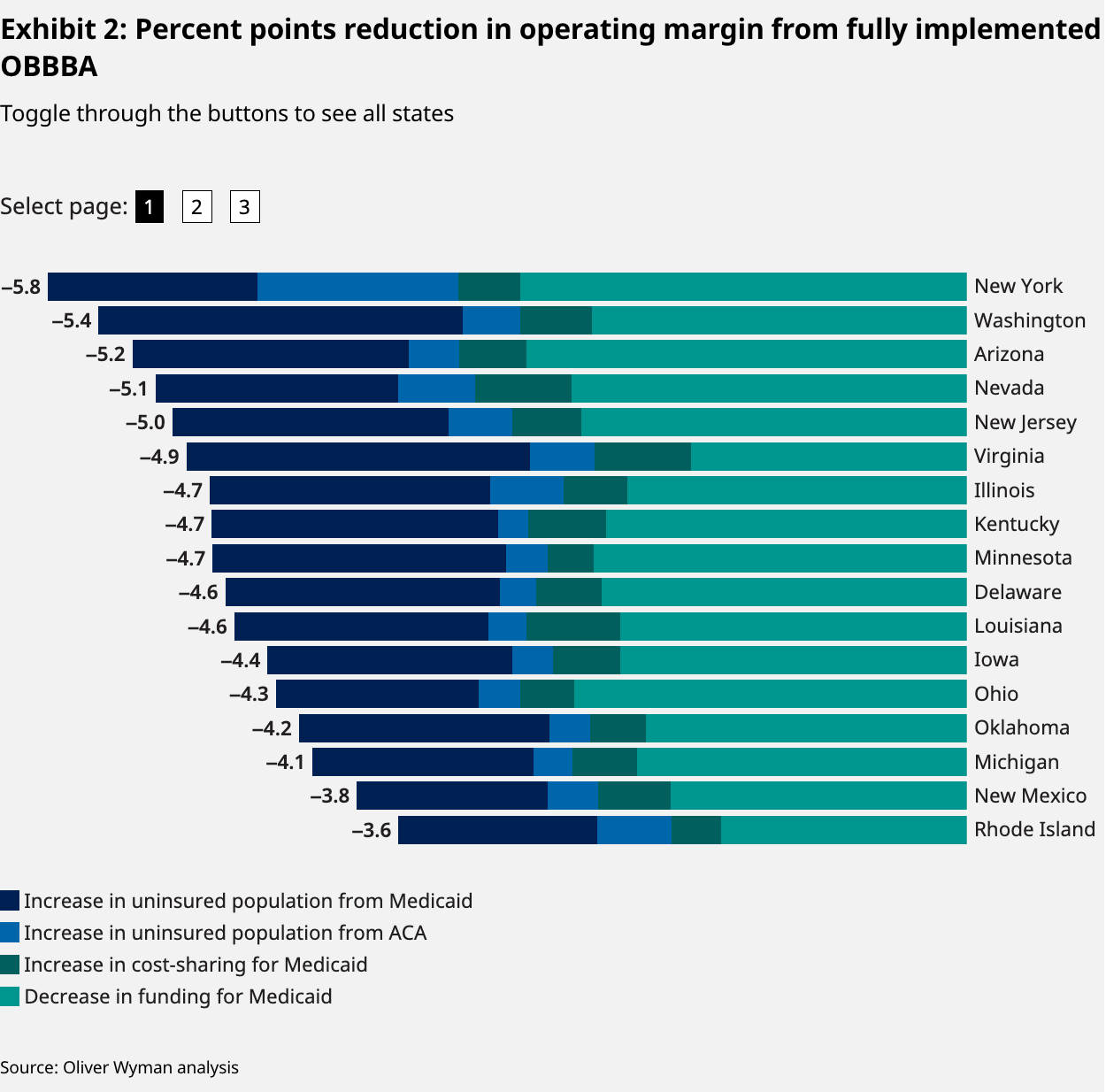

Oliver Wyman released an interesting analysis examining the expected operating margin reductions for hospitals across various states. Below is the chart of the states most impacted — New York expects to see a 5.8% reduction in hospital operating margins. Wyoming is at the other end of the spectrum, with a 0.2% reduction.

It’s interesting to think about HCA’s result above while reading through reports like this — certainly, it seems like many more hospitals could benefit from HCA’s level of operating discipline in these market conditions.

Featured Jobs

Third Way Health, an AI-enabled medical practice and payer operations solution, is hiring for the following roles:

Vice President of Revenue $350K - $450k | Remote (LA preferred). Learn more.

Director of Demand Generation $140K - $170K | Hybrid (LA). Learn more.

Chief of Staff, Clinical at Equip, a virtual eating disorder treatment program. Learn more.

$150K - $175K | Remote

Senior Full-Stack Engineer at Anuly, an AI-powered payment integrity platform. Learn more.

$120K - $140K | Remote

Senior Director, Network & Pharmacy Strategy at Maven, a virtual clinic for women’s health. Learn more.

$213K - $250K | Remote

Contact us to feature roles in our newsletter

Other Top Headlines

Virtual care provider Sword Health acquired Kaia Health for $285 million. Kaia gives Sword a foothold in the German MSK market, and if you really want to go deep on the strategies here, Brian Dolan’s Exits and Outcomes this week does a great job. Sword apparently is kicking off seven straight weeks of news with this acquisition, and it also hinted that it is both raising $500 million and planning to be very active on the acquisition front this year, per the Bloomberg article. Sword stated it has no need for outside capital to fund existing operations, as it reported being cash flow positive in 2025 while still growing quickly. This would seem to imply they’re planning to issue equity in Sword to investors to buy startups with that cash. Interesting to think about the dynamics at play with that for both the startups and Sword in terms of preferences of cash vs equity, and in Sword's case, why not use debt to finance? Either way, they seem to have a lot of positive momentum in the market at the moment. [Bloomberg]

In the mental health market, Spring Health and Alma merged. Financial terms were not disclosed. A Spring Health blog post notes the deal brings together Spring Health’s AI capabilities with Alma’s provider infrastructure and network. Spring Health has 50 million contracted lives today via employers and health plans, while Alma has health plan contracts covering 120 million lives across national and a few regional carriers. Spring Health, a rumored IPO candidate, has raised over $470 million, most recently at a $3.3 billion valuation in June 2024. Alma has raised over $220 million, most recently at a $800 million valuation in 2022.

Crossover Health merged with Premise Health in a combination of two leading employer primary care assets. Premise Health has 800 wellness centers across 44 states, while Crossover has 50 clinics, 26 of which are on-site and 24 of which are near-site locations shared across employers. Seems like a logical combination of assets in this market.

Included Health launches an alternative plan design for employers. This seems like a fascinating strategic move, one I’d expect we’ll see more navigators and others selling to employers move towards over the coming years as employers grapple with navigating cost increases. I had the chance to chat with Included Health CEO Owen Tripp late on Friday about the news, which we plan to share with the community tomorrow. He shared some interesting data points about the traction Included Health has already seen in the market with this plan, how an AI-enabled member experience is core to the plan's functionality, and how he thinks of this type of offering as another tool for brokers to help employers manage outcomes moving forward. While the employer market has taken its lumps in the public markets recently, it actually strikes me that there is a lot of opportunity here moving forward.

According to Endpoints News, senior primary care provider ChenMed shared at a virtual event this week that it is no longer encouraging its members to take GLP-1s after seeing a spike in hospitalizations among its members taking GLP-1s due to lean muscle mass loss and an increase in associated falls. In a population of ~10,000 members, it apparently saw 500 excess hospitalizations in a six-month period, which seems like quite the cautionary anecdote for GLP-1 use in that population. [Endpoints]

Yosemite, the oncology-focused venture fund started by Reed Jobs, announced it has closed on $200 million out of a $350 million new fund, with LPs including Amgen, Memorial Sloan Kettering, MIT, and John Doerr. While still a newer fund, Yosemite has an interesting approach and an impressive track record in oncology. [Forbes]

Funding Announcements

Tandem, a prior auth model for prescription drugs, raised $100 million at a $1 billion valuation, per Bloomberg. Accel is leading the round. This brings Tandem's total funding to $137 million, with Thrive Capital and General Catalyst as other investors. Tandem’s site notes that it has thousands of providers using it daily and is processing millions of prescriptions annually. [Bloomberg]

Gyde, an AI-enabled roll-up of insurance brokerages, raised $60 million. Seems like a pretty straightforward model for driving efficiency using AI to improve margins within a brokerage, creating a win-win for both the brokerage owner and Gyde. Will be curious to see how quickly these models scale.

Indigo, an AI-centric medical malpractice business, raised $50 million. Rubicon Founders and Town Hall Ventures invested. The press release notes that Indigo is currently serving 10k providers nationwide, underwriting $10 billion in premiums, and has fully automated 20% of submissions.

What I’m Reading

Directing Medicare: Past, Present, and Future with CMS Medicare Director Chris Klomp by Paragon Health Institute

A timely virtual discussion between a former and the current Director of Medicare at CMS, Demetrios Kouzoukas and Chris Klomp. I already referenced this extensively above related to its discussion of the 2027 Advance Notice, but it also covers a number of other helpful topics, including the approach to MFN and more. Worth listening to. Watch

The Means-Testing Industrial Complex by Luke Farrell

A good deep dive into a topic Martin has been covering a lot in HTN over the past several months, which is the massive businesses Equifax and Deloitte have built, managing Medicaid work requirements. Read more

How GLP-1s Broke Healthcare Distribution by Sophia Ye and Sachin Maini

I thought this was a good think piece on how GLP-1s are bringing in a new era of healthcare distribution. Back to the conversation above about innovation in cash pay and commercial markets, it’s interesting to consider how healthcare distribution is changing. Read more

We must not let AI ‘pull the doctor out of the visit’ for low-income patients by Leah Goodridge and Oni Blackstock

An interesting opinion piece about the risk of AI for primary care, increasing the class divide. Andy Slavitt pointed this out in our conversation with Town Hall linked below, taking the opposite side of this argument. If I’m certain about one thing, it’s going to be that we’re going to be having a lot of debates like this over the coming years as AI inevitably plays a bigger role. Read more

HTN Radio

In addition to writing thousands of words a week across newsletters and Slack musings about healthcare industry trends, we’re having a lot of fun chatting live more regularly about these topics as well. Here’s the latest set of conversations we had last week:

A conversation with Andie Steinberg and Andy Slavitt from Town Hall Ventures on the policy environment in 2026. Note we recorded on Tuesday, just after the 2027 Advance Notice, so got to hear how that news adjusted their perspectives on the MA market moving forward.

Martin chatted with the Pair Team crew twice this week, first about the overall model and then about Pair Team’s news that it had acquired Town Square.

Want to comment or share feedback?

If this newsletter was forwarded to you, subscribe here or see more from Health Tech Nerds.