Sponsored by: CaringBridge

Nearly 30% of caregivers felt significantly less overwhelmed after using CaringBridge, a nonprofit, free platform that helps caregivers and patients share updates, coordinate help, and stay connected in one secure, private space.

CaringBridge just released its 2025 Impact Report, which follows 600+ users across their health journeys. The report reveals how online health communities can measurably reduce loneliness, ease stress, and strengthen emotional well-being.

Read the full report to explore key findings and actionable takeaways on how the broader health ecosystem can strengthen caregiver support.

If you're interested in sponsoring the newsletter, let us know!

PSA: Given the Thanksgiving holiday this Thursday, I’ll be taking next weekend off from newsletter writing. I’ll see you all here on 12/7 for the next Sunday round-up, and in Slack between now and then. Happy Thanksgiving to all our US-based friends!

My reflection: VBC and the broader health policy conversation

Everywhere I look these days, it feels like folks are eager to offer their perspectives on how to fix healthcare in this country. One of the most seductive aspects of entering this healthcare conversation is that it seems so easy to fix — you simply need to curtail the bad behavior of whichever incumbent actor you perceive to be the problem. It all feels like a great example of the Dunning-Kruger effect in action.

As families around the US gather for Thanksgiving this week, I am sure there will be countless conversations about the insanity of healthcare costs and the inevitable follow-up questions about why it is so challenging to fix. If I were running a DPC model or a sharing ministry, I’d be offering a sweet Black Friday deal this year (obviously, only for healthy consumers who meet my eligibility criteria).

At the same time, I am pretty confident that virtually none of those families will be discussing what I thought was a fascinating policy debate I came across this week — a Penn LDI debate between Aledade’s Farzad Mostashari and Brown’s Andrew Ryan. It’s an hour-long debate on the topic of: “After Fifteen Years, is Value-Based Care Succeeding?” You can watch the video here:

This sort of conversation is like catnip for health policy nerds. And yet, as much as I enjoy a good debate, this one mostly felt like two smart folks with a deep philosophical disagreement on VBC talking right past each other. It reminded me of my least favorite memory of LD debate in high school, when a judge wrote on the comment sheet: “that was like two ships passing in the night, there was no real debate that happened here”. A dagger to the heart of any debater. At the end of the day, I didn’t leave the debate feeling like I’m any closer to an answer to the question of whether VBC is succeeding.

I am predisposed to Farzad’s side of the argument, and I think he technically “won" on many of the finer points around MSSP and the conceptual promise of VBC incentivizing the right behaviors. But I also thought that Andrew made reasonable points about how MSSP is being gamed by various ACOs and the need to focus on adjusting the fee schedule, which were enough to muddy the water. The back-and-forth over skin substitutes was a particularly interesting point of contention. Andrew’s general point that we should stop wasting energy on VBC and instead focus our collective energy on fixing the Medicare fee schedule has a logical appeal, and it is one I can see resonating in DC these days. But as he also noted, it also seems quite practically challenging given the various special interests at play.

In so many ways, the conversation underscores the political challenge VBC faces at the moment. I think it's telling that you have two incredibly smart folks, who understand healthcare policy better than 99.999% of the country, and they’re spending a chunk of time arguing about the relative interpretations of the data in a MedPAC report. At a moment in time when trust in experts and institutions seems to be at an all-time low, when you have two experts who are arguing about the underlying data in reports that nobody else is actually going to read, it only seems to invite more skepticism.

Personally, I think tying VBC’s success to bending the cost curve has made it a Sisyphean task. As past CMMI efforts have demonstrated well, lots of things can and have gotten in the way of achieving cost savings. It seems like the VBC movement needs to decouple the issues with implementing value-based payment from the theory of value-based care models. Focus the argument on how VBC is the only mechanism sustaining the primary care workforce in this country. Build on Farzad's argument that this is the only model that incentivizes keeping people healthy. That is where VBC wins IMO. It loses in the complexity of risk adjustment, benchmarks, MSSP vs ACO REACH, and all this other stuff nobody can ever actually make heads or tails of.

Stepping back, the fact that this debate is even happening I think indicates the answer to the original question — it seems like a matter of time before people decide it’s time to move on and try something new. While policy wonks argue over how to calculate whether MSSP is actually driving savings, it seems like most of this country will be talking this Thanksgiving about some flavor of why they’re spending a fortune on healthcare and getting nothing in return for that. And looking at the bigger picture, that is where it seems obvious VBC is not succeeding.

- Kevin

11/16 Poll Results

On the topic of US healthcare, here are the poll results from last week’s question conversation about the merits of US healthcare versus other systems. As of this morning, 462 of you voted. Not surprisingly, only 92 (20%) voted for the US.

Switzerland was a narrow winner with 34% of the votes, beating out the “other” category. I immediately regretted not putting Singapore as its own option instead of lumping it into “other” as that seemed to be the preferred option there. There was a healthy mix of others mentioned as well — Norway, Australia, Germany, Japan, Taiwan, Portugal, and the Netherlands were all mentioned. Based on the comments, I’d guess that Singapore would have been close to the US for second place.

I think this comment sums up the various sentiments expressed well (and is a reasonable suggestion on reframing the question 🙂):

IMO, there's a better way to phrase the question. If you ask: "Does the US offer the best healthcare in the world?" then I'd say the answer is yes. By inserting the word "system," the whole thing falls apart. We barely have anything that resembles as system, and perhaps there are several different systems experienced in the US - depending on insurance type / status, income, etc... Finally, I think we are living the notion that - you can have theoretical access to the best healthcare in the world but - if it sits on top of an absolutely devastated public health and prevention infrastructure, its capacity to deliver positive impact is severely constrained.

M&A

Abbott buys Exact Sciences for ~$23 billion

On Thursday, Abbott announced that it has signed a definitive agreement to acquire Exact Sciences, best known for its Cologuard colon cancer screening test, for ~$23 billion. Exact Sciences will generate $3+ billion in revenue this year and is growing organically at a high-teens rate. It has two key revenue streams: its screening business and a precision oncology business. The screening business generates almost 80% of revenue and has grown at a 15% CAGR over the past three years, while precision oncology has grown at only a 5% CAGR. Listening to the investor call on the transaction, the only real question is how durable Cologuard growth is over time in the US.

Abbott’s investor presentation highlights the opportunity here in the diagnostic business, noting that this deal “positions Abbott at the forefront of the next era in diagnostics” while doubling Abbott’s diagnostics TAM from $60 billion to $120 billion.

✍ Going Deeper

Seeing this news reminded me of an op/ed in The Hill last month. Dr. Naresh Gunaratnam, a gastroenterologist at MNGI, lamented using Cologuard as a screening tool by insurers. He cited the example of a patient who received a Cologuard kit from his insurer and had a false-positive result. This patient also happened to have his colon removed years before the test. Obviously, that patient shouldn’t have received the test. The author uses this example to make the point that blanket screening of insurance members in this way disintermediates the provider / patient relationship and, given the rate of false positives (1 in 6), it causes undue stress and anxiety (not to mention costs).

Personally, I’m not particularly convinced by The Hill article. This is, of course, a nuanced conversation, but the fact that Mayo Clinic is offering Cologuard to its patients suggests that payers aren’t that far off base here, although it seems like an understatement to say they might benefit from better underlying data on their members.

Nonetheless, it’s a good example of the upcoming arguments that are sure to surface in the diagnostics and longevity market as more and more consumers turn to longevity companies.

LONGEVITY

Function Health raises $298 million, focuses on “medical intelligence” AI model

Function made waves in the longevity market this week, announcing it raised $298 million in Series B funding round at a $2.5 billion valuation. Function offers tests at 2,000 Quest locations, and it has completed 50 million lab tests since 2023. Function also acquired Ezra back in May to provide MRI scans, which are now available at 130 locations and are projected to expand to 200 by the end of 2025 (side note: 70 scan location launches in the next month seems like a lot to me ?). As is mandated in any large funding announcement these days, Function shared that it is launching a new generative AI model called the “Medical Intelligence Lab” that lets members chat with a chatbot manage their biology.

✍ Going Deeper

This is one of those funding announcements that is generating all sorts of strong opinions on social media. If I’m an investor thinking about Function, I think I’m asking myself three questions in sequence:

Does the longevity market go mainstream?

Does Function have what it takes to win?

Can I generate returns at this valuation?

Personally, my answers to 1 and 2 are squarely in the “I don’t know” camp, leaning towards “no” on 1. So I wouldn’t be an investor here. But I can also see how, particularly in this MAHA moment, investors get to “yes” on both of those. I can only imagine the conversations pondering whether we should give everyone in this country a cash stipend that they can spend on buying a Function membership.

I’m not sure I have anything productive to say about that, so instead lets’s focus on the third question as the valuation discussion is an interesting question to me. $2.5 billion actually seems like pretty reasonable for Function today if I do some math:

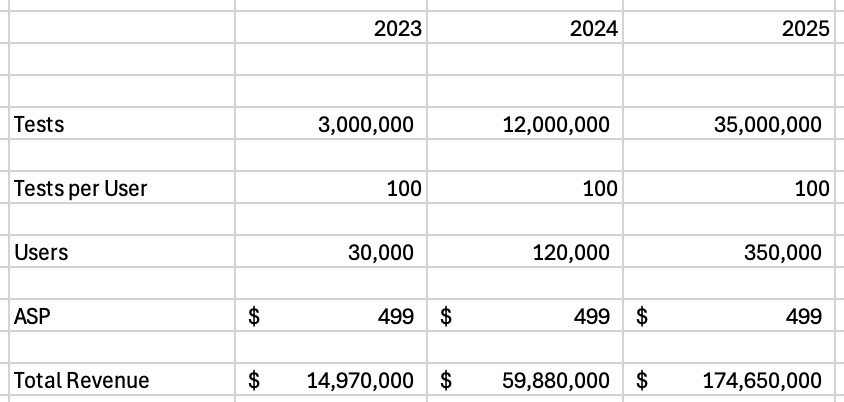

I’d guess that Function Health is on track to do something like $175 million of revenue in 2025. Sacra estimates it at $100 million in revenue, but I think that’s low. Here’s why: if I take the 50 million lab test number since 2023, along with the reporting that it did 3 million lab tests in 2023 on 30k members, I back into the following revenue figures for Function that look like the following:

Source: One of my many open Excel files

If anything, I could see 2025 revenue being higher than that. But let’s assume that revenue figure is directionally accurate. It implies that Function’s round is at roughly 14x TTM revenue and 7x FTM revenue. If I make another assumption that Function doubles revenue in 2026, the valuation looks even more reasonable. Check out the math below, compared to the valuation of Hims and Exact Sciences:

Source: One of my many open Excel files

So assuming those numbers are somewhat close to reality, this actually seems like a pretty reasonable funding round to me. Of course, your opinion on the round is going to depend on your view of the longevity market as a whole and Function’s long-term positioning as a brand. If you think that revenue is going to evaporate, the valuation obviously looks crazy.

Other Top Headlines

Cigna launched a new copay-only plan design, Clearity. It’s interesting to see more of the large insurers offering these copay-only plan designs (i.e. UHC has Surest, Aetna has SimplePay, Blues have Coupe). While ICHRA tends to dominate the conversation right now, these copay-only plan designs seem to be gaining steam as well.

UCare, a nonprofit health insurer here in Minnesota, announced this week that it will shut down and transfer its 300,000 remaining members to Medica in 2026. Provides yet another data point about the ongoing carnage in the regional health plan market, something I imagine we will continue to hear about well into 2026. The Star Tribune article does a nice job of highlighting how this closure ties back to COVID-era issues — after Medicaid insurers in MN reported huge profits because people weren’t using care during COVID, the state pulled back on benefits, while plans like UCare accelerated growth plans. This all highlights the fragility of insurance business models, as within a few years, a 40+ year-old institution went from record profits to failure.

Speaking of regional health insurers, Independent Health announced it is joining MVP Health Care.

Novo Nordisk and Eli Lilly are partnering with Waltz Health — which recently merged with EVERSANA — to launch a direct-to-employer program for GLP-1s. Per Modern Healthcare’s coverage, the drugs will be listed at an upfront, fixed price, with no rebate or fees. Despite that, price transparency again seems elusive here, as Waltz Health’s CEO declined to share the negotiated rates for the GLP-1s when asked by Modern Healthcare.

STAT featured an update on K Health, which has now partnered with six health systems to offer a virtual primary care platform — Cedars-Sinai, Mayo Clinic, Hackensack Meridian Health, Hartford HealthCare, Mass General Brigham, and Northwell Health. While the article highlights how organizations like Hartford are creating Super Bowl ads calling this model “primary care like never before” it is also clear that not all docs are thrilled about the rollout. STAT also explored back in October how Mass General Brigham providers aren’t thrilled about the rollout, with Michael Barnett summing up the sentiment well: “it’s like your local neighborhood restaurant getting replaced by a vending machine”

For HTN Community Members

If you’re not an HTN member but enjoy nerding out on conversations like these, you’re welcome to sign up here to join the discussions!

Martin’s weekly Health Policy roundup, which, among other things, touched on ACA conversations, the provider tax provisions for Medicaid, and CMMI’s strategic priorities.

Editor’s note: I originally wrote incorrectly that this was the physician fee schedule, my bad

We hosted a conversation around the merits of prior authorizations and the WISeR program with Jeremy Friese, the CEO of Humata Health. Humata was recently selected as one of six participants in the WISeR program.

Another data point on the latest trends in 2026 Medicare Advantage enrollment. HealthWorksAI data predicts that Humana and Devoted are tracking toward quite strong growth, along with the C-SNP market.

Our interview with the leaders of Hopscotch Primary Care, a rural primary care model. Going back to the VBC conversation above, Hopscotch seems like a very tangible example of how VBC can help sustain PCPs in rural areas.

We penned up a Q3 2025 earnings season wrap-up if you’re looking for a summary of key takeaways from earnings season.

Featured Jobs

Manager, Analytics at Hopscotch Primary Care, delivering tech-enabled primary care to rural communities. Learn more.

Chicago (Hybrid)

VP, Operations at Pair Team, a community-based primary care platform for Medicaid. Learn more.

$215k - $230k | Remote

Executive Director, Patient Experience at Oak Street Health, a primary care provider for seniors on Medicare. Learn more.

$131k - $303k | Remote

Associate Business Operations Manager at Virta Health, virtual care for diabetes. Learn more.

$87k – $116k | Remote

Growth Strategy & Operations Manager at SCAN Group, a not-for-profit Medicare Advantage plan. Learn more.

$106k - $161k | Remote

Contact us to feature roles in our newsletter.

What I’m Reading

Reimagining sustainable healthcare and business models by Jason Azzoparde, Oleg Bestsennyy, Subham Singhal, and Tuhina Kapoor

An interesting read from a McKinsey team highlighting what they think are four winning models that can address the headwinds facing healthcare — shifting site of care for episodes, payer-led models focused on care management, risk-bearing primary care, and specialty-led models. Read more

We Need Medical AI for Patients by Bob Wachter

Wachter offers an interesting, nuanced perspective on why we need patient-facing AI (it’s better than nothing, which unfortunately is generally the alternative) and also why he is losing enthusiasm for patient-facing chatbots. He suggests we need a new category of patient-facing chatbots that do more hand-holding than general purpose LLMs provide. Read more

Why We Are Stuck with Prior Authorization Review by Drew Altman

A thoughtful perspective in KFF on the topic of prior auths, and why they’re likely here to stay. Read more

Funding Announcements

Function Health, a longevity platform, raised $298 million. See discussion above.

RapidSOS, an emergency response platform, raised $100 million.

Arbiter, an AI interoperability platform, raised $52 million at a $400 million valuation. The Business Insider reports that Arbiter acquired a data platform from SecondWave Delivery Systems, which appears to aggregate data to enable clinical decision support.

Voize, an ambient scribe for nurses, raised $50 million.

WellBeam, an interoperability platform for post-acute care coordination, raised $10 million.

FamilyWell Health, a women’s mental health care model, raised $8 million.

Ember, an AI RCM platform, raised $4.3 million.

No Barrier, an AI interpreter integrated into clinical workflows, raised $2.7 million.

Sandy Health, an AI operations platform, raised a pre-seed round.

Show your support by sharing our newsletter and earn rewards for your referrals!