Sponsored by: Elation Health

Physicians using Elation’s Note Assist save an average of 13 minutes per visit–giving them more time with patients. The result speaks to how Elation co-creates solutions with frontline providers.

Heading to HLTH? Stop by their booth #4922 to see for yourself and learn how they are transforming clinical workflows with AI.

Can’t make it? Learn from their Product, Design, and Clinical teams in this behind-the-scenes session on how they’re designing and developing their AI-powered EHR with clinicians at the center.

If you're interested in sponsoring the newsletter, let us know!

A Reflection on the Week

I spoke on a panel this week at an investor’s annual LP meeting, which included a number of smart folks and also me. We talked at length about the wave of AI innovation and the role incumbents can play in helping move meaningful innovation forward (my general thought: the point made in this post about the barbell outcome very much rings true to me — i.e. that the biggest winners from AI will be the smallest and the largest businesses. This is why I think efforts like GC / Summa Health are so interesting to keep an eye on. I also happen to think that in healthcare, the benefits will accrue in particular to vertically integrated organizations that can turn adversarial counterparty negotiations into friendlies, but I digress from the point at hand).

At the end of the panel, we were all asked a question along the lines of: “what is something that is unpopular but you believe to be true?” I thought I’d share my answer here as it sparked some interesting follow-up conversation after the panel.

My answer: similar to the old adage about needing to pick two between good, fast, and cheap, in healthcare you need to pick two between improving quality, access, and cost. You can’t have all three.

This isn’t exactly a novel argument. Aaron Carroll penned a thoughtful article on this idea of the “Iron Triangle” in JAMA Forum back in 2012, highlighting the challenging tradeoffs across the three. The idea traveled through health policy circles before that as well, going back to a 1994 book on the broader topic. Carroll’s piece in 2012 was met with skepticism by some, underscoring the unpopular nature of the idea.

As we enter another round of major policy conversations this fall in this country, I am reminded of my skepticism of solutions that promise to achieve all three. Those narratives seem to be coming fast and furious these days, particularly in entrepreneurial circles, as folks vie for the opportunity to be the next big thing. This is one of the reasons why the ICHRA advocacy piece I highlighted in last week’s newsletter stood out to me, and not necessarily in a good way.

[Just for clarity here: in general I think ICHRA seems like a good idea and should be an increasingly viable option for employers, but I think the helpful nuanced conversation needed is very different than suggesting to 250k people that they’ll magically get access to Eight Sleep mattresses via ACA plans while also paying less. I don’t think that suggestion is a particularly helpful to anyone other than folks heavily invested in the ICHRA market]

While I certainly understand how the argument of “hey, this model is going to cost less, be good for health outcomes, and give people access to more” is naturally appealing — particularly in political circles when attempting to win over constituents — I also think should also invite some critical questions as to how that actually occurs. The Iron Triangle may not be a law of gravity, but it is a good reminder of the tradeoffs inherent in healthcare decisions, and how I often find the simple solutions that offer a fix for everything are a distraction from the challenging conversations that need to happen.

Anyways, in typical Sunday newsletter fashion, I thought I’d share in the event it spurs dialogue in your office or among your friends, whether you agree or disagree. Rather than glossing over the hard tradeoffs that exist in healthcare, I think the path forward lies in us all actively grappling with them.

- Kevin

AI

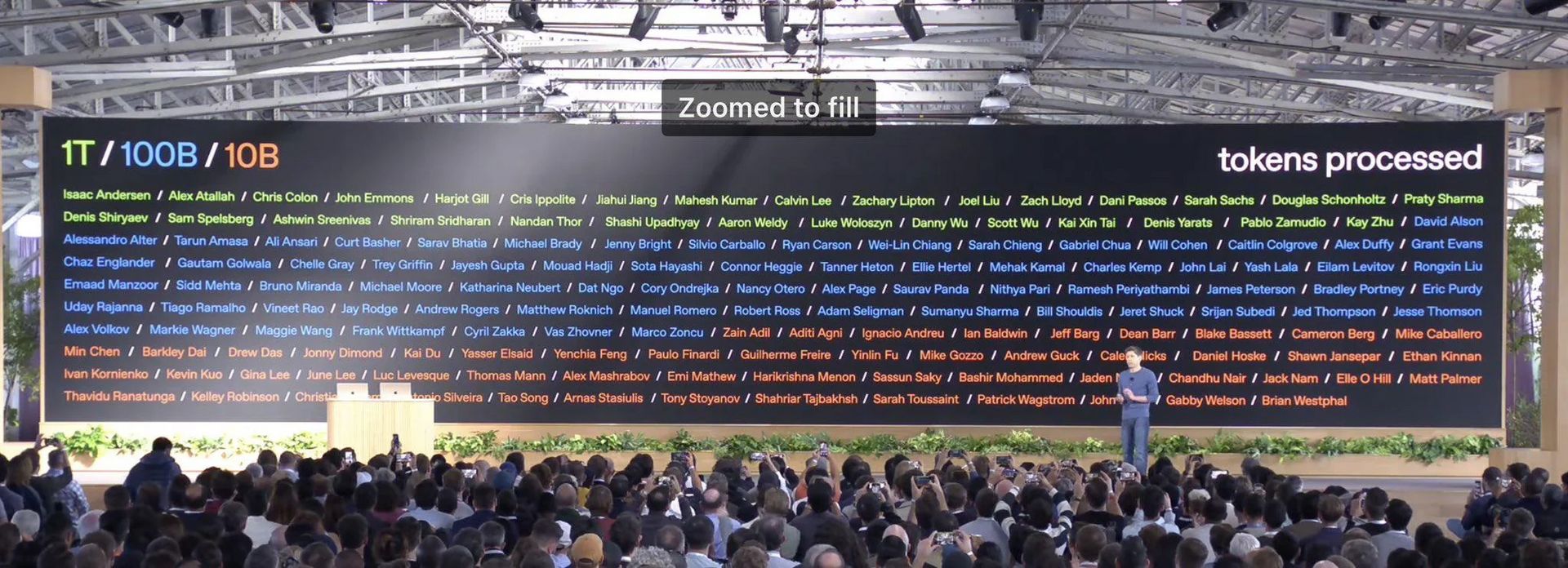

OpenAI’s DevDay highlights top token users, which include Abridge and a few other healthcare companies

Source: OpenAI’s DevDay

OpenAI apparently hosted a DevDay this week. During that event, it apparently shared its top users in terms of the number of tokens processed, visible in the image above. A token is essentially every word that a user sends to or receives from the OpenAI API.

Notably, of the 30 names that received an award for having processed over 1 trillion OpenAI tokens, Abridge’s CTO is #10 on the list. The full list of names who appear to be in healthcare roles is below. This is based on me sleuthing LinkedIn, not an officially verified list by the companies, so take it with a grain of salt:

Source: My LinkedIn sleuthing based on the slide above

It is interesting to me both that Abridge is in the top 10 use of OpenAI, and also that it is the only healthcare company above 1 trillion tokens (I know I included Whoop but I’d call them more of a wellness company). It’s also interesting to me that while many employees at other companies like Whoop took to the internet to celebrate the apparent award, Abridge does not seem to have recognized it as far as I can tell.

Doing the math on 1 trillion tokens, it seems as though Abridge is sending the transcripts of a pretty substantial portion of its visits to OpenAI for some sort of analysis. Here’s my math:

Google tells me that the average amount of words spoken in a 20-minute primary care visit are roughly 6,000. Lets assume with punctuation and everything, that a single visit transcript would be ~10,000 tokens. That means that 1 trillion tokens would represent 100 million visits that have been transcribed (1 trillion / 10,000 = 100 million). For reference, Kaiser noted that Abridge had transcribed 6.3 million visits back in February as part of that partnership. So, just rough math, if Kaiser’s visit volume has grown and represents something like 10% of Abridge’s overall volume, that would put Abridge somewhere around 100 million visits.

It’s certainly interesting to think about the potential use cases here for Abridge and what work it is having OpenAI do that puts it in a class that is multiple orders of magnitude higher than most other healthcare companies. I’m not quite sure how to interpret that at the moment or what that says about the core competencies of each organization. Will be curious to watch if we hear more about this moving forward.

Beyond Abridge, the list is fascinating in how random it seems. Perhaps it doesn’t mean much, but I’m filing it away as a data point to keep an eye on as the market evolves.

MEDICARE ADVANTAGE

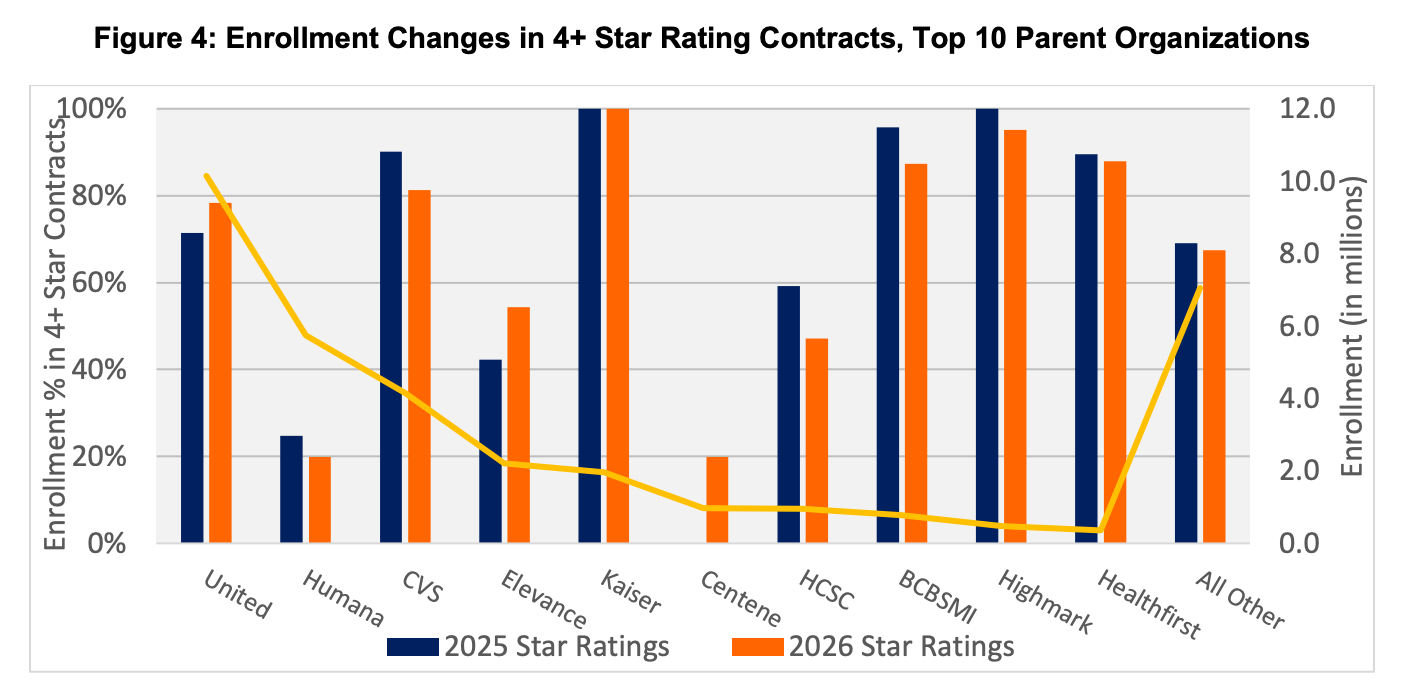

2026 Star Ratings appear generally stable for Medicare Advantage plans

A team at Wakely summarized the 2026 Star Ratings data nicely in this report, with the key theme being stability in the market.

After a tumultuous period the last few years where we saw Star rating results drive massive revenue swings for payors based on seemingly trivial matters — and the lawsuits one might expect as a result — this year seems relatively stable across the board.

That seems like welcome news for many large insurers, perhaps other than Humana and Centene. As the Wakely chart below illustrates well, those two plans have some work to do to catch up to other plans. It’s striking to see Humana’s numbers getting worse, particularly given the efforts they’ve noted to drive improvement here.

One of the most notable under-performers in 2026 Stars is Clover Health, which saw its primary MA contract with 98% of its members fall below the 4 Star bonus threshold, coming in at 3.5 Stars. Clover issued a press release on Thursday, taking the opportunity to critique the current Star Rating methodology for not being focused enough on clinical outcomes while also noting that its performance is not dominated by Star rating results. This HealthcareDive reporting noted that one analyst predicted this drop could wipe out Clover’s MA profits in 2027 (2026 Stars performance impacts what health plans are paid in 2027). Clover’s stock briefly dropped 8% on the news before rebounding a bit. Back in 2024, Clover was much more upbeat about its Stars performance as it achieved a 4 Star rating for its primary contract for 2025 Stars. At that time it noted how hitting that milestone demonstrated Clover’s foundational strength and would allow it to reinvest more in benefits to members.

Meanwhile, Alignment Healthcare continued to chug along and reported 100% of members in 4 Star contracts for a second consecutive year.

Charts of the Week

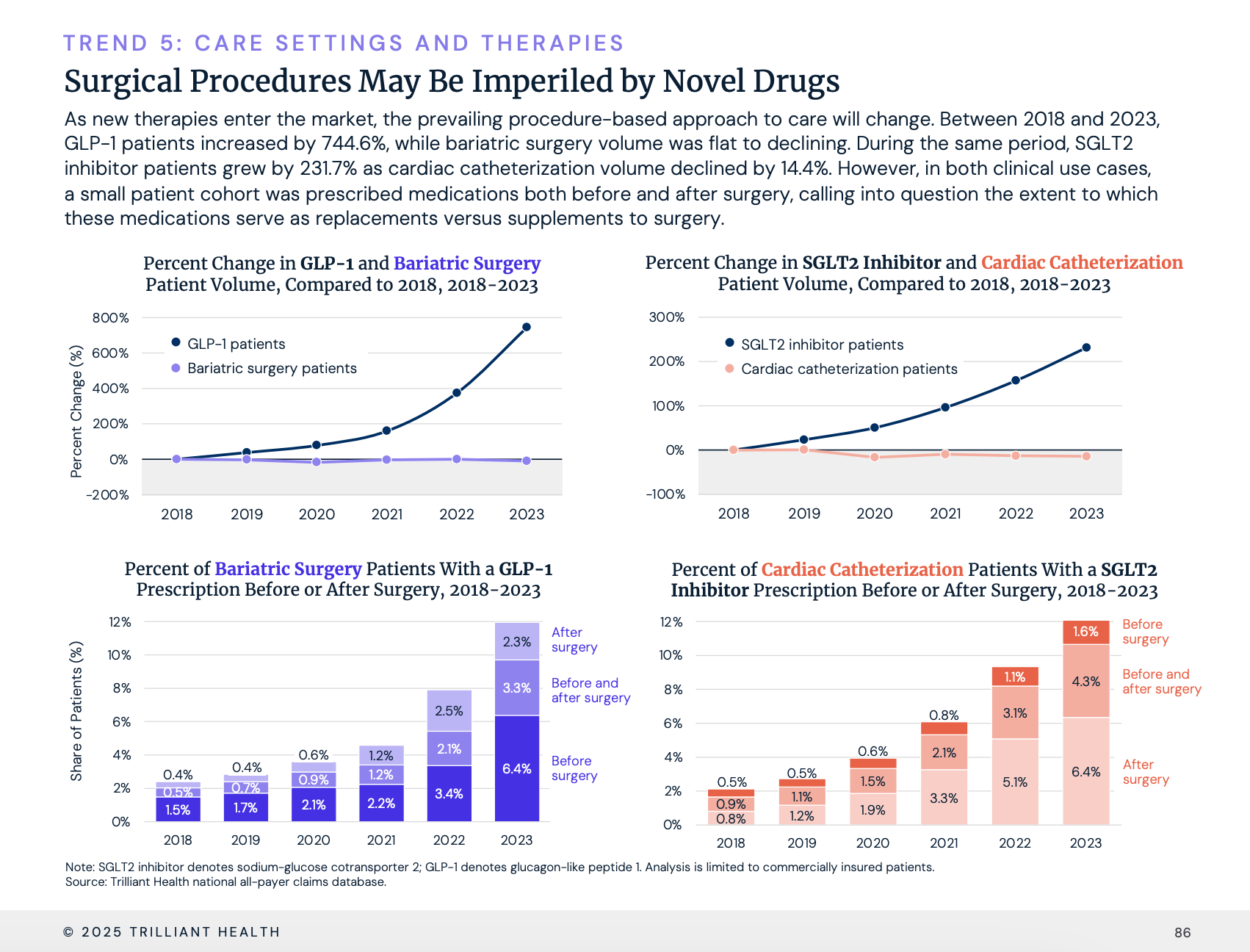

Trilliant released its excellent 2025 Trends Shaping the Health Economy report this week. It covers a range of topics within six broad trends — price and affordability; demographics and lifestyle; neglecting the fundamentals; fraud, waste, and abuse; care settings and therapies; and value for money or price controls. With 117 slides of fascinating charts, it doesn’t quite do it justice to highlight just one of them here, this one caught my attention about the impact that new high-cost drugs may have on surgical procedures.

Source: Trilliant Health analysis, slide 86

Other Top Headlines

Qualtrics acquired Press Ganey for $6.75 billion in a combination of cash and equity. The press release includes a heavy dose of AI-enabled patient experience language.

Axios reported that AARP’s most recent annual financial filing included a one-time $9 billion royalty payment from UnitedHealth as the two apparently restructured their relationship. AARP’s note 3 of its financials goes into the revenue calculation — it received a one time royalty payment of $9.062 billion, with a deferred revenue amount of $8.727 billion that will be amortized over twelve years. Functionally it appears that UHC is paying AARP roughly $700 million a year for the next decade plus to have exclusive access to their brand and market insurance products to seniors. AARP brought in over $1.2 billion in royalty revenue in 2024, with $960 million of that coming from health products and services. It seems like a very nice business for AARP capitalizing on their trusted relationships with seniors, although the nature of these deals has invited scrutiny in the past, as this KFF report from back in 2022 highlights.

Axios reports that Iqvia is acquiring value-based care analytics platform Cedar Gate Technologies for $750 million. Private equity firm GTCR helped launch Cedar Gate in 2014, with Ascension Ventures and Cobalt Ventures (BCBS Kansas City’s investment arm) joining later as strategic investors. The Financial Times reported back in April that GTCR was running a process to sell Cedar Gate at an expected $1+ billion valuation.

Per Bloomberg, Optum’s Atrius Health filed notice with the Massachusetts Health Policy Commission that it has agreed to acquire Boston-based primary care group Acton Medical Associates, which employs 45 providers and has treated 36,800 patients in the last two years.

Amazon Pharmacy is launching kiosks for One Medical patients to fill their scripts while at the doctors office. Amazon will roll this out in December in Los Angeles-area One Medical locations.

Talkspace acquired Wisdo, an AI-powered peer support platform.

Funding Announcements

DUOS, a member engagement platform for payers, raised $130 million. DUOS notes its AI-centric platform is solving the ‘last mile’ member engagement problem that payers often have, focusing on Medicare Advantage, Medicaid, and ACA populations.

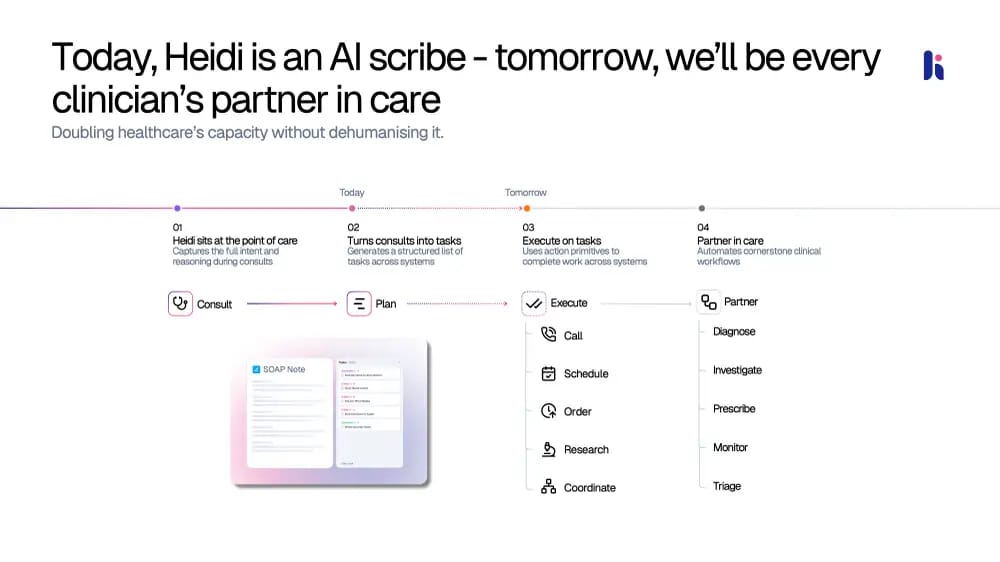

Heidi, an AI assistant for providers, raised $65 million at a $465 million valuation. Heidi has a heavy international presence, noting it is doing 2 million patient sessions per week across 116 countries in 100 different languages. Business Insider shared the pitch deck from the round here. This slide below about how Heidi intends to move beyond just transcribing today to become a clinician’s partner is a fascinating one:

Foundation Health, a pharmacy-as-a-service platform, raised $20 million.

Attuned Intellience, a voice AI platform for hospital call centers, raised $13 million.

Previvor Edge, a solution for the prevention and early detection of cancer, raised $3 million.

What I’m Reading

Pharmaceutical Wholesalers — Under-the-Radar Middlemen? by Hayden Rooke-Ley and Rachel Sachs

An interesting look at the pharmaceutical wholesalers, which — stop me if you’ve heard this before — is seeing more consolidation and vertical integration. The paper notes that three companies control 98% of the market. McKesson, the largest of the three, did $345 billion of revenue in 2024.

Read more

Cui Bono? Misaligned Incentives in the 340B Program by Ryan Long, Karen Mulligan, Melissa Frasco, Erin Trish, and Michael Chernew

A good look at the 340B program, diving into its original intent and how it has grown over time. Read more

The Rise in Early-Onset Cancer in the US Population—More Apparent Than Real by Vishal Patel, Adewole Adamson, and H Gilbert Welch

This JAMA Internal Medicine article suggests that rising rates of early-onset cancer diagnosis are because of increased diagonstic scrutiny and over-diagnosis versus a meaningful increase in the occurrence of cancer. It suggests that this may lead to unnecessary screening. Read more

Profile of Marketplace Enrollees Using Claims Data by Matt Powers, Carrie Rosenzweig, Darren Johnson, and Emily Nau

A team at HMA shared some helpful summary data of ACA marketplace enrollees. Read more

ACO Foundations: Four Pillars for Successful Risk Management in Value-Based Contracts by Wakely

A team at Wakely highlights four pillars of success in VBC: underwriting and contracting, risk adjustment, care management, and in-year forecasting. You can quickly see why providers need partners like Wakely and/or enablers to succeed in these contracts — it’s complicated. Read more

Featured Jobs

VP of Finance at Nimbus Health, a digital pulmonary care company. Learn more.

$150k - $200k | Remote

Clinical Coordinator at Nimbus Health. Learn more.

$90k - $120k | Remote

Medical Director at Nest Health, a value based care model for families on Medicaid. Learn more.

$275k - $350k | Remote with some travel

Business Operations Associate at Elektra Health, a menopause care company. Learn more.

$35/hr - $40/hr | Remote, contract-to-hire (3 months, 40 hrs/week)

Business Operations Lead, New Ventures at Pomelo Care, a virtual maternal care company. Learn more.

$95k - $115k | Remote

Contact us to feature roles in our newsletter.

Want to share feedback with us?

Show your support by sharing our newsletter and earn rewards for your referrals!