Weekly briefing

H.R.1

Provider reimbursement cuts and prior auths: Colorado’s plan to rein in Medicaid costs

Colorado Governor Jared Polis released a budget letter detailing the plan to manage increasing Medicaid costs and the anticipated federal funding cuts from the One Big Beautiful Bill Act. Colorado’s fiscal situation is unique in a couple of important ways, so it may not be generalizable, but I do think it is instructive as to the hard decisions and trade-offs states are making or will have to make.

All in all, of the $252 million in spending cuts, about $80 million are coming from the state’s Medicaid department HCPF or about 30%. The biggest spending reductions are:

A rollback of a provider rate increase in FY24-26, saving $38.2 million

Pre- and post-claim review of pediatric autism behavioral therapy codes, saving $7.0 million

Reinstating prior authorization of outpatient psychotherapy exceeding best-practice limits, saving $6.1 million

Ending continuous coverage for children up to age 3, saving $5.6 million

Eliminating nursing facility minimum wage supplemental payments, $4.3 million

There are seven more reductions that will each save a million or more like reducing payments for pediatric behavioral therapy, slashing dental reimbursement rates, and prior authorization for more than 16 drug tests a year which will add friction for SUD treatment.

Analysis

This quote from Centene’s CEO keeps ringing in my ear as I read these reports:

We do expect there will be budget pressures. In our world, that's actually an opportunity to help them think about managing care and therefore managing taxpayer dollars. That's really kind of the business that we're in.

Centene, Molina, and the other plans with Medicaid Managed Care businesses are going to be in high demand as OB3 is implemented over the next few years. If we play this through, utilization management and lower provider reimbursement are two of the bigger levers a state or MCO can pull, but there are others.

Earlier this fall, Centene subsidiary Oklahoma Complete Health announced a partnership with Positive Development for a lower cost alternative to ABA. Positive Development is a company we cover at HTN, and if there’s any sort of silver lining to these cuts, it’s that there may be more appetite from state Medicaid Agencies and MCOs to work with thoughtful, innovative models like PD and Bluebird Kids Health.

CMS

Squeezing the balloon: MPFS Final Rule edition

As a Halloween treat for health policy nerds, CMS released the Calendar Year (CY) 2026 Medicare Physician Fee Schedule Final Rule on Friday night. The headline number is a little over 3% raise for the conversion factor (what RVUs gets multiplied) bringing it $32.35 or $33.40 depending on participation in qualifying alternative payment models.

Some other highlights (or lowlights if you’re, say, a procedure-based, “ASC-heavy specialty like ortho”:

A new -2.5% efficiency adjustment to help reconcile “long-standing overvaluation of certain procedures and undervaluation of time-intensive services like primary care.”

A change to the Practice Expense methodology that hits facility fees for ASCs in particular

A new, mandatory model from CMMI called the Ambulatory Specialty Model focused on heart failure and lower back pain

Other notable items from the 2300 page rule:

Streamlining the process for adding Telehealth services to the PFS

Soliciting comments on improving the payment for global surgical packages

Add-on codes for Advanced Primary Care Management services focused on chronic illness and behavioral health needs

A final payment rate of $127.28 for skin substitutes, down from what has been over $1000 per treatment

Analysis

A fee schedule, and in a broader sense, a budget, is a sort of priority list and who is getting more and less of that budget is generally a good signal for what’s being prioritized. This is especially true with CMS as they get a budget and some instructions from Congress, and need to divide the pie based on that budget and those instructions. So if you want to one group of physicians some more money, it has to come at the expense of others. The squeezing of a balloon metaphor is a popular one in health care, and is basically, figuratively spot on when it comes to the Physician Fee Schedule.

A priority for this CMS is primary care, so the ones getting squeezed are procedure based specialties which they expect to get more efficient over time:

We further explained that efficiencies gained in services that could be performed many times per day such as cataract extractions, skin biopsies, and CT scans, allow the practitioner to perform more of those services in a given day.

Of course, the doctors who perform these procedures don’t really care for this. Reading through the comments and responses are an interesting example of why it’s so hard to reduce spending in health care, though CMS mostly had the courage of its convictions and the special pleading was politely batted away:

We appreciate the commenters' diligence in reviewing the list of services to which we proposed to apply the efficiency adjustment…We continue to believe that applying the efficiency adjustment to non-time-based services more broadly, instead of applying it only to certain services, will help to improve the overall accuracy of our valuation of these services under the PFS.

Medicare Advantage

Two new-ish MA plans pursuing divergent strategies heading into open enrollment

Earnings season is nearing a close, and it was interesting listening in to Alignment Health and Clover Health, two MA plans with two very divergent strategies as Annual Open Enrollment begins.

Alignment Health, whose Star results were strong again this year, has been rewarded for its focus on care management as other plans who were over indexed on a risk adjustment strategy have struggled with V28. They posted another good quarter and in many ways, they seem to be a model for what an insurance company that isn’t named UnitedHealthcare, Humana, Cigna, or Elevance can do to succeed in a choppy market.

Clover’s call came after disappointing Star results for their largest contract, and they had to revise their 2026 guidance on adjusted EBITDA down and medical loss ratio up for the year. The Clover narrative is focused on a PPO network and their Clover Assistant tooling for providers— sort of the inverse of Alignment’s tightly managed care model.

Analysis

No one is going easy on Medicare Advantage right now, certainly not CMS administrator Dr. Oz who has been enthusiastic about two things since he took over the job:

Auditing and clawing back overpayments from MA plans

Reducing prior authorization

In response to this shifting policy landscape which also includes payment reductions for risk adjustment resulting from V28 and a big surprise to the upside on medical spending, it’s been a tough year to be in the Medicare Advantage business. The bigger payers all shared on their earnings calls that 2026 was going to be a rebuilding year, whereas Alignment and Clover are both forecasting profitable growth. Whether those profits will materialize remains to be seen, I’m bullish in the case of Alignment and bearish a bit with Clover, but it is interesting to see a big regulatory shift diminish some of the returns to scale for the larger payers and open up avenues for alternative strategies for the smaller plans.

The Hickpuff Review

CMS reported that all 50 states submitted their Rural Health Transformation Program applications which was on a very tight timeline but isn’t all that shocking— a share of the $25 billion dollars is worth some late nights and paperwork.

Paragon’s Brian Blase and John Graham report on the relative size of tax expenditures of ACA subsidies versus employer-based coverage which is an interesting point academically, but I’m not sure how it could be any other way. A small individual market of mostly-near Medicaid income people is a lot more expensive way to insure people than a large market heavily subsidized by employers.

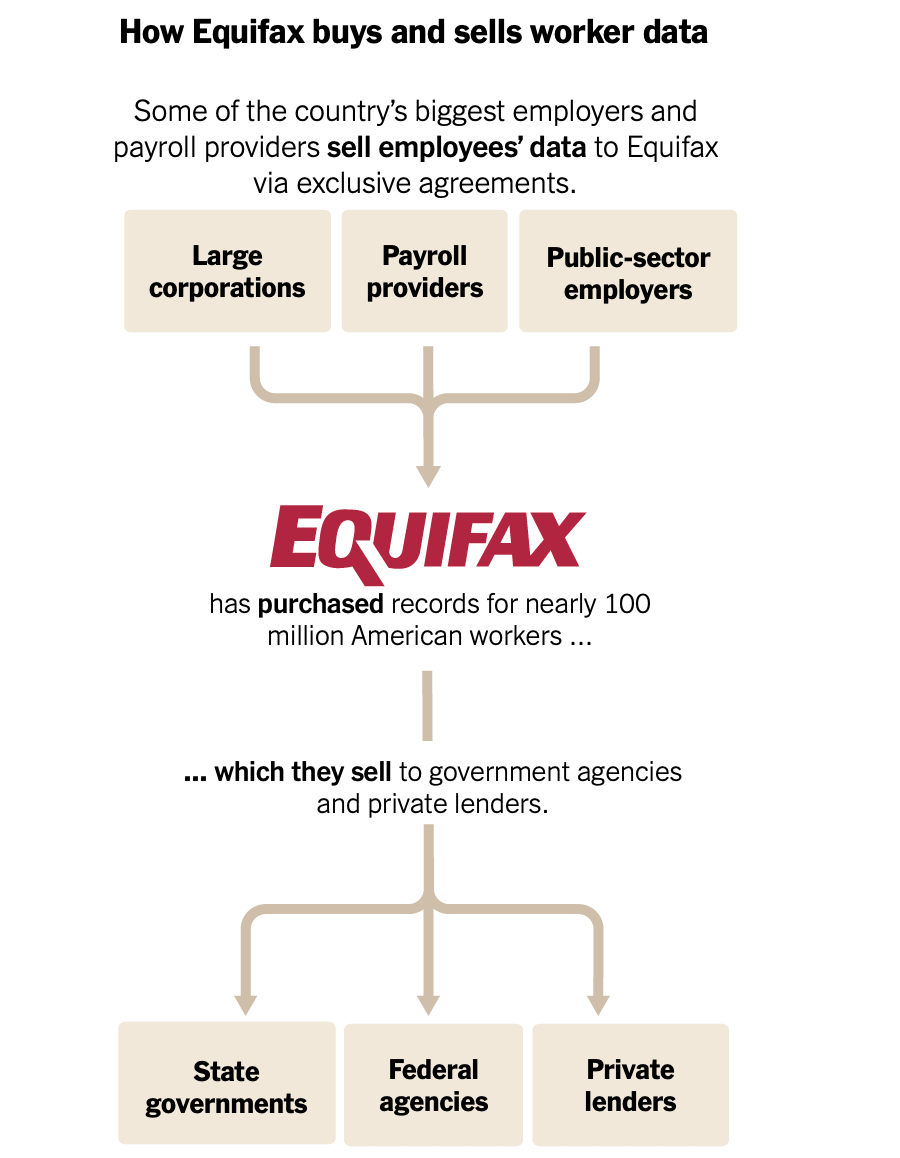

The New York Times reports on Equifax’s OB3 tailwinds at the state and federal level. In their earnings call, they shared that the business that includes this segment is doing $553.6 million in revenue with 51.2% ebitda margins on exclusive data agreements. Must be nice!

UCHealth (Colorado, not California) is taking over a critical access hospital in Estes Park which gets funded in part by local taxes. This is a tough call, the Estes Park hospital is struggling financially so it seems reasonable for UCHealth to take it over, but UCHealth is a private non-profit with, to quote, Fitch, "a long track record of profitability and double-digit operating EBITDA margins. Between fiscal years 2018 and 2024 (June 30 FYE), the operating EBITDA margin averaged a very strong 14.2% (12.2% in FY 2024)"

Kevin and I chatted with the ACA experts at Evensun Health to get a better sense of how all this uncertainty is impacting the ACA marketplace and how insurers are thinking about it going into 2026

CMS misses November 1st deadline for the Hospital Outpatient, Home Health, and ESRD final rules. We’ve all been there, you wait until the last minute and something comes up, but the Home Health rule in particular has bankers tapping their feet as M&A in the space has slowed down until the rule is finalized.

Long form: the hard thing about hard things in healthcare financing

I’m going to editorialize a bit on the Medicaid cuts the Colorado government approved. By way of context and disclosure, I used to work for Colorado’s Department of Health Care Policy & Financing and before that, I was a teacher in Denver Public Schools.

Earlier this summer, HCPF described their sustainability framework on a webinar for stakeholders:

Part of the draconian cuts the slide is talking about is un-expanding Medicaid. For not very good reasons, Colorado is severely limited in the amount of money it can collect in taxes and was able to finance Medicaid expansion through the use of provider taxes well above the new 3.5% threshold from OB3. As tough as the inevitable consequences are of lower provider reimbursement and more utilization management, preserving Medicaid expansion seems, in my humble opinion, like a reasonable trade-off.

As a health care guy, I mostly think about the health care trade-offs. But it’s worth noting that the trade-offs of these cuts are part of a larger set of trade-offs that Polis and the state legislature have had to navigate:

“The increases in Medicaid costs would crowd out essentially everything the state does. We would largely just fund schools and Medicaid — no money for roads, no money for public safety, no money for housing.”

A few years ago, Colorado decided to fund full day kindergarten and universal pre-k and now there’s less room in the budget for dental providers and pediatricians who serve Medicaid patients and so some of those kids will wait longer for a teeth cleaning or an office visit.

I think the reason this has been top of mind is what Kevin talked about in the newsletter last week:

A thing that worries me: as frustrating as people think this conversation is about costs today, the coming wave of pharmaceutical innovation is going to put so much more pressure on healthcare costs in this country. When the median list price of new drugs approved by the FDA is $390,000 (per Cigna), who exactly is going to foot the bill to allow people to access these new medications? The iron triangle rears its head again here — either healthcare costs are going up (cost), we’re rationing care (access), or we’re slowing down innovation (quality)… It goes without saying that these are challenging trade-offs, but not addressing them head-on doesn’t avoid them…

The hard thing about hard things in health care financing is that someone has to choose, and deciding between keeping Medicaid expanded or reducing provider reimbursement such that the expansion population experiences degradation to their access and services must feel like impossible decisions for the joint budget committee and governor had to make, and I don’t envy them one bit.