👋 If you enjoy the free weekly newsletter, consider joining the Health Tech Nerds Community, a members-only Slack community designed for networking and knowledge sharing!

Capitol Hill

Reforming the (mostly already reformed) PBMs

While some sort of compromise on the Affordable Care Act enhanced premium tax credits remains elusive, Democrats and Republicans have found common ground on a set of regulations to “modernize and ensure accountability“ for Pharmacy Benefit Managers (PBMs).

You can read the legislative text of the bill here, under Sections 6223, 6224, 6701, and 6702, but the headlines are:

For Medicare

Mandating “flat dollar, fair market value” service fees, not rebates, as the way for PBMs to get paid, and requiring any rebates and discounts to be passed through to plan sponsors.

Fixing a loophole in the “any willing pharmacy” policy, which allowed PBMs to favor their own speciality pharmacies.1

Transparency and annual reporting requirements for PBMs, specifically around drug costs, along with audit rights for plan sponsors.

For commercial plans

Increased transparency and reporting requirements similar in structure and spirit to the Medicare requirements

Requiring full rebate pass-through for most employer-sponsored plans

More from STAT and Politico. Also, a fact sheet from the Senate Finance Committee chair and ranking member on their Pharmacy Benefit Manager (PBM) Price Transparency and Accountability Act, which served as the basis for the deal.

Analysis

The industry group for PBMs, the Pharmaceutical Care Management Association, didn’t have anything nice to say about the deal, but the reaction in the markets was relatively muted for the “Big 3” PBMs: Express Scripts (owned by Cigna), OptumRx (owned by UnitedHealth Group), and Caremark (owned by CVS Health). NB: the deal was announced early on the 20th.

All these companies are large, diversified businesses with nothing in the public markets close to a “pure play” PBM, so there are limits to the usefulness of the charts. But still, you’d expect it would be a bit of a headwind, so why can’t we see it in the price action?

It turns out, we can, if we zoom out a bit:

That steep drop in Cigna’s stock price, which rippled to the other PBMs in late October 2025, was on the news that their plan to end PBM rebates “would lower that segment’s profits.” Each of these PBMs has a transparent, service-fee-based model that they’ve announced and are starting to implement: Caremark has TrueCost and CostVantage, Express Scripts has ClearCareRx and ClearNetwork, and OptumRx has Cost Clarity and Clear Trend Guarantee.

There’s been a lot of enthusiasm about alternative PBMs in the private markets, and I’m curious to see how this shakes up their strategy, as it seems to me that this legislation aligns the entire industry around their main value propositions of passing through rebates and transparent pricing. In a world where that’s table stakes because it’s the law, I’d imagine it’s even more the case that there will be returns to scale in the PBM business and that this will improve the Big 3 PBM’s position relative to their upstart challengers.

Capitol Hill

Other spending deal highlights: extensions to Medicare Telehealth and Hospital at Home, an increase in Community Health Center funding, and more

The PBM news is getting most of the headlines, but the appropriations deal also included some welcome news for the healthcare services and technology industry:

2 years of funding for the Medicare telehealth program, which expired last fall and was only temporarily patched until the end of this month

5 years of Hospital at Home funding, which, similar to Medicare telehealth, lapsed last fall and was temporarily extended

More money for rural providers with a $1 billion increase in funding for the Teaching Health Center Graduate Medical Education program, including provisions for rural residency programs, $25 million for a new Rural Hospital Provider Assistance Program, and delays to disproportionate share hospital payment cuts

$100 million for the Preventing Maternal Deaths Act and $15 million for community-based organizations to develop programs that deliver fresh fruit and vegetables for pregnant and postpartum mothers

Telehealth modifiers for virtual care, allowances for telehealth cardiopulmonary care, and virtual-only provider participation in the Medicare Diabetes Prevention Program, and mandating a report on wearables and AI from the U.S. Comptroller General

More on the telehealth, maternal and infant health, and rural health provisions.

Capitol Hill

UnitedHealthcare goes “non-profit” for its 2026 ACA business

As I write this, health insurance CEOs are testifying before the House Subcommittee on Health on lowering healthcare costs and insurance affordability. In advance of the testimony, UnitedHealthcare announced that it would rebate all profits from its marketplace business to its members in 2026.

You can read CEO Stephen Hemsley’s prepared remarks here and reporting on the announcement here from Fierce Healthcare.

Analysis

Three thoughts on this:

First, I’ve been speculating over the last few weeks about whether it’s going to be a relatively good year, profit-wise, for the ACA, and I wonder which way this news cuts. Perhaps UnitedHealthcare’s executives are looking at their prices and open enrollment results and saying, “We did too well this year, it’s going to be a PR nightmare.” I don’t think this announcement is strong evidence for the high-ACA-profits thesis, but maybe, if you squint, it is a bit. Of course, the opposite could be true; they think they got caught offside on pricing and aren’t planning to make any profits this year.

Second, there’s a possibility it isn’t a PR move at all, but instead a bit of competitive strategy. As Hemsley acknowledges, it’s a small part of their business and profits. But it is very nearly 100% of Oscar Health’s business, and I bet you can pick out on this chart when the announcement hit the wires:

Is UnitedHealth Group putting its ACA competitors in a bind for strategic purposes? I doubt it. It’s a weird year in the ACA marketplace; the general vibes around the health insurance business are quite bad, and this seems like PR more than anything. But you never know! I hope this gets some airtime on their Q4 earnings call next week.

Finally, what a strange announcement. It isn’t very controversial to say that corporations exist to make profits. These profits have some social utility: some of those profits go to pay corporate income taxes to finance the government, and shareholders get what’s left over so they can retire one day. Insurance companies have a picking up pennies in front of a steamroller business model where they make a little, statutorily regulated margin on a lot of premium revenue, and if it becomes the expectation that they shouldn’t make a couple of hundred basis points on their individual market businesses, I’m not sure why shareholders would want to invest in these businesses. As someone who thinks the individual market is a nice thing to have, this strikes me as a bad outcome.

The Hickpuff2 Review

This podcast from Health Affairs with Vanderbilt health policy professor Stacie Dusetzina gives a good overview of the Trump Administration’s recently released healthcare plan, and the Republican Study Committee released their framework for “making the American dream affordable again,” which includes similar concepts.

AnswersNow, a virtual ABA platform, raised a $40m Series B led by HealthQuest Capital. It’s a variation on the pitch we’ve heard from companies like Positive Development and Headstart Health, which is that outcomes are possible with a lot lower intensity/hours than what incumbents, largely owned by private equity firms, are pushing. I’ll note that it’s a great time to make that pitch, as publicly traded Medicaid Managed Care organizations and states are discussing increasing utilization management, cutting rates, and/or increasing program integrity efforts, given that ASD therapy costs have been a driver of Medicaid cost growth.

Michael Chernew, health policy professor and MEDPAC commissioner, shared his reaction to the National Health Expenditures release from CMS, saying “it’s not the prices, stupid” but volume and coding intensity that are driving the 7.2% YoY cost growth. Of note, as health insurance CEOs are testifying before the House Health Subcommittee, “non-medical spending by private health insurers, which includes profits, grew at 4.4 percent rate, which is below overall spending growth… the increased medical spending was unanticipated by many insurers, which led to reductions in nonmedical insurance expenditures, the subcategory that includes underwriting gains or losses and thus where profits (or surpluses in the case of non-profit insurers) are recorded.”

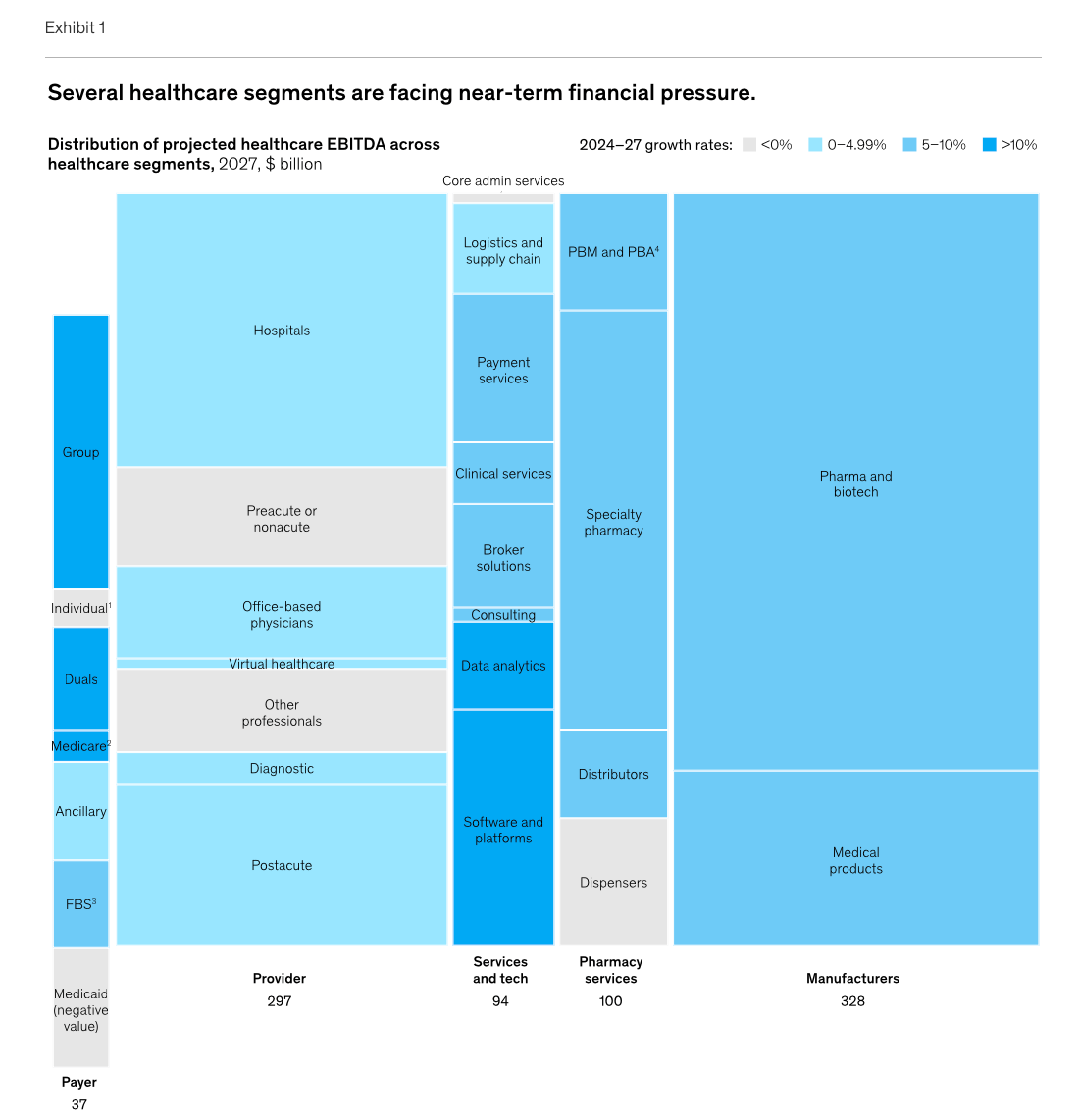

McKinsey & Company’s annual healthcare trends for 2026 are worth a read. In particular, the profit pools analysis is the most near-term bullish on Group, Duals, and Medicare in the quite slim Payer segment, and data analytics along with software and platforms in the Services and tech segment.

Tim and Paul from Signals published the third entry in their series on the current landscape of value-based kidney care, focusing on the levers to reduce the total cost of care across patient support, provider enablement, and technology. The kidney care industry has long been a pioneer in value-based care through bundled payments and a host of CMMI models, and as we look for productivity improvements in healthcare, I think the VBC kidney care companies make for interesting case studies.

More from Health Tech Nerds

2026 J.P. Morgan Recap with Bailey & Company’s Rebecca Springer on the middle market: Rebecca from Bailey & Company joined the HTN crew to discuss her perspective from the JP Morgan Healthcare Conference, including the state of middle-market activity and the outlook for 2026. I also found BNCO's conference recap and Q4 M&A recap quite insightful.

Want to comment or share feedback?

If this newsletter was forwarded to you, subscribe here or see more from Health Tech Nerds.

1 We discussed this provision with Ogi Kavazovic, CEO of HouseRx, if you’re interested in learning more.

2 https://www.healthaffairs.org/content/forefront/happy-birthday-hcpf