Today is the last day of the J.P. Morgan Healthcare Conference. Kevin spent the week out in S.F., and I listened in to the public company presentations from the comfort of my dining room table in Washington, D.C.

CMS leaders Dr. Oz, Chris Klomp, Dan Brillman, Amy Gleason, and Stephanie Carlton hosted a keynote that touched on the ACA and the administration’s skepticism about extending the now-expired tax credits, not throwing the baby out with the bathwater when it comes to value-based care in Medicare, and the necessity of the Medicaid reductions given the program’s growth trajectory.

All in all, it’s choppy water that CMS-regulated companies are sailing in, but I’m including links to the presentations of a few companies that seem to be navigating these choppy waters well:

Medicare Advantage insurance plan Alignment Health talked about growing membership 31% and adjusted EBITDA as much as 50% in 2026, while other MA plans are contracting after a tough couple of years.

Program of All-Inclusive Care for the Elderly (PACE) operator Innovage is pulling off an impressive turnaround at just the right time to capitalize on increased demand for budget certainty from states in their LTSS programs and staffing and capacity constraints in nursing homes

If you want more in-depth coverage of what went down at the Westin St. Francis in SF this year, HTN’s in-depth coverage and analysis is available for purchase here including the reports from Monday-today.

ACA

Another strong ACA Marketplace Snapshot update from CMS, but effectuated numbers will tell a more complete story

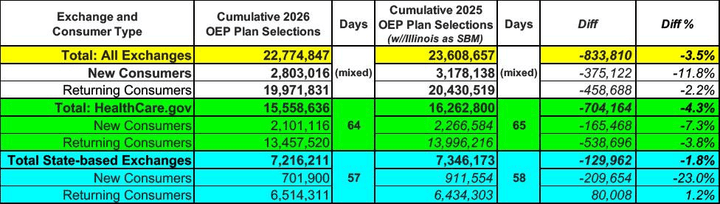

On Monday, CMS released the latest Marketplace 2026 Open Enrollment Period Report. Headline numbers are 22.8 million signups, with 2.8 million members new to the marketplace, and 20 million re-enrolled either actively or automatically.

Estimates of how much the market would contract if the subsidies expired ranged from 15% on the low end to the mid-30s on the high end, but Charles Gaba from acasignups.net did the math: enrollment is only down 3.5% year over year.

Gaba’s analysis here

However, both Gaba and KFF warn against drawing strong conclusions from these numbers, as people haven’t paid their first premium bills yet, and there is always some attrition as people decide it’s not worth it. The number of enrollees who pay their premiums, which CMS calls the effectuated enrollment, will come later this year, although we may get some hints on Q4 earnings calls from Oscar, Centene, and other marketplace participants.

Analysis

An interesting thought exercise is to try to figure out what that attrition rate might be. Assuming open enrollment ends at 3.5% lower than last year, at around 23.45 million enrollees, in most markets today. There are a few plausible scenarios. 5% attrition is a reasonable estimate for the enhanced subsidy era, 15% is closer to the high premium increase years of 2016 and 2017.

Attrition Rate | Raw Attrition (People lost) | Projected Effectuated Enrollment |

5% | 1.17 Million | 22.28 Million |

10% | 2.35 Million | 21.10 Million |

15% | 3.52 Million | 19.93 Million |

20% | 4.69 Million | 18.76 Million |

I’ve talked before about a scenario where 2026 could be a good year, margin-wise, for ACA Marketplace plans, and that scenario isn’t contingent on the enhanced subsidies expiring. Insurers were conservative in their estimates and pricing, so any positive surprises from market contraction, acuity shifts, or medical trends could make for an unusually profitable year for payers, with an eAPTC extension icing on the proverbial cake.

The Hickpuff1 Review

Axios is reporting that PBM reform, extensions for Medicare telehealth flexibilities, funding for community health centers, and an incremental step towards site neutrality are all part of a potential bipartisan congressional deal on healthcare. The PBM reforms outlined here include strengthening the “any willing pharmacy” provisions that HouseRx CEO Ogi Kavazovic mentioned during our conversation.

Chuck Grassley, the senior senator from Iowa, released a report alleging that UnitedHealth Group is gaming the Risk Adjustment system. Interestingly, Grassley was Senate Finance Chair during the passage of the Medicare Prescription Drug, Improvement and Modernization Act back in 2003, which created the Risk Adjustment framework, meriting a thank you from George W. Bush during the signing ceremony.

Over on LinkedIn, friend of HTN Lawson Mansell noted that at least eight states have committed to removing, at least partially, certificate of need requirements as part of their Rural Health Transformation Program applications, including Alaska, Delaware, Iowa, Maryland, Nebraska, Rhode Island, South Carolina, and Tennessee.

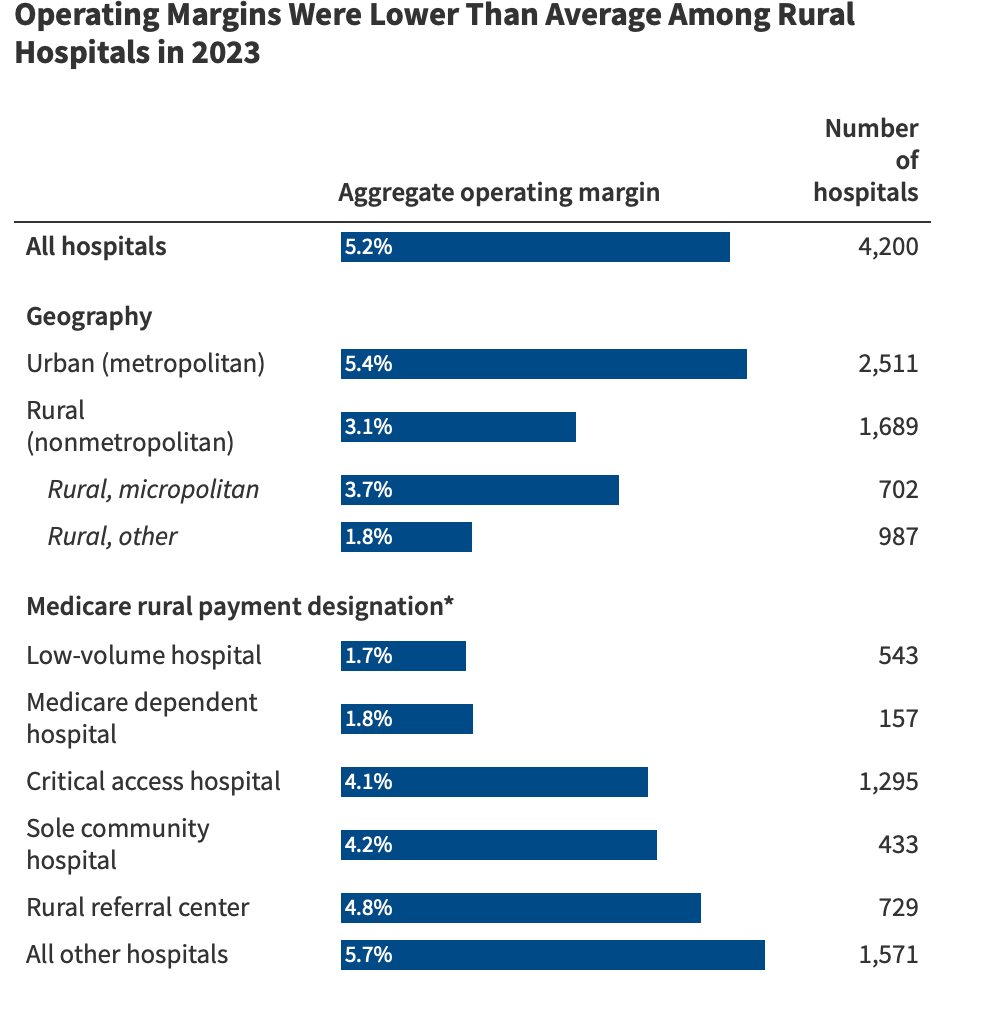

Speaking of UnitedHealthcare and rural health, they announced a pilot program to advance MA payments to rural hospitals, which seems like a nice thing to do for the very sensitive to the cash-flow operations of these businesses.

From KFF

Emma Curchin and John Schmitt from the Center for Economic and Policy Research published a report titled “The High Cost of Living: What Working Families Pay For Health Care” with a few interesting data points, including that “the typical working family spent $3,960 on health care in 2024, including premiums and out-of-pocket costs.” A hard part of discussions on costs, generally and healthcare costs specifically, is that I’m never sure what the “right” amount of spending should be. Real median household income2 in 2024 was $83,780, so about 5% of their household income. For reference, the 2026 IRS affordability percentage of household income table is below:

More from Health Tech Nerds

Financing value-based care with Aledade CEO and Co-Founder Dr. Farzad Mostashari: The Medicare Shared Savings Program is one of the stand-out successes of value-based care, saving Medicare $2.5 billion dollars in Performance Year 2024 while driving improved quality measures in blood pressure, A1c control, and depression screening. Aledade has been one of the program’s success stories, and they recently announced a $500 million credit facility to support growth. Kevin interviews Farzad, discussing the fascinating and complicated topic of ACO finances as well as his policy recommendations to encourage continued growth in value-based care.

Network builds, new CMS mandates, and DME marketplace dynamics with Tomorrow Health's Vijay Kedar: Tucked into the CMS Calendar Year (CY) 2026 Home Health Prospective Payment System Final Rule were some pretty significant changes to the Durable Medical Equipment program, including restarting the competitive bid process for DMEPOS. CMS is attempting to better manage costs alongside waste, fraud, and abuse, while also being thoughtful about preserving a competitive market with lots of small, independent suppliers. It’s a tricky balance to strike and indicative of a lot of the trade-offs that need navigating in our healthcare system, and Vijay was kind enough to walk me through the mechanics of these programmatic changes.

Want to comment or share feedback?

If this newsletter was forwarded to you, subscribe here or see more from Health Tech Nerds.

1 A term of endearment for Health Care Policy & Financing

2 Not a perfect apples-to-apples comparison because CEPR looked at households with at least one working adult, and the FRED number is for all American households.