This newsletter is sponsored by Particle Health

Ready to build something great? Join the Particle Health team on June 1st at 2pm ET / 11am PT to learn and win big. Discover how to build powerful, scalable solutions from clinical data that grow with your organization. Plus, attendees will be entered to win two tickets to Legoland!

During the virtual session, the team will highlight how curated patient datasets enable providers and care organizations to unlock value and leverage data in a meaningful way across the entire patient journey, from onboarding to care management. Particle's customers have experienced benefits like:

Reduced implementation costs and expedited timelines without requiring specialized knowledge of C-CDA or FHIR

50% increased treatment enrollment within the first month

43% additional returned records for all patients

News:

CVS lowers its earnings target for the year as they close Oak & Signify deals early

This earnings call highlighted the tenuous position CVS all of a sudden finds itself in having acquired two assets burning through cash as it had to reduce its earnings target for the year because it closed the acquisitions of Oak and Signify earlier than expected. Between that, the Star rating headwind, and the general Medicare Advantage rate environment, CVS has a really tricky path to walk here.

CVS seems to recognize that, repeating on a number of occasions during the earnings call that the benefit of closing on the Oak deal early is that it will be able to get losses associated with new clinics off CVS’s P&L. From the response to an analyst question below, it sounds like they’re racing to make this happen this year before a new set of clinics are opened in 2024: “[closing Oak Street early] will allow us to explore alternative growth vehicles that allow us to accelerate clinic growth and mitigate dilution and very importantly, begin this work well in advance of 2024. In other words, CVS recognizes it needs to get losses off its books and we should probably expect to see a Humana / Welsh Carson style arrangement announced over the coming months for new clinic builds. It would be a logical move by CVS to avoid additional dilution from Oak Street while still growing the business. At the same time, it seems somewhat problematic that the core benefit of closing early on a massively important strategic deal you is that you can move faster to get its losses off your books.

Adding to that challenge is that analysts clearly seem confused at how profitable Oak Street is expected to be over time. If you’ll recall, during the acquisition announcement, CVS leadership suggested that Oak Street’s Embedded EBITDA would be $2 billion in 2026. So when an analyst asked a question about how attainable that number is during this earnings call, it was painful to have to hear the CFO have to explain that the number isn’t relevant in a “GAAP world” which happens to be the world most public companies lived in. This is because Embedded EBITDA is a made up construct designed to highlight how profitable Oak Street could theoretically be if all of its clinics were generating profits like its most mature clinics are. Yet in reality, it is a mathematical impossibility that Oak Street will hit that number.

CVS clearly made a big bet with these acquisitions, one it seemingly had to make to keep up with its competitive set as it transitions from retailer to healthcare business. But a few months in, these deals do not appear to be aging well at all for CVS as the world has shifted underneath their feet. It was no surprise to hear CVS’s CEO say during the earnings call that they won’t be making any big healthcare services acquisitions in the near future and instead will be focused on integrating these assets. It’s a big task ahead.

Carbon Health takes its contract dispute with Elevance to Twitter

Carbon has apparently been in a protracted contracting battle with Elevance and recently took that battle public, penning a blog post and taking to Twitter to air their grievances. We’re going to take a minute diving into this one because we think it provides some fascinating insight into life as a provider. According to the STAT article, Elevance represents ~10% of Carbon’s patients in California and ~5% of all Carbon patients, which highlights how big of a deal this negotiation is for Carbon.

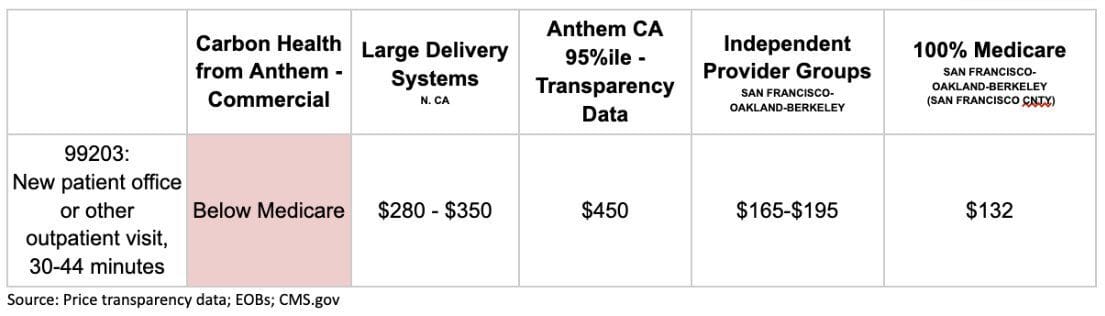

It appears that Elevance has refused to increase rates since 2013. Elevance is now paying Carbon substantially less than Medicare rates per the chart below, which was posted on Twitter. It highlights the disconnect that so often happens in this industry - while Elevance leadership is talking publicly about how it wants to support providers and move them towards VBC contracts, its contracting teams are also making life really hard on providers. It’s a fascinating negotiating tactic by Carbon that reverses the typical power dynamic between a large payor and a small (by typical patient volume standards at least) provider by leveraging the massive social media following of Carbon folks. I’m sure a lot of other small providers (startups and traditional providers alike) wished they had the ability to draw the same attention to a contracting dispute like this.

It is also interesting to see Carbon take the traditional provider contracting argument in this dispute, saying: “We can’t accept those [Elevance’s] rates and pay our clinical workforce livable wages”. As with other providers in similar battles, it is a seemingly fair argument, yet for Carbon it also seems like an acknowledgement that its public narrative the past few years might not hold water. Keep in mind that less than two years ago, Carbon was publicly touting how its mature clinics were able to generate 30%+ EBITDA margins while it was only collecting Medicare rates because its tech platform made it more efficient than other providers. It also called out health systems for charging through the roof because they operated inefficiently. So it seems worth asking the question: how can it be true that Carbon was making 30%+ EBITDA margins on mature clinics in 2021 and yet two years later it now can’t even afford to pay livable wages to staff on the exact same rates they’ve been getting paid for years? The answer is likely complicated, a combination of adding primary care offerings, staffing costs increasing, COVID-19 testing dynamics, and it being challenging getting clinics to maturity. Regardless, it seems like the claims of consistently generating 30% EBITDA margins on Medicare rates haven’t held up.

Despite my questions of Carbon’s public narrative from the past few years, it is understandable that Carbon needs to be paid more looking at the numbers below. Healthcare delivery is hard to make work as a small scale provider attempting to make a profit. Elevance doesn’t come out looking great here, particularly given Carbon claims that Elevance is no longer paying claims. Given I just spent 400+ words talking about this, it seems like Carbon’s negotiating tactic is working. Will be curious to see if Elevance chooses to respond publicly here.

Rubicon Founders partners with US Heart & Vascular to build a VBC platform for cardiology

US Heart & Vascular was launched in 2021 by Ares Capital as a new practice management platform for cardiology groups, and this investment (the press release calls it a partnership but it reads like an investment) from Rubicon will help USHV develop its VBC capabilities. Seems like a smart move by some astute investors getting out in front of increased interest in VBC in specialty care.

It’s interesting to look at this deal in conjunction with the recent news of NovoCardia merging with Cardiovascular Associates of America as we think about the broader market trends at play. The two moves seem like a clear indicator that investor interest in VBC is focusing more in specialty care delivery, but also that you can’t ignore the current state FFS business that sustains these specialty practices today. As we discussed in the Slack thread, it seems like USHV will bolt on the VBC support capabilities to its existing FFS practice management software, and give its cardiology practices the ability to start entering into VBC contracts to capture additional financial upside. Seems like a smart a bet to make.

Privia announces earnings along with two new large investors

Privia posted another strong quarter of earnings, as Privia appears to be growing nicely across almost all fronts. The one interesting place they’re not growing is in MA lives with upside / downside risk. Privia noted during the earnings call it decided to pause a capitated Medicare Advantage contract with a payor because of operational challenges that payor was apparently having with getting timely data to Privia. So their Medicare Advantage lives in upside / downside risk contracts actually declined from ~47,000 to around ~31,000. So as you can see, this was a pretty meaningful capitated contract for them to pause on, as it represented ~34% of Privia’s upside / downside risk book of business in MA. As Privia notes on the earnings call, in many ways this actually highlights the advantages of Privia’s business being both VBC and FFS - rather than losing the revenue entirely, Privia now just gets FFS revenue on those patients. If you’re just in VBC, you don’t have that option. Yet it also highlights that while Privia is bullish on the opportunity of moving its FFS patients to VBC, it is not always going to be an easy transition. You can see in the Q&A that analysts were particularly interested in this news, and it’ll be worth keeping an eye on how consistently Privia can move contracts to upside / downside risk.

Yet even with that challenge, Privia now has ~170,000 lives in upside / downside risk contracts across MA, MSSP, and MDPCP. Privia, like other PCPs, appears to be recognizing that there is only so much spend you can control in primary care and if you want to manage spend, it is important to build density in local markets so you can go downstream into specialty care. Privia noted this will be a “big part” of their strategy moving forward, as it seems like will be the case for most primary care organizations.

Alongside the earnings announcement, Privia announced it completed a $689 million secondary offering that subsequently was upsized to $936 million with Rubicon Founders and Durable Capital Partners buying shares in Privia. It’s interesting to see Adam Boehler (Rubicon’s CEO) making a second large move this week in enablement platforms that have one foot in FFS and one foot in VBC, not long after giving a loan to Cano Health. Rubicon appears to be opportunistically jumping into a lot of interesting opportunities at a pretty large scale.

Link (transcript)

Option Care Health, a post-acute care and infusion services provider, acquired Amedisys, a home health and hospice provider, for $3.6 billion

Investors hated this deal for Option Care, sending its stock price down 15+% on the news of the acquisition. Amedisys is selling for $80.47 per share, down from ~$300 per share at its peak a few years ago, as Amedisys is facing serious headwinds in the Medicare Advantage market given what’s happening to home health reimbursement rates there. The analyst questions on the investor call discussing the deal were about as negative as they could possibly be, with multiple questions from analysts questioning the timing and the logic of the deal. It appears that investors saw Option Care as a relatively attractive acquisition target, and this deal presents a good deal of risk given the headwinds Amedisys is facing. Still, you can see the outlines of a strategy that might make sense here for two organizations that aim to be the post acute care / home health partner for the healthcare system.

Centene divests Apixio to New Mountain Capital

Apixio is a platform that leverages AI to help payors and providers automate various admin tasks. Centene acquired Apixio only a few years ago with the intent of transforming itself into a technology business. Makes sense given the challenges Centene is having and need to focus on the core business, even if the timing of divesting an AI business in this environment is a bit ironic.

Kindbody, a network of fertility clinics, raised $25 million from Morgan Health

Inbox Health raised $22.5 million to help health systems collect more money from patients

Opinions

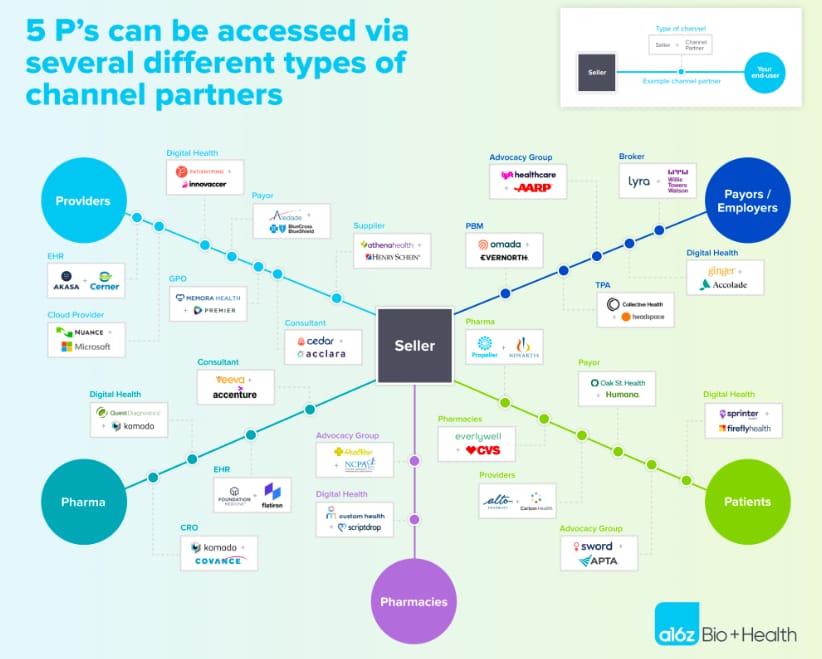

Andreessen interviews founders on the pros / cons of channel partnerships

This is a good read for startup leaders thinking about growing via channel partnerships (which should basically be all healthcare startup leaders I’d imagine). It highlights the different types of potential channel partners, some typical financial structures, and things to think about when setting up channel partnerships. It notes that 33% of channel partner relationships were viewed as failures according to the startup founders Andreessen polled - a number that’s even higher for earlier stage companies. Highlights well the risk / reward dynamic of building these relationships.

Another perspective on whether healthcare is venture backable

This is a worthwhile addition to the conversation on whether healthcare is venture backable from HTNer Niha Jain. It takes a cautionary yet optimistic tone that technological and regulatory advancements will create opportunities for more businesses to scale quickly while also generating profits. It also highlights how Doximity is the healthcare unicorn we all should probably be talking about more.

Khosla doubles down on his AI replacing doctors thesis, suggesting there will be a fully computerized AI PCP practicing medicine within 5-6 years

It’s always interesting to think about healthcare change through the lens of a techno-optimist to think about what change might be afoot. Given where AI is today, and how quickly it’s progressing, it’s not hard to imagine a world where Kholsa is generally right about the technology capability being there. Yet as we dove into in HTN Slack, there seems to be a key distinction here between the ability to practice medicine autonomously and providing clinical decision support for providers. The idea that an AI bot will be accessible to patients acting in place of a PCP in 5-6 years, as Khosla seems to be predicting here, seems silly. Not because the technology won’t be capable, but because among other issues, state medical boards exist. Medical boards can’t even agree whether NPs should be able to practice medicine without the supervision of a doctor - and somehow they’re going to approve an AI bot to practice medicine in the next five years on its own? It seems much more reasonable to suggest that AI will be augmenting clinicians, which would align more closely with Khosla’s suggestion that it’ll be an FDA-approved AI doctor.

Data

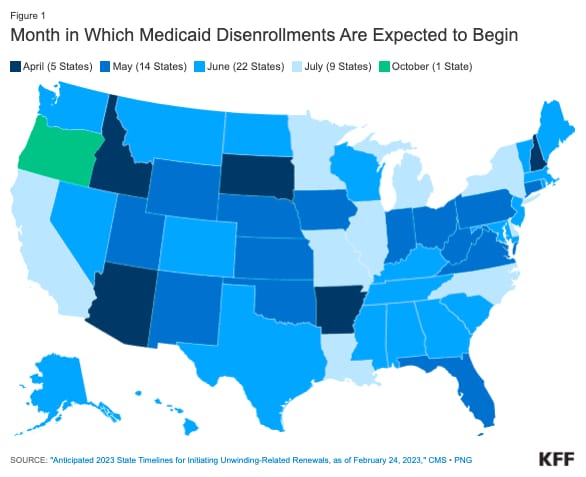

KFF’s Medicaid Disenrollment Tracker highlights when states are expected to begin disenrollments

A helpful resource for people trying to figure out when states are starting to disenroll people from Medicaid again.