This newsletter is sponsored by Medallion

Streamline your healthcare operations effortlessly with Medallion. Join them for "Demo Day" on May 17th to see how their platform simplifies your provider experience and administrative tasks.

Medallion is your one-stop solution for provider licensing, credentialing, payer contracting, enrollment, and continuing education tracking. Their groundbreaking technology, designed with a sleek interface and intelligent automation, makes managing these complex tasks a breeze.

Get a firsthand look at Medallion's core capabilities through live demos, engage with their provider operations experts, and have all your questions answered in interactive Q&A sessions.

Experience the Medallion difference - a unified platform that brings together all departments, creates a single reliable source for provider data, and enables swift and simple completion of all your business operations.

News:

Oscar’s Q1 earnings indicates it continues to head in the right direction

As we discussed in Slack, it appears that the actions Oscar has been taking are helping it move in the right direction towards profitability. Oscar made the call to exit the California market, which at one point was 25% of Oscar’s business but today is less than 5%, with 35,000 members. It all seems like a sign that Oscar’s insurance business is maturing and starting to behave like a traditional insurance business, with all the pros and cons that come along with that. The +Oscar platform also sold a new client on the Campaign Builder tool, a VBC primary care group using the campaign builder tool to engage with its patients. Bertolini sounds particularly excited about opportunities in ICHRA and partnering with providers to get back into Medicare Advantage.

Babylon runs out of runway and its creditor AlbaCore takes over the business

Babylon ended up canceling its earnings call as it appears it has reached the end of the road, announcing a transaction that is referred to as a take-private deal in the press release. The deal appears to be a bankruptcy proceeding triggered by Babylon defaulting on its debt obligations to AlbaCore as it was unable to raise additional capital via the sale of Meritage Medical Network, the California IPA they’ve been trying to divest since last October.

The SEC filing notes that the British Courts will appoint an administrator to oversee the proceeding, and equity holders in Babylon will get no value as part of the transaction, unless Babylon manages to receive an offer from a third party before the end of June that repays Albacore’s debt facility. It’s an unfortunate end for a business that SPACed just under two years ago at a valuation of $4.2 billion.

WSJ reports Envision Healthcare plans to file for bankruptcy

The WSJ article provides a nice summary of the challenges that have led Envision to the brink of bankruptcy. KKR took Envision private back in 2018 in a $5.5 billion buyout, making this one of the worst losses in KKR’s history. Envision has been pummeled by a number of headwinds - the No Surprises Act, increasing labor costs, and a massive legal battle with UHG. These headwinds caused Envision’s EBITDA to drop from $1 billion in 2020 to only $250 million in 2022, and it has $7 billion of debt outstanding. Despite the loss for KKR, the fund that made this investment is still apparently generating a 19% net annualized return, even with the Envision write off.

Bright’s Q1 earnings call leaves more questions than answers

We didn’t learn much about Bright’s future during Q1 earnings, as Bright leadership declined to take analyst questions during the call due to the potential sale of the Medicare Advantage insurance business. It clearly gives the sense that Bright’s future is out of management’s hands and the Board will be making a decision on how to proceed, which again feels like something you do when your business is being managed by your creditors. All of this will hinge on whether Bright can bring in enough cash from the sale of the MA insurance business.

Cano Health earnings hints at some changes ahead

Cano’s Q1 earnings featured some changes that were intended to respond to the public spat it has been in with Board members. In addition to the CEO talking notably less than you’d expect during an earnings call, Cano also shared it plans to divest non-core assets and focus on the core Medicare Advantage business. It’s not clear exactly what this means will be divested - you can see some analyst questions about if that means Cano will be retreating from non-Florida markets, where it shared it expects to lose $40 million in Adj EBITDA this year, though the answer wasn’t totally clear. Cano did share that it won’t divest everything in one transaction, but likely a number of smaller deals. Beyond that, the talk track was what you’d expect for a company focusing on providing primary care to MA - adding in home care delivery, focusing on engaging more high-risk members, adjusting their specialty partner networks, working with payors on negotiating more favorable contracts.

Link (transcript)

agilon’s earnings sheds some light into payor mix

agilon earnings announcement featured some interesting insight about the state of their payor contracts. agilon shared they’re up to 100 distinct full-risk contracts across 30 payors, up from 60 full-risk contracts with 20 payors a year ago. The revenue concentration of their two largest payors (presumably two of UHC, Humana, and CVS) declined over the past year, prompting an analyst question about whether those payors are attempting to shift patients to their owned assets. agilon doesn’t think that’s happening – rather the decline is due to new market entry and regional plans being more dominant in those markets. agilon also shared that for many of their payor partners, these are the first risk arrangements the payors have entered into. It’s not hard to see why agilon’s momentum seems to continue to increase momentum in signing up provider groups at the moment. They noted they’ve already shifted their focus to 2025 selling, and are expecting to start implementing 2025 providers in the second half of this year.

CMMI feeling some increased political pressure

Politico Pulse covered how CMMI was coming under fire in Congressional hearings this week as House Republicans were seeking greater oversight of CMMI. In particular, a plan to cut Medicare payments for accelerated approval drugs caused at least one Congressman to suggest CMMI is actually slowing innovation.

Amino, a healthcare navigation platform, raised $80 million

Wellthy, a platform for caregivers, raised $25 million

As part of the news, Wellthy also shared it has acquired Lantern, an end of life planning startup.

Optain, an AI retinal imaging technology, launches with $12 million in funding

It’s being launched out of the partnership between Northwell and Aegis Ventures focused on launching AI companies.

Opinions

Zeke Emmanuel on healthcare mega trends

Emmanuel penned a a three part series in Health Affairs highlighting megatrends in the industry over the next several years. Many of the trends highlighted here already seem like they’re well underway - things like reduced upcoding in Medicare Advantage, payors and providers merging, more automation, hospital closures, and more. So in many ways, we think the most interesting question to ask seems to be: in what ways will we look back on these trends in five or ten years and say “wow I can’t believe that was so wrong”?

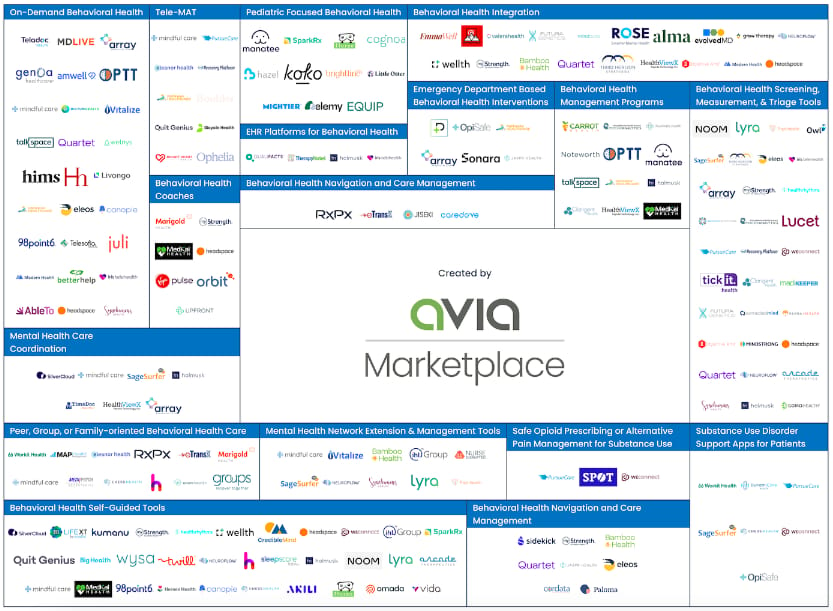

AVIA’s behavioral health market map

A good market map of startups addressing the behavioral health market.

Data

Another perspective on LLMs versus clinician judgement

An article from Mayo Clinic attempted to highlight the limitations of ChatGPT in a complex clinical setting because of its inability to reason. Some interesting discussion in Slack on the limitations of the prompt and what this says about the potential role of LLMs versus clinicians.