News:

Elevance reports solid earnings but its stock still slides

It’s interesting to see the juxtaposition of Elevance’s stock dropping 5% on the earnings report, but it generally was a positive report with Elevance increasing earnings guidance for 2023. A theme across this and the recent UHG earnings call is questions from analysts about how the 2024 risk adjustment changes will impact VBC contracts they're working on with providers. Similar to the UHG call, the response is really a non-answer to the specific question. Just a generic statement about how Elevance is happy with the decision to phase-in changes and how it won’t be disproportionately impacted versus other insurers. But given the repeat questions, it hints that analysts are hearing this enough to ask the question and it makes sense why: if CMS is compressing what it pays to payors, and in turn those payors seek to manage profitability by paying providers less, all of a sudden PCPs might not be able to make 2+ times the amount in VBC and FFS anymore. Elevance noted its target by 2027 is to have 80% of contracts with a VBC component, up from ~65% today, and 40% of contracts having downside risk. Their new annual report on VBC is a good read to explore on the topic, and it’ll be interesting to watch their progress here over the next few years.

Link (transcript)

Clover gets out of core insurance operations, partnering with UST Healthproof

At the same time, Clover also announced it cut 10% of its workforce in a move unrelated to the insurance operations outsourcing. Clover estimates the two moves combined will save it $30 million annually in operating costs starting next year, and it will allow Clover to focus on the provider side of the business, specifically calling out Clover Home Care and the Clover Assistant. This move appears to be implicitly acknowledging Clover never really built the core competency of operating an insurance business, and it is now moving on to greener pastures in the provider world. Leaving aside the general ridiculousness of the past few years for a second, it actually seems like a pretty wise move by Clover to acknowledge this and focus on the provider business. Link / Slack

OneOncology acquired by TPG and AmerisourceBergen for $2.1 billion

As was rumored a few months back, General Atlantic has sold OneOncology for $2.1 billion. AmerisourceBergen will acquire 35% of OneOncology for $685 million in cash, and TPG will be the majority owner. The deal includes a series of put / calls for Amerisource and TPG to buy each other out at 19x EBITDA, seemingly a way to put a band around TPG’s upside and downside here. The move bolsters AmerisourceBergen’s capabilities supporting oncology practices.

Autism care provider Cortica acquired two practices including Springtide alongside a $75 million capital raise

This move consolidates some of the startup activity in the autism care market as Cortica acquired Springtide, which had previously raised $18 million from Deerfield and Optum Ventures. Deerfield and Optum apparently rolled their equity into Cortica, and then invested another $75 million on top of that. Cortica also acquired another pediatric provider group as part of the transaction. Given the commentary in the article, it seems like an acknowledgement of the challenges with scaling these models and building a team of clinicians. Makes sense that a combined entity with more scale would be better positioned to succeed moving forward. You can imagine we’re going to be seeing a lot of these deals with VCs rolling their equity from sub-scale care delivery models into a platform roll-up play in order to achieve better economics from scale. Which sure sounds a lot like a private equity play, doesn’t it?

VBC cardiology platform NovoCardia acquired by Cardiovascular Associates of America (CVAUSA)As discussed in Slack, it seems like this is recognition that the cardiology practices NovoCardia was targeting are looking for a partner that can support not only growth in VBC but also their core FFS business. NovoCardia was working with two cardiology groups in Florida, both of which will move over to CVAUSA’s cardiology network, which will now include eleven groups across eight states. It provides some insight into the sales cycle here and scale of these partnerships when you think about the fact that NovoCardia appears to have signed up two groups since it launched in 2020 and raised $54 million from Deerfield in 2021.

Memora Health, a patient engagement platform, raised $30 millionMemora Health noted in the press release that it was not intending to raise funding, but this was a strategic opportunity to bring in capital from health systems and payors. It’s interesting to note that the only strategics listed in this article were Northwell and Edwards-Elmhurst, which invites the question of who the payors are who are investing here. Memora notes that it targets health systems, payors, and digital health companies as clients, but I’d imagine at some point it will have to focus more on a specific client set. it will be interesting to watch how the go-to-market evolves over time - from the way the product offering is described currently, it certainly feels like health system population health work flows are the dominant use case here.

Define Ventures raised a new $460 million fund for early stage digital health investments

Not many new fund announcements these days, so seems notable that Define was able to close a large new fund focused on digital health. Notable investments include Hims & Hers, Tia, and UniteUs.

Augmedix partnered with and received a $12 million investment from HCA as they intend to build AI-enabled ambient clinical documentation

Scan.com, a UK-based marketplace connecting patients with imaging services (CTs, MRIs, etc), raised $12 million

Third Way Health raised $1.55 million led by ApolloMed to help provider offices manage front office

Opinions

A good look at how PE-giant Blackstone leverages digital health to avoid GLP-1s in its portfolio companies

Blackstone has partnered with Twin Health to offer employees with diabetes a lifestyle modification program that attempts to get them off high cost medications like GLP-1s. Apparently, it is pretty well received at the moment (15% of employees offered the program are participating, which is higher than typical corporate wellness rates) and it’s seeing some success in managing weight. This seems like it’ll naturally be a response to the rise of GLP-1s with employers looking to limit the number of employees on these high cost medications while doing so in a way that doesn’t feel like rationing care, but rather encouraging alternative treatment options that just happen to be lower cost.

Perspective on the changing AI landscape in healthcare

HTNers Ben Lee, Paulius Mui, and Blake Madden shared a deep dive on the AI space, providing a good overview of all the activity happening currently, a clinician’s perspective on the changes in the space, and the financials of clinical documentation models. It provides a nice overview of what all the hype is about in the AI market the various use cases that are emerging in healthcare.

An interview exploring the changes in the transplant industry

HTNer Marissa Moore did a nice job exploring the changes in the organ transplant industry via an interview with a few experts on the topic. It highlights how innovators can get involved in the upcoming competitive bid process for the OPTN contract, which governs the US organ donation system. Seems like a good opportunity for some needed innovation.

Data

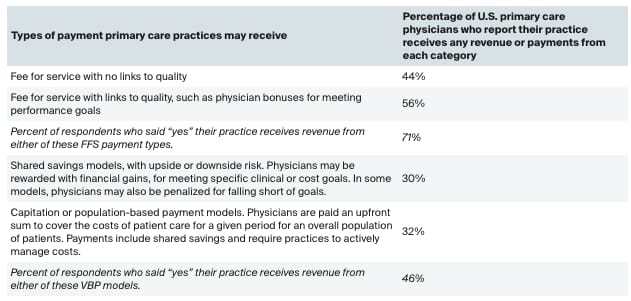

Commonwealth Fund surveys PCPs on the state of value-based payments

A survey of 1,000+ PCPs showed that 71% of PCPs are reporting their practices receive some FFS payments while 46% of practices are receiving some value based payments. 32% of PCPs are reporting receiving some capitated or population-based payments. That percentage of practices that are receiving capitated / population-based payments is higher than I would have expected it to be. For instance, if you go back to Anthem’s earnings call transcript, they’re targeting 40% of payments in VBC by 2027, which seems comparable to the 46% number Commonwealth is reporting here. Seems like it indicates that there might be a relatively high N of PCPs with a VBC contract or two that aren’t yet making up a meaningful portion of their revenue.