This newsletter is sponsored by Synapse Medicine

If you’re planning on attending HIMSS later this month and need help facilitating your clinical decision support, you should find time to connect with the Synapse Medicine team at their booth. Synapse is dedicated to serving hospitals and health systems, EHRs, and telehealth platforms. Their goal is to optimize drug regimens throughout the entire care journey, ultimately improving patient outcomes through their medication success platform.

To learn more about how Synapse Medicine’s technology and team can help with your clinical decision support, be sure to swing by booth #4467. Plus, you’ll also be able to enjoy a freshly brewed cup of coffee while you’re at it! Sign up for a demo and learn more here

News:

Cano loses another two Board members, faces fight over path forwardTwo additional board members also announced their resignation from the Cano Health Board, alongside Barry Sternlicht last week. The three resignation letters collectively shine a bit more light into the issues Cano has been facing. For months now this group of three Board members, who collectively own almost 36% of the outstanding shares of Cano, have been trying to focus on driving profitability by focusing on the core Florida business and selling other assets. It appears the CEO ignored those requests and created a “shadow” Board that excluded those three members. Not surprisingly, that move appears to have backfired, as these Board members are now banding together to push for a new CEO, sale of non-core assets, and a new Board. Cano’s stock price jumped almost 40% this week on the news, so it’s not hard to imagine a lot of change on the horizon for Cano. Meanwhile, we can’t help but wonder what sort of impact this has on the Cano Health team as folks show up to work trying to deliver care for patients in the midst of a great deal of uncertainty about the state of their company.

Texas judge rulings open the door to denying access to careLast week, we saw a federal judge in Texas rule in favor of eliminating the ACA’s preventative care coverage rule that requires private health plans to provide free coverage for preventative care for individuals on those plans. The White House plans to appeal that ruling, but not surprisingly health plans are not happy with the ambiguity this ruling creates. This week, another federal judge in Texas invalidated the FDA’s approval of mifepristone, the abortion pill. Within an hour of the Texas decision, a judge in Washington contradicted that order, ordering the FDA to make no changes to its approval of mifepristone.

When you think about the emphasis we’ve seen on investing in access to primary and preventative care over the last several years - this feels like a step back that will only confuse individuals and/or get them to stop coming in for care. It will be interesting to see how health plans and employers handle these issues while these cases seem set for lengthy legal battles that may ultimately reach the Supreme Court.

CMS final rule cracks down on advertising and prior auths in Medicare AdvantageOn the heels of finalizing the 2024 rate notice last week, this final rule received support both from payors and hospitals who were in favor of the changes related to streamlining the prior authorization process. Medicare Advantage ads will probably also look a little different, as the final rule prohibits the misleading ads made infamous by the likes of Joe Namath.

DaVita and Medtronic officially launch a new kidney care venture, Mozarc Medical

DaVita and Medtronic shared they have invested $200 million each in this joint venture, which was originally announced last year. Medtronic spun out its renal care business into Mozarc, recognizing that it needed DaVita’s service capabilities in order to successfully sell into the market. The JV will focus on developing therapies for in home dialysis.

Friday Health placed under supervision in Oklahoma

The hits keep coming for Friday Health Plan, which this week was placed under supervision by the insurance department in Oklahoma. This means they can’t spend more than $5,000 without insurance regulator approval.

Pear Therapeutics files for Chapter 11 bankruptcy, will continue to seek a sale

Zorro, a benefits platform for employers and brokers, raised $11.5 million

Eli Health, a women’s health startup focused on saliva-based hormone testing, raised $5 million

Opinions

STAT highlights SCAN’s street medicine model, Healthcare in Action

This is an interesting piece highlighting how SCAN, a non-profit Medicare Advantage insurer in Los Angeles is attempting to leverage technology to provide healthcare services to the unhoused in Los Angeles. SCAN has spent $10 million on the program over the past year, treating 1,000 patients, and fifty of those patients now have housing. While the program has had some failed attempts at efforts like telehealth visits or providing phones to patients, it is now apparently finding success offering patients free GPS trackers so that they can check up on individuals for routine visits. Despite some members declining the trackers for fear of surveillance, the mobile care teams have seen good adoption among patients. It prompts an interesting conversation about the trust these patients must have with their providers in order to consent to being tracked. The article even notes patients compare the trackers to ankle bracelets.

A big part of this is the trust these patients have with their providers in the program. using it as a trust based tool. One line that stood out was: “the key to building trust, even with technology, is viewing care as “patient-led,” instead of “patient-centered”: Patients should determine what they need, and providers should listen.” Kudos to SCAN for investing in programs like this, it’ll be worth watching if they can sustain, and hopefully scale, this investment over time.

Health Affairs article details the need for nursing home redesignThe article focuses on a topic that shouldn’t be a surprise to anyone - nursing homes are generally not nice places to live, people don’t want to live there, and staffing them is hard. It provides some really interesting data around the impact of converting smaller homes into nursing facilities citing research from a specific effort around this design - the Green House Project. The Green House Project currently has over 300 houses in 32 states, and are home to ~3,200 residents. The data cited in the article related to the Green House Project is pretty compelling with significantly lower mortality rates, lower staff turnover rates and higher satisfaction. Having grandparents who have been in long term nursing care in both homes like these and traditional nursing homes, this feels like a solution that should be garnering more attention.

WSJ dives into Mounjaro, Lilly’s “king kong” of weight loss drugs

Mounjaro appears to be a more powerful GLP-1 weight loss treatment than either Wegovy or Ozempic, helping a typical person weighing 230 lbs lose up to 50 lbs during a 17 month period. The article suggests Mounjaro could generate over $25 billion in annual sales, while Ozempic and Wegovy each generated almost $10 billion last year.

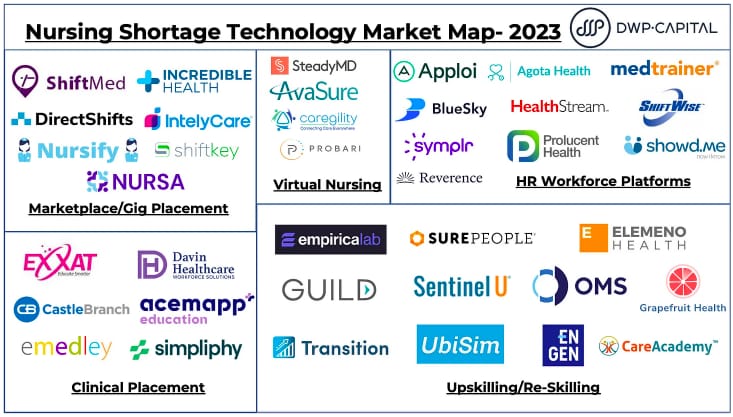

A market map of startups addressing the nursing shortage crisis

HTNer David Paul shared an overview of companies addressing the nursing shortage crisis in various ways - marketplaces, virtual nursing, workforce platforms, clinical placement, and upskilling. Provides a nice market map of companies working on the topic.

Data

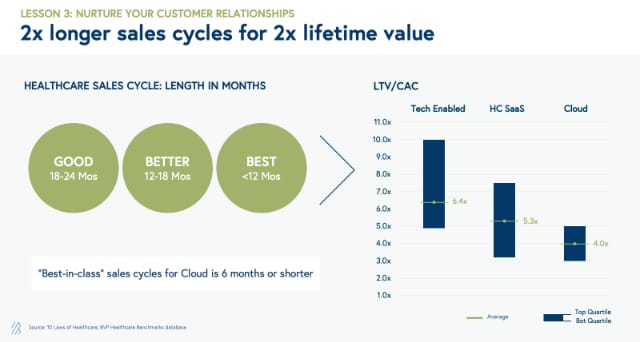

Bessemer released a set of financial benchmarks for scaling health tech businessesHTNers Sofia Guerra and Steve Kraus of Bessemer analyzed 100+ ventured backed health care companies to compile benchmarks for getting to $100M in ARR. It includes some helpful category breakdowns to see differences across metrics like time to gross profit run-rates, margin structures, FCF by scale, CAC payback, etc. In particular, this chart was interesting, highlighting the LTV/CACs across different subsectors and how much higher the tech enabled services category is than either healthcare SaaS or Cloud.

Rock Health releases its Q1 2023 funding report

Q1 2023 saw $3.4 billion in deals, 40% of which came from six mega deals (defined as $100+ million). The report highlights a more treacherous funding environment, between the lingering impact of the Silicon Valley Bank collapse, the closed IPO market, and changing regulatory developments are having on digital health startups. Link

Health Affairs article suggests 99% of hospitals are using third-party trackingNot surprisingly, it isn’t just digital health startups that have been sharing information with social media. This study finds that almost all hospitals are also sharing similar data that digital health companies have been in the news for recently. The article highlights that 99% of hospitals are sharing information with Alphabet, including visits to pages about specific conditions. I’d expect we’ll be hearing a lot more about this topic in coming months as regulators realize how widespread this behavior is.

Stanford’s take on GPT-4 performanceStanford’s Human Centered Artificial Intelligence (HAI) group explored how safely and accurately GPT-4 could be used to provide curbside consults for providers, 90%+ of the time, the GPT-4 responses to questions were considered “safe” by a group of 12 Stanford providers who reviewed the responses. It’s a nice article on both the potential and the risks of GPT-4 in healthcare.