This newsletter is sponsored by GlobalSTL

If you’re a healthcare startup looking to secure revenues and/or investment from one of the largest organized healthcare marketplaces, you should check out GlobalSTL’s 7th annual health innovation summit on August 15 - 16th in St. Louis. Learn more and apply here by 4/14!The GlobalSTL Health Innovation Summit is designed to facilitate business partnerships between innovators and healthcare organization decision makers via highly curated 1:1 meetings. Past attendees have raised $4B of capital and over 40% signed revenue-generating contracts as a direct result of the summit. The event is curated to address the strategic needs of its 20+ health system and payor partners, including Ascension, Centene, Cigna-Evernorth, Mercy, SSM, BJC and others.

News:

Bright again disappoints in earnings as it veers dangerously close to bankruptcy

Obviously, this week did not bring good news for Bright, which is now trading at a market cap of less than $300 million. To put that into perspective, it is barely over 10% of the $2.4 billion in total capital that has been invested into Bright. This quarter, Bright’s management team shared it is on the brink of bankruptcy and that it needs to raise additional funds as they’ve defaulted on the terms of their loan. It’s another unfortunate unforced error by Bright’s leadership team, which has made a habit out of that as a public company. Just six months ago, Bright confidently proclaimed its $175 million capital raise from existing investors would fully fund the business to profitability. Yet Bright now has close to $0 liquid cash on hand, due to an unexpected $150 million risk adjustment true-up and $70 million in losses in their investment portfolio. Bright will need to raise additional capital in the next two months.

If there’s one positive here to call out, it’s that the two misses here seem unrelated to the viability of the core business moving forward. So I’d imagine Bright will be able to find the capital to keep the business afloat, even if it’s on investor friendly terms. It’ll be really interesting to see if existing investors provide the capital again here, or if they’ve finally tapped out. You have to imagine the LPs behind Bright’s VCs are wary of throwing good money after bad at this point, given all the strategic blunders here. Unlike other insurers, Bright refused to even comment on the impact of 2024 advanced notice on its business, which probably gives a good sense of the magnitude of the crisis they have on their hands currently. One existential crisis at a time, I suppose.

If you can get past all that, the analyst Q&A actually had some interesting questions about the business moving forward. Bright is still projecting it can get to Adjusted EBITDA profitability in 2023, even though their own waterfall chart on getting there highlights how big of a question that is (check out this Slack thread for more on that). One thing that becomes clear between the profitability waterfall and the Q&A is that a big part of why Bright’s provider group was so unprofitable in 2022 is because Bright had its providers take full upside / downside risk on exchange lives, which caused losses for the provider groups. Presumably, that was a key part of their strategy to claim insurance company profitability while still growing quickly in markets, which highlights just how out-of-whack things got here as Bright was essentially shifting losses between its two businesses to make it seem as if the insurance side was more profitable. Proof of this comes in Bright leadership mentioning that now that those exchange lives are with another payor, Bright is much more reluctant to take on full-risk on those lives. Which, again suggests there is an underlying care delivery asset here that is still worth something, even if Bright leadership made some reckless decisions about VBC contracts internally.

It’s easy to dunk on Bright at the moment for all the issues they’ve had as a public company, but at this point we mostly just have a sense of sadness - a lot of employees worked really hard at trying to build a better insurance company, and it certainly seems like an over-eager leadership team and Board drove this thing into the ground by making some really poor decisions for the sake of rapid growth.

HTN’s 2023 Market Conditions Survey

Last summer, we surveyed the HTN community exploring how the changing investment market was impacting how startups and investors viewed the funding landscape.

As we continue to see conditions change, and in particular a handful of early stage companies starting to go under because of challenges securing funding, we thought now would be a good time to update the survey, focused on how startups are navigating the changing landscape. Both in terms of business impact, but also personal impact to leaders as they navigate stressful times.

Clover reports earnings, highlights in-home primary care growth while overall revenue declines ~40% from 2022 to 2023

Clover again highlighted its in-home primary care business as a key strategic priority for Clover, as they intend to grow from 3,300 patients in 2022 to 4,000 in 2023. It makes sense we’re seeing Clover highlight this more as they need to find something to highlight within their business that’s growing - the insurance business is now flat as it gets to profitability, and the Direct Contracting / ACO REACH business is contracting significantly as Clover seeks to hit profitability there. Clover proactively called out the fact that it expects the 2024 advanced notice news to impact other MA plans more than Clover. It sees risk bearing providers as having significantly more risk in the proposed changes, along with the plans who have delegated risk to those providers. It seems like the trend of the week here is companies acknowledging the impact of 2024 advanced notice, but everyone is saying other companies are going to be worse off than they are.

Separately, Clover is projecting a revenue decline of over 40% in 2023 from 2022, a rather incredible change of course from its Chamath SPAC story of growth only 2.5 years ago. It’s interesting to notice that despite revenue coming down in 2023, Clover is projecting SG&A expense as flat between 2022 and 2023. Clover says this is because it has very little SG&A expense associated with its ACO REACH business, which is the primary driver of the decline. But in many ways, that seems indicative of Clover’s performance, or lack there of, in ACO REACH. If you look at other PCP enablement platforms, they make significant investments in helping practices achieve success in VBC. The fact that Clover has no SG&A savings associated with the pull back in ACO REACH shows how little they’ve invested in supporting those practices. It shouldn’t be surprising, then, that Clover lost a ton of money in this market. In many ways, it highlights how Clover is struggling in its transition from insurer to enablement platform. When you look at the momentum that both agilon and Privia have at the moment, it highlights just how far Clover has to go in building a real business in this market. 2023 is going to dictate Clover’s future, and it’s going to be interesting to watch how it navigates the revenue decline, and perhaps more importantly, its relationship with PCPs through all of this change. Link (transcript) / Link (press release) / Slack

agilon reports earnings and makes an acquisition of a VBC interoperability platform, mphrX

The momentum in the primary care MSO space is palpable at the moment. Between Privia and agilon’s earnings calls and Aledade’s partnership with Humana this week, this market feels like an arms race where MSO are seeking to sign up practices and move as many patients into VBC contracts as possible. You can see the the agilon flywheel spinning into overdrive in quotes like this from the earnings call: “As I mentioned. in our last call, our sales cycle has accelerated, and this will allow for a longer implementation period for new partner groups in 2024. This, coupled with the increasing scale of our platform, positions our new partners to generate outcomes much earlier in their life cycle, including a higher starting point for quality performance and medical margin.” The mphrX acquisition is designed to help speed up the onboarding process with providers, which certainly makes sense as you think about the agilon flywheel. agilon is projecting to have 405k Medicare Advantage lives at the end of 2023 and another 88k ACO reach lives. Revenue projections are taking a step up, as agilon both continues bringing in huge numbers of new members, and its revenue PMPM is also increasing by around 6% due to benchmark improvements and RAF improvement in newer markets.

Given all the momentum here, we think the most interesting question to noodle on is what ends up stopping the flywheel here? And we think you can start to see it in the Q&A answer here from agilon’s CEO: “if you think about what we do, we love going to these markets and being first. They’re 100% fee-for-service and we want to move them to value. I think we found that there are markets out there with higher healthcare spend and therefore, higher starting points on rates as part of our mix that are really attractive for us.” It underscores the land grab that is happening in this market today, and how there are a lot of “low-hanging fruit” for enablement platforms to help PCPs make more money on moving to VBC contracts. The challenge on the not-too-distant horizon for this market is what happens when there are no new markets left for these platforms to enter, and we reach saturation with provider groups having picked their VBC dance partner? Does this market just become a race to the bottom of who offers a provider the best financial terms, or is there anything that actually differentiates one platform from another?

Privia Health posted a solid quarter as it starts moving into VBC contracts

Like agilon, Privia’s core business continues to perform really well. Privia is moving more and more into VBC contracts, growing to 46,000 Medicare Advantage capitated lives as of Jan 2023, after launching its first capitated agreements a year ago with 23,000 capitated lives. The earnings call highlights how Privia is taking a nuanced approach to VBC contracts – when analysts ask what the typical economics are, they make a point to say they don’t just do 85% of premium contracts, but rather have different deals with each payor.

The earnings call provided some interesting insight into that growth and how Privia is now starting to enter markets in different ways. Privia included a slide in their earnings materials showing an ad attempting to recruit physicians in North Carolina, a market they recently entered in partnership with Novant Health – see the image below. It highlights how complicated the messaging is starting to get in this space – “Hey independent PCPs, we’re your option to stay independent and operate how you want to. Just ignore the Novant affiliation, you won’t actually be working for a large health system in North Carolina.” The ad also highlights the fact that Privia is now embarking on major recruitment efforts as it looks to grow in markets like North Carolina and Ohio where it entered with no providers. Like, we’re now recruiting providers to these platforms via ads on the sides of city busses? Compare this to its market entry into Delaware and Connecticut, where it is entering with attributed lives as a result of the partnerships there. As we discussed with agilon – the flywheel here seems to be spinning in overdrive at the moment, and encouraging / demanding growth from these platforms. Privia is in a really good spot as it signs up practices and increasingly moves from FFS to VBC contracts. So there’s a lot of reason to be bullish here in the short term. But at the same time, the space is changing rapidly, and it will be worth watching how Privia’s model performs as changes how it enters markets. Cano’s earnings, which we’ll look at next, highlights well the challenges of scaling to new markets and the financial challenges that can crop up in doing so.

Cano Health reported earnings, gets a $150 million loan but its stock drops

Cano’s earnings call in many ways highlights the way the market has changed over the past 18 months. Cano opened 42 medical centers in 2022, and will only be opening 5 new medical centers in 2023 as it focuses on profitability and driving membership growth in its existing centers. Cano faced a cash crunch, presumably in part due to the rapid growth, but was able to secure a $150 million loan from Diameter Partners and Rubicon Founders (the investment firm started by Adam Boehler). Boehler putting money in here seems to highlight the opportunity in the MA market - while paying through the nose for these clinics might not make a ton of sense, if you can buy into a distressed asset on good terms, there still is probably a lot of opportunity here. And the terms of this loan includes $0.01 warrants for ~5% of Cano. So long as you think this company isn’t going under, it seems like a smart investment here. And Cano’s earnings call highlights how there’s a solid underlying asset here in the Florida clinics. Cano has been rapidly growing outside Florida, which is dragging down its EBITDA as it enters new markets where it doesn’t have density and suffers from losses in entering those markets. In many ways, this highlights the challenge of scaling these approaches - Cano builds a nice business in Florida, but that in no way means it’s going to work elsewhere. It’s also worth noting that Cano doesn’t see 2024 advanced notice as much of a headwind, suggesting it might have a 2% impact. On the whole, it seems like Cano is hitting the reset button here. It’s understandable why they’re doing so.

Walmart Health is back on a growth trajectory

Walmart is planning to double the number of Walmart Health centers by the end of 2024, growing from 32 open today to over 75. Of the new clinics, 28 will be placed across Dallas (10), Houston (8), Phoenix (6), and Kansas City (4). Given Walmart’s stops and starts here over the past several years, it’s easy to be skeptical about their commitment to growing by 33 clinics over the next two years. In our quick informal Slack poll, ~23% (10 out of 42) nerds said they thought Walmart would hit the 75 clinic number they're targeting. It’s still a massive opportunity if they can wrangle the internal politics.

VillageMD acquired a multi-specialty group in Connecticut

VillageMD acquired a multi-specialty group, Starling Physicians, with over 30 practices in Connecticut. As noted in the article, VillageMD sees this as a natural extension of the recent SummitMD acquisition, extending its capabilities in the Northeast. VillageMD seems to be advancing its specialty strategy quite quickly here, and it’ll be interesting to watch how the other primary care players react to these moves. Wouldn’t be surprising to see a lot more activity amongst the VBC primary care players in acquiring multi-specialty groups like this before the end of 2023.

Humana & Aledade announce a ten year deal in Medicare Advantage

Continuing the theme of primary care enablement platform momentum, Aledade and Humana announced a ten year partnership this week. Given Aledade’s historical focus in the MSSP model, it seems like another sign of the times of the race that’s happening in the market, as this should speed up Aledade’s growth in the MA market. If you think about the pitch Aledade is making to PCPs to sign onto the platform, this makes all the sense in the world for Aledade. For PCPs who have Humana’s MA members, Aledade is now a much more attractive option. And for Humana, this should help them move more providers to risk faster. At the surface, this seems like a win-win, although as with every VBC relationship between a payor and provider, it’s worth watching how this relationship evolves over time.

DEA restrictions on telehealth wreak havoc on mental health startups

Last Friday, the DEA proposed a new set of rules for telehealth prescribing as the PHE comes to an end. The changes present a massive issue for telehealth startups as they’ll be more restrictive and require more in-person exams in order to prescribe controlled substances. This is challenging for mental health startups that are treating conditions like opioid use disorder - for instance Cerebral announced on Monday that it was shutting down its program for opioid use disorder and laying off another 15% of staff.

UnityPoint and Presbyterian Health Services are merging

The two health systems will still operate under their individual brands, but will bring together their 40 hospitals under a new parent company.

The FTC fined BetterHelp, Teladoc’s mental health unit, $8 million

The fine was related to allegations that BetterHelp shared consumers’ health information with social media companies. HTNer Aaron Maguregai highlighted well in Slack why this is a big deal, between the broad definition of health information that the FTC is using, and the fact that the FTC is using BetterHelp’s claims of HIPAA compliance against it here, suggesting it is a deceptive practice.

Kindbody, a new fertility clinic model, raises $100 million at a $1.8 billion valuation

Mental health provider network Headway is in talks to raise ~$100 million at a $1+ billion valuation

CodaMetrix raised $55 million for AI-based rev cycle management tools

BetterNight, a virtual sleep care platform, raised $33 million

Pair Team, a tech platform for FQHCs, received investment from CHCF

Ryse Health, a new clinic-based model for diabetes care, raised $6.5 million

Opinions

A Health Affairs opinion on investment opportunities in Medicaid

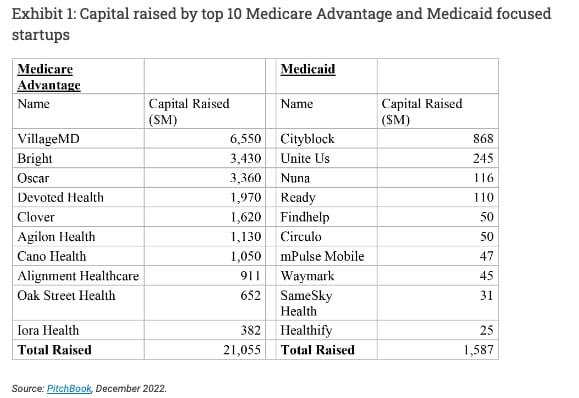

The funding chart below shows just how different investor interest has been between Medicare Advantage and Medicaid, with over $20 billion plowed into the top 10 MA startups, versus only $1.5 billion in the top 10 Medicaid startups. The article highlights nicely some areas where Medicaid innovation is necessary - access to care, SDoH, health equity, and VBC. Yet what the article doesn’t really touch on is that the issue here isn’t related to identifying innovation opportunities in either MA or Medicaid. It’s related to where there is an ROI for investors, and that Medicaid hasn’t been structured in a way that results in massive exits. The interesting question here to me is - if the top 10 Medicaid startups also had $20 billion of capital invested instead of $1.5 billion, would it have moved the needle at all on improving the state of Medicaid for patients?Link / Slack (h/t Paulius Mui)

The State of Tennessee OIG puts Medicaid patients on a “most wanted” list

In one of the most asinine things I’ve read in quite a while, this KHN article highlights how Tennessee’s OIG spends $6.4 million a year funding a task force that puts together a list of “most wanted” individuals who are suspected of Medicaid fraud. Of course, this isn’t providers bilking Tennessee out of millions, rather the article highlights how this can be as simple as someone having an old drivers license. Yet even when Tennessee mistakenly includes someone on the list, the damage is still done to peoples’ lives. The article does a nice job highlighting how it really doesn’t have to be this way - numerous other states handle these matters without ruining the lives of people on Medicaid. And for what? Tennessee has prosecuted 3,200 people through this program since 2004, and brought in a total of $10 million for the state. So back to the point above - when states that are in charge of implementing Medicaid programs are treating people as cruelly as this, what exactly are startups going to do here?

Propublica tells the tale of another healthcare sharing ministry scam

Also up there for one of the most asinine things I’ve read in quite a while, this Propublica piece highlights the story of Liberty HealthScare, a scam posing as an alternative to health insurance. Many aspects of the Liberty story unfortunately read similarly to other HSM scams. When people get sick and have expensive bills, they realize that HSMs aren’t actually insurance when those bills no longer get paid. The consequences are both predictable and devastating. The article tells of how Liberty was paid hundreds of millions of dollars by individuals. Instead of using that money to cover medical bills, the family behind Liberty funneled millions of dollars into for profit businesses including an airline, a weed farm, and a bank. Should serve as a really good reminder for folks of the bad actors that exist in healthcare.

Ro’s CMO argues for GLP-1s, suggests treating obesity like a chronic condition

This is an interesting read from Ro’s Chief Medical Officer arguing about the clinical importance of GLP-1s in treating obesity. And certainly, the clinical reasoning seems sound here. One of the more interesting aspects of this that didn’t make it into this article is the cost of GLP-1s. As the article notes, more than 70% of adults today are overweigh / obese, and the article advocates for an expanded clinical indication from the FDA for GLP-1s. The rub is that GLP1’s run $1000 per month, and to the best of my knowledge patients need to stay on them indefinitely in order to see improved clinical outcomes. So, you’re now talking about an added $12k per year of cost to the health system. Who exactly is covering off on those costs for up to 70% of the adult population? Or perhaps drug costs come down over time, or there is savings associated with better managing obesity. All of this prompted a good discussion in Slack on the tradeoffs here.

WSJ highlights the 2024 advanced notice battle

The article does a nice job combing through some of the nuance of the debate over 2024 advanced notice if you’re looking to get up to speed on the topic. It highlights how CMS is seeking to remove “codes that are ripe for gaming, meaning diagnosis codes that can be manipulated to increase payment but don’t actually reflect what it will cost to treat that patient.” It’s interesting to look back at the various earnings calls with that lens - of course every insurer / PCP tech platform / primary care practice is going to suggest that their approach isn’t going to be impacted because they’re doing things the right way. But clearly given the uproar over this change, not everyone is doing it the right way. There’s a reason why America’s Physician Groups is projecting some doctors groups revenue might decline by 20%. It’ll be interesting to watch which organizations get hit the most by this change.

Data

A review of literature on symptom checkers

HTNer Rachel Menon shared a really helpful post looking at the state of symptom checkers and research into how well they work. it’s a nice view into some of the challenges in terms of writing clinical vignettes and the like to assess accuracy here, with some suggestions for future research.

JAMA study looking at whether MA reduces inpatient care or just shifts the care setting versus Medicare FFS

The study explores whether MA reduces the need for inpatient care by decreasing the number of avoidable hospitalizations because patients have better access to outpatient care, or if the reduction is just from shifting hospitalizations to other sites of service. It finds that MA is likely shifting site of care more than it is actually reducing the incidence of avoidable acute care visits.

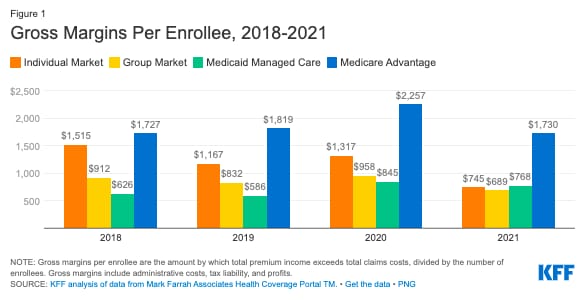

KFF data highlights gross margins for insurers

Not that this is new news to readers here, but it’s still striking to see the margins of MA versus other insurance products.

A state-by-state breakdown of patient ID requirements for telehealth

This is a helpful interactive graphic highlighting the requirements for each state to verify patient identification for a telehealth visit.