This newsletter is sponsored by Stellar Health

Stellar Health is the first of its kind health technology company that enables success across the value-based care continuum by bridging the incentive gap between providers and payors. Stellar takes the unique approach of rewarding physicians and their staff for the time it takes to complete value based actions and administers direct payments to providers and staff as the work is completed. As we hear all the time related to implementing VBC, success or failure generally comes down to whether any number of small, daily tasks are completed. Stellar’s approach helps incentivize that granular level of task completion.

Stellar partners with both payors and providers to release the value in value based contracts in 22 states, including everyone’s favorite state, Minnesota!

For more information on Stellar Health, visit www.stellar.health.

News:

A tide shift in Medicare Advantage? CMS shakes things up between 2024 Advance Notice and RADV

This week seems like it’ll go down as one to remember for the Medicare Advantage world, as CMS set in motion some potentially meaningful changes for companies operating in MA. First, on Monday, CMS announced its new rule around risk adjustment. Both Humana and Cigna expressed their overall displeasure with the rule in their respective earnings calls this week, noting among other things their issue with the lack of a fee-for-service adjuster. While the overall tone was one of concern, it does seem like for a win for payors that CMS is only looking back to 2018.

The 2024 MA Advance Notice also came out midweek. As discussed in the HTN Slack, the proposed rate trend increase for 2024 is quite low at 1%. CMS is also proposing some seemingly large changes to the risk adjustment calculation moving forward that could impact revenue in the space in 2024. Cigna, which reported earnings after this news came out, called the proposal “anemic” and that it would result in a “revenue dislocation” if the proposal is finalized.

On the whole, it’s not hard to envision a narrative where the increasing public attention on outsized MA profits is causing CMS to tighten the screws on the program a bit. If that is indeed the case, leaner years might be ahead for the MA market, starting with the plans and then trickling down to the VBC providers. We expect we’ll hear both payors and VBC providers pushing back on this.

RADV: Link

Humana earnings call highlighted its return to growth in MA in 2023

Humana’s call highlighted how its push to refocus on MA has paid off in significant growth for 2023, moving past a rocky 2022. Humana’s investment in benefits clearly is paying a dividend in terms of growth, although it’ll be worth keeping an eye on longer term ramifications as analysts were asking about impacts of these richer benefits to insurance MLR. The revamped approach to member sales also appears to be paying dividends, as Humana shared the data point that its CenterWell clinics added 8,000 to 10,000 patients during AEP, and of those patients, 60% already had a visit scheduled as of December 31st. Certainly seems like they’re doing a good job of leveraging brokers to set up patient visits during the enrollment process. On the M&A front, Humana reiterated that in 2023 it will be focused on organic growth, and any M&A will be focused on growing in primary care / home health under the Centerwell umbrella. It seems like the bigger question for Humana at this point will relate to 2024 and beyond given the Advance Notice news that came later in the week. It seems like a tough strategic spot to be in having invested heavily in richer benefits to drive growth when CMS is starting to squeeze on profitability.

Link (earnings transcript)

Cigna’s earnings call spends a lot of time on VillageMD

Cigna’s relationship with VIllageMD was a major topic on the earnings call, after Cigna invested $2.5 billion in VillageMD in November as part of the Summit acquisition. After Cigna’s CEO described the partnership briefly in opening remarks, analysts asked four separate questions attempting to understand the nature of the relationship. The answers to the questions aren’t particularly clear, but it does appear there are two phases to the relationship. In phase one, VillageMD will be leveraging Evernorth assets to do things like identify the best oncologist in a market so that VillageMD can refer patients to that provider. Which definitely sounds great in theory, although it’ll be curious to watch whether that level of partnership actually materializes here given the level of integration it’d take to do that well. The second phase of the relationship will then be to develop new insurance products for Cigna leveraging the VillageMD provider network. That phase seems much more straightforward to execute upon than the first phase.

Link (earnings transcript)

Blue Shield California launches a new virtual first plan

It is partnering with Accolade and TeleMed2U to launch the product offering. Folks reading this will probably be familiar with Accolade, which will be providing primary care services. TeleMed2U also looks like an interesting model, and will be used to provided virtual specialty care for up to twenty specialties, with $0 out of pocket costs for both virtual primary and specialty care. Will be interesting to watch whether there is meaningful uptake of this plan design, and if so, how well care is coordinated across Accolade, TeleMed2U, and any in-person care delivery needs.

Verily is burning a massive hole in Google Alphabet’s pocket

The Information shared that Verily posted $470 million of revenue and an operating loss of $327 million in the first nine months of 2022. That operating loss ballooned to $540 million for 2022. Apparently a key driver of Verily’s revenue increase is coming from healthcare - both its insurance stop-loss business Granular and its JV with DexCom in the diabetes space. Those two initiatives accounted for $248 million in revenue in the first nine months of 2022, versus $27 million over the same period in 2021.

YouTuber MrBeast pays for cataract surgery for 1,000 people

The YouTube video he posted has gained 79 million views since it was posted 5 days ago. While this may seem a bit silly, when you think about the impact MrBeast has had both on the 1,000 people who can now see and also the millions of people who are now a bit better educated on cataract surgery, its a pretty cool thing. Good luck to all the healthcare execs trying to explain to their pre-teen kids what it means to work in healthcare, who will now get the response “oh so you’re like MrBeast!”

The Public Health Emergency is ending May 11th

This KFF article does a nice job summarizing the various impacts this will have.

GoodRx fined for sharing user data with Google & Facebook

GoodRx is settling its case with the FTC by paying a $1.5 million fine. GoodRx shared a response to the settlement highlighting how it resolved the issue at hand over three years ago, before the FTC began its investigation.

Tivity Health acquired digital wellness platform BurnAlong

Tivity is building in more digital capabilities to support its SilverSneakers program for seniors.

Digital health infrastructure startups Canvas Medical and Zus are partnering

NOCD, a virtual platform for OCD treatment, raised $34 million

Opinions

A tough story of a patient getting stuck in the high cost claims review process in UHC

This is a really hard story about a patient with a rare, high cost condition getting the run around from UHC as the patient attempted to navigate the healthcare system and get the care they needed. In many ways, the story highlights both the incredible potential of the US healthcare system, and also the completely broken nature of it. Here you have a patient with a rare case of ulcerative colitis who was able to see the best doc at Mayo Clinic, who prescribed a combination of medications way outside of FDA guidelines. And, it turns out those medications worked! Incredible, right? But that was also ended up being the issue for this patient, as those medications are incredibly expensive - and btw its worth noting the pharma profit pool generally gets a pass in this artic!e, even though we think there are a number of questions that can and should be asked of them here.

It shouldn’t be a surprise that the insurance approval process isn’t exactly designed for Dr. House-style unconventional treatments that happen to cost millions of dollars a year. The result as seen here is that the approval decision in the hands of a random UHC case manager overseeing a clunky peer-to-peer review process, and again, it’s unsurprising that this ends poorly. The article does a good job highlighting all of the very human ways this process ended up failing the patient here. And at the end of the day, that’s really the story of healthcare in this country, isn’t it? If you’re lucky, you can find your way to the one “Dr. House” in the world who can treat your debilitating rare illness. But even if you get that far, good luck figuring out how to get that treatment - which will likely be incredibly expensive for a rare illness - paid for.

Another installment of Duncan Reece’s Medicare Advantage strategy series looking at Las Vegas as a microcosm for the market

Using data now available on 2023 AEP results, this post does a nice job examining enrollment changes in the Las Vegas market as a microcosm of the Medicare Advantage market. Per the discussion above about Humana’s growth, you can see it pretty clearly reflected in the chart below, with Humana seeing substantially more growth than any other plan. As the article mentions, it’s going to present some interesting strategic questions for Humana moving forward given the Advance Notice news.

Berwick continues calling out greed in American healthcare in JAMA

This Berwick article prompted a good discussion in Slack discussing the various incentives at play here. There seems to be general consensus agreement that what Berwick is describing here is indeed bad, but it sparked some good dialogue about what the root cause of this issue is and whether the suggested paths forward will actually make an impact.

The boom and bust of adderall leaves patients facing medication shortages

This is a good read in The Guardian on the current state of the adderall market, where there is now a huge shortage of medications, leaving patients in the lurch.

Data

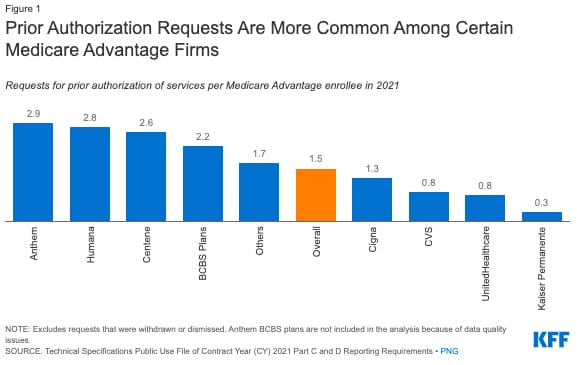

KFF data on prior auth usage in Medicare Advantage

In 2021, over 35 prior auth determinations were made by Medicare Advantage payors representing 23 million Medicare Advantage enrollees. It is interesting to see the variation across payors here - i.e. Anthem averaged 2.9 prior auth requests per enrollee, while UHC was only at 0.9. While it makes sense Kaiser would be on the low end here given its integrated model, it’s not as clear why there is so much variation between the big payors.