This newsletter is sponsored by Elation Health

Elation, an EHR platform for new primary care delivery models, shared a couple of perspectives on 1) the importance of investing in primary care in 2023 and 2) the potential for new financing mechanisms for primary care, such as direct primary care, to gain traction. Elation’s leaders make the logical case that investing in primary care will be a critical part of creating a more equitable and accessible healthcare system, given the health outcomes and cost savings that effective primary care drives.If you’re building a new primary care organization and need an EHR to power your care delivery model, check out Elation’s scalable clinical platform here!

News:

CVS makes moves in primary care: an $100 million investment in Carbon Health, and reports it is in talks to acquire Oak Street

CVS dominated the headlines out of JP Morgan this week, with its investment in Carbon and rumored acquisition discussions with Oak Street leading the way. The investment in Carbon is particularly notable because it also includes a strategic relationship – CVS will be piloting Carbon’s model and software for CVS customers. It’s a curious move for CVS over a year into the rollout of HealthHUBs, presumably you’d think they would already have a software platform in place. Piloting Carbon in CVS stores at the very least demonstrates a willingness to test different care models, which seems like a departure. It will be interesting to watch how the CVS strategy continues to evolve here.For Carbon, obviously this comes at an interesting time as Carbon just last week announced more layoffs and a re-focusing of the business on urgent care and primary care. The press release notes that JPMorgan served as Carbon’s financial advisor here, which seems to indicate that Carbon’s Board was considering a number of strategic options, whether that be M&A, capital raise, or IPO, and this path with CVS came out on top. It wouldn’t be a surprise to see this announcement as the first step towards an eventual acquisition here.

While Carbon Health gives them a solid asset in the urgent care market, the news that CVS is also in discussions to acquire Oak Street certainly would be a massive move - if it materializes. It feels every M&A discussion CVS is involved in these days gets leaked, so who knows what will end up happening here. When you think about CVS’s interest in acquiring One Medical, the combo of Carbon Health and Oak Street wouldn’t make for a bad consolation prize here. It’d provide for a very similar set of capabilities across the commercial and Medicare Advantage markets.

A rundown of JPMorgan presentation takeaways

As usual, the JPMorgan conference featured a number of interesting updates on a variety of public (and some private) healthcare companies. Modern Healthcare’s rundown of the events served as a very helpful summary for those who weren’t able to attend the presentations, and we’ve highlighted some of the presentations / updates we found interesting below.

Link (Modern Healthcare live updates)

agilon appears to be seeing really good momentum both signing up PCPs and adding new patients. It remains unclear how much of this is due to agilon riding strong general market tailwinds versus agilon having a differentiated offering versus other MSO platforms. agilon was asked how they’re differentiated in the Q&A and the response was a bit of a non-answer about how they support PCPs. Transcript / Slides

Bright has moved on from the exchange business, aside from the $65 to $90 million it’ll need to spend on restructuring in 2023 just in order to exit the exchanges, per the amended 8-K it filed. The presentation itself was uninspired, highlighting how the business that remains is essentially a handful of PCP groups and MA plans it has acquired over the last few years. Webcast / Slides

Centene will have “soft” growth in MA because of their decision to focus on proprietary enrollment channels, but is seeing strong growth in the exchanges. Centene noted that in terms of VBC adoption, it is seeing both lots of interest and capability among providers in Medicaid. VBC adoption on the exchanges has been a bit slower because of member churn. Webcast

Clover reported that Medicare Advantage enrollment will be flat YoY as it has adjusted pricing. It appears to be focusing more on its in-home primary care model as a key business driver moving forward, calling it out as one of three key business growth levers, in addition to MA and the ACO business. Clover will serve 3,300 patients with this model in 2023. Meanwhile they don’t appear to address the poor ACO Reach performance beyond highlighting in Q&A that by narrowing providers they’re working with it’ll make the business more efficient. Ok. Webcast / Slides

Humana’s recent move to refocus on MA appears to be paying dividends as is seeing solid growth in Medicare Advantage, at 625k members, or ~13.6%. It expects the broader market to grow in high single digits. Humana shared a number of updates indicating a solid open enrollment - reduced churn, reduced third party call center activity, increased members switching from other MA plans. Webcast

Oak Street’s presentation was business as usual, highlighting how it is executing on moving centers along the j-curve toward profitability. Oak plans on opening 35 centers in 2023. The Q&A included some interesting dialogue about what differentiates various center models and how Oak is different from others. Not surprisingly Oak points to ACO Reach results as a good proof point demonstrating its differentiated model. Webcast / Slides

Oscar’s strategy talk track sounded a lot like any other big insurance company as it drives toward profitability - talking lots about scale to improve vendor contracts, pushing providers to VBC contracts, etc. Seems like a good (and necessary) approach for business viability. Oscar’s product demo as always highlights how advanced the tech platform is versus other insurers, regardless of whether they can sell it to third parties. Webcast / Slides

Walgreens mentioned they’re open to M&A in population health and provider-enablement capabilities, but only in the $200 - $500 million range max. The slides also include a nice future state consumer journey for Walgreens as it stitches together all of its care delivery assets. Interestingly, they mentioned in Q&A that Walgreens intends to manage risk contracts at the Walgreens Health level over time and then subcontract that risk out to VillageMD and other Walgreens assets. Will be curious to watch how that happens. Webcast / Slides

UnitedHealth’s earnings call suggests a “pretty interesting” year of M&A

United’s earnings call was pretty mundane in terms of broader strategic updates. Perhaps most notable was an analyst question about M&A opportunities - UHG noted that it will continue deploying capital via M&A across its five key growth pillars. UHG’s M&A pipeline is “bigger, deeper, [and] more diverse” than ever, and it appears to be set up for a very active year. Keep in mind that in 2022, UHG acquired Kelsey-Seybold, LHC, and Refresh Mental Health, among others. So it seems like we’re going to see a big year of M&A. Beyond that, UHG leaders also seem excited about the potential for OptumInsight this year, announcing that two new health systems have signed up back-office outsourcing partnerships with Optum (Northern Light Health in Maine and with Owensboro Health in Kentucky).

Link (earnings transcript)

MSK platform Hinge Health is adding in-person house calls

Hinge took a big strategic step as it is moving away from a virtual-only model and incorporating house calls with physical therapists. Initially, Hinge will roll this capability out in Chicago, with plans to expand into its MSK offering for employers nationwide. The HTN Slack discussion touched on lots of interesting strategic / operational questions here for Hinge, including how Hinge is pricing for this and whether it will help drive more uptake within employer populations. Between this move and the Omada partnership below, it seems like this sets the tone for a key trend we expect to see much more of in 2023 - virtual care models blending together with in-person care offerings.

Intermountain and Omada expand existing relationship and integrate care delivery models

Omada and Intermountain have a relationship going back years, with Intermountain investing and including Omada as a covered benefit for Intermountain employees. This week, the two orgs expanded their relationship as Omada is partnering with Intermountain’s VBC subsidiary, Castell, to integrate care delivery models around Omada’s DPP offering. According to the article, any patient with an Intermountain Medical Group PCP will be asked by a Castell care coordinator if they want to use Omada. It sure seems like a sign of the times for digital health selling to employers - the article highlights how point solution sales are getting harder, and integrating Omada into a primary care offering makes a ton of sense for both parties. Omada gets more patient volume, while Castell / Intermountain gets access to a new tool for their PCPs. Relationships like this will also raise natural questions about the issues that have always existed when integrating care delivery models about who owns the patient relationship and how integrated the care actually ends up being.

Home-based VBC kidney care startup Monogram Health raised $375 million

Monogram’s $375 million in growth equity comes both from VC/PE investors as well as a number of strategic investors, including CVS, Humana, Memorial Hermann and SCAN. This deal seems like a major win for Frist Cressey Ventures, which launched Monogram a few years ago. That said, the kidney care space seems relatively crowded at the moment with a handful of companies - including Strive Health and Somatus - that have raised massive amounts of capital. This will naturally invite questions about how many exit opportunities actually exist for these entities. Having CVS and Humana as investors here seems like a natural eventual exit path for Monogram via M&A.

Hospital workflow automation platform LeanTAAS acquired Hospital IQ

The combined entity has a $1+ billion valuation. Given hospital financial challenges, it shouldn’t be a surprise to see companies like this pitching near term financial gains do quite well this year.

Health system consulting firms merge as Kaufman Hall acquires Gist Healthcare

Shiftkey, a nurse staffing platform, raised $300 million at a $2+ billion valuation

Paytient, a healthcare financing platform for employees, raised $40.5 million

Virtual behavioral health provider Array Behavioral Care raised $25 million led by CVS

Oula, a NYC-based maternity clinic, raised $19.1 million

Nest Genomics, a new genomics model, raised $8.5 million

Opinions

A herculean effort to provide care for the homeless in Boston

This NYTimes article does a really nice job highlighting the herculean efforts of Jim O’Connell, a provider who has built a really cool care model for the homeless in Boston. The article discusses O’Connell’s desire to deliver “upside-down medicine” - focused on building trust with these patients and spending time with them first and foremost. It’s a reminder of how important building trust is with these individuals, and how hard of a problem this is to tackle. This quote from O’Connell is a good reminder of the challenge that homelessness presents: “This is a complicated problem. Homelessness is a prism held up to society, and what we see refracted are the weaknesses in not only our health care system, our public-health system, our housing system, but especially in our welfare system, our educational system, and our legal system — and our corrections system. If we’re going fix this problem, we have to work together to fix the weaknesses of all those sectors.”

An overview of the Direct Primary Care landscape

This blog post from HTNer Paulius Mui does a nice job detailing the Direct Primary Care market, and differences between DPC, concierge medicine, and FFS primary care. The market map below provides a nice way of breaking down some of the activity in the space broadly.

Data

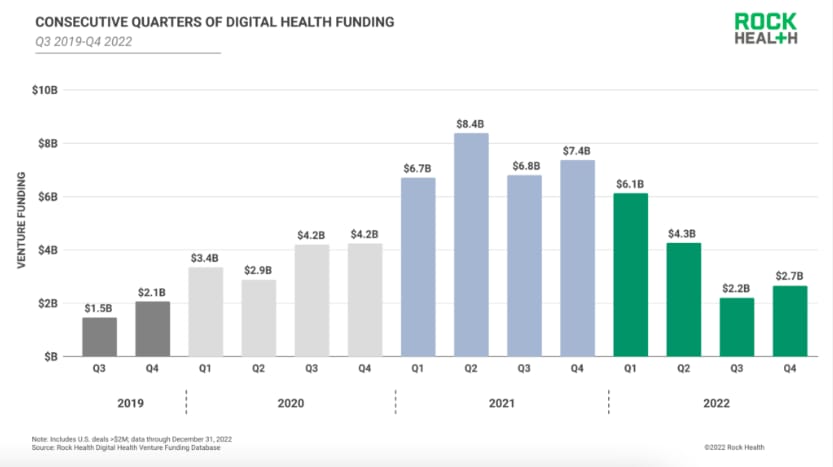

Rock Health’s year end funding summary highlights the turning tide

The report highlights the end of the COVID-fueled digital health funding boom and provides some good insights into the new normal. The chart below provides a nice view of quarter-by-quarter funding, highlighting just how different 2H 2022 was from the previous 18 months.

HHS shares 15.9 million people have signed up for an ACA plan during open enrollment