On July 31st, 2025, CMS published the FY 2026 Inpatient Prospective Payment System final rule, which included the Transforming Episode Accountability Model (TEAM). TEAM has been in the works from the innovation center for a while and builds on the Bundled Payments for Care Improvement (BPCI) program (2013) to the Comprehensive Care for Joint Replacement model (2016) to BPCI Advanced (2018).

There may be opportunities for HTN members and their companies to help hospitals drive success in this model, so we’re sharing this briefing in the hope of sparking some ideas and connections for the community.

HTN members: the goal is for this to be a living document, so if you are doing something with TEAM or working with a participating hospital and we missed, send me a note on slack (@Martin Cech) with what you’re up to and a link to your website and we’ll update the Opportunities for the Health Tech Nerds Community section with a market map.

Program Overview

5-year, mandatory model (participant list csv here) starting January 1st, 2026 and ending on December 31st, 2030

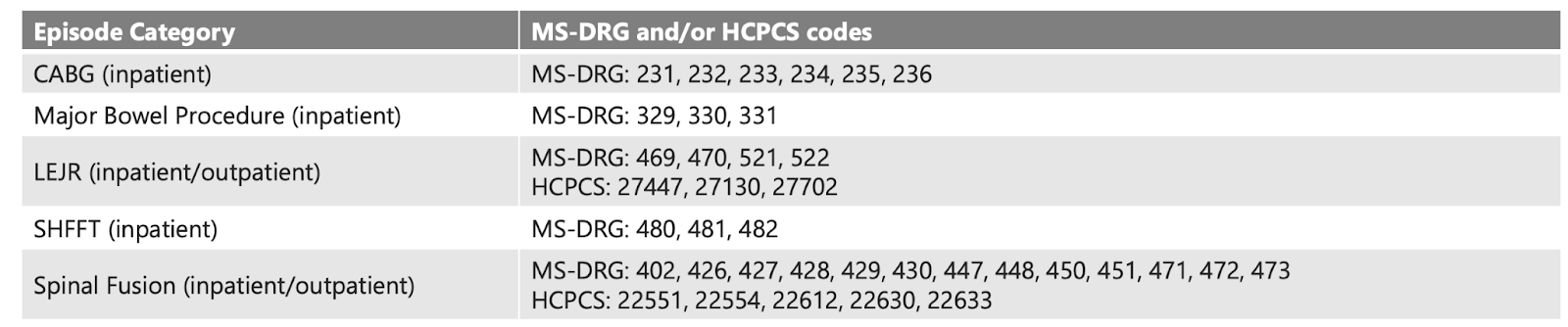

The model covers the following procedures

Hospitals assume responsibility for the cost and quality of care from the procedure through the first 30 days after the beneficiary is discharged from the hospital

Hospitals bill under the traditional Medicare Fee-For-Service system. At the end of the year, CMS will either make a reconciliation payment or collect a repayment amount based on the hospital's performance compared to the baseline. The baseline for year 1 is performance between 2022 and 2024.

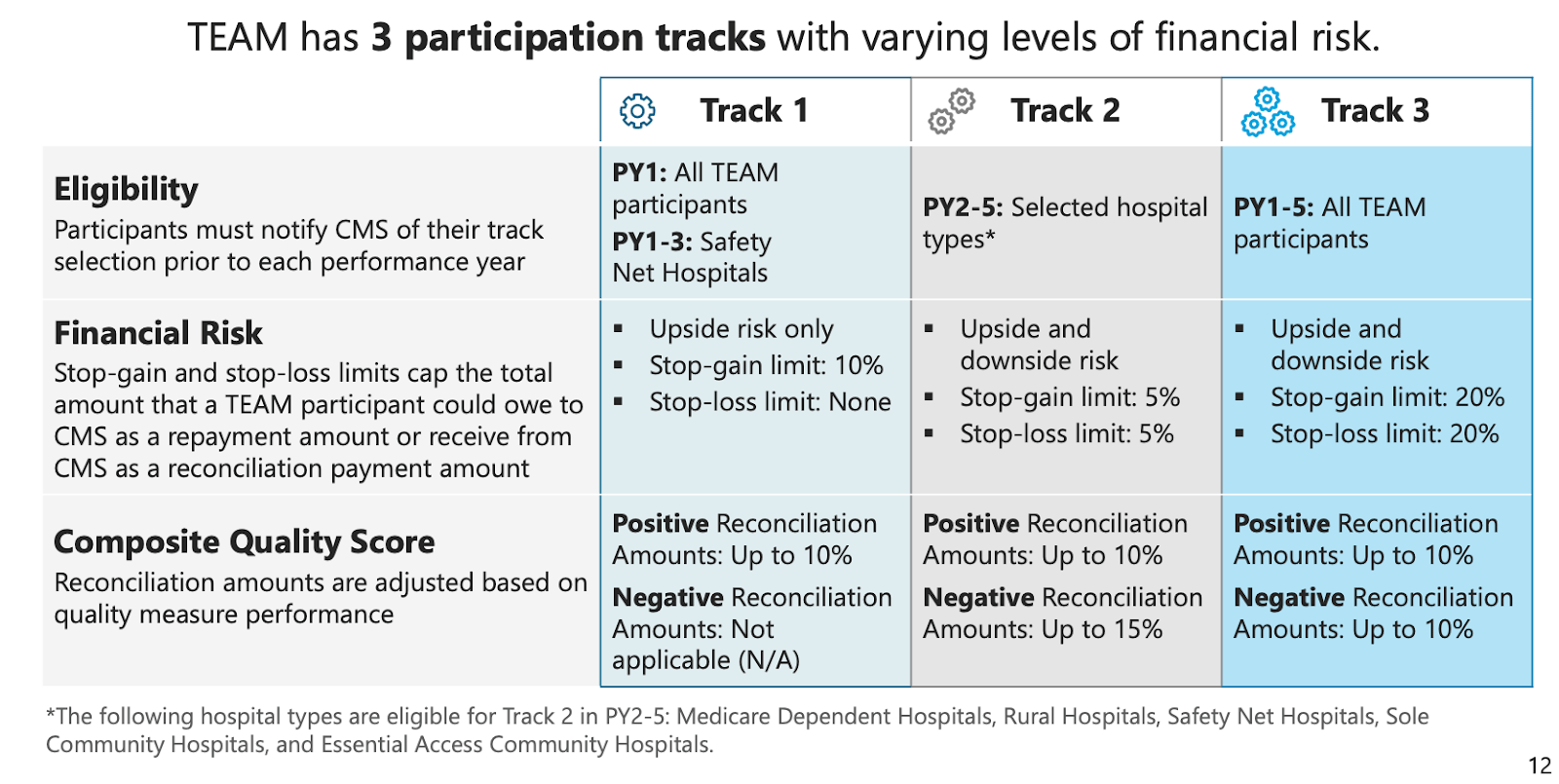

There are three performance tracks with different upside and downside risks and eligibility criteria.

Low financial stakes for the biggest hospitals, but the likely model for future payments

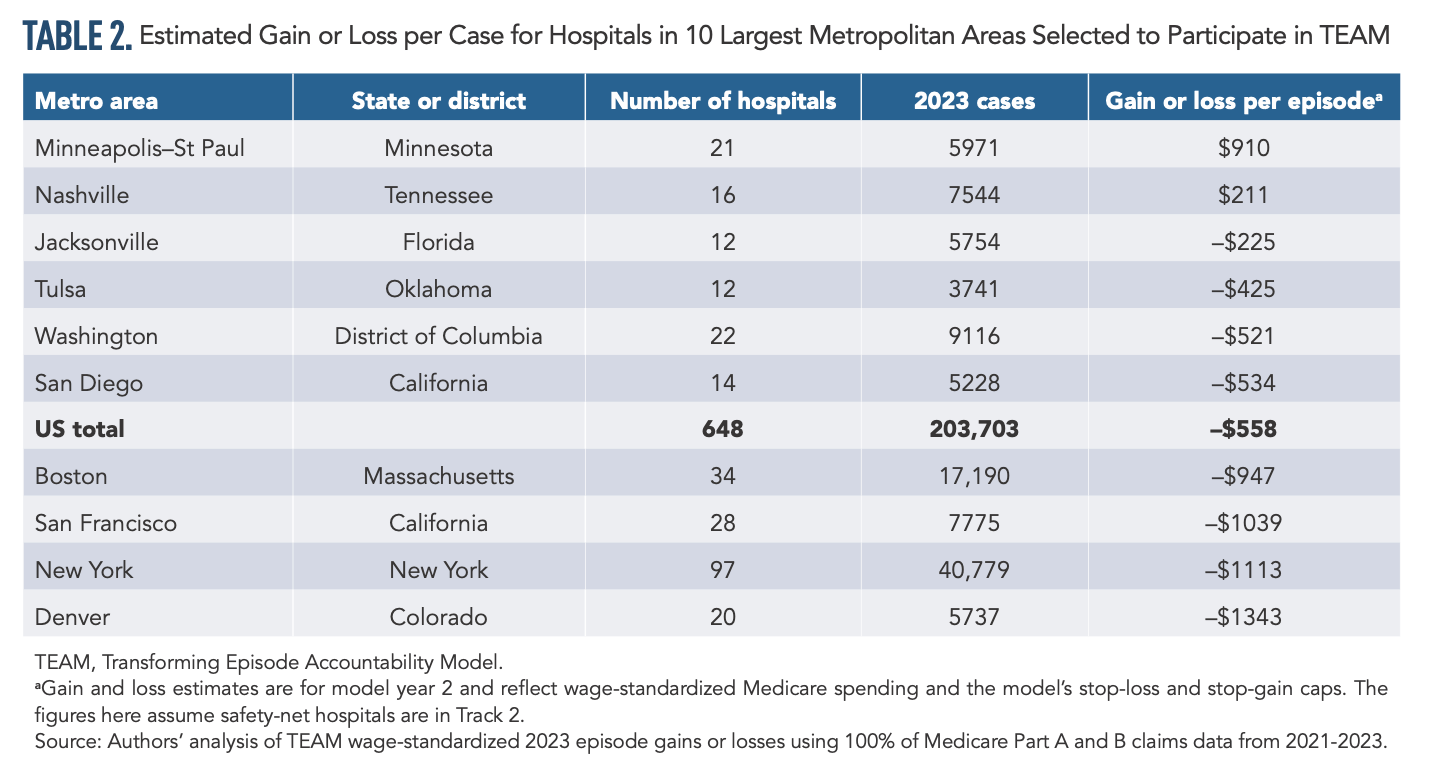

In the American Journal of Managed Care, Brandeis University teamed up with the Institute for Accountable Care and looked at claims data and estimated gains or losses for hospitals in different metro areas. The headline here is that the upside and downside are not hugely meaningful.

For instance, let’s take Allina Health as an example of a health system with meaningful market share in a metro area. Assume for a second that Allina Health’s share of admissions (31%) in the Minneapolis-St. Paul area would be roughly the same as their share of TEAM cases. That would mean their potential upside is about $1.7m on $5.8b in revenue.

Under normal circumstances, these gains or losses might be marginal enough to be ignored by the larger systems with stronger finances. But it’s worth noting that Allina, like many hospitals, has posted negative operating margins recently, and the latter performance years of TEAM line up with cuts to provider tax revenue, limits on state-directed payments, and decreases in Medicaid coverage and the consequential increase in uncompensated care that could raise the stakes of TEAM performance.

Forward-looking systems may note that TEAM is similar in spirit and structure to earlier payment programs, and it’s clear there’s a consensus in D.C. developing around bundled and episodic payments as a mechanism to improve cost and quality in traditional Medicare, so even if you’re not interested in TEAM, you might be dealing with it for a while.

Opportunities for the Health Tech Nerds Community

CMS’s goals for the program are:

Quicker recovery after surgery

Fewer avoidable hospital and emergency department visits

Shorter hospital and post-acute care stays

Smoother transition to primary care

Lower costs

As we brainstorm opportunities for the community, we’ve been thinking about them across four buckets:

The Hospitals and Health Systems that are required to participate.

ACOs and primary care organizations that are positioned to coordinate care post-discharge. The Sparx team shared a post on LinkedIn about how a retrospective look at ACOs showed mixed results on TEAM procedures and opportunities for ACOs to position themselves better

Recovery and rehab costs will make up a smaller or larger percent of the episode depending on the procedure and patient, but I’ll be curious to see if Hinge Health and Sword become partners for patients that don’t rise to the level of needing in-patient or outpatient services or something like a Paradigm Rehab bringing therapy to the patients home if that makes more clinical sense than outpatient services.

Innovative health tech solutions that help manage the complexity of the model. For instance, surgeons are the bottleneck in the TEAM model, with the procedure kicking off the episode of care. Making sure surgical resources are used efficiently, patients are appropriately prepped and triaged based on acuity and potential risks, and having a discharge plan where the patient understands and is bought in can help reduce costs and drive success in a model like TEAM. Companies like DOCSI, Orchestra Health, and Qventus come to mind, along with Rainfall Health and Guaranteed.

Special thanks to HTN community member Luis Argueso, who helped with background research for this briefing, who made a TEAM dashboard to evaluate the potential impact for hospitals, and Chris Raesly from Connected Health Resources, who is helping hospitals think about the right level of rehab for discharged patients.