not sure why you’re receiving this email? want to opt-in or out of specific HTN newsletters like this one or Kevin’s weekly Health Tech Reads? Click this button to update your preferences:

Weekly briefing

ACA

Obamacare Open Enrollment and Subsidies Update

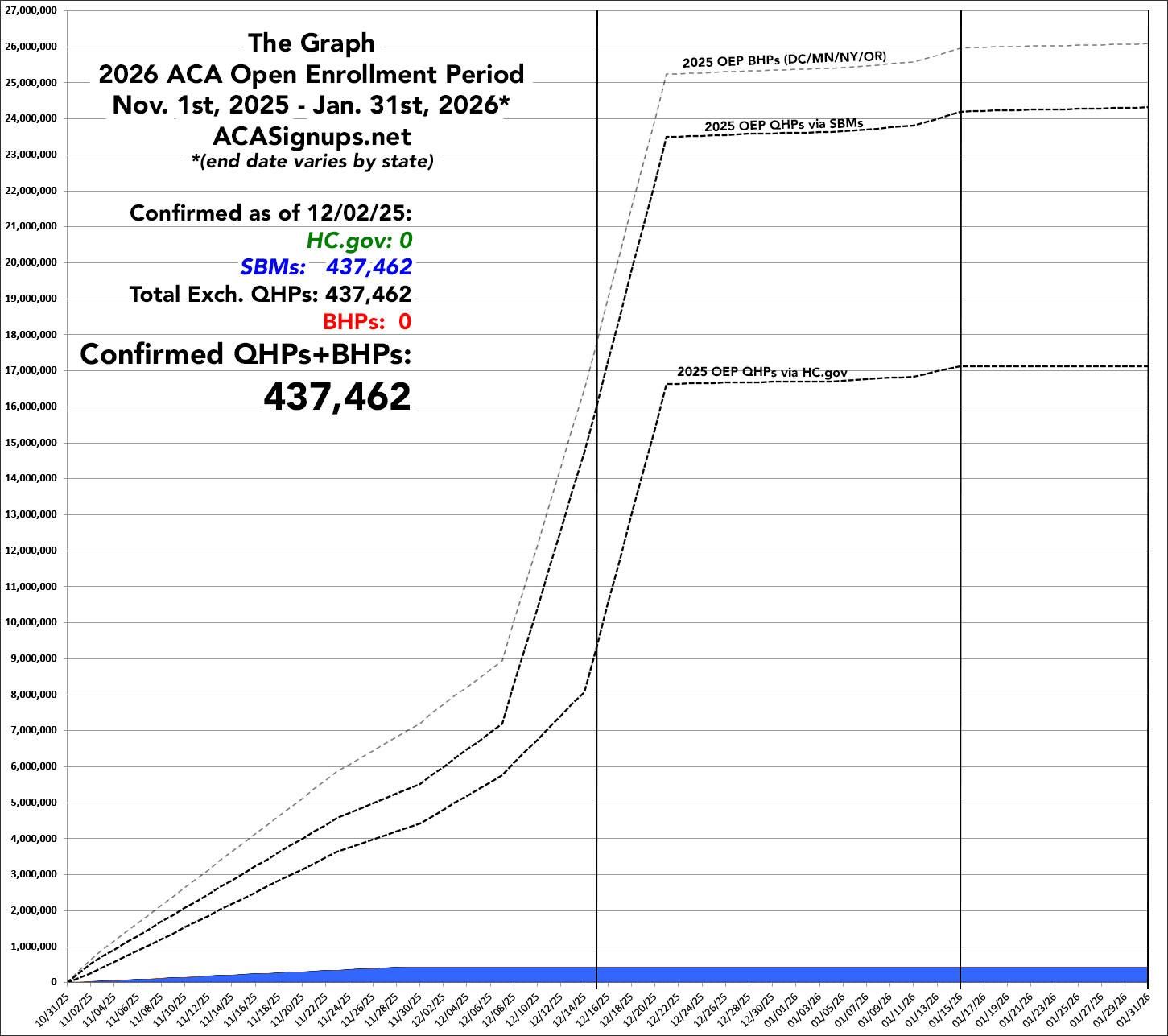

For much of the country, ACA open enrollment has been going on for a little over a month, and the deadline to start 2026 off with coverage is 11 days away. CMS hasn’t released a snapshot report yet, and California, New Mexico, and Maine are the only state-based exchanges to publish their reports so far. Charles Gaba, of ACAsignups.net, shared his latest iteration of The Graph

But without the snapshot reports from CMS, and only three states reporting, it’s not much to look at yet, and he’s careful to put quite strong caveats around the following inference:

The data for all three states is updated as of either Nov. 29th or 30th; combined, they have 437,462 active enrollments (this includes both new enrollees as well as current enrollees who have actively selected a plan for 2026). By comparison, CA/ME/NM had 411,959 active enrollments as of 11/30 last year, so for these 3 states at least, the 2026 OEP is actually running 6.2% ahead of where it was a year earlier.

Meanwhile, the Senate HELP committee held a hearing on Making Healthcare Affordable Again with testimony from Joel White (Council for Affordable Healthcare Coverage), Marcie Strouse, (a benefits broker on behalf of the National Federation of Independent Businesses, and Claudia M. Fegan, MD (National Coordinator of Physicians for a National Health Program). Meanwhile, on the other side of the Capitol, House Republicans seem to have a few irons in the fire, but nothing close to consensus.

Analysis

I continue to feel a tension when writing the weekly policy briefing because on the one hand, how open enrollment is going and the fate of the subsidies are clearly very important with tremendous downstream impacts for payers, health systems, and provider groups along with the individuals who get their insurance on the marketplace.

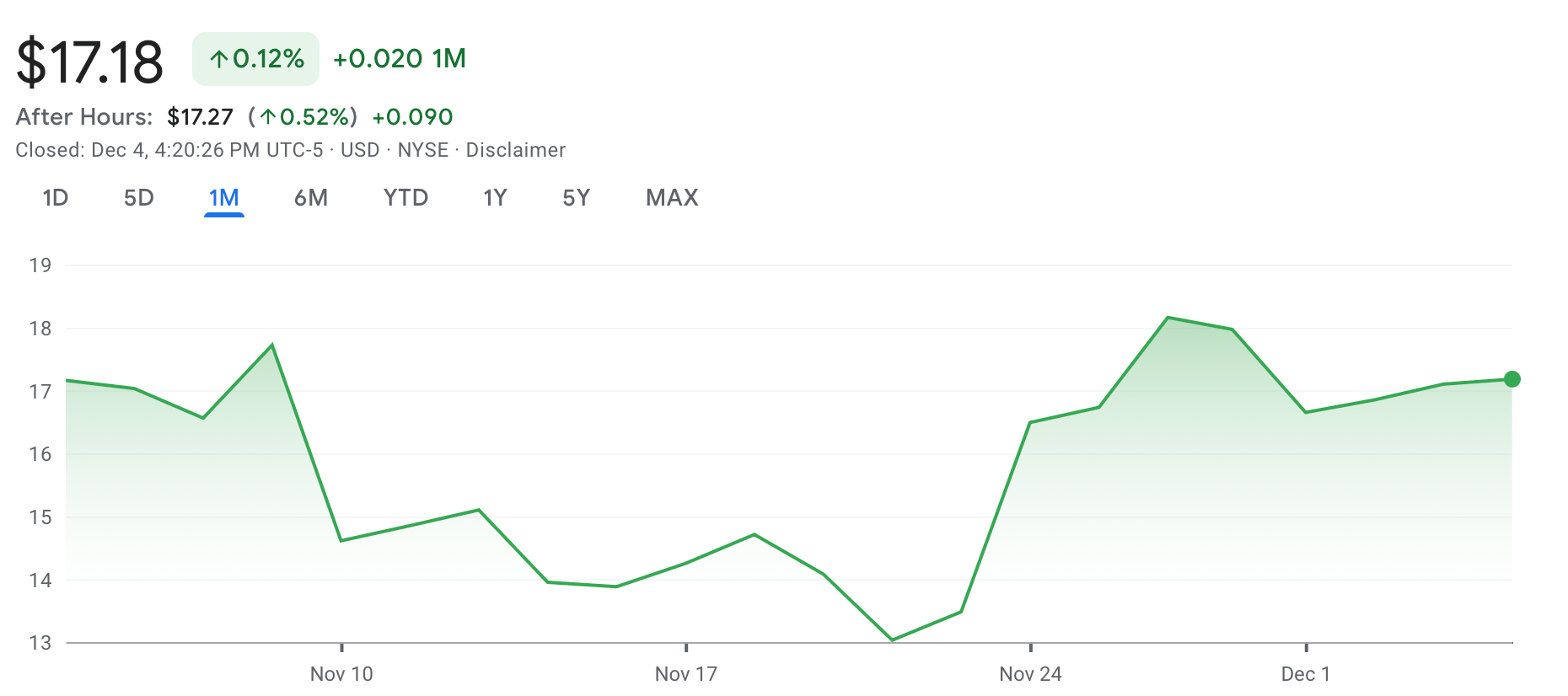

On the other hand, there isn’t much in the way of updates this week beyond rumor and innuendo (and the official New Mexico numbers). I continue to be fascinated by the divergence between the DC conventional wisdom on the question which seems to be pretty bearish, reflected by the Kalshi odds, which are now in the low double digits, down from over 50% a month ago, and how $OSCR ( ▲ 10.1% ), the only ACA pure play, is essentially flat over the same time period.

Predictions are hard, especially about the future (of the ACA). But if you forced me to take a guess, I’d say that I can’t count enough votes for an extension when majority party is so divided on the question of what to do.

CMS

The last of the major CMS final rules were released including ESRD, OPPS, and Home Health

Going in chronological order, the Calendar Year (CY) 2026 End-Stage Renal Disease (ESRD) Prospective Payment System Final Rule was released on November 20th and included:

A slightly higher than proposed bump to the bundled per-treatment payment (2.2% finalized vs 1.9% proposed) which brings 2026 payment to $281.71

Some changes to the ESRD Quality Improvement Program including trimming down the patient experience questions to reduce patient burden and eliminating some SDOH screening questions

The Calendar Year 2026 Hospital Outpatient Prospective Payment System (OPPS) and Ambulatory Surgical Center Final Rule was released on November 21st and the headlines were:

A slightly higher 2.6% increase in payments versus 2.4% in the proposed rule

Phasing out of the inpatient-only list over the next three years and changes to the ASC covered procedure list adding an additional 560 procedures that can be done in an ambulatory setting

Some site-neutrality for certain physician-administered drugs

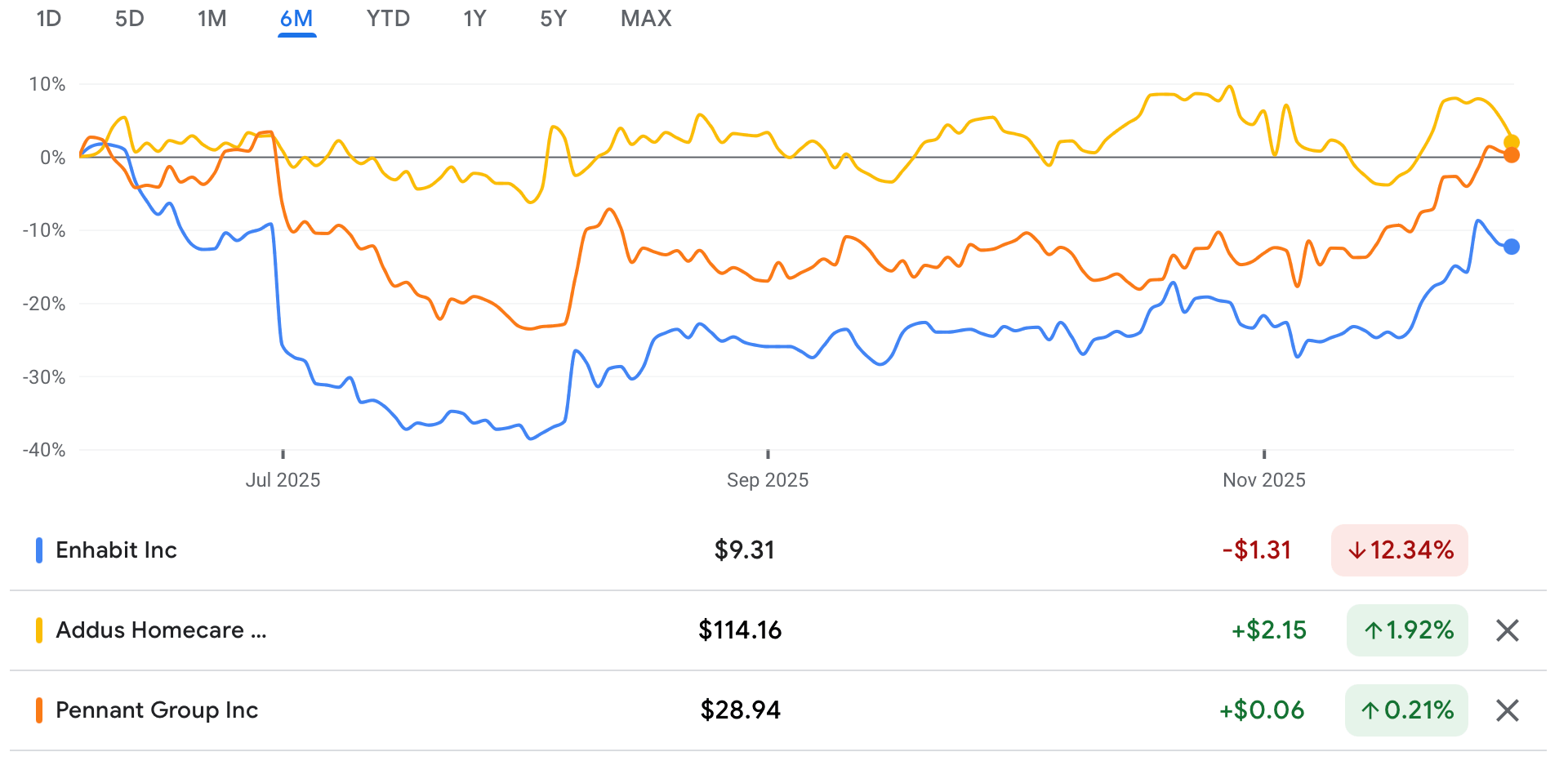

The Calendar Year (CY) 2026 Home Health Prospective Payment System Final Rule was released on November 28th. CMS had originally proposed a net -6.4% cut to the home health payment rates, but in the final rule, the cut was a much more modest -1.3%.

Analysis

Just for a sense of scale, $DVA ( ▲ 1.66% ) has ~154k Medicare patients which means this annual increase to the bundled, per-treatment rate is about $190 million a year and the difference between the proposed and final rule netted them somewhere in the neighborhood of $15 million.

While the expansion of the ASC procedure list is welcome news for ASC operators, this was all pretty priced in some relatively muted reactions for names like $SRGY ( 0.0% ) and $THC ( ▲ 0.79% ).

Home health is a tough business to be in, but it was interesting to look at the U-shaped recovery in home health operators like $EHAB ( ▲ 0.07% ), $ADUS ( ▲ 2.25% ) and $PNTG ( ▲ 1.58% ). You can probably eyeball where the original, -6.4% cut was proposed back in July.

The Hickpuff Review1

CMMI announced the ACCESS model this week which seeks to create a payment pathway for digital health solutions and doctors who use them in traditional Medicare. Examples of covered technology could include telehealth, wearables, and apps and will focus on hypertension, diabetes, musculoskeletal conditions, and behavioral health. This seems like a tailwind for a business like Omada which has impressive clinical results, but has historically been stuck in the employer benefits space.

State Treasurer of North Carolina Brad Briner shared a direct to camera update on negotiations between Duke Healthcare and the state’s health plan administrator Aetna. North Carolina has been one of the states most willing to play hardball with their hospitals in negotiations whether it be Medicaid or the state health plan, and his move is a pretty clear example of that.

CMS released the Medicare Advantage and Part D Proposed Rule for contract year 2027 which included some significant proposed changes to the Star program including not implementing the Excellent Health Outcomes for All reward and removing 12 measures from the program. There’s also a handful of Requests For Information, including one about risk adjustment changes.

Our friends at Niskanen are hosting a panel on opening new licensing pathways for international doctors on December 11th. Between an increasing focus on expanded scope of practice for NPs, PAs, and pharmacists, and this licensing pathways conversation, it seems plausible that we might make some progress on provider abundance.

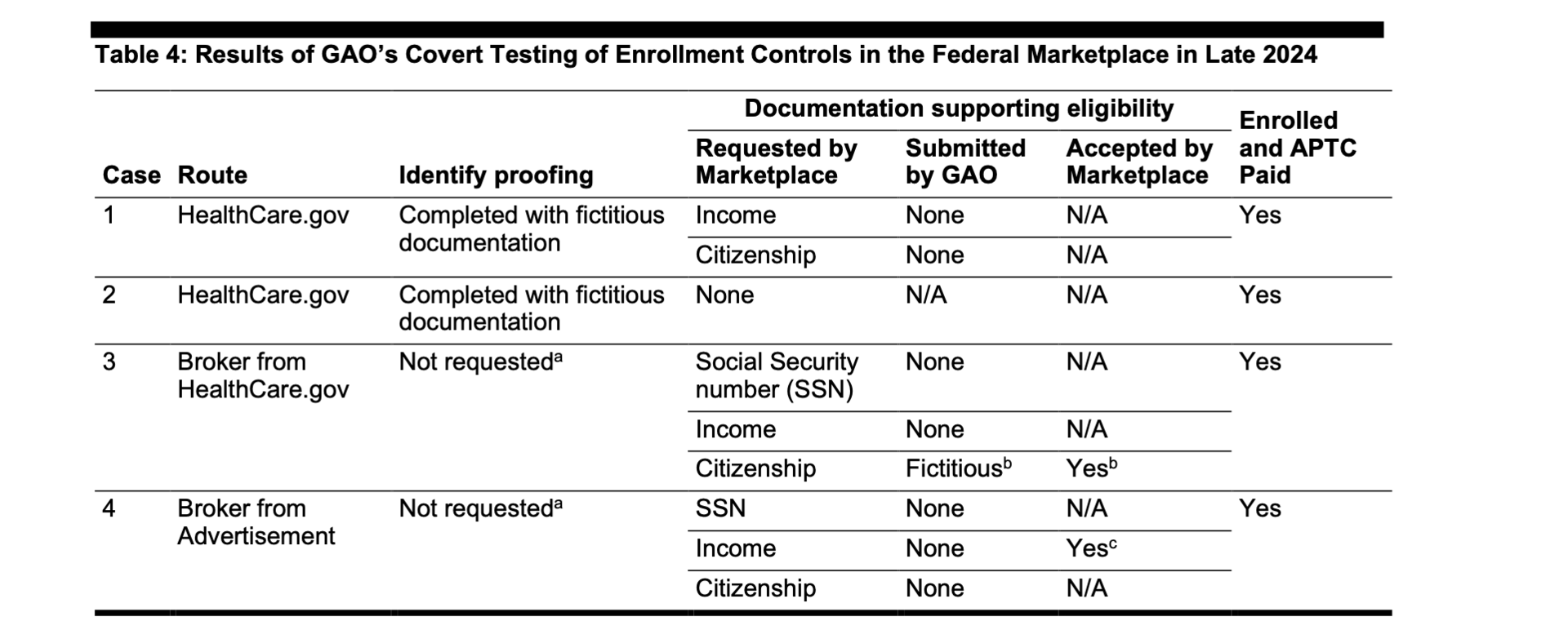

The Government Accountability Office released a report on fraud in the ACA Marketplace where they did some secret shopping to check in on fraud prevention efforts for the APTCs. The results were not good, and it’s becoming increasingly clear that whether the subsidies are extended or not, there’s a lot more work to do on the fraud front.

A quick recap of some HTN Discussions: Buck Poropatich, Lyft’s VP of Healthcare, came by to discuss the non-emergent medical transport market which you can watch here. Hopscotch Primary Care’s Tim Gronniger and Aditi Mallick chatted with us about rural healthcare which you can watch here. Tomorrow, we’re hosting Syed Mohiuddin, UnitedHealth Group’s SVP and Chief AI Transformation and Strategy Officer, and you can register here.

Longer form

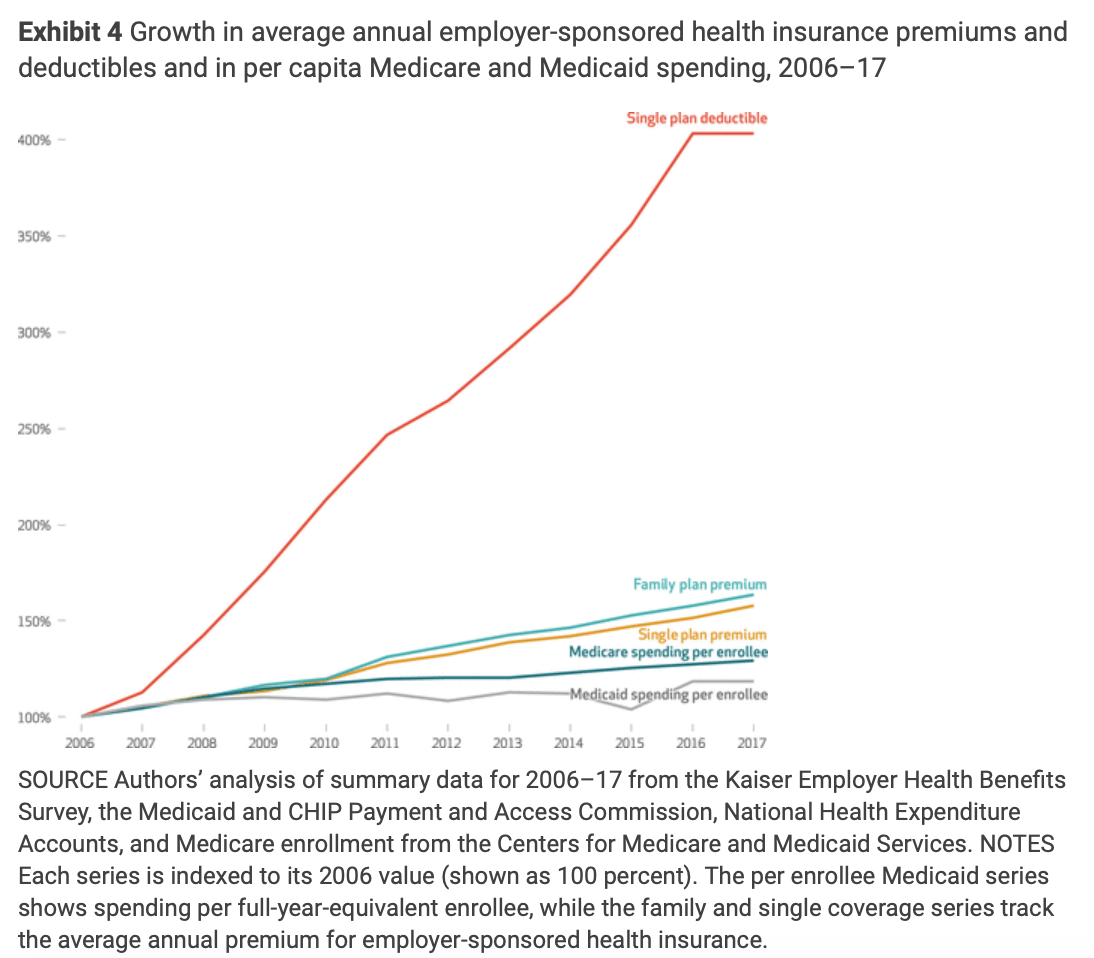

While listening in to the Senate HELP committee’s Making Health Care Affordable Again hearing, I was struck by how down everyone is on high deductible health plans on both sides of the aisle. High deductible health plans were a major part of the consumer-driven healthcare revolution, and quite popular among the DC healthcare policy set. The high-deductible proponents were really successful as evidenced by the average deductible growth compared to premiums and Medicare and Medicaid spending:

Melinda Beeuwkes Buntin and John A. Graves in Health Affairs

High deductible plans are popular from a policy perspective because they’re very effective at reducing healthcare consumption. Most people most of the time have low healthcare spending, and high deductible plans encourage people to be especially choosy about any spending they’re considering which diminishes the moral hazard potential of a third-party payer system.

But their efficacy poses a political problem. People pay what is frankly a lot of money in premiums every year for their insurance, and they mostly don’t get anything in return for that spending. Paying something for nothing is, not surprisingly, an easy thing for a politician to complain about and so after years trying to get people to embrace higher deductibles, it seems they’re losing their political cover.

Absent high deductible plans, the options for controlling costs are even more limited and require more utilization management from insurers, lower payments to providers, or both. There’s a lot of this all over healthcare policy where without some sort of bipartisan consensus, there’s a lot of incentive to do make suboptimal policy choices.

For example, CMMI has lost a bunch of money since its inception which makes it an easy political target. But that leaves CMMI in a place where it’s not going to do anything transformational because that would require potentially wasting a lot of money. So in my view, models like TEAM and Ambulatory Specialty Model seem interesting enough, but the stakes seem too low. No one is going to get embarrassed about them in ten years for blowing all this money if they don’t work, but if they do, the savings will seem barely worth it.

Without some sort of Washington consensus to provide political cover for hard decisions and big swings in healthcare, it would be easy for us to be stuck in a bad policy trap for a while.

if you were forwarded this email and want to subscribe, a few options: To subscribe to just the weekly Health Policy Briefing, click here. To subscribe to all the HTN newsletters, you can click here. To join our premium Slack community where we discuss all things healthcare policy, technology, and financing, you can click here.

1 Health care policy and financing, named after my favorite Medicaid agency