Weekly briefing

ACA

The shutdown drags on, but the shape of a deal is forming

It was quite a week for the ongoing government shutdown over the ACA tax credits. On Monday, the President seemed to indicate he was open to making a deal on the ACA extensions, though he walked this back later on. Then, Marjorie Taylor Greene, Republican representative of the Georgia 14th, went on CNN to say that her phone was ringing off the hook with constituents asking that the subsidies be extended. Meanwhile, Republican Speaker of the House, Mike Johnson, keeps saying the deadline for extending the subsidies is an eternity away, which isn’t quite accurate, as I discussed with some actuaries this week. Renewal letters are going out, the window shopping period starts next week, but some plans filed two sets of rates in states for extension and no extension scenarios, so a deal sooner would be better than a deal in late December if there was going to be a deal at all.

Which there might be! InsideHealthPolicy is reporting:

Top Senate Appropriator Susan Collins (R-ME) told reporters Thursday (Oct. 9) extending the enhanced Affordable Care Act subsidies is a bipartisan issue, though the system needs to be reformed -- backing reports that Congress is considering a one- or two-year extension of the credits and new income caps on who receives them. Overall, Republican senators gave reporters conflicting accounts on how negotiations to reopen the government are progressing.

Sen. Jeanne Shaheen (D-NH), whom Collins said she’s been working with to end the shutdown, told Inside Health Policy she supports income caps but says there haven’t been any real negotiations on the potential reform.

Analysis

I was last working in Congress in any capacity about 15 years ago (summer intern), so grains of salt all around, but I suspect a two-year extension of the subsidies with income limits is probably sufficient to peel off enough Democrats to break the filibuster.

A two-year extension gives everyone a little more certainty on what’s going on and punts the renewal question until after the midterm elections, which a 1 year extension would not.

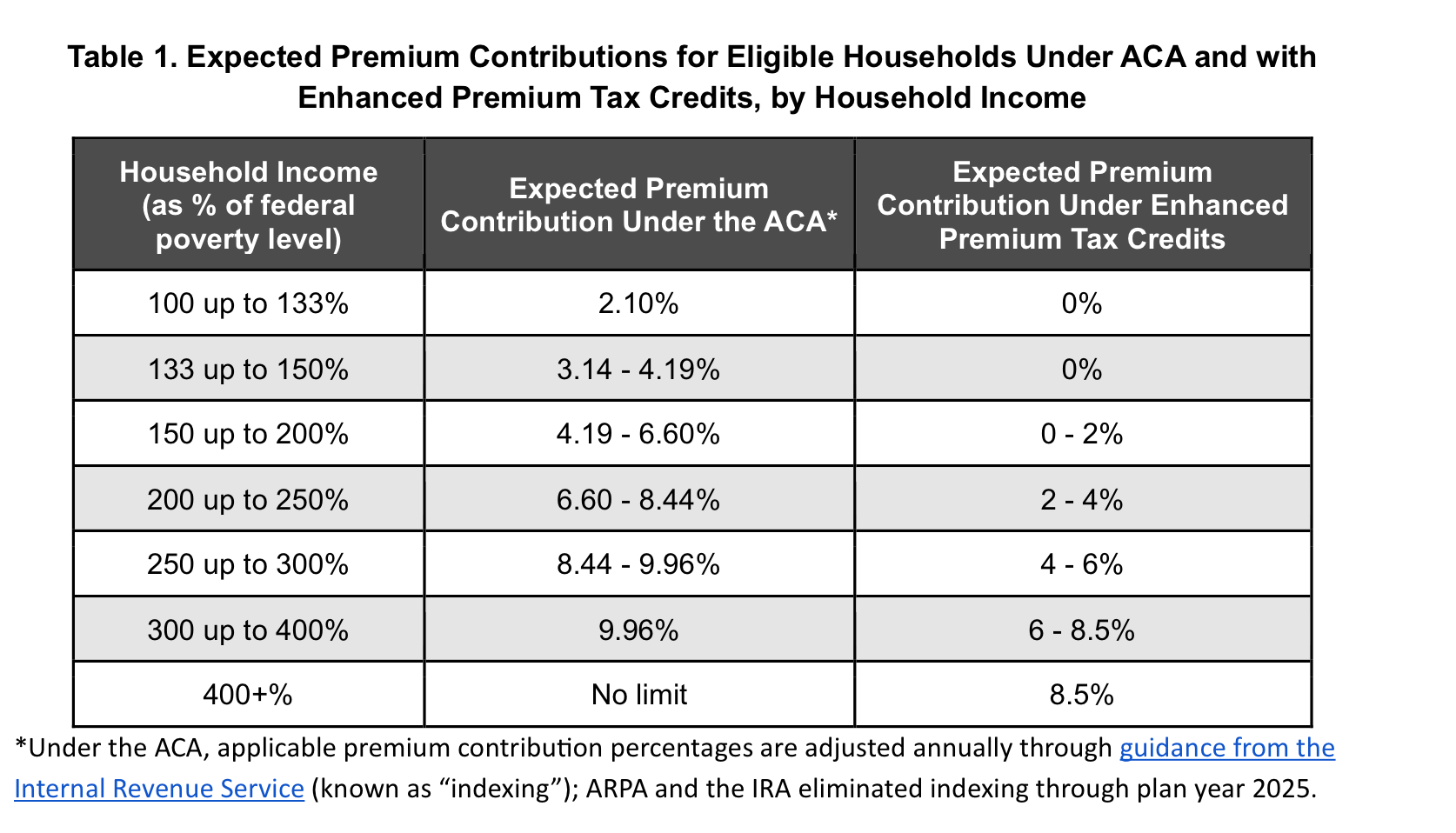

The income limits being discussed are an interesting case because the number being floated is around $200k. Looking at CMS’s open enrollment files, only about 3% of ACA enrollees are above 500% of the poverty line, which, for a family of four, is about $160k a year. And if you’re at $200k a year in income, an unsubsidized bronze plan is probably right in line with the enhanced subsidy premium limits. Basically, that’s an easy deal for the Democrats to make because basically no one will be impacted by it.

If you’re curious about the electoral implications of the subsidies, you can take a look at the excellent enrollment data by congressional district file put together by Charles Gaba at acasignups.net. I believe MTG when she says she’s getting calls, but notably, her margin of victory in the last election is larger than the total number of ACA enrollees in her district, so I think it’s fair to say she's standing on principle here, and it isn’t just her being concerned about re-election.

On the hill

Oscar “applauds” the introduction of pro-ICHRA bills on the hill

Oscar published a blog post celebrating the introduction of two bills in Congress that, in Oscar’s view, will accelerate the adoption of Individual Coverage Health Reimbursement Arrangements, also known as ICHRAs.

The first is called the CHOICE Arrangement Act, which turns ICHRA from a regulatory to statutory policy and offers two years of incentives to employers who adopt the arrangements.

The other bill is the Small Business Health Options Awareness Act, which directs the Small Business Administration to do more outreach and education on the arrangements as an alternative to traditional employer-sponsored health plans.

Analysis

People have strong opinions on ICHRA as a matter of business and of policy. I cannot say that I do. I think it seems like a reasonable way to redesign a health care system (i.e., vaguely Swiss!); it has trade-offs that are real, but so does every health care policy, and if we could get consensus that this was the path, it would be fine.

What I don’t understand is the push for ICHRAs right now with all the volatility and uncertainty in the individual market. In many ways, this would be a bad year to ask your employees to go out and buy insurance on the individual market because options are limited and prices are really high because no one knows what’s going on with the enhanced subsidies.

If we want to push everyone to the individual market, we should stabilize and subsidize the individual market first. Bringing on a bunch of healthy folks currently covered by group plans would certainly do a lot to help them, but it’s a big ask for employers to do it in a year where the main thing people know about the individual markets is that premiums are skyrocketing. It’s a real cart before the horse situation in my mind.

CMS

Dr. Oz shares his vision of Medicare, Medicaid, and the marketplaces at the Aspen Institute’s Public Health Grand Rounds

During a Q&A with Bertha Coombs of CNBC, CMS Administrator Dr. Oz laid out his theory of the case for the future of health care programs under his purview. If you’ve got an extra 1.5 hours, it’s worth a watch or listen, but some highlights for me were:

Reiterating the position he laid out in his WSJ op-ed with FDA administrator Marty Makary about using the government as a place to convene private businesses to work on problems outside of the regulatory process

Laying this out as the carrot, he also described the various sticks he has as a regulator, including being “loaded, ready to go” with AI tools for monitoring Medicare Advantage plans

The urgent need for transformation in rural health, citing the Rural Health Transformation Program as a unique opportunity to leverage technology to rationalize the costs of rural care delivery

Supply side initiatives like the $75m CMS is investing in training nurses and nurse assistants, and also encouraging states to license pharmacists to prescribe medication.

Shouting out Kaiser’s integrated system and Highmark’s Gold Card program as alternatives to prior authorization.

Analysis

Admittedly, I have a pro-experienced bureaucrat bias for jobs like CMS Administrator, or perhaps an anti-television personality bias for these jobs, because I didn’t have particularly high hopes for Dr. Oz administering CMS, but watching this talk has caused me to revise my beliefs. A clear benefit of bringing someone with his background into the role is that he is a very effective communicator on really complicated issues. As we seem to be entering an age of orality (as opposed to literacy), it seems like Dr. Oz is the model rather than a wonky bureaucrat because being able to talk about risk adjustment in an animating way is what the role requires.

The Hickpuff Review

Georgetown’s Center for Health Insurance Reform published its memo to Senators on ACA rate increases in 2026, with some great charts like this:

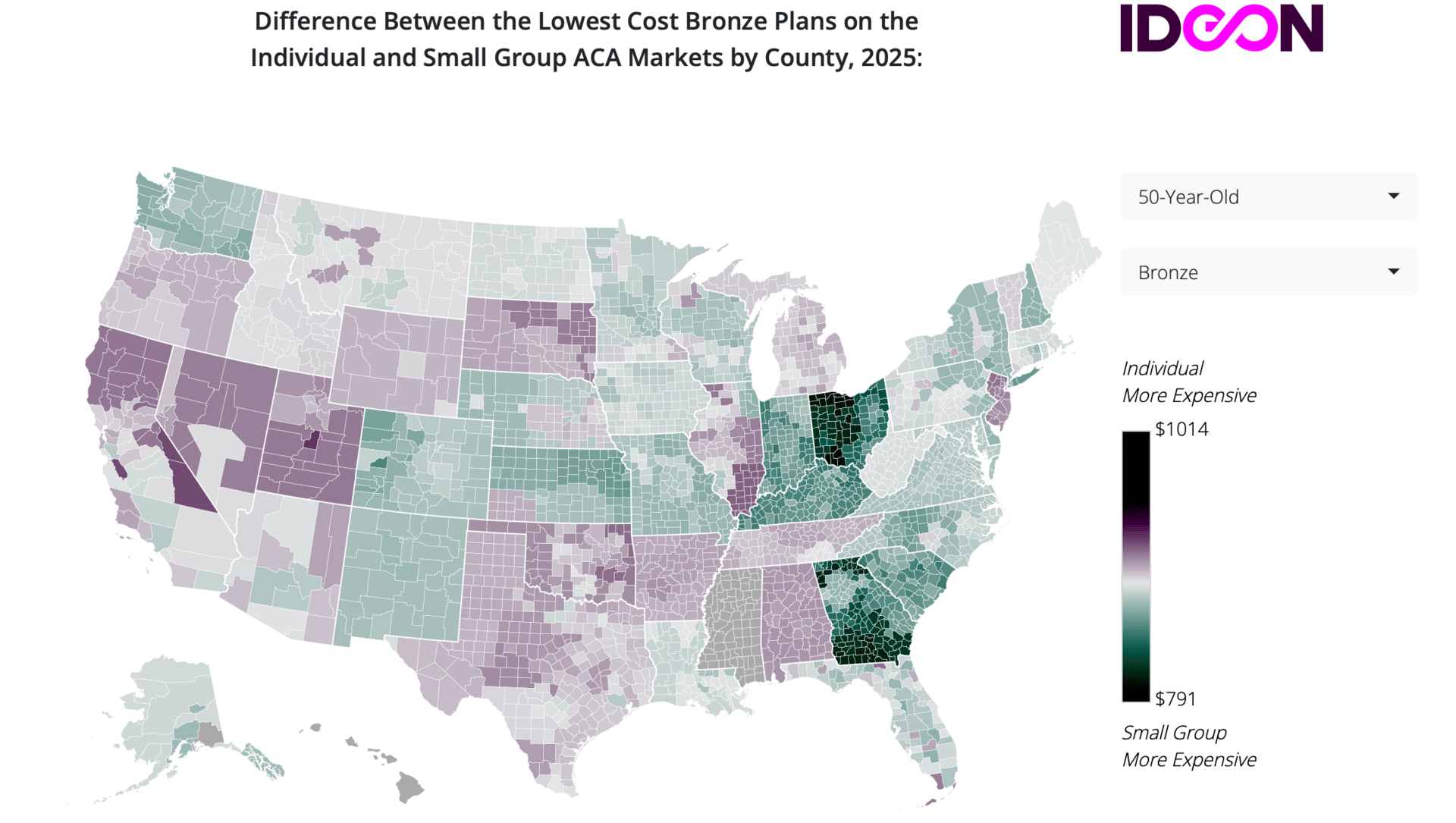

I came across this interactive map from IDEON, which is not from this week, but it’s the first time I’m seeing it, and it’s neat. It shows states where individual plans are more or less expensive than small group plans. Georgia stands out here, and I was wondering what was going on… it turns out they have a 1332 waiver where they fund reinsurance for the individual market with state and federal dollars. I imagine that helps!

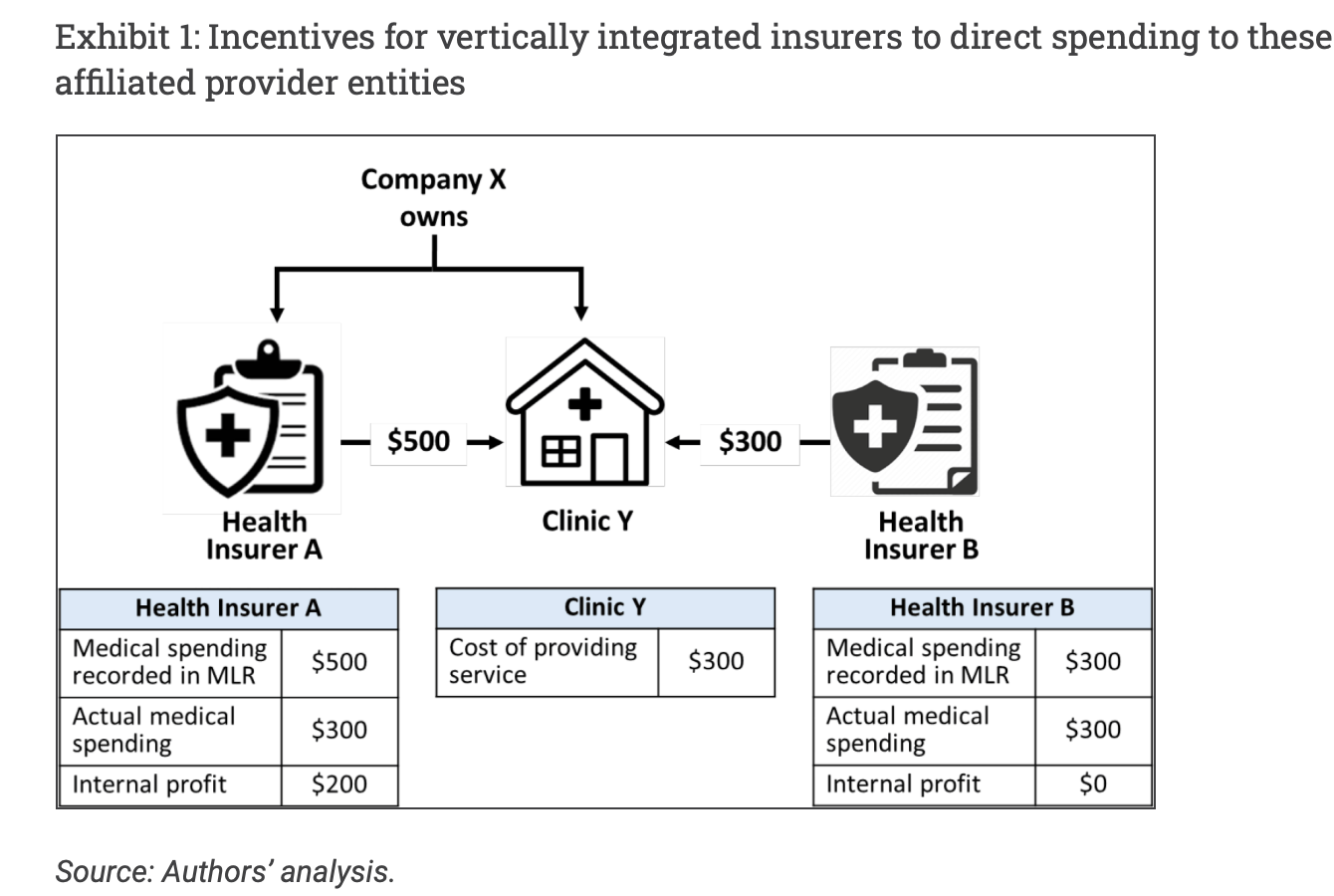

One of the most interesting concepts in health policy to me is the “MLR laundering”, where a payer acquires a provider group to transform medical spend into a source of uncapped profits. Health Affairs published a Forefront article from January Angeles and Michael Bailit with a great illustration of how it works:

Long form: brittleness among provider businesses

Mark Cuban has a line about hospitals and providers in general that I think is both clever and true: that in our current system, they are, in essence, subprime lenders who provide a service and then need to collect from people who, in a lot of cases, cannot pay.

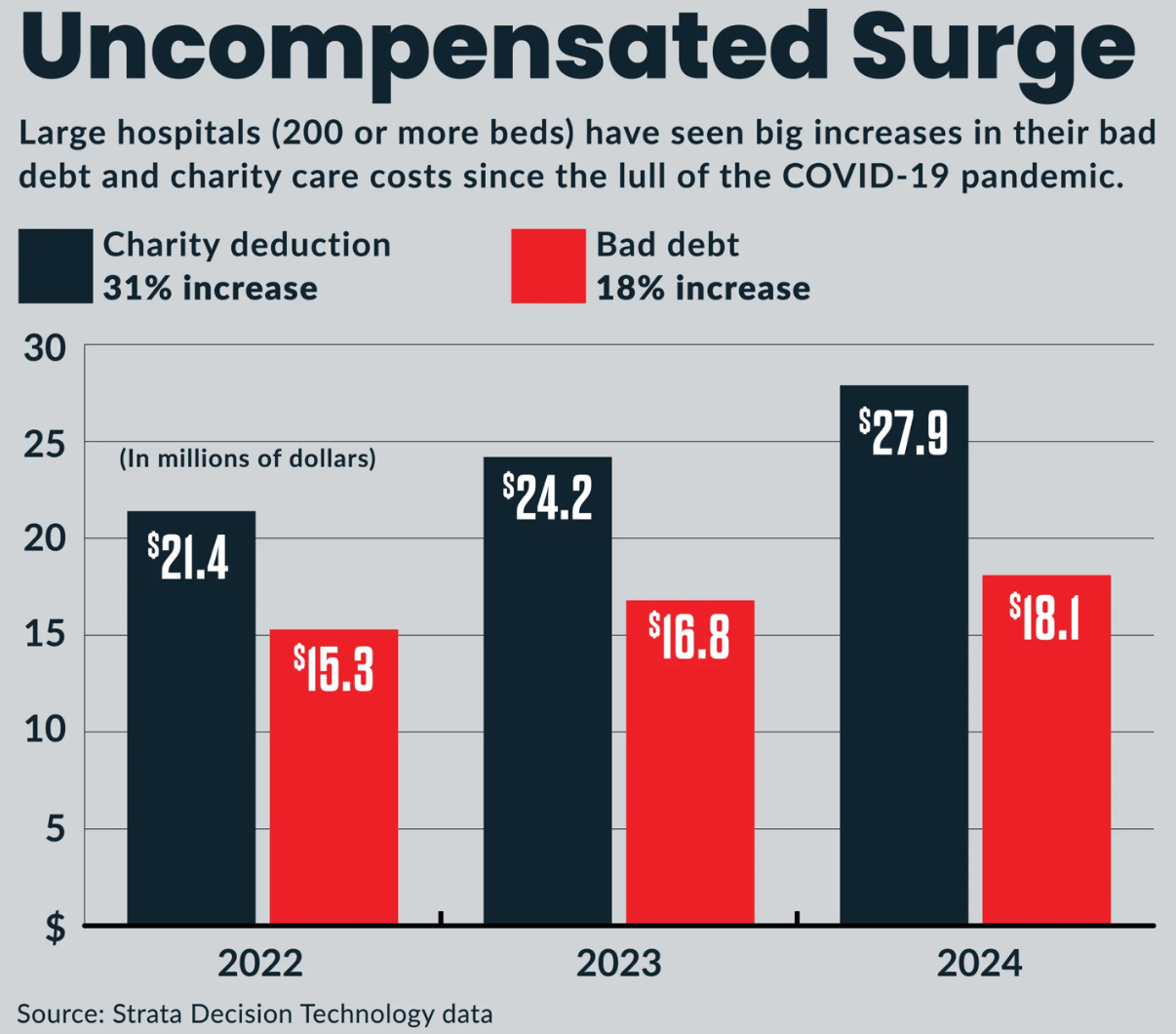

Uncompensated care and bad debt are rising year over year despite rising incomes and increased insurance coverage. And while it’s hard to muster a lot of sympathy for large hospitals with nice margins, even they have to pay their employees, and not every hospital or provider group is fat and happy.

So I think Mark Cuban is obviously correct on the matter, but it’s also hard to imagine how else to design the system. Someone needs to extend the credit, either the insurer or the provider, or else the patient needs to pay up front. You can make good arguments that this burden shouldn’t fall on providers, but it does need to fall on someone.

To my mind, the biggest problem with the current system, where hospitals and providers are extending the credit, is that it’s somewhat at odds with a cultural preference we have in the United States for small and independent physician practices. Wanting a robust, competitive market of small doctor practices sounds great in theory, but if they are also in the subprime lending business, that’s a recipe for a lot of dislocations if there’s a shock.

I think a lot about The Corvallis Clinic, a group in Oregon that fell on hard financial times and had to sell to Optum in a bit of a fire sale. In the popular imagination, it was the story of a greedy and cutthroat corporate takeover of a mom-and-pop clinic. But public comments on the merger at the time tell a different story:

Cash flow issues stemming in part from the ill-advised gross receipts tax, compounded by COVID were the real drivers. It’s the sort of thing that could happen to any low-margin small business. Optum was the only one willing to pay anything for it, so they did. If you don’t have a fortress balance sheet, a shock happens, and someone with the balance sheet absorbs you.

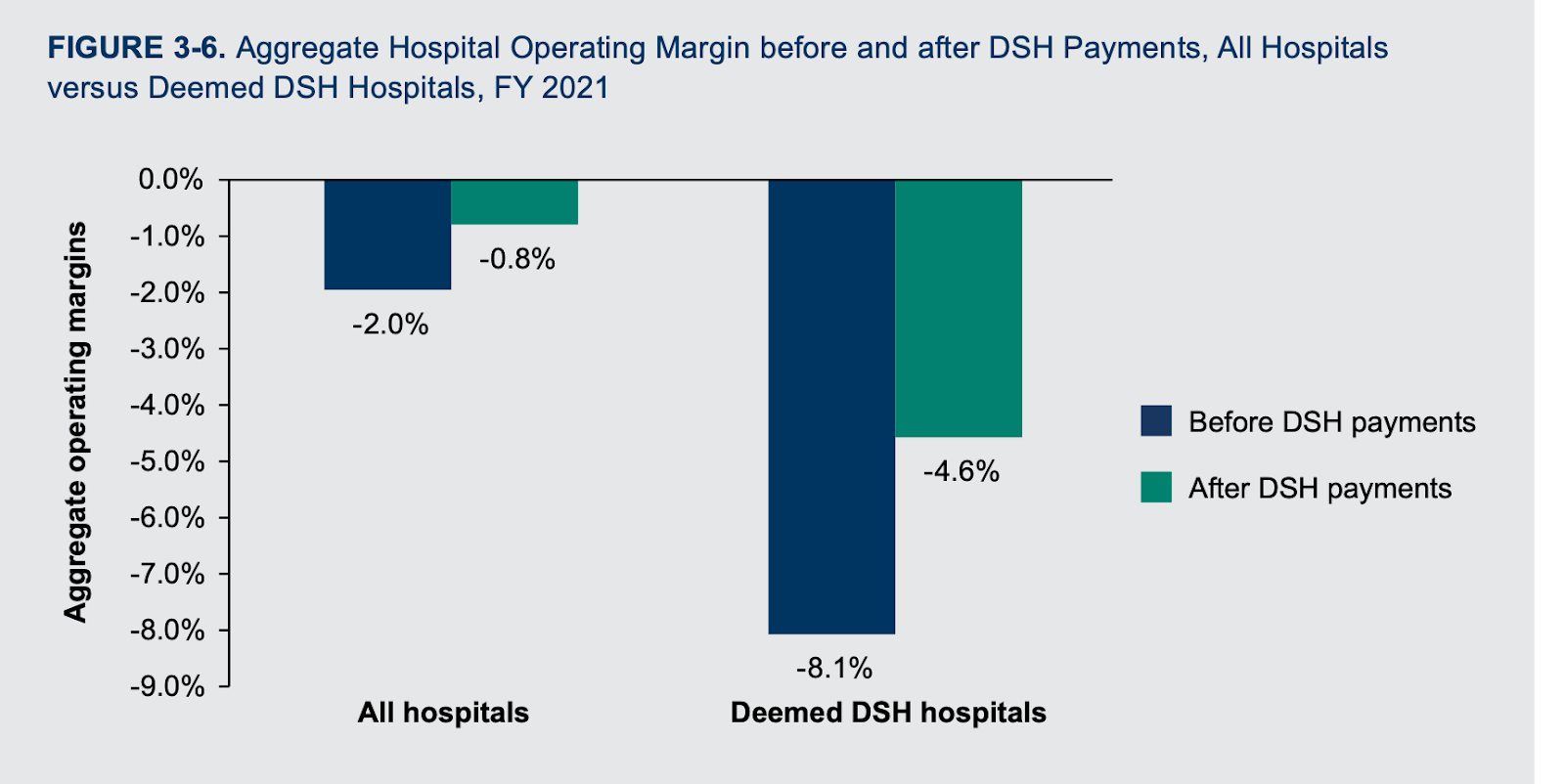

Part of the reason why this is top of mind is that I was reading McDermott+’s Regs and Eggs where they go through the list of health care programs currently unfunded due to the shutdown. It is extensive. Telehealth waivers, DSH payments, and the program for Federally Qualified Community Health Centers. Probably the money will come back soon. Probably this won’t be an issue. But for the hospitals and clinics with the thinnest margins, who are, in essence, subprime lenders, even a small delay could create cash flow issues. Take DSH hospitals, for instance, and this frightening graphic from MACPAC:

A delayed DSH payment for a hospital running at negative 8.1% operating margins is throwing a big stone in a still lake and is bound to have ripple effects. No one is lining up to lend money to a hospital with -8% margins, their employees have car payments and mortgages, and so the cash crunch for the hospital becomes a cash crunch for everyone else with financial ties.

I think it would be nice to have a robust ecosystem of independent care providers, but I’m not sure the current environment is all that conducive to it.