Sponsored by: Lyft Healthcare

Transportation is one of the most solvable barriers to care, yet traditional Non-Emergency Medical Transportation (NEMT) solutions often fall short due to outdated technology, unpredictable wait times, and advanced scheduling requirements.

In the last ten years, Lyft Healthcare has partnered with 28 states to incorporate rideshare into their Medicaid NEMT programs to expand access to care, improve patient experience, and reduce costs.

In addition, Lyft Healthcare’s technology such as GPS tracking and real-time ride status provides an enhanced level of oversight and monitoring to address and mitigate fraud, waste, and abuse.

If you're interested in sponsoring the newsletter, let us know!

Public Markets

Regulatory exposure on display in Q4 earnings calls

Listening to how management teams of publicly traded companies process regulatory and legislative developments, what Wall Street analysts have to ask about what’s going on in Washington, and how markets react or don’t react is, to me, the most useful way to understand where the business of healthcare and public policy intersect.

A quick whip-around of the regulatory and policy-driven puts and takes from this week:

DaVita had a strong Q4 and 2025 despite the overhang of elevated mortality and increased missed treatments that have lingered post-COVID across the kidney care industry.

Going into 2026, they’re penciling in a $40 million headwind from the expiration of the advanced premium tax credits as they expect some of their members will go from ACA plans to Medicare, which has less generous reimbursement. I suspect the net impact on the Medicare trust fund and taxpayers on this trade is worse, too, as the risk moves off the ACA book onto Medicare and the financing switches from a subsidy to the full cost of dialysis treatment.

They also reported their first full-year Operating Income profit in their value-based care segment called Integrated Kidney Care (IKC).

InnovAge is the largest (and only publicly traded) PACE operator in the country. If you’re not familiar with PACE, it’s for medically frail older adults who are typically eligible for Medicare and Medicaid. There are a couple of things that make this business attractive from a rules and regs perspective. Unlike D-SNP insurance plans, PACE operators aren’t limited by the Medical Loss Ratios rules for insurance plans, and they have two streams of revenue, both Medicare and Medicaid, which is better than one.

Their fiscal year runs through June, so this was their Q2 2026 call. Two things that stood out to me:

The investments they’ve made in improving their Medicaid eligibility and redetermination processes. From a business perspective, this has allowed them to retain and grow membership and reduce the revenue they need to set aside while they wait for approval. But it’s especially important in light of the new rules getting implemented from H.R. 1. Although PACE members aren’t specifically impacted by the rule, Medicaid offices will have a much higher volume of redeterminations to process, and InnovAge is smart to build this muscle before the redetermination deluge begins on January 1st, 2027.

The flip side of the positives associated with two government revenue streams is having to deal with twice the rate risk between CMS and state Medicaid agencies. That risk was a major topic of conversation on this call. PACE is somewhat impacted and somewhat insulated from the proposed rate change in the Advance Notice, and there was a bit of a relief rally as the risk adjustment formula changes coming to PACE were better than expected. The bigger risk, in my view, is on the Medicaid side. Although Medicaid rates were slightly favorable this quarter for InnovAge, state budgets are in a fragile place and as Medicaid budgets shrink, even programs that enjoy consensus as smart investments in the long run aren’t immune to cuts in the shorter term.

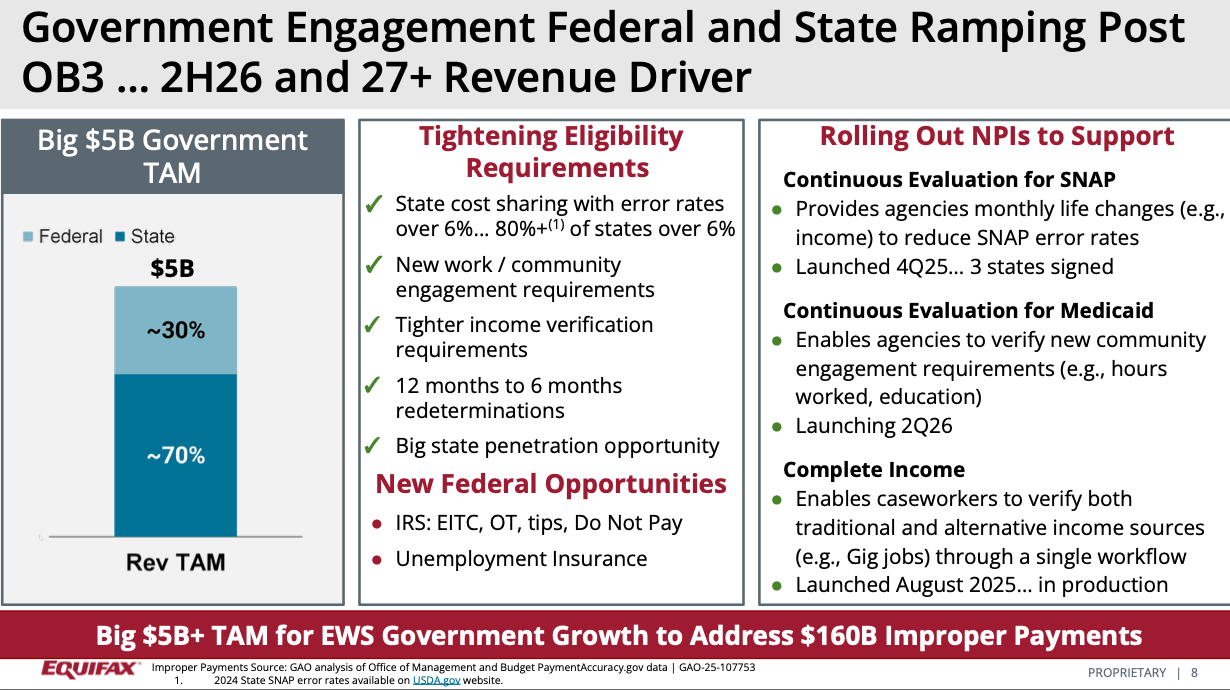

Equifax had an interesting week which started with an angry letter from Senators Wyden, Warren, and Sanders to the Equifax CEO Mark Begor on Monday, promising investigations on “price gouging” for transactions states use for Medicaid and SNAP program integrity as well as antitrust concerns. Then, Equifax reported embarrassingly strong results, including above-expectations, double-digit revenue growth in their government line of business. During the Q&A, it sounded like their government revenue run rate is around $700 million, and they see lots of opportunity for growth in a total addressable market of $5 billion:

As I write, Cigna is reporting earnings, which comes the day after its PBM division settled a case with the Federal Trade Commission. Lots of smart people are talking about this and other recent PBM reforms in pretty dramatic terms for PBMs generally and Express Scripts specifically. I tend to think markets are pretty efficient, so I’m not sure how to reconcile industry expert Adam Fein’s commentary about this “blowing up Express Scripts’ PBM model” with Wall Street basically shrugging it off, except that these developments are already priced in.

Tomorrow, we’ve got a double header with Molina and Centene reporting back-to-back. If you’re an HTN community member, you can read and discuss the calls in the #htn-earnings-coverage channel and read our longer-form analysis on a select number of companies here:

The Hickpuff1 Review

On January 29th, CMS published a final rule on the provider tax financing scheme for Medicaid. The basic way the scheme works is that states levy a tax on providers and Managed Care Organizations that work with Medicaid; the organizations happily pay it because the state uses that money to draw down more federal funds, which are used to pay the providers and MCOs more money. The rule has always been that the tax rates for Medicaid and non-Medicaid organizations have to be uniform but you can get a waiver if you pass a “statistical test” that the tax is “broadly redistributive”, so if your state had good enough statisticians you could, for instance, have MCO tax rates at $274 per member, per month (PMPM) for Medicaid while commercial rates were closer to $1.75 PMPM like California did. CMS estimates that closing this loophole will save the federal government over $78 billion over the next 10 years.

Yesterday, CMS published an update on Accountable Care Organization participation starting at the start of 2026. The headline numbers, as of January, are:

14.3 million Medicare Beneficiaries receiving care coordinated by ACOs, up 4.4% YoY

In the Shared Savings Program, 12.6 million beneficiaries, up 12.3% YoY

ACO Reach beneficiaries contracted by ~800k members, -32% YoY in the final year of the program before transitioning to LEAD

Kidney Care Choices lost 3k beneficiaries, -1.3% YoY

ACO PC Flex added about 10k beneficiaries, up 3.1% YoY

As part of the deal to fund the government, we got a little progress towards site-neutral payments. This article from McDermott gets into the weeds, but the gist is that CMS is requiring off-campus hospital outpatient departments to file provider-based attestations (PBAs) and get a location-specific national provider identifier for the off-campus department. This works as an incremental step in two ways: first, the PBA requirement means that off-campus outpatient departments have meet a higher threshold for compliance, and second, the NPIs bring a new layer of transparency to CMS for payments. This represents a potential headwind for HCA and other large hospital operators who are busy acquiring and tucking in, among other things, free-standing emergency rooms into their system.

Modern Healthcare’s Noah Tong published “ICHRA market growth may be hampered by sky-high premiums.” When we interviewed Rebecca Springer post-JPM, her sense was that ICHRA adoption has been pretty strong in spite of these headwinds because prices are just not any better in the small group market. I doubt we’ll get any commentary from Centene this week or Oscar the following week on the state of ICHRA, but the question of how employers are choosing between bad options is an interesting one.

Olivia Webb Kosloff’s Acute Condition is always worth a read. Today’s piece, “What a time to be an oncologist,” discusses the increasingly high bid for the attention of oncologists, and the increasingly creative ways manufacturers, wholesalers, PBMs, and specialty pharmacies are driving up that bid.

More from Health Tech Nerds

How Nest Health is building and scaling an in-home care model for Medicaid populations: I really enjoyed this conversation with Nest Health co-founders Dr. Rebekah Gee and Rebecca Kavoussi on risk contracting at the family unit level for Medicaid Managed Care.

The Grand Roundup: February 2nd, 2026: Kevin and I have been experimenting with a new format where we talk through what’s top of mind after writing our newsletters. This week, we spent some more time on the MA Advance Notice, last week’s earnings calls, and a big AEP for Devoted Health.

Included Health’s new alternative plan design with co-founder & CEO Owen Tripp: Owen and Kevin discuss Included Health's recent announcement about their expansion into alternative plan design.

In the coming weeks, two HTN community events that may be of interest to the policy set:

Any Willing Pharmacy and Medically Integrated Dispensing with House Rx’s Denali Cahoon and Tamiko Yamatani on Friday, February 13th at 2 p.m. Eastern.

Reengineering ACOs To Make Medicare Competitive with Purva Rawal and Liz Fowler on Tuesday, February 24th at 4:30 p.m. Eastern.

Want to comment or share feedback?

If this newsletter was forwarded to you, subscribe here or see more from Health Tech Nerds.